As 2025 approaches, how will JOC take root in the Japanese crypto ecosystem to achieve large-scale adoption of Web3 in various real-world consumption scenarios?

Author: Deep Tide TechFlow

According to a report by Japanese crypto media Coinpost, on December 20, the Liberal Democratic Party of Japan is promoting cryptocurrency tax reform, which includes a 20% separate tax rate on cryptocurrency trading profits and the introduction of a loss carryforward system, to further enhance the competitiveness of Japan's crypto market. Currently, the reform outline is in the "review stage."

The news has sparked widespread attention from the community regarding the Japanese crypto market.

Historically, the Japanese crypto market has been a very unique entity: on one hand, Japan, as the world's fourth-largest economy, was also one of the first countries to embrace the crypto industry, possessing a solid real-world foundation and compliance advantages under a well-established regulatory system; on the other hand, due to regulatory intervention, the Japanese crypto market also faces issues such as inefficiency, high taxes, and relative closure.

With Bitcoin breaking the $100,000 mark and crypto-friendly President Trump taking office, many view 2025 as a critical juncture for the crypto industry. The signals of regulatory easing from the Japanese government have generated significant interest in establishing a presence in the Japanese crypto ecosystem.

Based on this, with the native token JOC Coin set to launch simultaneously on six global exchanges at 11:00 AM (Beijing time) on December 23, 2024, Japan Open Chain (referred to as JOC) is further entering the public eye.

As a Layer 1 public chain focused on practicality and compatible with Ethereum, JOC is managed by the Japan Blockchain Foundation under the Japanese entity G.U.Group. It aims to build a blockchain infrastructure that complies with Japanese laws and is safe, fast, and low-cost, providing a stable, reliable, and compliant environment for the development of Web3 businesses for enterprises and local governments.

Naming a project is an art of branding, and we rarely see cases where a country is directly included in the project name. The direct incorporation of the term "Japan" in JOC reflects the project's vision to become the infrastructure for Japan's Web3 digital economy. Furthermore, extensive cooperation with top national enterprises and deep penetration into Japan's digital economy consumption field highlight its ambition and capability.

In the future, starting from the Japanese market, JOC will actively seek cooperation with enterprises from multiple countries to develop international business, further advancing towards the goal of becoming a cornerstone of the Web3 digital economy.

As the year-end approaches, with JOC Coin landing on six global exchanges as the core value carrier of the ecosystem, will it drive JOC into a growth flywheel? As 2025 nears, how will JOC take root in the Japanese crypto ecosystem to achieve large-scale adoption of Web3 in various real-world consumption scenarios?

Through JOC, let us delve into the mysterious Japanese crypto market and explore the specific reasons why JOC is worth attention.

Compliance: An Important Prerequisite for Blockchain to Achieve Inclusive Digital Economy

Like most Japanese crypto projects, JOC distinctly embodies the unique qualities of Web2 elites venturing into Web3 projects.

This is understandable; on one hand, there are not many VCs in Japan focusing on Crypto and Web3, with most active institutions backed by Japanese Web2; on the other hand, the company behind JOC, G.U.Group, Inc., based in Shibuya, Tokyo, focuses on providing Web3 solutions, with its representative directors, Hidetaka Kondo and Akira Inaba, both hailing from traditional Web2 giants.

This Web2-related characteristic has also made JOC stand out in terms of compliance, resources, and ecosystem.

Compliance has always been regarded as the necessary path for Web3 to step into the sunlight and achieve large-scale implementation.

Due to the decentralized nature of Web3 projects based on blockchain, and the fact that most Web3 projects are built around financial scenarios, they are prone to issues such as fraud and market manipulation, severely disrupting the government-led centralized financial system. Especially in the field of cross-border transactions, some unscrupulous Web3 projects can easily bypass customer verification (KYC) and anti-money laundering (AML) regulations, becoming breeding grounds for crime and terrorism, which is unacceptable to various countries.

In this necessary path, Japan is a leading explorer.

On one hand, since entering the "lost thirty years" in 1990, Japan's economy has been in a recession characterized by low growth, low employment, low inflation, low wealth, and low leverage. Web3 is seen as an important layout for achieving a leapfrog development. As a crypto-friendly country, Japan recognized virtual currencies, including Bitcoin, Ethereum, Ripple, and Litecoin, as payment methods as early as 2016. Additionally, on April 6, 2023, Japan released a white paper viewing Web3 as a national strategy.

