Bitcoin is gradually entering the later stages of a bull market, with multiple indicators showing significant upside potential after a short-term consolidation, with target prices possibly between $150,000 and $200,000.

Author: Bitcoin Magazine Pro

Translation: Baihua Blockchain

As Bitcoin now regularly enters the six-figure range, higher prices seem inevitable. By analyzing key on-chain data, valuable insights can be provided regarding the fundamental health of the market. Understanding these indicators allows investors to better predict price trends and prepare for potential market peaks or upcoming corrections.

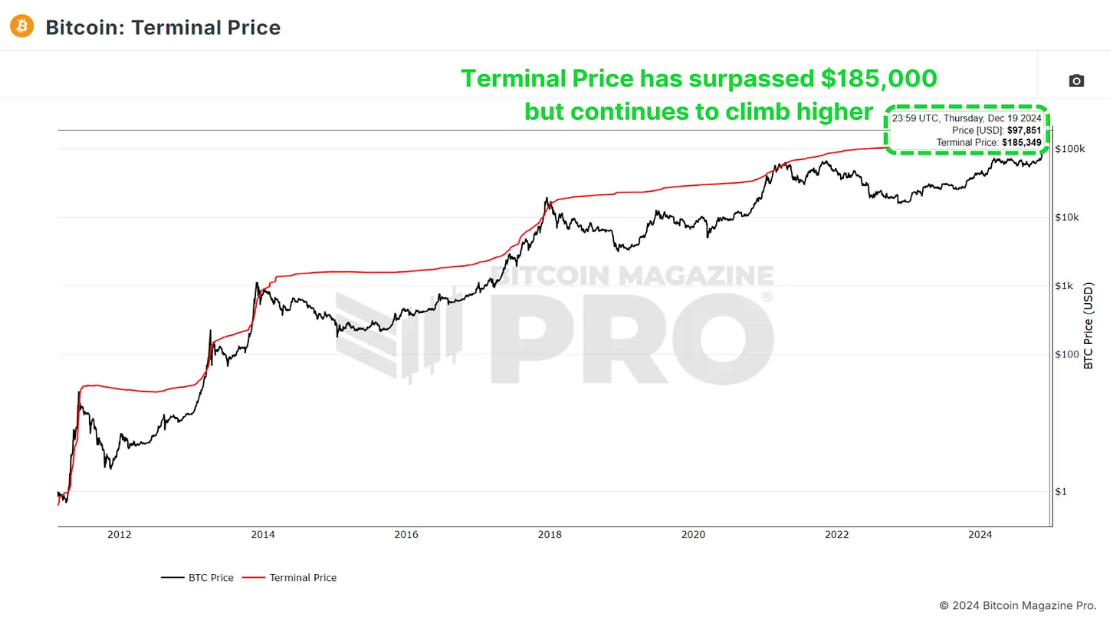

1. Terminal Price

The "Terminal Price" indicator combines Coin Days Destroyed (CDD) and Bitcoin's supply, and has long been regarded as an effective tool for predicting Bitcoin cycle peaks. Coin Days Destroyed is simply a measure of the activity level of Bitcoin transactions, considering both the duration of holding and the amount of Bitcoin involved in transactions.

Translator's Note:

Terminal Price is an indicator used to predict price peaks for cryptocurrencies like Bitcoin. It combines Bitcoin's supply and on-chain transaction data, such as Coin Days Destroyed (CDD), to assess market activity and investor behavior.

Coin Days Destroyed (CDD): Simply put, it looks at how long Bitcoin has been held before being transferred, while also considering the amount transferred.

Function of Terminal Price: When the Terminal Price rises, it usually indicates that market trading is active or even overheated, potentially nearing the peak of the current bull market.

In simpler terms, the Terminal Price acts like a "market thermometer," helping investors determine whether Bitcoin is in the later stages of a bull market or about to adjust.

Figure 1: Bitcoin's Terminal Price has surpassed $185,000

Currently, Bitcoin's Terminal Price has exceeded $185,000 and may further rise to $200,000 as the cycle progresses. Given that Bitcoin has surpassed $100,000, this suggests that the price may maintain a positive upward trend in the coming months.

