Original Author: siixx

Since Trump's victory, the cryptocurrency market has been injected with strong momentum, initiating a remarkable bull market. Bitcoin's price has soared, breaking through the $108,000 mark, a 126% increase from the peak of the previous bull market, while mainstream cryptocurrencies like Ethereum have also risen, bringing the total market capitalization to an unprecedented $7.5 trillion. This robust bull market has not only attracted the attention of numerous traditional investors but has also revitalized various sectors within the cryptocurrency market. In this opportunity-filled bull market context, the following sectors and potential projects are worth close attention from investors and industry practitioners.

DeFi Sector: New Lending Protocol Fluid

In the DeFi space, the momentum of this bull market is particularly strong, with total locked value experiencing explosive growth. As of December 18, it has reached $137 billion, a 65% increase from $83 billion on November 1, all within just 60 days. Among them, lending protocols, as one of the core applications of DeFi, are rapidly expanding. For example, the leading lending protocol AAVE has a total locked value of $22 billion, growing by 73.36% in this bull market, while the emerging lending protocol Fluid has surpassed $1 billion in locked value within just three months.

Fluid is a lending protocol deployed on Ethereum that combines automated market making (AMM) and directly competes with Aave for market share. Its features include a dynamic interest rate mechanism and an innovative risk control model, which have garnered enthusiastic user reception and positive community feedback, indicating significant growth potential. Its innovations and advantages are as follows:

1. Innovative Liquidation Mechanism

Fluid utilizes a mechanism similar to Uniswap to categorize assets that may be liquidated. When liquidation occurs, it is done on a scale basis by asset group rather than sequentially by individual assets. This innovation allows users' liquidation thresholds to be approximately 5% higher than that of the leading AAVE, while also reducing liquidation costs. For instance, during significant market fluctuations, traditional lending protocols may trigger multiple liquidations due to price volatility of individual assets, whereas Fluid can manage risks more effectively, reducing unnecessary liquidation events and providing users with a more stable lending environment.

2. High Capital Efficiency

Assets (collateral) and debts (loans) on the Fluid platform not only earn lending interest (similar to AAVE) but also generate transaction fee income (similar to Uniswap). This dual-income model enhances capital utilization efficiency, resulting in higher deposit interest and lower borrowing rates. For example, if a user deposits a certain amount of cryptocurrency as collateral and borrows, through Fluid's mechanism, their assets can earn lending interest while also participating in the distribution of transaction fees, achieving asset appreciation.

3. Project Collaboration and Development Potential

AAVE has recognized Fluid by voting to purchase its tokens at a low price, indicating industry acknowledgment of Fluid.

The experienced instadapp team behind the old project has not issued tokens recklessly, and Fluid plans to launch a new token economy, with the instadapp project token INST potentially convertible 1:1 with Fluid's project token, providing users with greater value expectations.

Binance's web3 wallet has recently partnered with Fluid, increasing the likelihood of its token being listed on Binance in the future, further enhancing the project's visibility and market potential.

Fluid is expected to fully benefit from the bull market in the DeFi sector, as more users and capital flow into the DeFi space, Fluid's innovative model will attract more lending demand, driving its business growth.

AI Sector: Binance Boosts AI Application Mall myshell

The AI sector has also performed excellently in this bull market. The integration of AI concepts with cryptocurrency technology has spawned a series of innovative projects, attracting substantial investment. Over the past year, the total financing for AI-related cryptocurrency projects has reached 278.1 billion yuan, a 113% year-on-year increase. Projects like myshell, an AI application mall, have gained investment from well-known institutions like Binance due to their unique positioning and strong technical support, positioning them to play a significant role in the wave of AI and blockchain integration.

Myshell is an AI application mall project that aggregates various AI applications, allowing users to purchase, use, and trade AI solutions, while developers can publish their own AI applications. The potential and highlights of the Myshell project are as follows:

1. Supporting Developers and AI Industry Development

As an AI application mall, myshell aims to break the monopoly of large AI companies in the future, providing income opportunities for small and medium-sized developers and promoting diversification in the AI industry. The platform features a variety of useful AI products across different application areas, offering developers a platform to showcase and profit while providing users with a rich selection of AI applications.

