Original | Odaily Planet Daily (@OdailyChina)

Author | Wenser (@wenser2010)

With Trump successfully elected as "Time Magazine's Person of the Year" and gracing the cover on the 12th of this month, the Trump effect in the cryptocurrency market continues. Recently, the Trump family crypto project WLFI (World Liberty) has brought a new wave of attention to the diverse tokens in the market. After previously purchasing a series of mainstream coins, infrastructure project tokens, and RWA tokens, the project officially announced its collaboration with Ethena Labs around 2 AM today, planning to integrate Ethena's yield token sUSDe into the WLFI lending platform.

Odaily Planet Daily will summarize WLFI's recent operations and their impact for readers' reference.

WLFI's Recent Activities: Buying ENA, ONDO, etc.

Around 4 AM yesterday, according to Onchain Lens monitoring, the Trump family crypto project WLFI (World Liberty) spent 250,000 USDC to purchase 231,726 ENA, increasing its ENA holdings to 741,687, with a total cost of 750,000 USD. Additionally, it exchanged 103 cbBTC worth 10.36 million USD for WBTC.

On December 16, WLFI spent 250,000 USDC to buy 134,216 ONDO.

On December 15, WLFI spent 500,013 USDC to buy 509,955 ENA at an average price of 0.981 USD.

On December 13, WLFI spent 1 million USDC to buy 37,052 LINK and 151,985 USDC to buy 422 AAVE; within 48 hours, the project cumulatively spent 10 million USDC to buy 2,631 ETH; spent 1,246,722 USDC to buy 4,043 AAVE; and spent 2 million USDC to buy 78,387 LINK.

On December 12, according to Arkham monitoring, WLFI's multi-signature address held 14,573 ETH (approximately 57.03 million USD), 102.9 cbBTC (approximately 10.38 million USD), 3.108 million USDT, 1.515 million USDC, 41,335 LINK (approximately 1.17 million USD), 3,357 AAVE (approximately 1.16 million USD), and other cryptocurrencies. Notably, on that day, the project had just converted a large amount of stablecoins from token sales into ETH, at which point its ETH holdings were valued at over 50 million USD.

As previously shared by on-chain analyst Ai Yi mentioned, the non-stablecoin assets purchased by WLFI include LINK / AAVE / ENA / ONDO, half of which belong to leading DeFi applications, and half to RWA assets. Interestingly, although COW is not in World Liberty's portfolio, the recent purchases of tokens have all utilized Cowswap, causing its price to surge nearly 93% in the past week. This ripple effect is also reflected in the other tokens it has purchased:

On December 14, after buying LINK and AAVE, WLFI's holdings in the former gained a floating profit of 299,000 USD; the latter gained a floating profit of 338,000 USD.

On December 16, after the news of WLFI's purchases spread, ONDO broke 2.1 USDT, reaching an all-time high with a 24H increase of 16.33%.

On December 16, boosted by the news of WLFI's various token purchases, COW broke 1 USD, reaching an all-time high; ENA saw its price rise to 1.33 USD, just under 0.2 USD away from its previous all-time high.

If the previous BTC price was influenced by the "Trump effect" to break through the 100,000 USD mark from 70,000 USD, then undoubtedly, the tokens held by WLFI have also been driven by this effect.

After all, in the eyes of cryptocurrency traders in the U.S. and around the world, WLFI is "Trump's flagship project."

Current WLFI Holdings: AAVE, COW

From the end of November to December 19, after achieving a token sales target of 30 million USD, WLFI's previous token purchase operations included:

- 30 million USD USDC to buy 8,105 ETH;

- 10 million USD USDC to buy 103 cbBTC (converted to WBTC);

- 2 million USD USDC to buy 78,387 LINK;

- 1.91 million USD USDC to buy 6,137 AAVE;

- 750,000 USD USDC to buy 741,687 ENA;

- 250,000 USD USDC to buy 134,216 ONDO.

