Technological innovation, especially the "continuation of the AI boom," will become an important factor driving the market.

Author: Stoic

Compiled by: Deep Tide TechFlow

Extracting the core viewpoints of top global institutions for you, saving hundreds of pages of report reading time.

Data sources: J.P. Morgan, Blackrock, Deutsche Wealth, World Bank, Goldman Sachs, and Morgan Stanley.

1. Core Viewpoints from J.P. Morgan

Global Economic Growth: Global economic growth is expected to continue in 2025, but the Chinese economy may experience a significant slowdown.

Stock Market Forecast: The S&P 500 index is expected to reach 6500 points, but the global stock market may show divergent performance.

Global Market Outlook

In the coming months, market trends will be influenced by the interaction of macroeconomic trends and monetary policy, while policy changes from the new U.S. government will also bring uncertainty.

Technological innovation, especially the "continuation of the AI boom," will become an important factor driving the market.

Interest Rate Outlook

The baseline forecast suggests that global economic growth is resilient, but the persistence of inflation will limit the scope for further monetary policy easing in 2025.

However, the new Trump administration may bring risks, such as overly aggressive trade and immigration policies that could impact the supply side and undermine global market confidence.

Baseline Scenario Forecast

Strong global economic growth.

Positive outlook for U.S. stocks and gold, but the outlook for oil and base metals is not optimistic.

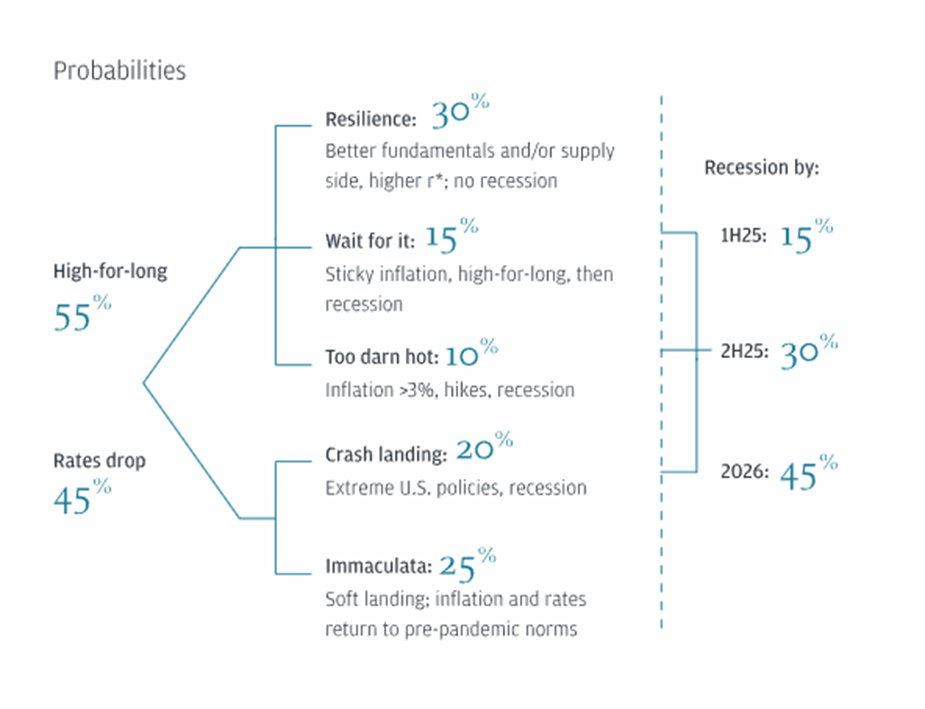

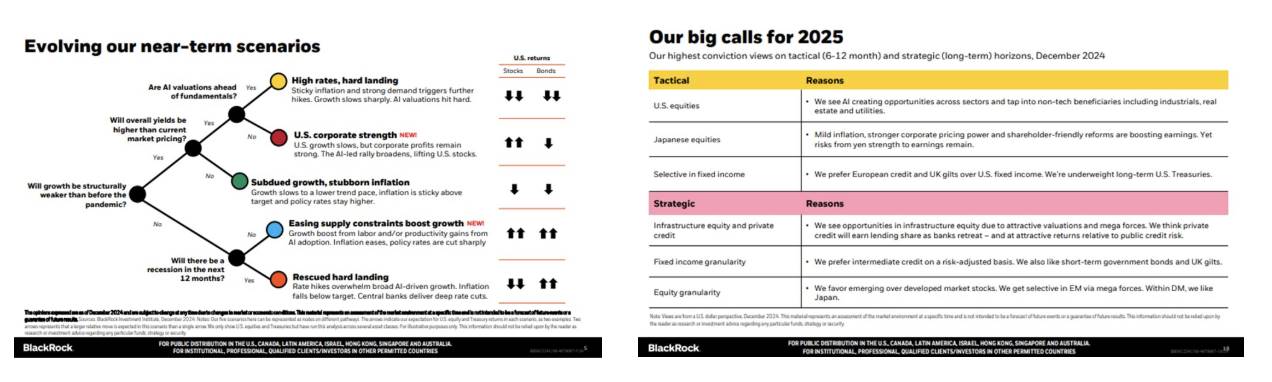

2. Core Viewpoints from Blackrock

Special Market Environment: The current market is in a unique phase, with long-term assets reacting unusually strongly to short-term events.

