Author: Frank, PANews

As an important driver of multi-chain interoperability, zero-knowledge proof applications, and the DeFi and NFT ecosystems, Polygon shone brightly during the last bull market cycle. However, over the past year, many public chain projects, including Polygon, have failed to achieve new breakthroughs and have gradually been overshadowed by new competitors like Solana, Sui, or Base. When Polygon returned to discussions on social media, it was not due to any significant updates, but rather the exit of ecosystem partners like AAVE and Lido.

"Borrowing Chickens to Lay Eggs" Proposal Raises Concerns

On December 16, the Aave contributor team Aave Chan released a proposal in the community to withdraw its lending services from Polygon's Proof of Stake (PoS) chain. The proposal, written by Aave Chan founder Marc Zeller, aims to gradually phase out Aave's lending protocol on Polygon to mitigate potential future security risks. Aave is the largest decentralized application on Polygon, with deposits exceeding $466 million on the PoS chain.

Coincidentally, on the same day, the liquid staking protocol Lido announced that it would officially discontinue Lido on the Polygon network in the coming months. The Lido community stated that the strategic refocus on Ethereum and the lack of scalability of Polygon PoS were the reasons for discontinuing Lido on the Polygon network.

Losing two major ecosystem applications in one day is a significant blow to Polygon. The main reason stems from the "Polygon PoS Cross-Chain Liquidity Plan" Pre-PIP improvement proposal released by the Polygon community on December 13. The primary goal of this proposal is to suggest using the over $1 billion stablecoin reserves held on the PoS chain bridge to generate yields.

It is understood that the Polygon PoS bridge holds approximately $1.3 billion in stablecoin reserves, and the community suggests deploying these idle funds into carefully selected liquidity pools to generate yields and promote the development of the Polygon ecosystem. Based on current lending rates, these funds could potentially generate about $70 million in annual returns.

The proposal suggests gradually investing these funds into vaults that meet the ERC-4626 standard. Specific strategies include:

DAI: Depositing into Maker's sUSDS, which is the official yield-bearing token of the Maker ecosystem.

USDC and USDT: Using Morpho Vaults as the primary source of yield, with Allez Labs responsible for risk management. Initial markets include Superstate's USTB, Maker's sUSDS, and Angle's stUSD.

Additionally, Yearn will manage a new ecosystem incentive program, utilizing these yields to incentivize activities within the Polygon PoS and the broader AggLayer ecosystem.

Notably, the signatories of this proposal include Allez Labs, Morpho Association, and Yearn. According to Defillama data from December 17, Polygon's total TVL is $1.23 billion, with AAVE's TVL at approximately $465 million, accounting for about 37.8%. Yearn Finance's TVL ranks 26th in the ecosystem, with a TVL of about $3.69 million. This may explain why AAVE proposed an exit from Polygon for security reasons.

Clearly, from AAVE's perspective, this proposal involves taking AAVE's funds and placing them into other lending protocols for interest. As the largest application of funds on the Polygon PoS cross-chain bridge, AAVE cannot benefit from such a proposal and instead bears the risk of fund security.

However, Lido's withdrawal may not be related to this proposal, as Lido's proposal and vote to reassess Polygon were released a month earlier, coincidentally at this time.

A Helpless Move Amid Weak Ecosystem Development

If AAVE's withdrawal proposal is formally approved, the TVL on Polygon will drop to $765 million, making it impossible to achieve the $1 billion fund reserve mentioned in the Pre-PIP improvement proposal. The second-ranked Uniswap in the ecosystem has a TVL of about $390 million; if Uniswap also follows suit with a proposal similar to AAVE's, the TVL on Polygon could plummet to around $370 million. Not only would the annual yield target of $70 million be unachievable, but all aspects of the ecosystem, such as governance token prices and active users, would also be affected. The losses could far exceed $70 million.

From this outcome, it seems that this proposal is not a wise move. Why did the Polygon community propose this plan? What has been the state of the Polygon ecosystem over the past year?

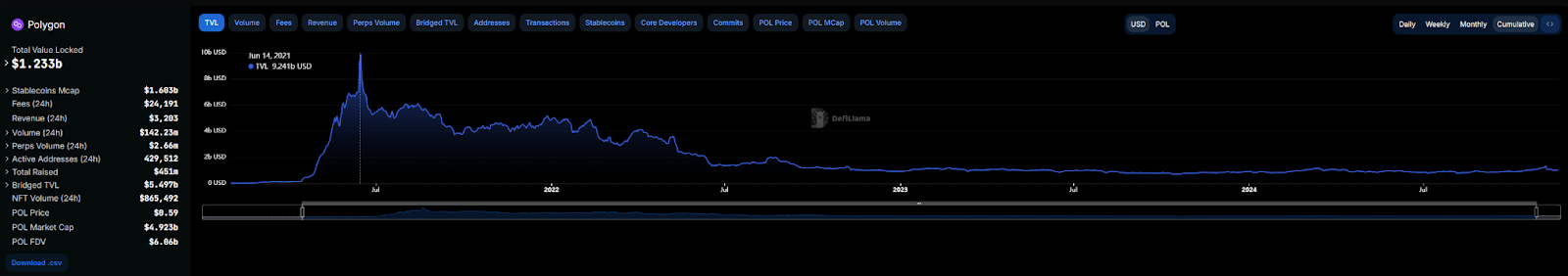

The most prosperous time for the Polygon ecosystem was in June 2021, when the total TVL reached $9.24 billion, 7.5 times that of today. As time passed, Polygon's TVL curve has been on a downward trend, maintaining around $1.3 billion since June 2022, with no significant fluctuations. By 2023, it even dropped to around $600 million at one point. In 2024, as the market warmed up, Polygon's TVL mostly remained below $1 billion, only barely rising above $1 billion since October.