To this end, the Japanese government has invested significant resources in promoting research and application of blockchain technology. For example, the Cabinet Office of Japan has established several special funds to support innovation and practical application research in blockchain technology.

On the other hand, Japan has also guided the compliant and healthy development of the crypto ecosystem by establishing a comprehensive regulatory framework: in 2016, Japan enacted the Payment Services Act and the Financial Instruments and Exchange Act, with the Financial Services Agency responsible for implementing these regulations, focusing on exchange registration, cybersecurity measures, and anti-money laundering protocols.

Moreover, Japan has established the Japan Virtual Currency Exchange Association (JVCEA) as a government-approved self-regulatory organization to raise industry standards and approve tokens listed on exchanges.

In the following years, Japan continued to revise and optimize relevant policies around enhancing investor protection, cybersecurity, and preventing money laundering, gradually clarifying a strict and comprehensive regulatory framework that includes cryptocurrency income in the tax system.

Although Japan's heavy regulation of the crypto industry has brought many restrictions, leading to inefficiencies, a lack of market vitality, and a slight lag in industry hotspots, it has effectively protected user asset safety during significant events like the FTX exchange crisis, and under a compliant framework, it can attract the participation of traditional institutions, further promoting the integration of Web3 with the real world.

For JOC, Japan's unique regulatory system also creates a significant opportunity for the project to move towards compliance and integrate with broader Web resources.

On one hand, as early as August this year, JOC's native token JOC Coin announced that it had passed the review by the Japan Cryptocurrency Exchange Association (JVCEA) and would be open for sale to ordinary investors through BitTrade, a top Japanese crypto exchange that has obtained a trading license in Japan. Under complex regulatory scrutiny, the cycle for Japanese crypto projects to obtain regulatory approval is at least over a year, and JOC, which has already completed the compliance path, undoubtedly has a first-mover advantage over other projects.

On the other hand, observing the Japanese crypto market, we can easily see the phenomenon of low diversity in the types of Japanese crypto projects, mainly dominated by NFT and gaming projects. Although there are also public chain projects, overall competition is smaller, and under stronger demand and less competitive pressure, JOC further gains rapid development space.

In fact, under the strong compliance advantage, several top institutions in Japan have already shown interest in JOC:

We know that the JOC network is operated by multiple blockchain operation partners to ensure the network's robustness and credibility. A closer look at the list of JOC operators reveals a powerful lineup: it includes well-known companies such as CORGEAR Co.Ltd., a startup under the Sony Group, Dentsu Inc., NTT Communications under the NTT Group, G.U.Technologies Inc., insprout Corporation, Kudasai Co., Ltd., Minna Bank, Ltd., pixiv Inc., TIS Inc., extra mile Inc. under Asahi Television Group, Kyoto University of Art and Design, Hatena Co., Ltd., CAC Corporation, CYBERLINKS CO.,LTD., SBINFT Co., Ltd., and Nethermind.

It is worth mentioning that in 2025, when Japan releases strong signals for crypto deregulation, it is expected that more Japanese users, funds, and institutions will enter the crypto industry, and JOC will become the main platform for accommodating users, funds, and institutions.

How to better welcome the new wave of traffic and funds while enhancing retention becomes a core issue for ecosystem construction.

From Stablecoins to NFTs: JOC Roots in the Japanese Market to Build a Consumer-Level Ecosystem

In this cycle, the call for consumer-level applications is rising, but despite years of shouting the "mass adoption slogan," there still exists an invisible wall between the crypto market and the real world. This is because building consumer-level applications is not an easy task; it requires real-world demand as a value support and imposes higher requirements on user scale, product quality, and product experience.

At this time, introducing Web3 solutions to traditional Web2 business models to provide better and more transparent services has become an efficient choice of "standing on the shoulders of giants." The integration of JOC's strong Web2 resources with Web3 solutions also gives the project an inherent advantage in rapidly penetrating specific consumption scenarios in the real world.

According to the official website, the current JOC ecosystem has over 36 partners, including: 16 operators; 12 development partners; 5 stablecoin partners; 1 crypto asset exchange; 5 JOC partner products; and 1 Web3 business promotion partner (the same project has multiple business scenarios, so there is some overlap in classification).

