On Jan. 3, 2009, Satoshi Nakamoto unveiled block zero—familiarly known as the Genesis block—just 64 days after introducing the Bitcoin white paper on Halloween, Oct. 31, 2008. The Genesis block stands out for two main reasons. First, the 50 BTC reward tied to it, referred to as the first BTC subsidy, is immovable and cannot be spent.

The second notable feature of the Genesis block is the message encoded in the coinbase parameter field, which reads:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

The hidden message in Bitcoin’s Genesis block is a snippet from a Jan. 3, 2009, London Times headline. Many interpret it as Nakamoto’s way of signaling that Bitcoin was created as a rebellion against fiat money and the centralized power of the world’s central banks. Bitcoin’s origins are rooted in the financial chaos of the 2008 Great Recession, a period marked by massive bank bailouts for institutions deemed “too big to fail.” Five days, eight hours, 39 minutes, and 20 seconds after the Genesis block was mined, block 1 joined the blockchain.

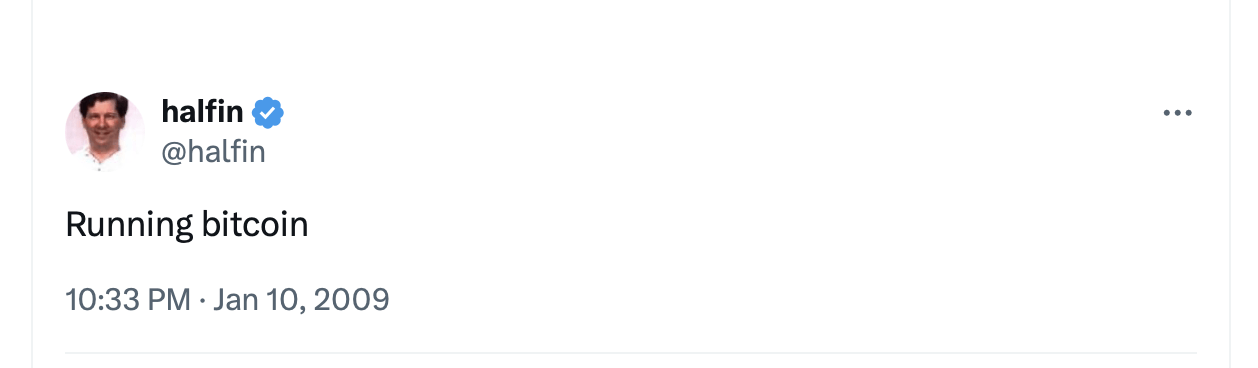

Computer scientist Hal Finney was “running bitcoin” two days after block 1 was mined.

Block 1 came into existence on Jan. 8, but it wasn’t until four days later that the very first Bitcoin transaction took place. This historic moment involved the transfer of 10 BTC to computer scientist Hal Finney on Jan. 12, 2009, as part of a test showcasing the blockchain’s functionality. Interestingly, Finney had already announced to his followers on X (formerly Twitter) on Jan. 10 that he was “running bitcoin,” just two days after block 1 was created.

Fast forward to 2025, and Bitcoin has transformed from a niche experiment to a financial powerhouse. Once dismissed as worthless and handed out for free, BTC is now fiercely coveted, with even major financial institutions and a few nations—including Bhutan and El Salvador—holding reserves. Speculation is growing that more nations, possibly even the United States, will follow suit. A U.S. senator has proposed creating a national Bitcoin reserve, and President-elect Donald Trump seems open to the idea.

Bitcoin stands as both an economic breakthrough and a moral challenge to traditional financial systems. Economically, it offers a decentralized alternative to fiat currencies, enabling peer-to-peer transactions without middlemen like central banks or financial institutions. This innovation reduces transaction costs, lowers barriers to global trade, and shields against inflation with its fixed supply of 21 million bitcoin.

From a moral standpoint, Bitcoin aligns with values of property rights and voluntary exchange. It empowers individuals to manage their finances independently, free from government coercion or the grip of monopolistic financial institutions. By relying on cryptographic proof rather than trust, Bitcoin has fostered transparency and personal accountability, resonating with ethical ideals of non-aggression and respect for consent.

In essence, Bitcoin challenges the state’s monopoly over money while championing free and decentralized markets. It embodies a union of economic freedom and moral integrity, offering a bold vision of financial autonomy and respect for individual rights. Sixteen years after its inception, Satoshi’s invention continues to push boundaries and inspire change.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。