Inclusive finance is one of the biggest opportunities in Africa's digital industry.

Written by: WSPN

1. Introduction

1.1 Africa's Digital Economy

With the rapid development of the global digital economy, Africa is at a crossroads where the digital economy drives economic transformation and sustainable development. Africa covers an area of over 30 million square kilometers, and as of 2022, its population exceeds 1.4 billion, with abundant natural resources. According to the World Bank, in 2022, the GDP of the African continent was approximately $2.98 trillion, maintaining an annual growth rate of over 3%. According to a report by Endeavor, the scale of Africa's digital economy in 2022 was about $115 billion, accounting for 3.86% of GDP, and it is expected to reach $712 billion by 2050. In contrast, Asia's digital economy accounted for over 30% of GDP in 2022. The development of Africa's digital economy has enormous potential.

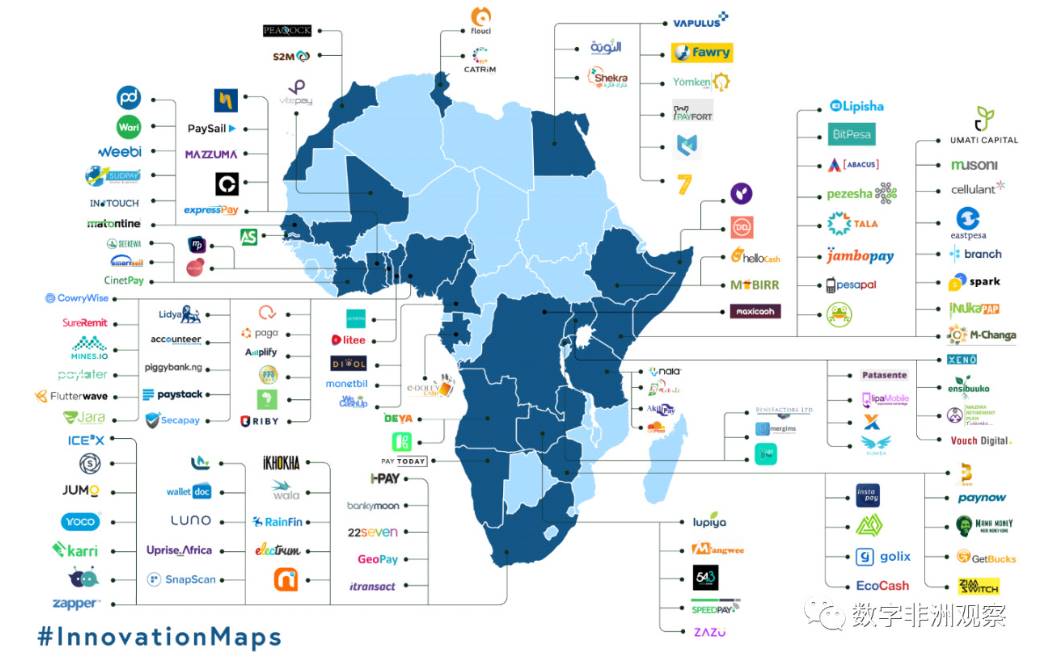

The digital economy encompasses various industries, including digital finance, digital commerce, and digital education. Digital finance integrates traditional financial services with digital technology. In Africa, up to 66% of the population lacks a bank account—people and businesses across all African countries face challenges such as difficulties in payments, loans, savings, and purchasing insurance. The number of relevant fintech companies in Africa has surged in recent years. Statistics show that in 2017, African fintech companies raised nearly $200 million, while the top 10 African fintech companies raised nearly $300 million in 2018. In 2019, investments exceeding $5 million totaled over $580 million. The most popular sectors in Africa's digital finance include mobile payments (digital wallets), online lending, and online remittances. Inclusive finance is one of the biggest opportunities in Africa's digital industry, with its core being the use of digital technology to broadly address the issue of financial service coverage.

Distribution of major fintech companies in Africa (Data source: Digital Africa Observatory, Briter Bridges)

