Author: Luke, Mars Finance

What is Binance Alpha?

As one of the largest cryptocurrency trading platforms in the world, Binance has always been at the forefront of the market, continuously adjusting its strategies to adapt to the rapidly changing industry environment. Recently, Binance launched Binance Alpha, a brand new listing mechanism that undoubtedly reflects a profound insight and response to the current state of the crypto market. Its main purpose is to filter and promote potential tokens that have not yet gained widespread circulation, providing a stage for these projects while also offering more investment opportunities for platform users.

Binance Alpha is essentially an innovative mechanism proposed by Binance to address the skepticism surrounding token listings. Unlike its traditional listing process, the Alpha market allows users to participate in "voting" and trading of new tokens in a more open and speculative manner. This not only enhances the liquidity of the Binance platform itself but also attracts more investors to participate in the price discovery process of tokens through a "crowdfunding" approach. Each period, Binance will introduce several potential tokens for users to trade, and the growth in trading volume is directly related to the price fluctuations of the tokens— the platform uses trading volume to filter the most promising projects and push them into the mainstream market.

This mechanism has a high level of engagement, akin to a large racetrack where users, like gamblers, place bets on Binance Alpha, speculating which tokens will become future stars. This "speculation and betting" operation quickly attracted a large number of active users to the platform, especially against the backdrop of a sluggish market, bringing a surge in trading volume in the short term.

Alpha? Drama!

Today at noon, a Space titled "Binance Wallet Rebirth: National Review Conference" was held on Binance Alpha. He Yi introduced future innovative plans, mentioning in the Space that a Telegram group related to Binance Alpha would be established to allow community members to report potential "Rug Pull" projects in a timely manner. This move is clearly aimed at bringing more community interaction and transparency to the Binance wallet; however, the host immediately interjected, saying, "Actually, this group already exists." Shortly after, Binance's official Twitter account posted a link to the group in the comments, seemingly the "official platform" related to Binance Alpha.

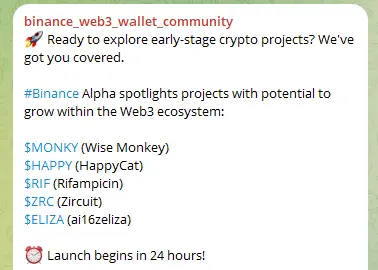

At this point, thousands of investors quickly flooded into the group chat. However, who would have thought that this simple link would turn into a "Waterloo" in the following minutes? Within this Telegram group, the official announcement of the first batch of projects to be listed on Binance Alpha was made, which included: $MONKY, $HAPPY, $RIF, $ZRC, $ELIZA.

Once the information was released, the market reacted swiftly and violently: the token prices of these five projects skyrocketed, especially ELIZA, which surged several times within just a few minutes. This seemingly fortuitous opportunity quickly attracted a large number of short-term speculators, with almost everyone feeling they had seized an excellent trading opportunity.

Holders of the mentioned projects cheered, "Great, it's Binance, we are saved," but at that moment, Binance officially released a statement debunking the rumors, stating that the Telegram group was not officially released. At this point, the previously skyrocketing token prices quickly suffered a heavy blow, and all project prices began to plummet, especially ELIZA, which sharply dropped from its high just minutes before. The original "lucky investors" began to incur losses, and market sentiment instantly shifted from excitement to panic. Investors' confidence rapidly collapsed, and Binance clearly became the catalyst for this chaos.

At this time, the truth of the event surfaced. Binance officials stated that the incorrectly released Telegram group link was indeed published by the official Binance wallet but was accidentally sent out incorrectly. Following this, a new Telegram group link was provided, which was quickly discussed by investors and formed a new "rights protection front."

In this group, users expressed their dissatisfaction and anger towards the official operations, criticizing the Binance wallet for its rashness and irresponsibility. Some even described the incident as a "shoddy production," harshly attacking the capabilities of the Binance team.

What should have been a market highlight release conference quickly turned into a public relations disaster regarding trust and transparency within just a few hours, leading to significant doubts about the Binance wallet and Binance Alpha.

There were many victims of this blunder, but the most amusing one was the following individual:

This unfortunate person sold 1.76 million $arc (about $170,000) after the news was released and bought 1.42 million $ELIZA at a cost of $0.1376.

Subsequently, he realized that ai16z eliza was in lowercase $eliza, and he cut losses by exchanging all tokens for $eliza at $0.09567, incurring a loss of $59,600. Finally, after the official announcement of the blunder, $eliza also subsequently dropped, and he again painfully cut losses, losing $43,000 (cost price $0.01693, selling price $0.01157), resulting in an overall loss of 52.5%.