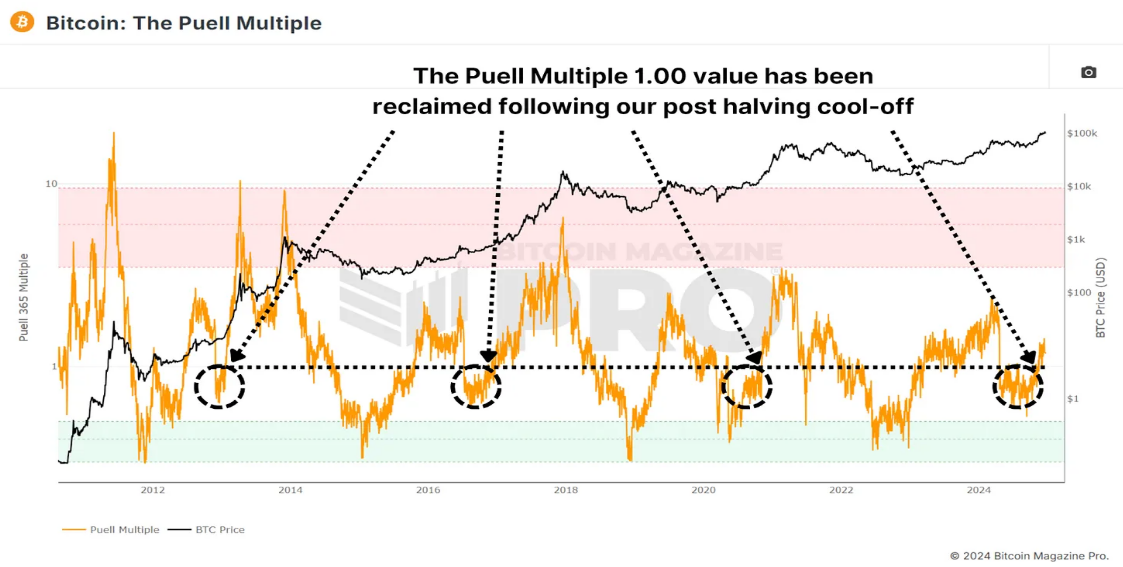

2. Puell Multiple

The Puell Multiple is assessed by comparing daily miner revenue (in USD) to its 365-day moving average. After the halving event, miner revenue significantly declined, leading the market into a consolidation phase.

Figure 2: The Puell Multiple has climbed above 1.00

Currently, the Puell Multiple has risen back above 1, indicating that miner profitability is recovering. Historical data shows that breaking this critical value typically signals the later stages of a bull market cycle and is often accompanied by exponential price increases. This pattern has been observed in all previous bull markets.