Investment Strategy: Continue to favor risk assets and further increase positions in U.S. stocks, as the "AI theme is rapidly expanding."

Inflation and Interest Rates: Inflation and interest rates are expected to remain above pre-pandemic levels.

2025 Market Outlook

Inflation Pressure: Due to increasing geopolitical divisions and accelerated spending driven by "AI infrastructure development and low-carbon transition," inflation pressure is expected to persist.

Federal Reserve Policy: The Federal Reserve is unlikely to significantly cut interest rates, with rates expected to remain above 4%.

Long-term Bond Yields: Given budget deficits, sticky inflation, and increased market volatility, investors may demand higher risk premiums, leading to rising long-term government bond yields.

Key Investment Themes

AI-Driven Investment Boom: The AI race will continue to drive market investment.

U.S. Stocks Continue to Lead: U.S. stocks are expected to continue performing well, but investors need to be flexible in responding to market changes.

Watch for Risk Signals: Signals such as soaring long-term bond yields or escalating trade protectionism could become key indicators for adjusting investment strategies.

3. Core Viewpoints from Deutsche Wealth

In the context of a "challenging economic environment," inflation may remain high due to "increased fiscal spending and potential tariff hikes."

"This will limit the central banks' ability to stimulate the economy through interest rate cuts, forcing them to seek a balance between growth and inflation control. This uncertainty may alter market expectations and trigger more volatility than in 2024. Additionally, geopolitical conflicts arising from changes in trade policy may further exacerbate market instability."

Asset Allocation Themes

The U.S. economy may achieve a soft landing, with robust economic growth and strong investment.

Focus on growth stocks, but be wary of high volatility risks.

Corporate profit growth and large-scale stock buybacks will benefit the U.S. stock market.

Investment Recommendations:

Focus on the long-term positive trend of economic growth.

Recommend a diversified investment portfolio and active risk management.

Key Points Overview

Despite geopolitical tensions and high interest rates, global economic growth is expected to slightly rise from 2.6% in 2024 to 2.7% in 2025-26.

Although short-term growth prospects have improved, growth in most global economies remains below the average level of the 2010s.

Global inflation is expected to decline slowly, averaging 3.5% in 2025. Central banks may remain cautious in monetary policy easing.

Risks such as geopolitical conflicts and climate disasters remain, particularly affecting vulnerable economies.

Policy recommendations include supporting green and digital transitions, promoting debt relief, and improving food security.

4. World Bank Group 2025 Outlook Highlights

Despite facing challenges from geopolitical tensions and high interest rates, global economic growth is expected to remain at 2.6% in 2024. By 2025-2026, this growth rate may slightly rise to 2.7% as trade and investment gradually recover.

Although short-term growth prospects have improved, overall performance remains weak. During 2024-2025, nearly 60% of economies will grow below the average level of the 2010s, accounting for over 80% of global economic output and population.

Global inflation is expected to ease more slowly than previously anticipated, with this year's average inflation rate reaching 3.5%. Due to persistent inflation pressures, central banks may be more cautious in relaxing monetary policy.

Recent multiple shocks have caused many emerging markets and developing economies to stagnate in catching up with developed economies. Data shows that nearly half of EMDEs will underperform developed economies between 2020-2024. For those severely affected by conflict, the future outlook is even bleaker.

Despite a balanced risk outlook, overall risks remain skewed to the downside. Major risks include:

Continued geopolitical tensions.

Potential escalation of global trade divisions.

High interest rates may persist long-term, compounded by ongoing inflation pressures.

Frequent natural disasters related to climate change.

To address these challenges, global policies need to focus on the following areas:

Maintaining the stability of the international trade system.

Promoting green and digital transitions to support sustainable economic development.

Providing debt relief support to help alleviate pressures on highly indebted countries.

Improving food security, especially in vulnerable economies.

For emerging markets and developing economies, high debt and its servicing costs pose a severe challenge. These countries need to find a balance between meeting huge investment demands and maintaining fiscal sustainability.

To achieve long-term economic and social development goals, countries need to implement the following policy measures:

Increase productivity growth to enhance economic efficiency.

Improve the efficiency of public investment to ensure proper use of funds.

Strengthen human capital development, such as education and skills training.