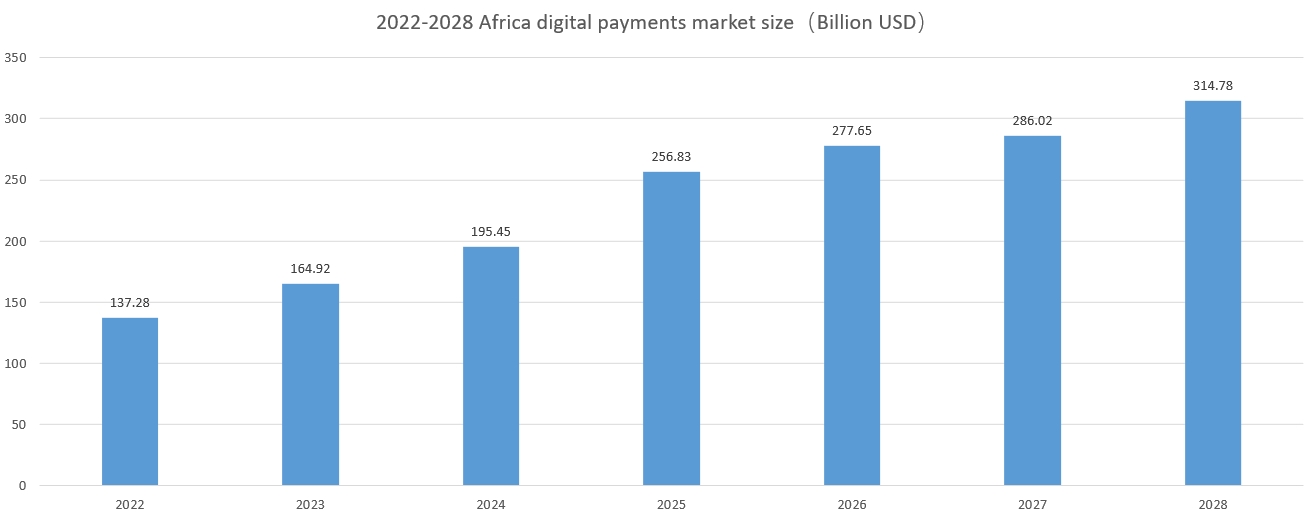

According to Statista, in 2024, the scale of mobile payments in Africa (transaction volume) will exceed $195 billion, more than double that of 2020, maintaining a double-digit annual compound growth rate. It is expected to further grow to $314.8 billion by 2028. Over the past two years, many African countries have seen record highs in electronic payment volumes. According to the Central Bank of Nigeria, the volume of mobile money transactions in Nigeria doubled in 2020, reaching about 800 million; South Africa's data shows that online commerce grew by about 40% during 2020 and 2021. Digital payments are becoming an increasingly popular payment method across the African continent. In 2023, 17% of consumers in Africa used digital payment services daily, with the proportion of consumers using digital payment services weekly reaching 48%.

Market size of digital payments in Africa (Data source: Statista)

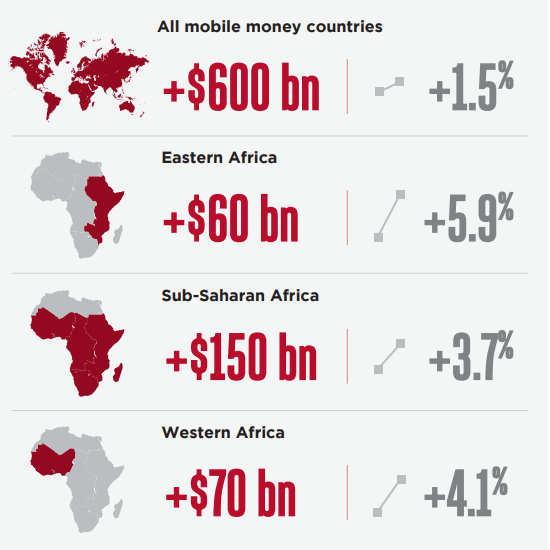

Mobile money is currently the most prominent and fastest-growing form of digital payment in Africa. According to the GSMA's "The State Of The Industry Report On Mobile Money," in 2023, the number of registered mobile money accounts in Africa reached 856 million, accounting for 49% of global registered accounts, with 136 million new registered accounts, representing over 70% of the total global growth in registered accounts, making it the primary source of growth for mobile money worldwide. Currently, Africa has about 169 mobile money services, including M-PESA, Airtel Money, Orange Money, MTN Mobile Money, Ecocash, and Tigo Pesa. These platforms allow users to save, send, and receive money using their phones, providing a convenient alternative to traditional banking, especially in areas with limited banking infrastructure. In addition to improving financial inclusion and access to other digital services, the adoption, use, and growth of mobile money have also driven macroeconomic growth in Africa. Mobile money has contributed over $150 billion to GDP growth in sub-Saharan Africa, with a contribution rate of 3.7%. In East Africa, the contribution rate to GDP growth reaches 5.9%.

Contribution of mobile money to GDP in different regions (Data source: GSMA)

Digital commerce, also known as e-commerce, faces challenges in Africa such as insufficient infrastructure, late start, and incompleteness. However, the large population base, high proportion of young people, and significant room for improvement have attracted investors from various countries. According to Statista, Africa's e-commerce market is expected to reach $49.02 billion in online retail revenue in 2023, with an annual growth rate of nearly 14%. By 2027, the user base of Africa's e-commerce market could soar to 600 million, with a user penetration rate of 44.3%. This expansion brings multiple benefits, including economic growth, job opportunities, and improved access to goods and services in rural and remote areas.