2. Gaining Binance Support and Token Launch Expectations

The project has received investment support from Binance, providing strong financial and resource backing for its future development. Given Binance's influence in the cryptocurrency industry, the likelihood of myshell launching its token and listing on Binance is high. Once launched, it will attract more users and capital to the platform, further driving project development. Additionally, there are currently relatively few high-quality AI agent projects on the BNB chain, making myshell a likely candidate for Binance's key support, enjoying more ecological resources and development opportunities.

3. Advantages of Web2 and Web3 Interaction

The myshell project excels in Web2 and Web3 interaction, lowering the entry barrier for users into the Web3 world. Users can more conveniently use AI applications, while the project's token will empower its ecosystem. Future airdrop plans also provide potential profit opportunities for early participants, attracting more users' attention and involvement in the project.

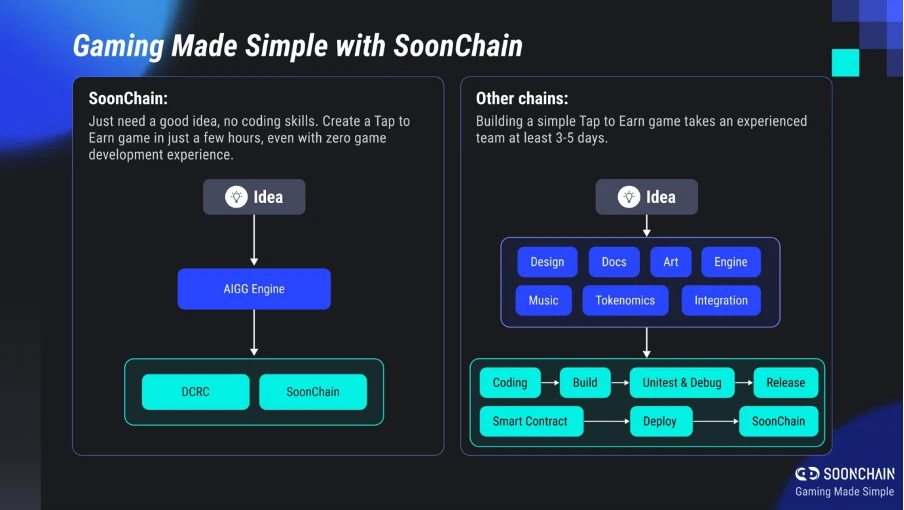

Gaming + AI Sector: L2 Soon Chain

The gaming sector has been steadily gaining momentum in the first half of 2024. According to market research reports, the cryptocurrency gaming market size grew significantly by 38.9% in Q2 of this year, reaching $2.75 billion, thanks to the application of blockchain technology, which better secures in-game asset ownership and transactionability, attracting numerous players. The SoonChain project has seized this trend by combining AI with Layer 2 technology, aiming to create a superior AI-powered gaming experience.

SoonChain is a Layer 2 public chain deployed on the Ethereum network, characterized by its integration of smart contracts and AI technology to optimize the performance of decentralized applications (DApps), enhance transaction throughput, and reduce transaction costs, improving user experience and functional innovation. The community holds a positive attitude, especially looking forward to breakthroughs in gaming and AI. Specifically, there are three points:

1. L2 Public Chain Optimizing Transaction Experience

As an L2 public chain, SoonChain addresses the scalability issues of traditional blockchains, optimizing transaction costs and efficiency. In AI-powered gaming scenarios, this means that real-time transactions, asset transfers, and NFT transactions for complex games can be conducted quickly and cheaply. Players no longer have to endure high fees and long confirmation times for in-game item trades and asset transfers, enhancing the fluidity of the game and user experience.