Wallets as the Entry Point for Ecosystem Traffic: Low Barriers are Key to Building a Seamless User Experience: Currently, JOC not only has the native compatible wallet G.U. Wallet, which allows users to easily and securely store and exchange crypto assets and NFTs, but has also established partnerships with several wallet projects, including Fox Wallet.

Stablecoins are seen as an important hub connecting the crypto economy with real-world finance. Compliant stablecoins, which have higher credibility, more robust value support, and lower systemic financial risks, are becoming a trend that can strongly promote the standardization of the industry and expand market size.

In 2023, Japan implemented the revised "Fund Settlement Act," defining stablecoins as a new "electronic payment method." This not only further clarifies the status of stablecoins within the Japanese legal framework but also establishes detailed rules to regulate the issuance and use of stablecoins domestically, providing positive guidance for the development of compliant stablecoins.

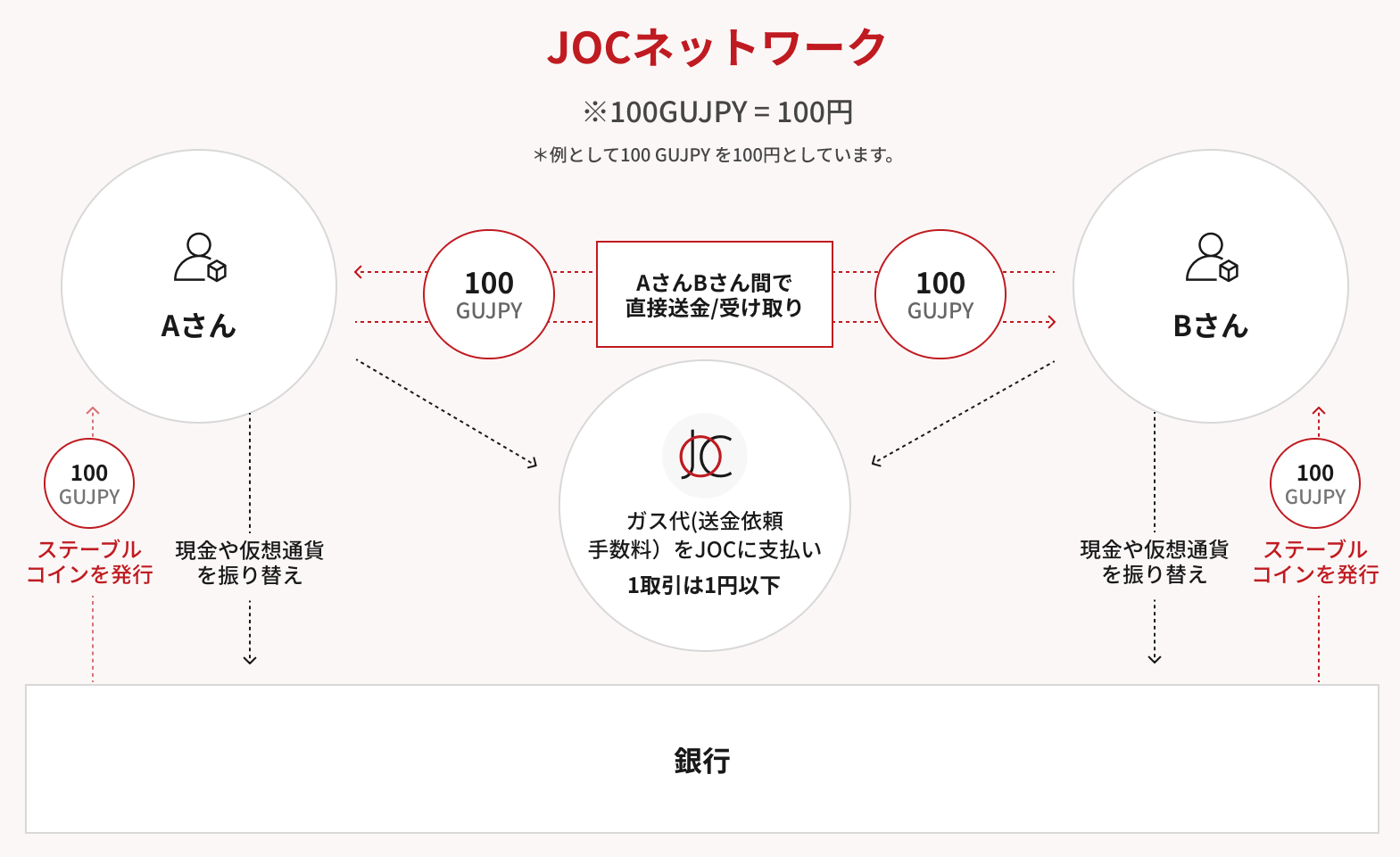

Currently, JOC is collaborating with five top Japanese financial institutions, including Aozora Bank, Minna no Bank, ORIX Bank, and Shikoku Bank, to conduct demonstration experiments for the actual issuance of stablecoins. It is reported that this stablecoin will be usable in mainstream wallets like MetaMask, and compared to cash payments, stablecoins have advantages in cost and speed, so their use is expected to expand as a payment method for inter-company payments and international remittances.

G.U. Coin Studio is a stablecoin issuance and management system provided by G.U. Technologies for financial institutions. Through G.U. Coin Studio, relevant parties can manage the issuance and distribution of stablecoins on JOC and connect with existing financial systems.

Beyond the banking payment system, the mature development of stablecoins has also introduced the rapidly growing RWA (Real World Assets) narrative into the JOC ecosystem this year: we know that stablecoins are one of the most important use cases in the RWA track, playing crucial roles in value measurement, transaction medium, payment methods, and liquidity hubs, empowering the development of RWA. Compliant stablecoins will further amplify their role, becoming a stronger driving force in the RWA track.

In the future, as JOC's compliant stablecoins mature, combined with JOC's strong resources in technology, communication, social networking, cultural creativity, and government work in Japan, it will become possible to bring more real-world assets on-chain, further solidifying JOC's important position as the foundation for Japan's digital economy development.

In fact, in JOC's ecosystem use cases, this consumer-level trend closely related to RWA is already evident:

