AI Agents are a battleground that everyone is vying for.

Author: Kevin, the Researcher at BlockBooster

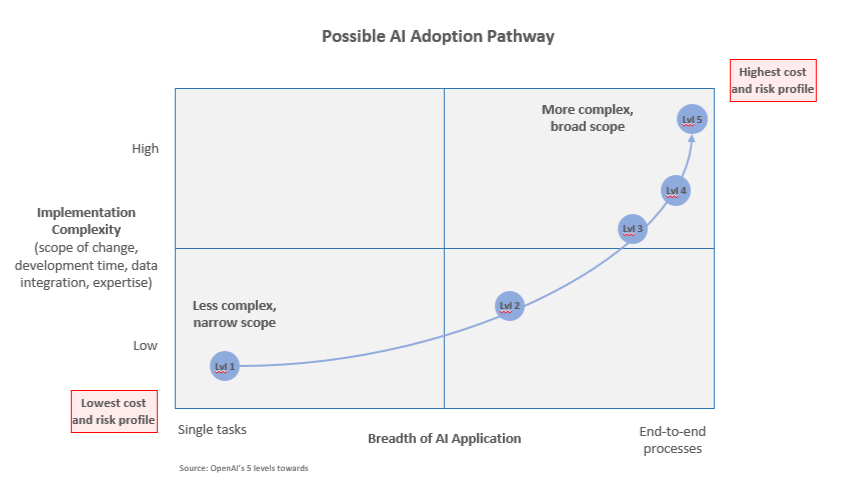

The term AI Agents comes from OpenAI's roadmap. Sam Altman categorized the capabilities that AI should possess into five parts, with the third step being the AI Agent that we will frequently encounter in the coming years.

AI Agents can autonomously learn, make decisions, and execute tasks. Of course, depending on their intelligence and capabilities, Stuart Russell and Peter Norvig in "Artificial Intelligence: A Modern Approach" categorized AI Agents into five directions:

Simple Reflex Agents: React only to the current state.

Model-Based Reflex Agents: Consider historical states in the decision-making process.

Goal-Based Agents: Focus on planning and finding the best path to achieve specific goals.

Utility-Based Agents: Aim to weigh benefits against risks to maximize utility.

Learning Agents: Continuously learn and improve through experience.

So, at what level do the AI Agents currently appearing in the market or industry stand? What direction are they taking?

OpenAI's o1 has reached Level 2 artificial intelligence. Personally, I believe that the current AI Agents in the industry are between Level 2 and Level 3, specifically at Level 2.5. This does not mean that the agents in the industry have surpassed OpenAI; in fact, web3 agents are still in the stage of being GPT wrappers. So why Level 2.5? Because through human or programmatic intervention, let's call it a mediator, the combination of the GPT wrapper and the mediator forms a shape that is not rigorous but has objective proactivity. It is an extension of a certain application direction of the OpenAI model. In terms of what agents can do, they are the most basic simple reflex agents. Some of these agents consider historical states, but they require active input. Only by continuously feeding data can the agent complete its learning, which is a passive model training method and far from reaching the state defined as Level 3. The latter three types—Goal-Based, Utility-Based, and Learning Agents—have not yet entered the market. Therefore, I believe that current AI Agents are still in the early stages, fine-tuning Level 2 general LLMs, and have not structurally moved away from Level 2. So can evolution to Level 3 be achieved solely through crypto? Or do we need to wait for companies like OpenAI to develop it?

Why discuss whether Base or Solana can become the narrative center for AI Agents?

Before discussing which ecosystem can promote the birth of Level 3 agents, we should determine which ecosystem has the potential to become fertile ground for AI Agents. Is it Base? Or Solana?

To answer this question, let's first review how AI has influenced Web3 over the past two years. When OpenAI first released ChatGPT, the protocols in the industry were still following conventional thinking, quickly rushing into the infrastructure bubble. This led to a large number of computing power/inference aggregation platforms, along with the emergence of AI + DePIN infrastructure. The commonality between the two is the construction of grand visions. This is not to say that grand visions are bad; in fact, agents can also build such visions. However, in terms of implementation and user needs, these large infrastructure protocols do not consider things thoroughly. Because the market demand they want to stimulate is far from saturated in the traditional internet industry, user education and market education are insufficient. Under the impact of the Memecoin craze, the empty AI infrastructure appears even more hollow.

Since the infrastructure is too heavy and large, why not lighten it? Agents derived from GPT wrappers are efficient and iterate quickly in terms of startup and user engagement. Lightweight agents have ample potential to create bubbles, and when the bubble bursts, fertile ground for new growth will emerge.