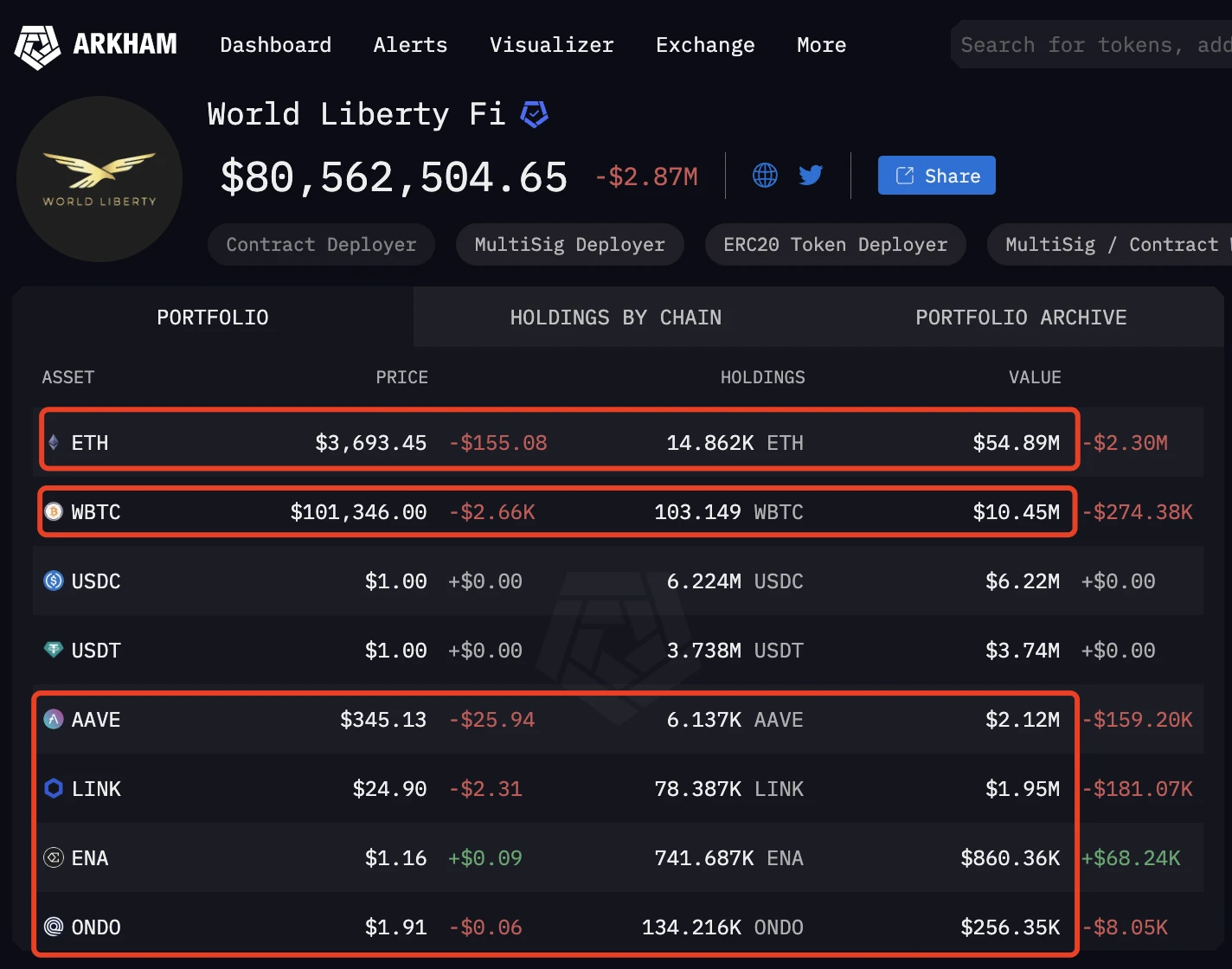

According to on-chain data site Arkham, the current holdings of WLFI project** are as follows:**

14,800 ETH, valued at 54.89 million USD;

103 WBTC, valued at 10.45 million USD;

6,137 AAVE, valued at 2.12 million USD;

78,300 LINK, valued at 1.95 million USD;

741,687 ENA, valued at 0.86 million USD;

134,000 ONDO, valued at 256,000 USD.

Stablecoins (USDT + USDC) holdings are approximately 10 million USD.

Currently, the total value of assets in this multi-signature address is approximately 80.56 million USD.

WLFI Token Holdings Information (as of December 19, 5 PM)

The Difficult Growth Path of WLFI: From a Target of 300 Million to Just Scraping Together 30 Million

Looking back at WLFI's growth path, it cannot be said to have been smooth sailing.

At the end of August, Trump's second son, Eric Trump, the current executive vice president of the Trump Organization, announced the official launch of the crypto project WLFI (@WorldLibertyFi), aiming to create a new financial era. Notably, after Trump's victory in the presidential election in early November, insiders revealed that the project was established to address the funding shortfall during Trump's presidential campaign.