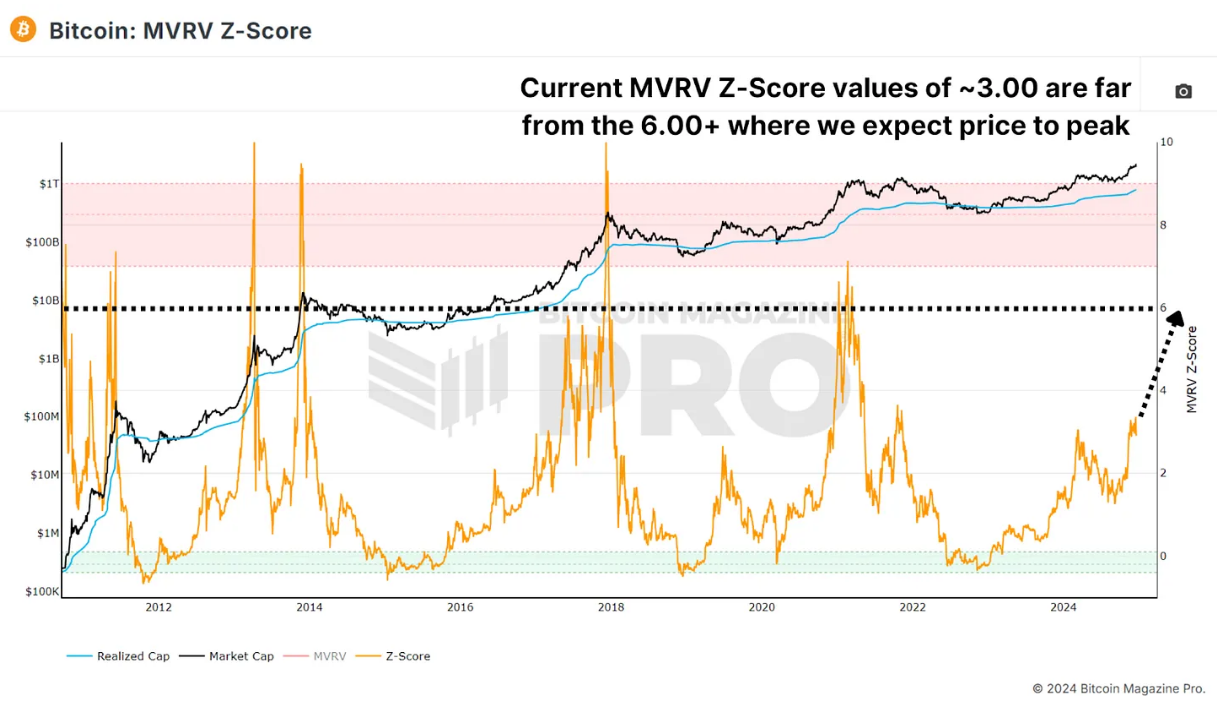

3. MVRV Z-Score

The MVRV Z-Score provides key market signals by measuring the relationship between market value and realized value (the average cost basis of Bitcoin holders). To account for asset volatility, this indicator is standardized to a Z-score, demonstrating high accuracy in identifying cycle peaks and troughs.

Figure 3: The MVRV Z-Score remains significantly below previous cycle peaks

Currently, Bitcoin's MVRV Z-Score is around 3.00, not yet entering the overheated red zone, indicating that the market still has room for growth. Although the trend of gradually lowering recent cycle peaks has emerged, the Z-score shows that the market is still some distance from reaching a euphoric peak.

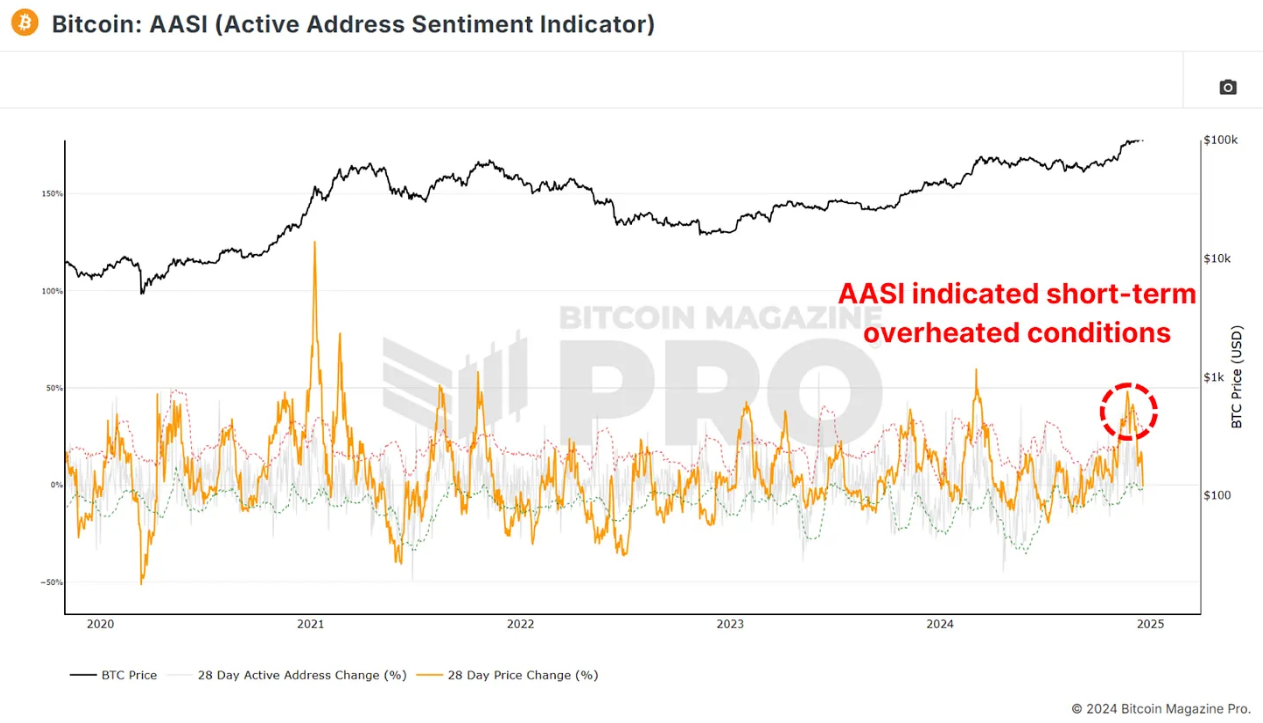

4. Active Address Sentiment

This indicator tracks the percentage change of active network addresses over a 28-day period and compares it to price changes during the same period. When price growth exceeds network activity, it suggests that the market may be overbought in the short term, as positive price performance may be difficult to sustain without sufficient network utilization.