Furthermore, in the current market environment, using agents and Memecoins to launch projects can bring products to market in a very short time. Users can directly gain experience, and in this process, agents can cleverly leverage Memecoins to strengthen the community roadmap, achieving rapid product iteration that is low-cost and fast. Serious AI protocols no longer need to be bound by heavy old consensus frameworks; breaking free from constraints, they can bombard users with lightweight and high-speed iterations. Once market education and communication are sufficiently conducted, they can then build on this foundation to construct the infrastructure for grand visions. Lightweight agents cover the ambiguous veil of Memecoins, and community culture and fundamentals will no longer be in conflict. A new asset development path is gradually surfacing, which may be a path for future AI protocol choices.

The above discussion answers the potential for AI Agents to become the core narrative. Under the premise that AI Agents can continue to grow rapidly, choosing the right ecosystem becomes particularly important. Is it Base? Or Solana? Before answering this question, let's take another look at the current state of serious agent protocols in the market.

First, there is Arweave/AO: PermaDAO mentioned that AO uses the Actor model for design, where each component is an independent agent capable of parallel computation, which aligns well with the application architecture driven by AI Agents. AI relies on three elements: models, algorithms, and computing power, and AO can meet such high resource demands. AO can independently allocate computing resources for each agent process, effectively eliminating performance bottlenecks.

In addition, Spectral is one of the few protocols based on agents, with document-to-code and model inference as its development direction.

Looking back at a type of agent token currently in the market, it can be found that these agents hardly utilize the chain's infrastructure. This is a fact because all models in the industry, including agents, are off-chain. Feeding data is off-chain, model training is not decentralized, and the output information is not on-chain. This is an objective fact because EVM chains do not support the combination of AI and smart contracts, and of course, Base and Solana do not support it either. Next year, we can expect the introduction of AO, which may allow models to go on-chain and perform well. If AO fails, it may take years for models to go on-chain, possibly not until after 2030, or other public chains may implement model on-chain, but if architectures and historical resource reserves like AO cannot achieve it, then model on-chain may be even more difficult for other public chains.

Currently, AI Agent tokens do not have many practical use cases. In fact, it is hard to clearly distinguish between AI Agent coins on Base and Solana and AI Memecoins. Although agent tokens do not have special uses, why do I believe that AI Agent coins and AI Memecoins should not be confused? Because I believe we are currently in the stage of creating an AI Agent bubble.

Why discuss Base's desire to compete with Solana for the dominant public chain position of AI Agents?

Base has attracted considerable market attention in the first half of this bull market, showing a brief impressive performance in the competition for market share of Memecoins, such as $BRETT and $DEGEN. However, it still lost to Solana. I believe AI Agents are the next direction for Base to compete in, and it already has several advantages.

AI Agents will accelerate the birth of bubbles and create chaos, but ultimately will leave behind users and applications:

The birth and expansion of bubbles will attract market attention, and this attention will undergo a qualitative change over time. What are the characteristics of such a qualitative change? During the continuous increase of market attention, a series of user pain points and market gaps will be exposed. When the main contradictions cannot be coordinated, but attention continues to increase, that is the moment when qualitative change is born. When the qualitative change is complete, the accumulated users and applications can support the grand vision. This is something Memecoins cannot and do not intend to achieve, which is also why I believe that although agents and Memecoins are currently ambiguous, they should never be conflated.

Before the qualitative change occurs, bubbles will give rise to a flurry of activity and various dramas, for example: the number of agents will increase exponentially, and thousands of agents will crowd into users' sight. How will they crowd in? Agents can connect to social media like X and Farcaster, self-promote tokens, and use various angles and unique information density that degens like to promote tokens.

Next, rapidly iterating agents can complete on-chain transactions, and a group of Viking pirates has invaded the dark forest. Currently, panel protocols, bots in TG groups, and Dune panels will be invaded by agents, and familiar metrics will be manipulated by agents. Trading volume, address numbers, chip distribution, simulating dealer behavior—on-chain data may require more professional cleaning to reflect value; otherwise, it will be deceived by agents, just like Viking pirates plundering your wealth.

If the market can reach this stage, then the new era belonging to AI Agents will have succeeded halfway, because "attention is value" will allow agents to enter the mainstream. This potential comes from:

Strong distribution capabilities: Agents generate enough topics, like Goat, and stable distribution paths can be replicated.

Ease of Deployment: The deployment platforms for agents will experience explosive growth, such as Zerebro, vvaifu, Dolion, Griffain, and Virtual. Users will be able to build agents without needing to know any code, and the UX of agent deployment platforms will also be optimized through competition.

Memecoin Effect: During the launch phase, agent tokens lack suitable business models, and their use cases are minimal. By donning the veil of Memecoins, they can quickly accumulate communities, maintaining a high success rate for launches.

