Author: Lim Yu Qian

Translation: Plain Language Blockchain

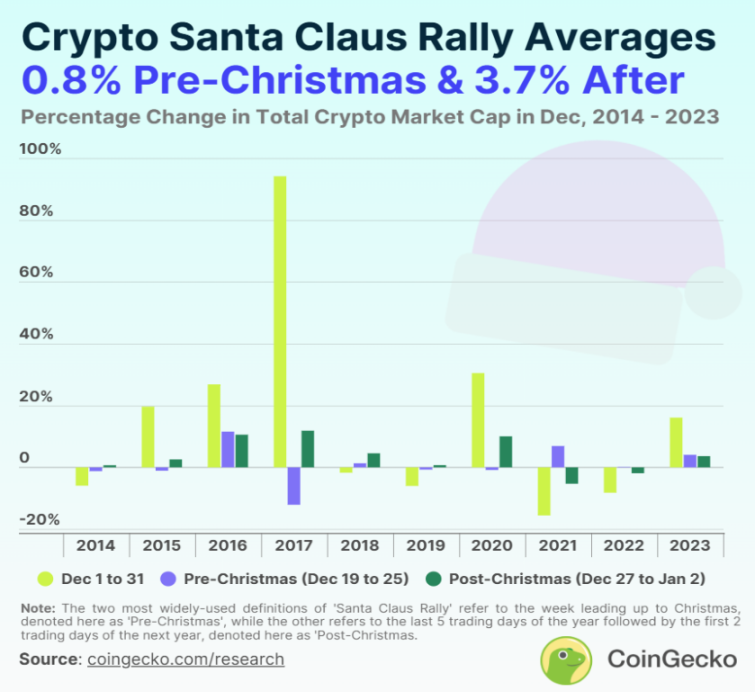

From 2014 to 2023, the crypto market experienced the "Santa Claus Rally" 8 times after Christmas within a decade, with the total crypto market capitalization increasing by 0.69% to 11.87% during the week from December 27 to January 2 of the following year. This phenomenon draws on the definition by Yale Hirsch, who is considered the originator of the term "Santa Claus Rally," originally referring to the market performance during the last five trading days of the year and the first two trading days of the next year.

On the other hand, the occurrence of the "Santa Claus Rally" in the week before Christmas in the crypto market has been less frequent, happening only 5 times in the past 10 years. Similar to the post-Christmas rally, these pre-Christmas increases ranged from 0.15% to 11.56%.

1. How Does the "Santa Claus Rally" Perform in the Crypto Market?

In years without a "Santa Claus Rally," the crypto market experienced the largest correction before Christmas in 2017, dropping by 12.12%. This decline was a result of the price crash following the ICO boom that year. Aside from that, the corrections in the crypto market before Christmas were relatively small, ranging from 0.74% to 1.25%. Meanwhile, the market corrections after Christmas in 2021 and 2022 were 5.30% and 1.90%, respectively.

Notably, in the past 10 years, there were only 3 years where the "Santa Claus Rally" occurred both before and after Christmas. These years were:

- 2016, when the total market capitalization of crypto increased by 11.56% before Christmas and 10.56% after Christmas;

- 2018, when, despite the market being in a correction throughout the year, it recorded moderate increases of 1.31% and 4.53% before and after Christmas, respectively;

- 2023, when, under the backdrop of a recovering bear market, the crypto market rose by 4.05% before Christmas and 3.64% after Christmas.

In contrast, the total market capitalization of crypto showed more extreme performance throughout December. In the past 10 years, there were 5 years where the market overall grew by 16.08% to 94.19% in December. In the other 5 years, during corrections, the market decline in December ranged from 1.73% to 15.56%.

Overall, the "Santa Claus Rally" in the crypto market is not a stable phenomenon, with significant variations in performance, making it difficult to predict.