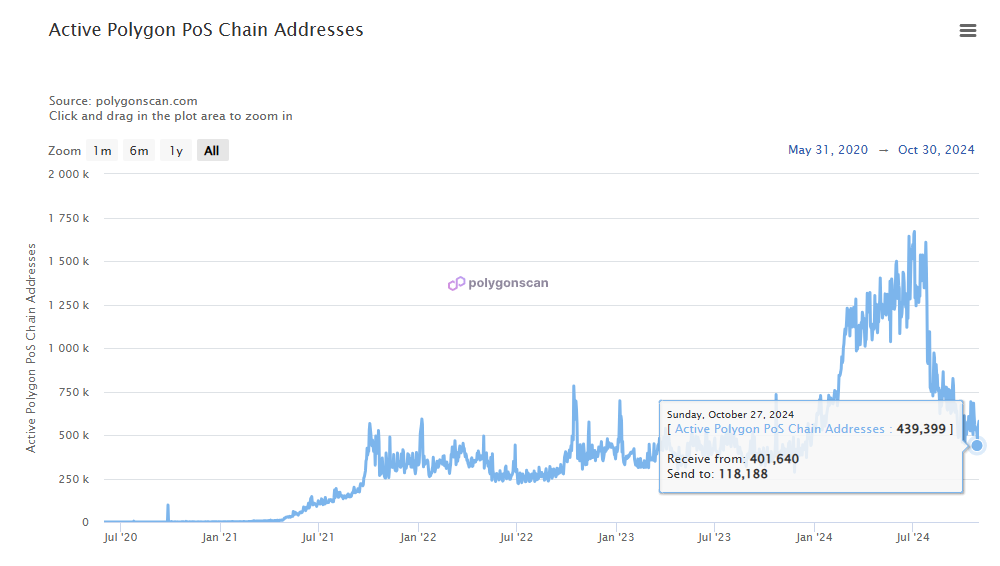

In terms of active addresses, on October 29, Polygon PoS had about 439,000 active addresses, a level similar to that of a year ago. Although from March to August this year, the number of active addresses on Polygon PoS saw a significant increase, reaching 1.65 million at one point, for some unknown reason, it cooled rapidly during the market's hottest period.

The market performance of the token has also been poor. From March to November 2024, the price of the POL token did not follow the rise of major cryptocurrencies like Bitcoin, but instead fell continuously, dropping from $1.30 at the beginning of the year to a low of $0.28, a decline of over 77%. It has only recently started to rebound, with the price now around $0.60, but it still needs to grow about five times to reach its historical high of nearly $3.

Technical Innovation + Brand Upgrade Not as Effective as "Distributing Money"

With weak ecosystem development, Polygon has not given up on technology and products, frequently announcing technical innovations and product layouts over the past year. The most notable performance has been from the prediction market Polymarket in the past year. Additionally, in October, Polygon launched a new unified blockchain ecosystem called AggLayer, which the official introduction describes as Agglayer = unified chain (L1, L2, L∞). However, the positioning of this new ecosystem seems difficult to understand, and in November, the official team even published an article specifically explaining AggLayer.

Moreover, the ZK proof system toolkit Polygon Plonky3 has become the fastest zero-knowledge proof system. Vitalik also interacted on Twitter, stating, "You won this race."

Besides technology, many established public chains this year have sought to reshape their brands through renaming and rebranding. Polygon has already undergone brand reshaping, changing from Matic to Polygon. Given the current market environment, non-disruptive technological innovations seem increasingly unlikely to become a narrative advantage for a project. This is indeed a harsh reality for projects like Polygon that are still focused on technological innovation or hope to reshape their brand through integration.

What truly attracts users and maintains attention are often reward distribution or incentive programs, such as the recently popular Hyperliquid. However, Polygon has limited options for reform in this area; on-chain fees generate only a few tens of thousands of dollars daily, which does not pique user interest. Thus, the "Borrowing Chickens to Lay Eggs" proposal mentioned at the beginning emerged.

However, it is clear that the owner of the "hen" does not agree to this business, and Polygon may end up losing more as a result. Overall, the fundamental reason for the stagnation of Polygon's ecosystem development is its lack of sufficient user incentives and new narrative driving forces. In the face of intensified market competition, Polygon needs to seek more attractive market strategies beyond technological innovation. This is a common dilemma faced by most established public chains today.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。