Japan has long been regarded as a fertile ground for NFT development due to its strong IP resources in anime, gaming, etc. The JOC ecosystem also boasts high-quality consumer-level NFT partners:

Kyoto University of Art, as a JOC network operator, is Japan's largest art university, and the high-quality artworks it produces will provide valuable resources for the development of tracks including NFTs; SBINFT, one of the operators, is a subsidiary of SBI Holdings, focusing on NFT-centered Web3 business; SUSHI TOP MARKETING is dedicated to all functions required for NFT marketing, including the patent-pending NFT Shot; NFT Garden, as a multi-chain NFT issuance platform, plays an important role as a quality NFT project incubator in the JOC ecosystem.

It is worth mentioning that JOC is also collaborating with the government to leverage the unique properties of NFTs in identity ID, providing e-Kaga Citizen ID NFTs for residents of Kaga City, Ishikawa Prefecture, Japan, based on the JOC-built e-Kaga Citizen system for population registration and management. This is one of Japan's important attempts to explore the use of digital technology to build smart cities.

Additionally, JOC has partnered with Japan Post Group to launch NFT artworks celebrating the 70th anniversary of Yamabe Town, as part of the Mirai Post Office project. Users can support Yamabe Town by purchasing NFTs, with proceeds used for the maintenance and development of Yamabe Town. Within two months of the sale, both types of NFTs totaling 1,000 sets sold out.

Furthermore, the JOC ecosystem's collaborative landscape includes infrastructure and development service projects, content service platforms, branding and marketing platforms, smartphone digital banking, decentralized loyalty programs, digital comic platforms, etc., providing participants in its ecosystem with an engaging experience that breaks down the barriers between Web3 and the real world.

It is noteworthy that the unique regulatory environment has shaped Japan's distinct crypto market, and we often observe mismatches in market hotspots. Therefore, for Japanese crypto projects, there is a higher demand for strengthening communication and cooperation with international entities and promoting the integration of the Japanese crypto market into the global market, and JOC has already begun to take action.

In September of this year, PhiloLab Technology, a blockchain technology company, announced a strategic investment in JOC through its cross-chain project Bifrost. This investment aims to promote the market expansion of Web3 enterprises in Japan and globally, and to build a blockchain ecosystem oriented towards practical applications. Bifrost plans to provide interoperability technical support for JOC and will deploy decentralized application (DApp) services on its network to further activate the JOC network ecosystem.

