Years ago, on Oct. 24, 2017, a collective of individuals bifurcated the Bitcoin software, birthing a new asset and blockchain christened Bitcoin Gold (BTG). The initial intent behind BTG was to foster greater decentralization, enabling proponents to mine the cryptocurrency using GPUs (graphics processing units). Nonetheless, the network has suffered from multiple 51% attacks in 2018 and 2020, casting a shadow over its reputation, akin to other networks like Vertcoin, Verge, and Bitcoinsv that have endured similar assaults.

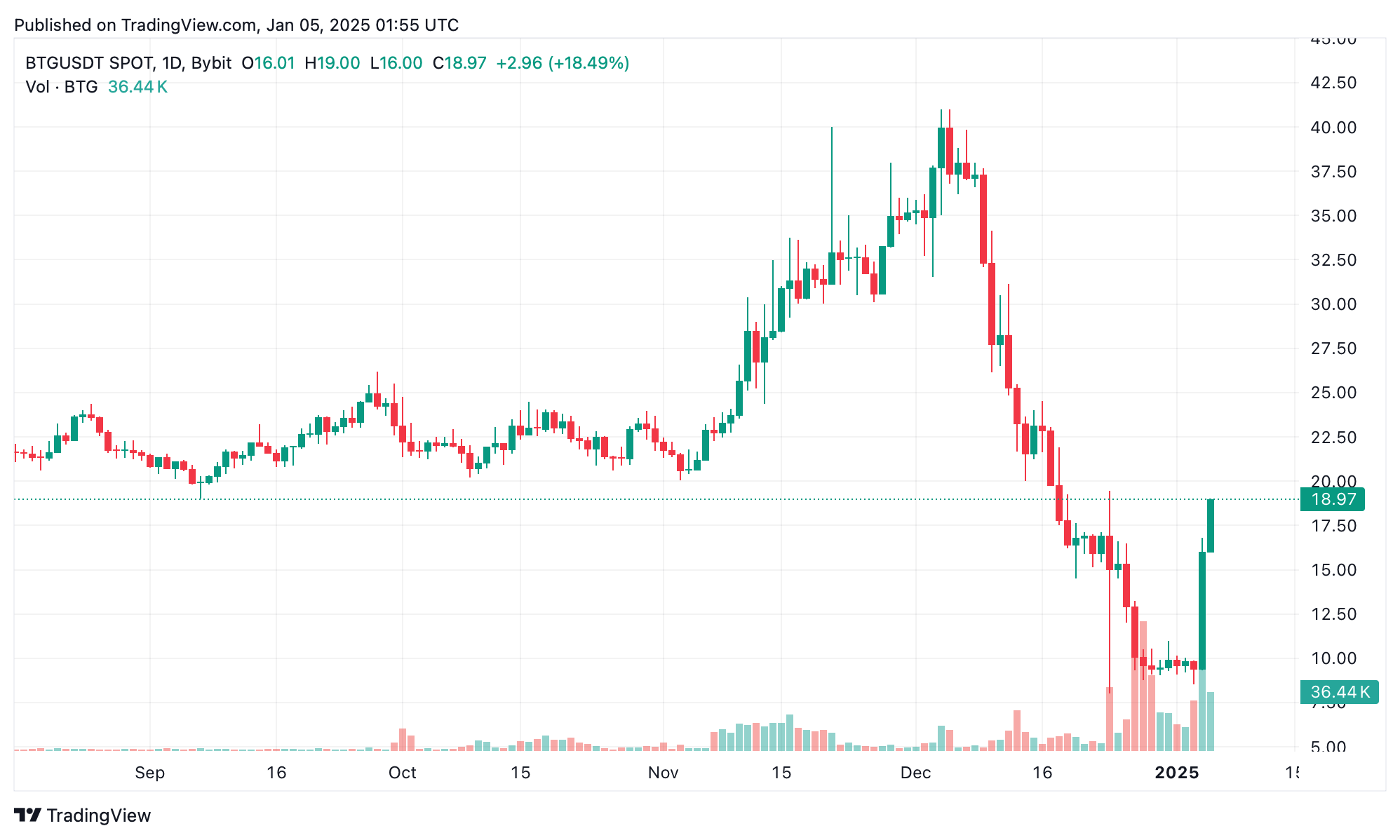

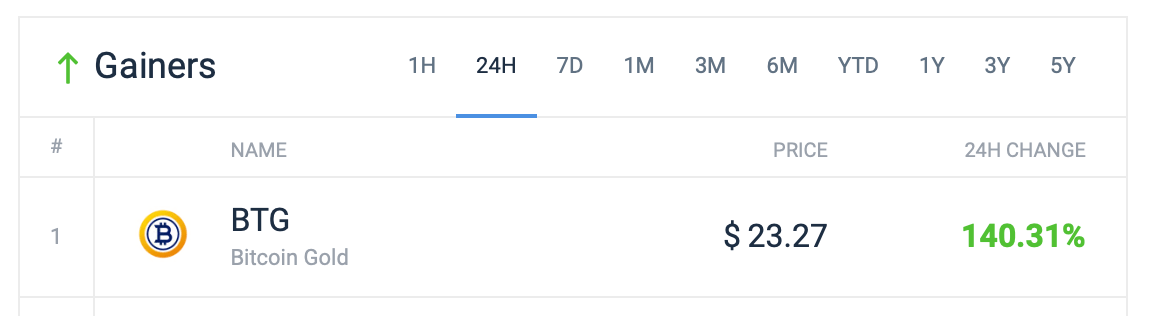

This weekend, bitcoin gold (BTG), the native cryptocurrency of its network, rose an astounding 140.31% against the U.S. dollar. The token emerged as the day’s supreme performer in terms of overall percentage gains over the past 24 hours, standing alone as the only cryptocurrency to achieve triple-digit growth. Intriguing indeed, this climb coincides with Upbit’s announcement to delist BTG on Jan. 23. Upbit, a South Korean trading platform, is currently witnessing significant trading activity and a premium on BTG.

For example, the weighted global exchange rate for BTG stands at $19.01, yet on Upbit, it fetches $24.75. As of 9:00 p.m. Eastern Time on Saturday, it reigns as the leading coin on Upbit. Interestingly, on the rival exchange Bithumb, BTG trades at $18.90 without a premium, yet it still holds the title of the most traded coin there. In fact, the majority of BTG’s trading volume originates from South Korea, with Upbit recording $1.31 billion in BTG transactions over the last day, while Bithumb observed $232 million

Bitcoin gold’s (BTG) brief resurgence, fueled by speculative trading in South Korea, highlights its fading relevance in the broader cryptocurrency ecosystem. The stark contrast between its meteoric 24-hour gains and Upbit’s imminent delisting underscores a grim reality: BTG’s narrative has shifted from innovation to obsolescence. Despite the fleeting spike, the project appears to be a relic of a bygone crypto era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。