2. AI-Driven Game Development and Upgrades

SoonChain leverages AI technology to drive game development, significantly simplifying the game development process and reducing development costs. Additionally, during later upgrades and adjustments of the game, AI can quickly optimize and improve based on player behavior data and feedback, providing higher quality game content. For example, AI can automatically generate game scenes, character designs, or quest narratives, saving time and effort for game developers while maintaining the freshness and appeal of the game.

3. Decentralized Governance Combined with NFTs

The public chain token AIGG allows holders to participate in the decision-making process of AI game development, incentivizing players and creators to actively engage in the platform's ecosystem construction. Furthermore, SoonChain combines AI with common NFT elements in gaming, enabling AI to quickly generate game-related items or peripheral NFTs, which can be traded rapidly on the public chain through AIGG. This not only enriches the economic ecosystem of the game but also provides players with more collection and investment opportunities.

Meme Launch Sector: Multi-Chain Launch Platform Chain.fun

The meme launch sector is also highly competitive in this bull market, with projects like pump.fun and Clanker attracting significant attention from investors and crypto enthusiasts due to the unique cultural attributes and virality of meme coins, as they seek the next coin to make a fortune. Since the bull market began, many new meme coin projects have emerged amid capital influx and media hype from figures like Musk, with trading activity continuing to rise, and some popular meme coins achieving daily trading volumes of several hundred million dollars. This explosive market performance reflects investors' pursuit of emerging and interesting crypto assets and demonstrates the powerful influence of meme culture in the crypto space. In this context, the Chain.fun project stands out as an innovative force in the meme sector, deserving our attention.

Chain.fun aims to help users easily initiate, create, and launch meme coins across multiple blockchain networks, such as Solana, Ethereum, BSC, Base, and Ton. The platform's goal is to provide the crypto community with a simple tool to help users leverage different blockchain technologies to launch their own meme coins at a lower cost for trading, investment, or entertainment. Its features include:

1. Multi-Chain Cross-Chain Support

Chain.fun is renowned for its multi-chain cross-chain support, allowing users to choose the most suitable platform for launching their memecoin projects based on blockchain characteristics. Users can take advantage of Solana's fast transactions, Ethereum's smart contract capabilities, and BSC's low costs to optimize transaction costs and speed, thereby enhancing project competitiveness. Cross-chain technology further breaks the limitations of a single chain, providing creators with more freedom and choices, enabling them to flexibly allocate resources and strengthen the overall strength of their projects.

2. Social and Community-Driven

Given that meme coins inherently possess social-driven characteristics, Chain.fun places a high emphasis on leveraging social platforms and community power to promote their popularity. The platform encourages community members to actively engage in interactions, allowing creators to promote their coins through various means such as voting, publicity, and collaboration. This community-driven model not only strengthens the connections between users but also injects strong momentum into the dissemination and development of meme coins.

3. Decentralization and Transparency

Adhering to the decentralized philosophy of blockchain, Chain.fun allows anyone to participate in platform activities without intermediaries. At the same time, based on the transparent nature of blockchain, every meme coin transaction and its related data are publicly traceable. This ensures the fairness and credibility of transactions, creating a safe and reliable environment for users.

4. NFT and Collectible Value

In addition to meme coins themselves, the Chain.fun platform also has the potential to transform memes into NFTs, thereby granting them unique collectible value. With the help of NFT technology, meme coins are no longer just a fun digital currency but have the potential to become digital assets with artistic value, further enriching users' investment and collection options.

Conclusion

In summary, in the current bull market environment of the cryptocurrency market, the four projects—Fluid, myshell, chain.fun, and SoonChain—demonstrate unique advantages and tremendous development potential in the DeFi, AI, meme launch, and AI and gaming sectors, respectively. Investors and industry practitioners can closely monitor the development of these projects to seize new opportunities in the cryptocurrency field. However, the cryptocurrency market is characterized by high uncertainty and risk, so when participating in project investments or collaborations, it is essential to fully understand the project's technology, team, market, and other aspects, and to make decisions cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。