According to signals released by JOC on social media platforms, in the future, JOC will actively seek cooperation with international crypto projects, on one hand promoting the Japanese crypto economy to go global, and on the other hand bringing in global crypto hotspots, further building a strong blockchain infrastructure to support the global Web3 digital economy, starting from Japan.

Of course, under this grand vision, a more important question is:

With the upper-level blueprint drawn, how can the underlying technology effectively support it, providing a secure, efficient, low-cost, and seamless ecosystem participation experience for tens of thousands of users in different scenarios?

PoA Consensus Mechanism: A Key Choice for Supporting Large-Scale Adoption

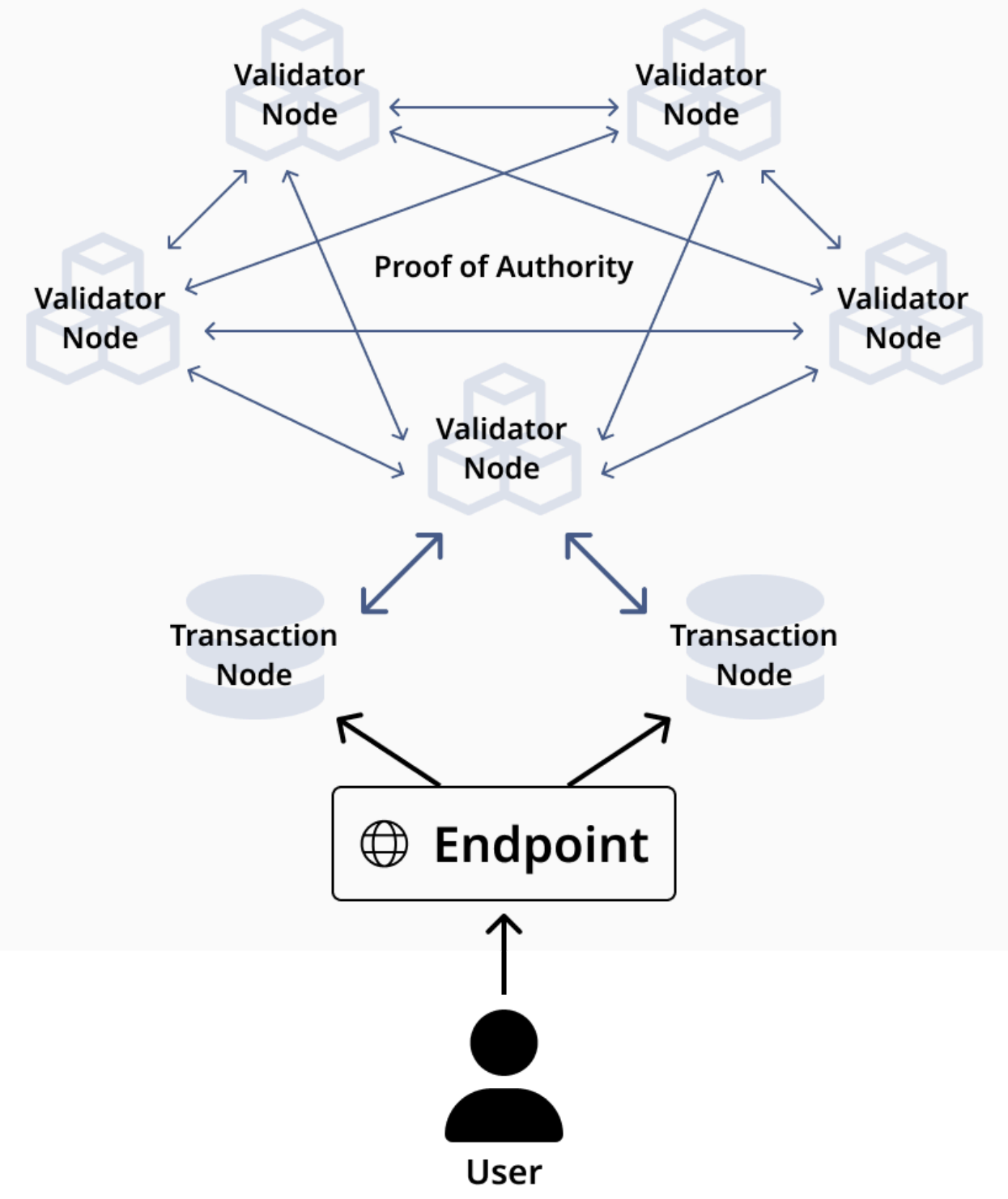

The PoA (Proof of Authority) consensus mechanism is a key design for the high performance and scalability of the JOC network.