Extremely High Ceiling: OpenAI's Level 3 agents are still in development, and products that giants cannot quickly launch will inevitably have a vast market space. The lower limit for agents is Memecoins, but the upper limit is highly autonomous advanced intelligences.

Low Market Resistance: Agents led by Goat can establish a large audience. Unlike AI infrastructure, users do not have an aversion to agents; when users are not averse, there is a significant possibility that they will start to pay attention to it.

Potential Incentives: The use cases for agent tokens have not yet been developed. If agents introduce a points system to strengthen incentives, they will have the capacity to accumulate a large number of users.

Iteration Potential: As mentioned earlier, agents are lightweight and capable of rapid iteration. This objective iterative ability can create increasingly attractive products and content for users.

Therefore, AI Agents can become a core narrative and are a battleground that everyone is vying for.

Why does Base have the potential to compete with Solana?

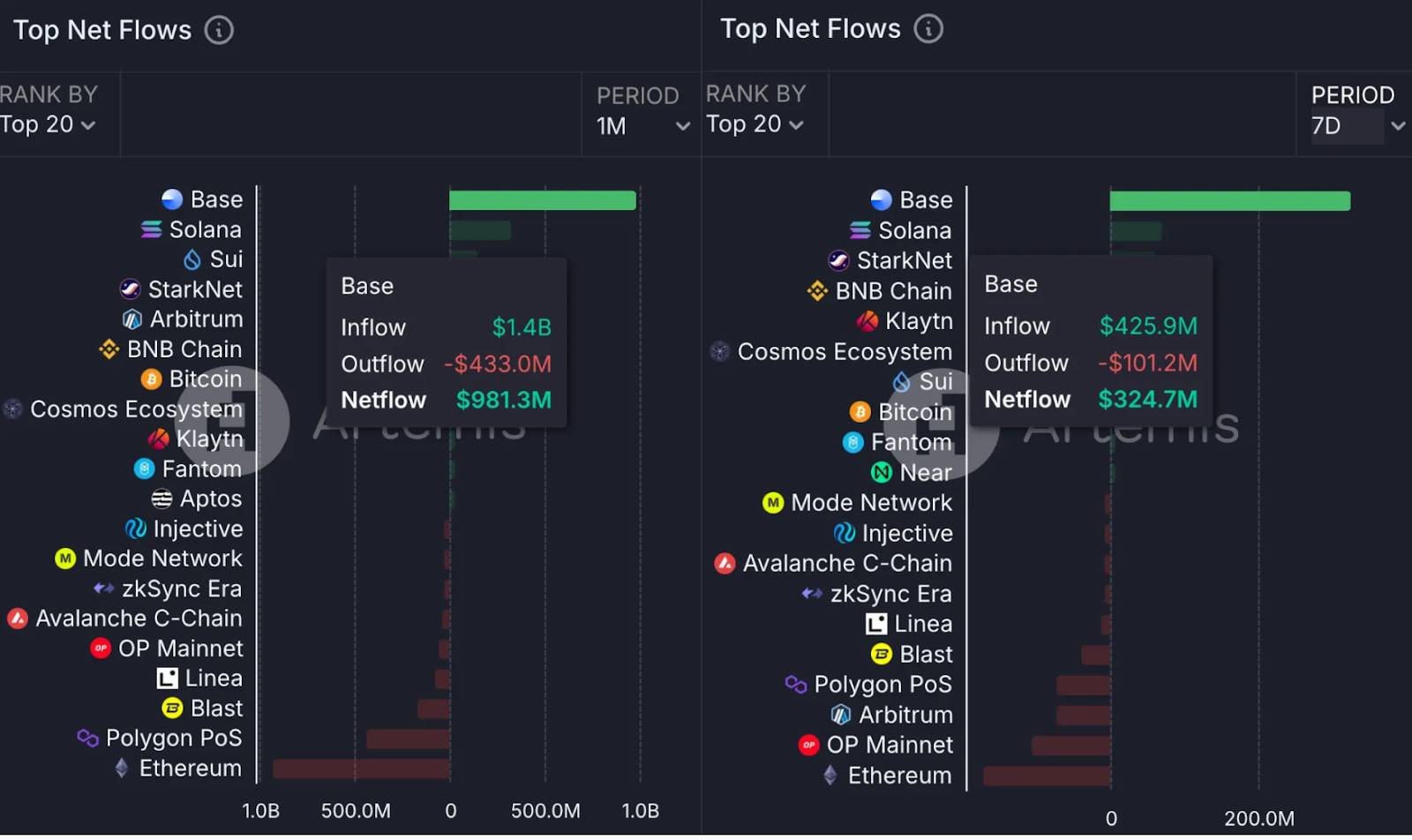

With strong support from Coinbase and North American capital, the Base ecosystem experienced explosive growth in 2024. In November, capital inflows exceeded those of Solana and significantly surpassed Solana in the past seven days.