This "official miscommunication" farce ended with a simple explanation of "the link was sent incorrectly," but its impact is far from over. With the launch of Binance Alpha, the influence of "the wolf is coming" seems to continue.

Binance Alpha's First Batch of Projects Show Varied Price Increases

The first batch of projects on Binance Alpha includes: KOMA, Cheems, APX, ai16z, AIXBT.

KOMA

Koma Inu (KOMA) is a dog-themed MEME coin inspired by Dogecoin (DOGE) and Shiba Inu (SHIB), aiming to become "the loyal guardian of BNB." The KOMA project team is experienced, having successfully incubated multiple crypto projects with a market cap exceeding $100 million, laying a solid foundation for KOMA's development. The project aims to promote the continuous growth and evolution of the BNB ecosystem by consolidating community consensus.

Cheems

Cheems is a meme project built around the classic internet meme "Cheems." This small and adorable Shiba Inu is hailed as the "King of Memes," embodying the humor and emotions of global internet culture. It has successfully transitioned from Web 2.0 into the crypto world, becoming a model for community-driven projects. The Cheems project not only attracts a large fan base with its strong IP endorsement but also aims to create a truly community-centric and fully decentralized cultural symbol within the meme ecosystem.

Cheems' development journey is filled with drama and comebacks. Since its initial issuance on ZKSync in 2023, it has become one of the hottest meme projects in the ecosystem due to its soaring popularity. Despite facing challenges such as contract FUD and near-zero valuations, Cheems did not falter. Instead, it leveraged the resilience of its team and community support to change contracts, complete migrations, and even reach an exclusive partnership with ZKSync's mainstream Dapp Syncswap. In 2024, Cheems successfully migrated to the BNB Chain and quickly attracted more users, with community activity continuing to rise.

APX

APX (apollox.finance) is a multi-chain decentralized derivatives DEX. APX received investment from Binance Labs in 2022 and supports BNB Chain, Arbitrum, op BNB, zksync, Manta Network, and Base chain, with a current TVL exceeding $350 million.

The main advantages that attract users to APX include:

- Classic perpetual contracts can reach up to 250x leverage, with a Degen mode offering up to 1001x leverage;

- Low slippage, as low as 0.01%, with 0 slippage in V2 Degen mode;

- High trading performance, used by over 30 partners including pancakeswap;

- Position isolation, meaning if one position is liquidated, it will not affect other positions.

ai16z

ai16z is a decentralized AI trading fund based on the Solana blockchain. As an "AI Investment DAO," the core of ai16z is to utilize AI agents to gather market information on-chain and off-chain, analyze community consensus, and automatically conduct token trading. This new model aims to combine AI trading strategies with decentralized governance through tokenization, providing investors with more transparent and trustworthy investment opportunities. Additionally, the project has the endorsement of Marc Andreessen, the founder of a16z, who shared the concept image and official Twitter link on his official Twitter account.

AIXBT

AIXBT is a project created on the AI agent creation platform Virtuals Protocol, focusing on discussions and token analysis in the cryptocurrency space.

Ironically, the trends of Binance's own projects have shifted from bullish to bearish, with sharp fluctuations, while other AI Agent projects on different chains have solidly benefited from this wave of positive sentiment, showing a steady upward trend.

Overview of the Second Batch of Projects

At 8 PM, the second batch of projects for Binance Alpha was also announced, which includes:

- BNBChain: CKP;

- Ethereum: GEAR, SD, SYRUP;

- Solana: FARTCOIN

CKP

Cakepie is launched by Magpie, aimed specifically at supporting the long-term development of PancakeSwap. The main goal of Cakepie is to accumulate CAKE tokens and lock them as ve CAKE to gain enhanced yields and governance power within the platform.

Cakepie provides CAKE holders with an opportunity to earn enhanced CAKE rewards as passive income. It also offers cost-effective voting power for PancakeSwap voters and allows liquidity providers to enjoy higher annual percentage rates (APR%) without needing to lock any CAKE tokens as ve CAKE.

GEAR

Gearbox is a leverage protocol on Ethereum that introduces Credit Accounts to facilitate leveraged lending and composability, enhancing capital efficiency in the DeFi world. Users can obtain leveraged lending funds on the protocol and enter mainstream DeFi protocols. Credit Accounts are independent smart contracts with specific whitelisted operations and assets, ensuring a higher level of security for user funds and borrowed funds in each account.