As the name suggests, authority is at the core of the PoA mechanism.

Specifically, in the PoA consensus mechanism, the number of nodes can be unlimited. JOC chooses PoA as the underlying consensus partly due to the important consideration of achieving permissionless access as a public chain. Theoretically, anyone can participate in blockchain operations by setting up their own node/server and connecting it to the blockchain network, allowing for greater freedom and inclusivity, which can introduce diverse cultures and innovations into the ecosystem.

At the same time, the number of network validators (i.e., operators) using the PoA mechanism is limited, and these validators are what we referred to as the "core" earlier. Nodes are primarily responsible for synchronizing blockchain ledger information, while validators are responsible for verifying transactions and packaging blocks. Due to the limited number of validators, PoA consensus mechanism blockchains far exceed public chains like Bitcoin and Ethereum in terms of efficiency and scalability.

Of course, many community members have concerns about the level of decentralization of the PoA mechanism, as limited validators = limited decentralization. If validators act maliciously, launching attacks on the network or tampering with the ledger, it can easily harm the entire blockchain network.

In response, JOC has also taken multiple measures to maintain the underlying security of the network:

In terms of the number of validators, the JOC network is still in its early development stage, currently having 16 validators. However, as the pace of ecosystem construction accelerates, JOC aims to expand the list of validators to 21, further enhancing decentralization.

Regarding the threshold requirements, JOC has high standards for validators, who come from different industries and interest groups, and are almost all large, highly reputable entities in Japan. To ensure the diversity of validators, JOC plans to introduce reliable crypto companies and startups that can contribute to the ecosystem as validators in the future. Due to the high entry barriers, the PoA consensus mechanism also has a certain guarantee of security.

In this way, JOC achieves a balance between security and efficiency through the PoA mechanism: according to official data, JOC can execute thousands of token transactions or hundreds of complex smart contract interactions per second, with transaction fees controlled to be under 1 yen, and can achieve finality of transactions within 5 seconds.

It is noteworthy that JOC is fully compatible with Ethereum, which brings greater convenience for interoperability between the two ecosystems: for Ethereum projects looking to enter the Japanese market or more consumer-level scenarios, they can seamlessly migrate to the JOC ecosystem; for developers interested in building on JOC, the vast array of development tools and resources available on Ethereum will significantly lower the barriers for developers and enhance efficiency, further expanding the imaginative space for building a rich ecosystem on JOC.

JOC Coin Launching Simultaneously on Six Global Exchanges, Multiple Milestones Set to Land