2. Will Bitcoin Rise During Christmas?

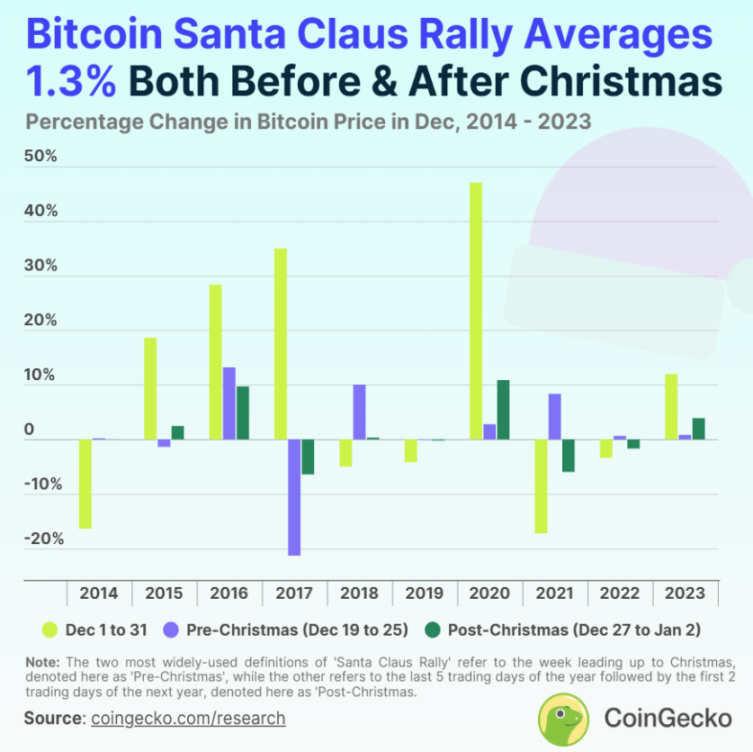

In the past 10 years, Bitcoin experienced the "Santa Claus Rally" 7 times in the week before Christmas, and 5 times in the week after Christmas. Specifically, Bitcoin's increase before Christmas ranged from 0.20% to 13.19%, while the increase after Christmas ranged from 0.33% to 10.86%. This aligns with the broader crypto market's "Santa Claus Rally" performance.

The largest "Santa Claus Rally" for Bitcoin occurred in the week before Christmas in 2016, when the price rose by 13.19%, breaking the $1,000 mark.

The largest decline for Bitcoin occurred in 2017, not during the "Santa Claus Rally." At that time, Bitcoin's price dropped by 21.30% before Christmas. Additionally, Bitcoin experienced smaller declines before Christmas in 2015 and 2019, at 1.37% and 0.11%, respectively. After Christmas, Bitcoin's price decline ranged from -0.04% to -6.42%.

In other words, if a speculator participated in Bitcoin's "Santa Claus Rally" every year from 2014 to 2023, buying in the week before Christmas and selling after, their average return would be 1.32%; while performing the same operation in the week after Christmas would yield an average return of 1.29%. In comparison, if the speculator chose to participate in Bitcoin's price fluctuations throughout December, their average return rate would be 9.48%, at least 7 times the returns from the "Santa Claus Rally."

However, similar to the crypto market's "Santa Claus Rally," Bitcoin's "Santa Claus Rally" effect also exhibits inconsistent characteristics.

3. The "Santa Claus Effect" in the Crypto Market Over the Past 10 Years

The following is the "Santa Claus Effect" data based on the daily percentage change in total crypto market capitalization:

Bitcoin's annual "Santa Claus Effect" data, based on the daily percentage change in Bitcoin price during each specific time period:

4. Summary: Methodology

This study is based on data from CoinGecko, examining the daily percentage changes in total cryptocurrency market capitalization over the past decade (from December 1, 2014, to January 2, 2024). The study references the two most commonly used definitions of the "Santa Claus Effect" or "Santa Claus Rally" from Investopedia:

Pre-Christmas Period: Refers to the week before Christmas, from December 19 to 25.

Post-Christmas Period: Refers to the last five trading days of the year plus the first two trading days of the next year.

This study is for illustrative and informational purposes only and is not financial advice. Please conduct your own research and exercise caution before investing in any cryptocurrency or financial asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。