SD

Stader Labs focuses on providing convenient staking solutions and maximizing user staking returns. The platform offers a full suite of DeFi products, including a simplified one-click staking solution, allowing users to easily invest in multiple validators, thus leading the future direction of staking. Stader has developed a liquid staking solution that allows users to concentrate assets without meeting all staking requirements while minting tokens representing staked assets, which increase in value as staking rewards grow. In July of this year, Coinbase announced that it would include Stader (SD) in its listing roadmap.

SYRUP

SYRUP is a lending platform launched by Maple Finance, with $SYRUP being key to transforming the institutional lending market. Users can convert existing MPL tokens into staked SYRUP at a ratio of 1 MPL:100 SYRUP, allowing them to immediately participate in the governance and growth of Maple Finance. Staking SYRUP will provide participants with reward opportunities related to the ecosystem's performance.

FARTCOIN

Fartcoin belongs to the AI meme concept. During a user interaction event held by Truth Terminal, the platform asked the public about the topics they wanted to focus on, and its first response was to continue generating endless Fart Jokes in tweets. This absurd and light-hearted humor quickly attracted a lot of attention, with even Tesla incorporating fart sound effects into its software, further promoting the spread of this cultural phenomenon. In this context, Fartcoin was born. It is not only referred to as "the best $GOAT beta" but also serves as an experiment on the future potential of AI technology. Fartcoin brings Fart Jokes to the blockchain with a irreverent attitude, combining technology and entertainment with a light-hearted, humorous, and ironic cultural stance, becoming a unique representative of modern internet culture.

Future Outlook

The launch of Binance Alpha reflects Binance's concerns about its market position. On one hand, OKX's web3 wallet shone brightly during the previous Bitcoin ecosystem boom, attracting a large number of users, while Binance's own wallet has received lukewarm responses; on the other hand, the recent transparent listing strategy and public discussions from HyperLiquid have also put considerable pressure on Binance, making it not an exaggeration to say that Binance Alpha is a response to a defeated army.

In the past few years, Binance's listing strategy has revolved around two main lines: one is to choose high-risk but potentially lucrative VC tokens (tokens with venture capital backgrounds), and the other is to list low-market-cap tokens that are already trading on other platforms. However, the effectiveness of the first path has not been ideal, as many VC tokens often show a downward trend after a high opening, and market speculation sentiment gradually cools. On the other hand, Binance has still not found a truly stable breakthrough in the selection and launch of such tokens.

Thus, Binance chose the second path: listing low-market-cap tokens that already have a certain circulation in the market. Project teams and communities compete for the opportunity to list on the Binance Alpha market, indirectly driving up the trading volume of these tokens on the Binance platform. For example, the recent MEME launched on the Solana chain and CAT launched on the BNB chain are typical representatives of this strategy. Through the introduction of these tokens, Binance hopes to create more trading pairs and attract more users to participate in trading.

However, this strategy also brings some significant challenges. On one hand, Binance faces a game between the two routes of VC tokens and low-market-cap tokens. While the selection of low-market-cap tokens may attract more attention and participation, due to the relatively weak liquidity and absorption capacity of the market, these tokens often fall into a cycle of market fatigue once they encounter price declines after being hyped. On the other hand, the introduction of high-market-cap tokens, while able to attract a large number of investors at one point, still leads to significant price volatility for these tokens due to the overall market not having returned to the liquidity levels of peak periods, often resulting in "high opening and low closing" situations, making it difficult for investors to gain sustained confidence.

The launch of Binance Alpha undoubtedly increases the platform's activity in the short term, but its sustainability remains questionable. As the market weakens, this high-frequency token selection and trading push may lead to investor fatigue. Additionally, this strategy from Binance may force project teams to focus more on "volume manipulation" and community mobilization. To gain Binance's favor, project teams will have to adopt a series of aggressive measures to increase trading volume, including volume manipulation, community voting, and hosting events, which may also lead to a vicious cycle in the market ecosystem. Some low-quality projects or "air coins" may take advantage of this mechanism to gain temporary popularity through hype, while truly promising projects may be drowned out in the noise.

In summary, Binance Alpha is a bold attempt, but whether its effect will be "trendsetting" or "a flash in the pan" remains to be seen. In this game, Binance is not only betting against the market but also racing against time, trying to bring new vitality to the crypto industry. However, any game can lead to unexpected outcomes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。