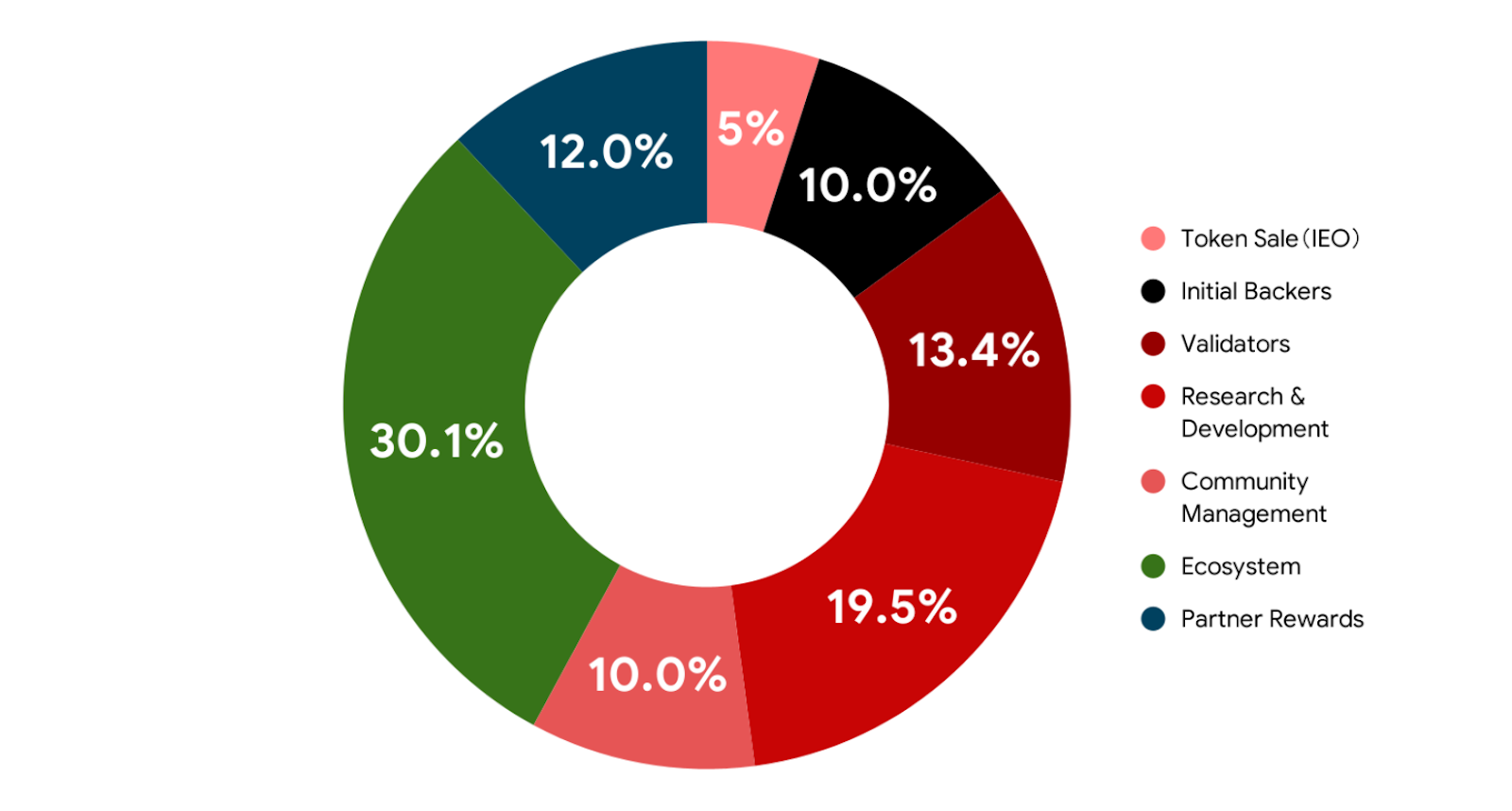

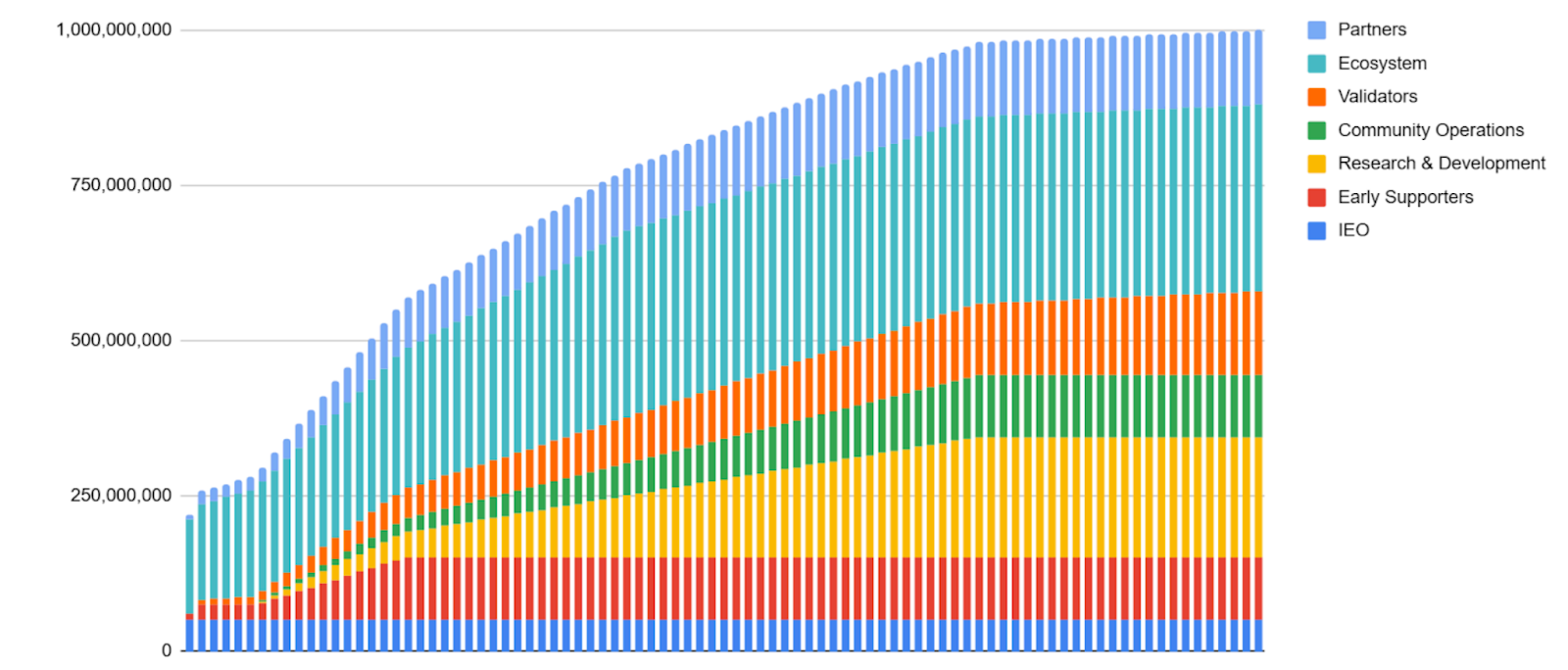

Of course, for JOC, the most unmissable ecological event this year is the launch of the JOC Coin token. As the native token of JOC, the total issuance of JOC Coin is 1 billion, and there is no mechanism for additional issuance. The deflationary economic model allows the token's value to gradually increase over time, with the primary use of the token being to pay transaction fees on the Japanese public chain. The specific distribution and release rules are as follows:

Recently, JOC announced that to ensure liquidity after the IEO issuance, the native token JOC Coin will launch simultaneously on six global exchanges on Monday, December 23, 2024, at 11:00 AM (Beijing time):

- Gate.io

- MEXC Global

- LBank

- XT.com

- Bit2Me

- BitTrade (*Note: formerly Huobi Japan)

This is the first time in Japan that such a global simultaneous launch has been achieved, allowing investors worldwide, including those in Japan, to purchase JOC Coin. The combined daily average spot trading volume of these six exchanges exceeds 2.7 trillion yen, equivalent to 75 times the daily trading volume of all cryptocurrency exchanges in Japan, providing ample market liquidity for JOC Coin. In the future, JOC will also strive to push for JOC Coin to be listed on more mainstream exchanges, offering broader users more opportunities to engage with and understand JOC Coin.

It is reported that in the previous IEO conducted on the BitTrade platform, the planned total sales amount for JOC Coin was 1.2 billion yen, including 500 million yen for priority early bird sales and 700 million yen for regular lottery sales. However, the actual application amount far exceeded expectations, attracting