After inviting several well-known figures, including the CEO of Paxos, the founder of Tomo Wallet, the CEO of Mixie Studios & Mixie Media, and co-founders of Glue, and experiencing a series of market skepticism and questioning, the WLFI project token presale finally launched on October 15 as scheduled.

Although it achieved a remarkable result of raising 5 million USD within the first hour of the presale, the market response was not ideal due to issues such as KYC certification, website crashes, and previous token distribution ratios. According to media reports, the roadmap indicated that WLFI's initial sales would seek to raise 300 million USD and sell 20% of the token supply at a fully diluted valuation of 1.5 billion USD.

Until October 17, according to Lookonchain monitoring, WLFI sold 83,373,000 tokens, with sales exceeding 12.5 million USD; over 10,000 users participated in the token sale, among which address 0x2d24 spent 351.3 ETH (903,000 USD) to purchase 60,430,000 WLFI, becoming the largest buyer.

Subsequently, according to a 13-page document titled "World Liberty Gold Paper" showing, the Trump family will receive 75% of the project's net profits while bearing no responsibilities.

The news caused an uproar.

Animoca Brands co-founder and executive chairman Yat Siu, Kenetic Capital co-founder and managing partner Jehan Chu, and Synthetix founder Kain Warwick each raised questions, comments, and suggestions from their perspectives.

In early November, WLFI reduced its fundraising target by 90%, planning to sell only 30 million USD worth of WLFI tokens instead of the initially planned 300 million USD.

On November 20, WLFI sold approximately 1.35 billion tokens, with sales reaching 20,283,014 USD, accounting for about 68% of its revised fundraising target.

Just when many thought the project had hit a dead end and it would be difficult to even gather the 30 million USD target, one person stepped in.

On November 26, Sun Yuchen announced a 30 million USD investment in the Trump family crypto project WLFI, becoming its largest investor. He also stated that the U.S. is becoming the center of blockchain, thanks to Trump's support for Bitcoin. Subsequently, he joined WLFI as an advisor.

I personally speculate that this is also the reason why WLFI recently converted cbBTC to WBTC.

As for the purchases of AAVE and LINK tokens, they are also related to previous collaborations—

On November 14, WLFI officially announced that it would adopt the Chainlink standard for on-chain data and cross-chain connections, as a secure way to bring DeFi into the next stage of mass adoption.

On December 13, the first community proposal initiated by the WLFI community to "deploy an Aave v3 instance for the WLFI protocol" was approved. It is understood that this instance will be managed by external risk managers and will be built on the existing Aave v3 infrastructure, ultimately launching on the Ethereum mainnet.

Thus, WLFI transformed itself, not only successfully "staying at the table" but also potentially becoming a "crypto barometer" for the U.S. in the future.

Conclusion: WLFI Will Continue to Be Active in the U.S. Crypto Market, Becoming a "Crypto Flagship"

According to a previous analysis, WLFI's behavior of converting stablecoins to ETH indicates that the project is seeking to participate in a deeper level of the crypto economy. This may also suggest that the team believes ETH is a better reserve asset than the dollar. Notably, the first to notice this trading operation was the well-known Ethereum investor and advisor Eric Conner.

As previously mentioned, 75% of the net profits from the WLFI project presale will be received by the Trump family, while bearing no responsibilities. The document also emphasizes that Trump and his family members are not directors, employees, managers, or operators of WLFI or its affiliates, and states that the project and tokens "are not related to any political activities." The remaining 25% of the net agreement income will belong to Axiom Management Group (AMG), a Puerto Rican company wholly owned by project co-founders Chase Herro and Zachary Folkman. AMG has agreed to allocate half of its profit rights to Trump's close friend and political donor Steve Witkoff and affiliated companies of some of his family members, WC Digital Fi.

In this light, WLFI may become the "crypto flagship" of Trump's faction, leveraging trading operations to engage in deep collaborations with more crypto projects to promote the development of the U.S. crypto economy; on the other hand, the project will also provide certain financial support for Trump and his faction, facilitating various personal and political actions during future governance.

Around WLFI, a core team that promotes the development of the U.S. crypto economy may emerge, and the project is expected to become Trump's "crypto Huangpu Military Academy."

Recommended reading: “Who are the decision-makers behind the Trump project WLFI that is aggressively purchasing crypto assets?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。