Figure 4: AASI shows signs of overheating as Bitcoin breaks $100,000

Recent data shows that after Bitcoin rapidly climbed from $50,000 to $100,000, the market experienced slight cooling, indicating that it is currently in a healthy consolidation phase. This adjustment may lay the groundwork for sustained long-term growth and does not imply that we should hold a pessimistic view on the medium to long-term trend.

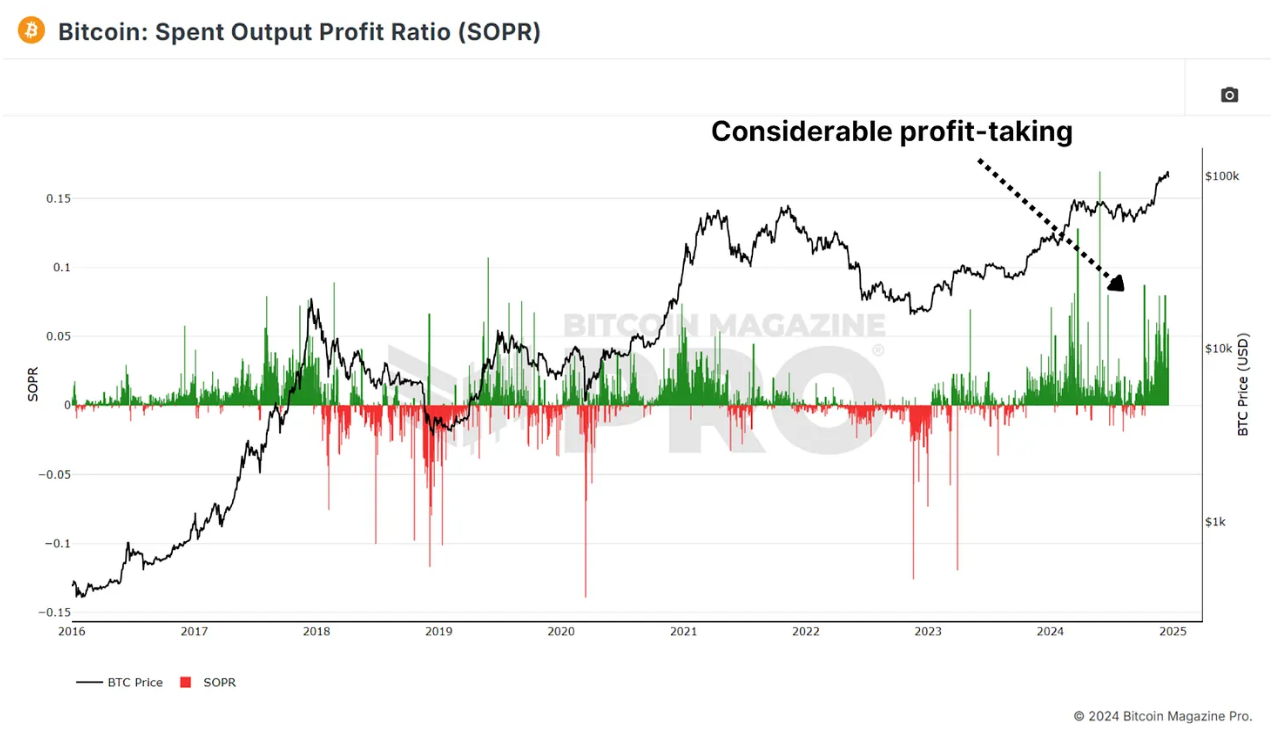

5. Spent Output Profit Ratio (SOPR)

The Spent Output Profit Ratio (SOPR) measures the profits realized in Bitcoin transactions. Recent data indicates an increase in profit-taking behavior, which may suggest that we are entering the later stages of the cycle.