Narrow gender gaps in the labor market to increase female labor participation rates.

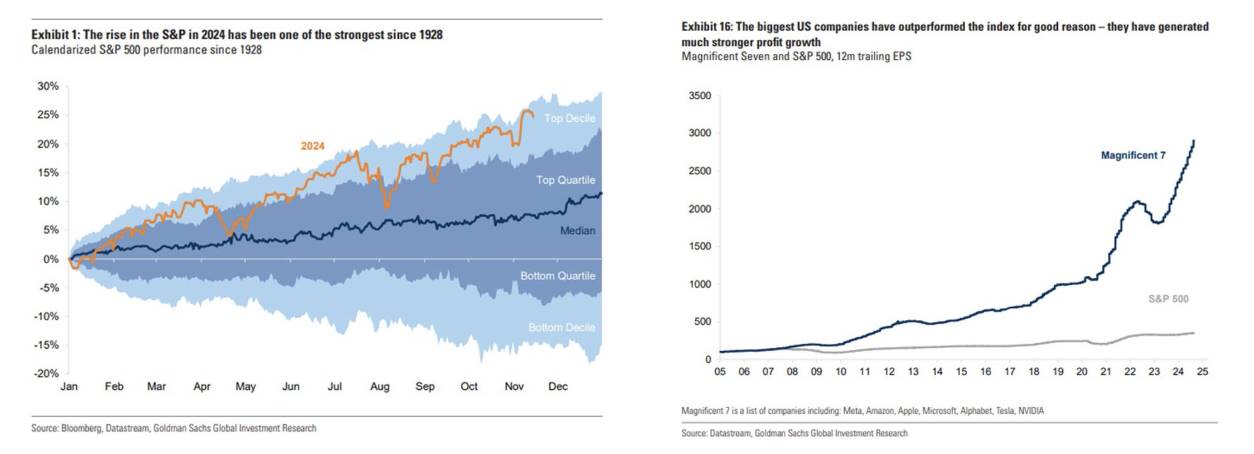

5. Core Viewpoints from Goldman Sachs

“2025: A Key Year for Exploring Excess Returns”

A decline in interest rates coinciding with economic growth may benefit the stock market.

Current stock valuations are nearing high levels, and future earnings growth will be the main driver of the market.

Since October 2023, global stock markets have risen by 40%, making the market more susceptible to negative news.

The S&P 500 index has seen one of its strongest increases since 1928. The Nasdaq index has risen over 50%, with NVIDIA's increase reaching as high as 264%. This trend is primarily driven by expectations of "peak inflation" and a "shift in Federal Reserve policy."

The rise in price-to-earnings ratios has led to historical highs in stock and credit valuations, especially in Europe and China, which are no longer undervalued.

Although stock valuations are high, this does not completely suppress the possibility of further increases. However, high valuations may exert some pressure on future returns.

Major U.S. tech companies have performed well, primarily due to strong profit growth, with their valuation levels reflecting their solid fundamentals rather than market over-speculation.

Risk Analysis

The report highlights two main risks:

Recent market optimism has already preemptively exhausted some returns, making the market more vulnerable to corrections.

There are still many unknowns regarding tariff risks, which may introduce uncertainty.

Goldman Sachs emphasizes the strategy of "diversifying investments and seeking excess returns (alpha)" to address these risks.

Specific strategies include:

Broadening the investment scope to include more asset classes;

Seeking potential value investment opportunities;

Achieving geographical investment diversification to spread risk.

6. Market Viewpoints from Morgan Stanley

Core Themes

Market Valuation is High Morgan Stanley believes that current market valuations are generally too high, and most investors no longer consider asset prices to be cheap. Therefore, it is recommended to prioritize obtaining excess returns (alpha) through optimizing asset allocation and investment choices, rather than relying solely on overall market returns (beta).

Bull Market Enters Optimistic Phase The market is entering the "optimistic phase" of a bull market, which is typically a later stage of the bull market, potentially followed by a "frenzy phase," the final sprint before a bear market arrives. Morgan Stanley states, "The market performance in 2025 is still worth looking forward to."

Impact of Generative AI on the Private Equity Market The potential impact of generative AI on the private equity market is considered one of the key themes for 2025. The rapid development of this technology may bring new opportunities and challenges for private equity investments.

Summary and Recommendations

From the viewpoints of various institutions, some common trends and themes can be identified, such as high market valuations, the impact of AI technology, and the importance of diversified investments. These insights can serve as a reference for investors in formulating strategies.

It is important to note that these viewpoints are not absolute truths but provide different perspectives for investors to compare and analyze.

If this content receives attention, I plan to write a dedicated article exploring the prospects of the cryptocurrency market. If there are other noteworthy reports or materials from research institutions, please feel free to recommend them to me; I would be very happy to further investigate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。