Master Discusses Hot Topics:

First, let's talk about the Federal Reserve's announcement of a 25 basis point rate cut at midnight, which aligns with market expectations. However, the changes in the wording of the statement compel a reevaluation of market sentiment. As the global economic driver, every policy adjustment by the Federal Reserve triggers a strong market reaction.

This time, the FOMC's attitude is more cautious, with some members opposing further rate cuts, indicating that they remain vigilant about inflation. Is the shadow of inflation still looming?

Personally, I believe the core logic of the market has subtly changed. The previous path of rate cuts has now transformed into a trend of a stronger dollar. Although the dot plot suggests two rate cuts next year, its hawkish tone undoubtedly serves as a warning to the market.

Powell's cautious words and implicit tone seem to convey, "You may have to coexist with high interest rates for a longer time." Investor expectations have been shattered, leading to a surge in the dollar, while U.S. stocks, gold, and even Bitcoin have all seen declines.

As for the discussion about Bitcoin reserves, it seems interesting, but I believe it is more short-term noise. The real protagonist remains the strengthening dollar, and the market's direction will continue to be dominated by it.

The Federal Reserve's speech this time leaned hawkish, making the possibility of rate cuts an uncertain variable, which will still depend on economic data in the future. The market's interpretation is clearly bearish, and this impact may be digested within 24-36 hours.

However, the market's emotional response has not weakened. From the market's performance after Powell's speech, the situation is even weaker than I anticipated. Since Bitcoin broke 90,000, it has experienced three sharp declines, and this latest drop is the fourth.

The first three sharp declines consumed a lot of buying power, resulting in a lack of strong buying support after this drop, leading to a sideways decline. This means that bottom-fishing funds have been buried again, making it very difficult to regain strength in the short term.

The best rebound range for Bitcoin may be around 103,000, while Ethereum may rebound around 3,800. Ethereum's weakness has exceeded my expectations; it not only follows Bitcoin down but even lags behind Bitcoin's decline, truly "not following during the rise, but falling sharply during the drop."

As for the current altcoins, with five new projects launching daily and a new project every second on-chain, there simply isn't enough to divert attention. This market environment is essentially distributing traffic to new projects, and the rhythm of the altcoin season is hard to grasp; being a wise observer is the safest approach.

Patience will always bring opportunities. The market will always give signals before rising; the key is whether you can capture them. In the short term, the rebound momentum in the Asian market may be slightly stronger, as the main funds are primarily concentrated in the Asian market before Christmas. At that time, I will make medium to long-term arrangements based on market conditions.

Master Looks at Trends:

The Federal Reserve's hawkish stance has strengthened, leading to increased downward expectations. After reaching a high, Bitcoin is on a downward trend, and a rebound may require more time and new upward momentum.

Just as there is never a continuous rise, adjustments after an increase are inevitable. Setting maximum support based on market trends and responding to its changes is the best strategy.

Resistance Levels Reference:

First Resistance Level: 102,100

Second Resistance Level: 103,700

Support Levels Reference:

First Support Level: 99,400

Second Support Level: 97,500

Today's Suggestions:

Current market selling pressure is increasing, so further declines cannot be ruled out. In the short term, the 60-day moving average may become a resistance level. During the European trading session, observe whether the market maintains a sideways consolidation and take short-term profits in the resistance area.

Since the 1-hour chart has broken below the 120-day moving average, the 4-hour chart is now resetting based on the 120-day moving average, setting a 100K support line for trading.

For the larger cycle charts, the upward trend is still maintained. The first and second resistance levels I provided are relatively conservative, but it is important to note that downward expectations are increasing, and this should be recognized when trading.

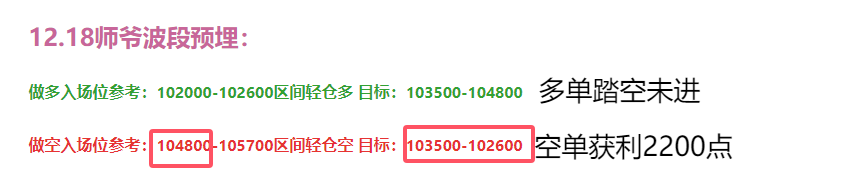

12.19 Master’s Wave Strategy:

Long Entry Reference: Light long position near 99,400; if it retraces to the 97,500-98,000 range, go long directly. Target: 108,000-102,000

Short Entry Reference: Not currently applicable

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。