Figure 5: A large accumulation of SOPR indicates profit-taking behavior

It is important to note that the increasing use of Bitcoin ETFs and derivatives may be influencing the SOPR values. Investors may be shifting from self-custody to using ETFs for convenience and tax advantages, which could impact SOPR figures.

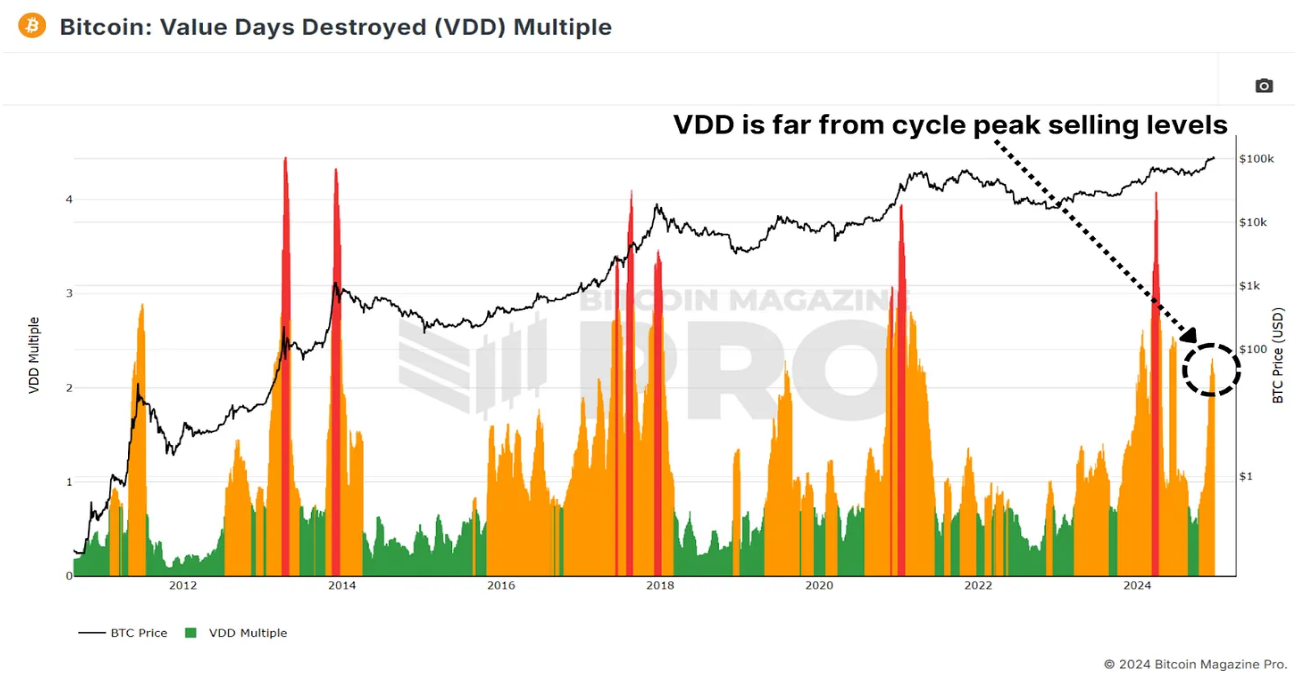

6. Value Days Destroyed (VDD)

The Value Days Destroyed (VDD) multiple adds weight to long-term large holders based on Coin Days Destroyed (CDD). When this indicator enters the overheated red zone, it typically indicates that prices have reached a major peak, as the most experienced large participants in the market begin to cash out.

Figure 6: VDD is at a high but not yet overheated level

Currently, Bitcoin's VDD level shows that the market is slightly overheated, but history indicates that this range may persist for several months before reaching a peak. For example, in 2017, VDD showed signs of overbuying nearly a year before the cycle top arrived.

7. Conclusion

Overall, these indicators suggest that Bitcoin is gradually entering the later stages of a bull market. Although some indicators show short-term cooling or slight overbuying, most still highlight considerable upside potential during 2025. The key resistance level for this cycle may be between $150,000 and $200,000, with indicators like SOPR and VDD providing clearer signals as we approach the peak.

Article link: https://www.hellobtc.com/kp/du/12/5597.html

Source: https://bmpro.substack.com/p/where-are-we-in-this-bitcoin-cycle?utmsource=%2Finbox&utmmedium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。