If ETH can continue to break through the ETH/BTC exchange rate next year, the spillover effect of the ETH season will have a significant impact on Base. Currently, 23% of the outflow funds from ETH are directed to Base, and this figure continues to rise.

AI Agent Launchpad Mapping

Virtual

The V1 phase primarily focused on model training, data contribution, and interactive features. In the V2 phase, Virtual launched a token incubation platform for AI agents, with a landmark update being the fun.virtuals released in October.

Among them, LUNA has developed into an "independent entity" with its own identity and financial capabilities. In this process, LUNA's roadmap aligns with Coinbase's, which provides powerful technical tools and support to facilitate the implementation of AI agents on Base.

AI agent technology has shown excellent performance in brand building, especially in creating cultural brands. Through AI agents, brands can interact with communities more efficiently. This includes simplifying interaction tasks and flexibly distributing rewards, enhancing user stickiness and brand recognition.

It is worth noting that all transactions of AI agents only support the use of the native Virtual token. The Virtual token absorbs the value capture of the entire ecosystem, becoming an important pillar for ecosystem development.

Virtual focuses on improving product functionality, empowering users with AI tools, and bridging the gap between Web2 and Web3. It emphasizes "use value" rather than "hype." Although its tool-based products are frequently called upon in practical applications, they lack the dissemination effect typically associated with cryptocurrencies, which is a shortcoming of the V1 phase.

Clanker

"Post to Mint" lowers the threshold for token issuance while attracting a large number of users to try it out. People rush to @Clanker, a phenomenon similar to the operation of having AI summarize video content on social media; but here, content publication directly translates into asset issuance.

How does Clanker work?

TokenBot (i.e., Clanker) will deploy Meme tokens on Base into unilateral liquidity pools (LP), and the liquidity is then locked. Token issuers will receive the following benefits:

0.25% of all swap fees.

1% of the total supply of tokens (with a one-month unlocking period).

Users can check the number of deployed tokens or create their own tokens through the official website clanker.world.

Unlike PumpFun, which issues tokens through bonding curves on Raydium, charging a 1% transaction fee and a fixed fee of 2 SOL during the process, Clanker does not adopt the bonding curve model but instead charges a 1% fee through Uni v3 transactions as revenue.

AI Agent Layer

The AI Agent Layer is a platform within the Base ecosystem focused on creating AI Agents and Launchpads, officially launched on November 18. Before the platform's release, the AIFUN Token was first issued on November 14 and is now listed on exchanges such as MEXC and Gate, currently priced at $0.09, with a market cap of approximately $25 million.

Creator.bid

Creator.bid initially focused on the monetization and ownership of digital content as an AI platform. In April of this year, the platform completed a new round of financing.

On October 21, Creator.bid announced its official launch on the Base mainnet, enabling one-click creation and publication of AI Agents, providing content creators with new tools and profit models.

Simulacrum

Simulacrum is built on Empyreal. It transforms platforms like Twitter, Farcaster, Reddit, and TikTok into a blockchain interaction layer. Users can perform on-chain operations, such as token trading or tipping, through simple social media posts.

By utilizing technologies such as account abstraction, AI agents, intent-driven actions, and language models, it simplifies complex blockchain backend operations, making DeFi more accessible to ordinary users.

vvaifu.fun

Similar to Pump.fun, users can easily create AI Agents and their associated tokens. AI Agents can seamlessly integrate with social platforms like Twitter, Telegram, and Discord to achieve automated user interactions.

Dasha is an AI Agent created by vvaifu.fun, with its own Twitter account, Telegram channel, and Discord community, all operated and managed by AI.

Top Hat

Top Hat can not only interact with users through text but also understand and process image content. After a user sends an image, the AI agent can "understand" the content of the image and respond accordingly.

Griffain

With a platform for trainable AI Agents, Griffain has launched 1,000 trainable AI agents, showcasing the future potential of smart contracts and automated trading.

About BlockBooster: BlockBooster is an Asian Web3 venture studio supported by OKX Ventures and other top institutions, dedicated to being a trusted partner for outstanding entrepreneurs. We connect Web3 projects with the real world through strategic investments and deep incubation, helping quality entrepreneurial projects grow.

Disclaimer: This article/blog is for reference only, representing the author's personal views and does not reflect the position of BlockBooster. This article does not intend to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific issues, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling this data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。