over 9 billion yen in participation, demonstrating users' optimism towards JOC. With the simultaneous launch of the token on six major exchanges, more people have high expectations for the future construction of the JOC ecosystem and the performance of the JOC Coin token.

Conclusion

For a long time, Japan's Web3 has been a market that cannot be underestimated.

According to the data interpretation of the Japanese market in the article "The Truth of Web3 in the Asia-Pacific Market" published by Deep Tide TechFlow in 2023: among Japan's 120 million population, based on the standard of holding CEX accounts licensed by the Japanese Financial Services Agency, there are over 5 million crypto users in Japan.

With the relaxation of crypto regulations in Japan expected in 2025, coupled with the positive outlook for the global crypto market in 2025, the Japanese crypto market may experience a new wave of growth.

For JOC, which is well-equipped in compliance and resources, leveraging its advantages and seizing market opportunities will be key to rising in the new round of competition.

It seems that JOC is well aware of this.

In the upcoming 2025, in addition to continuous technological iterations to achieve higher TPS, stronger scalability, and a more seamless user experience, JOC's stablecoin pegged to the yen/other foreign currencies, in collaboration with major banks, will soon meet the community, bringing more momentum to the global inclusive digital economy that JOC is committed to building.

As the year comes to a close, it is a suitable time to look forward to the future.

The community remains optimistic about the subsequent growth performance of the Japanese crypto market and JOC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。