Africa's e-commerce industry is redefining traditional supply chains and business models. For example, Kenya's Twiga Foods sources products directly from farmers and efficiently delivers them to urban retailers, streamlining the agricultural value chain. Egypt's MaxAB is a platform that connects food and grocery retailers with suppliers in underserved areas. These innovations add diversity to the solutions in Africa's e-commerce sector. The Pan-African Payment and Settlement System (PAPSS) serves as a payment solution that facilitates payment transactions across Africa without relying on banks outside the continent. With over ten countries and commercial banks adopting PAPSS, it supports significant growth in the e-commerce industry.

Additionally, the digital economy plays an important role in traditional sectors such as logistics, agriculture, education, energy, and transportation, driving economic and technological development while being more inclusive and fostering innovation. For instance, Nigerian company Kobo360 and Kenyan company Lori Systems have introduced digital technology and methods into the traditional road transport market, improving the efficiency and reliability of the entire process and reducing truck empty running rates, resulting in over a 50% increase in income for most drivers after collaborating with the platform. In the past, a lack of teachers, tuition fees, gender gaps, safety issues, long distances to school, and the lack of widespread smartphone use were major constraints on education in Africa. Therefore, Kenyan edtech company Eneza Education chose to provide services to feature phone users via USSD and SMS. According to their official information, their user base has grown to 4.9 million, sending over 1 million messages daily, with students answering over 10 million questions and asking over 1 million questions cumulatively.

1.2 Stablecoins

1.2.1 The Stablecoin Market in Africa

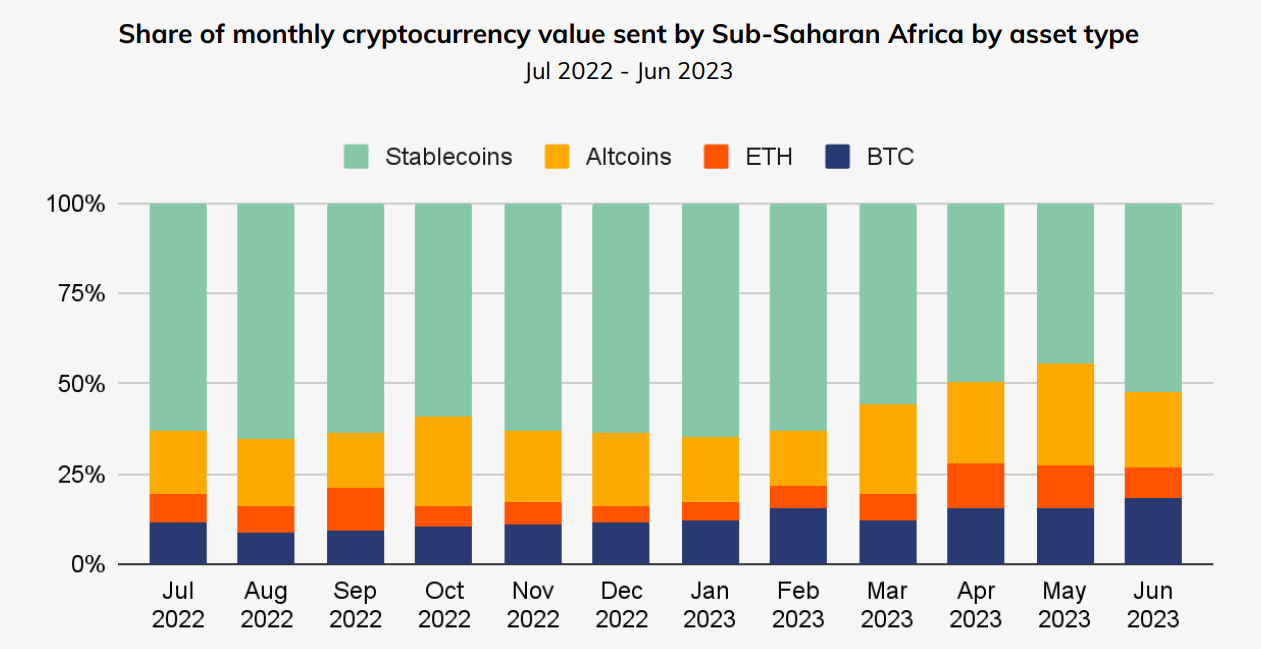

The adoption of cryptocurrencies in Africa is experiencing rapid growth. According to a report by Chainalysis, Nigeria ranks second in the global cryptocurrency adoption index, following India and ahead of the United States and other Western countries. Stablecoins dominate the cryptocurrency adoption landscape. From July 2022 to June 2023, the volume of cryptocurrency transfers in sub-Saharan Africa reached $117.1 billion, with stablecoins accounting for over 50% of all asset classes (significantly higher than BTC, ETH, etc.).

Monthly cryptocurrency transaction volume by asset in sub-Saharan African countries in 2023 (Data source: Chainalysis)

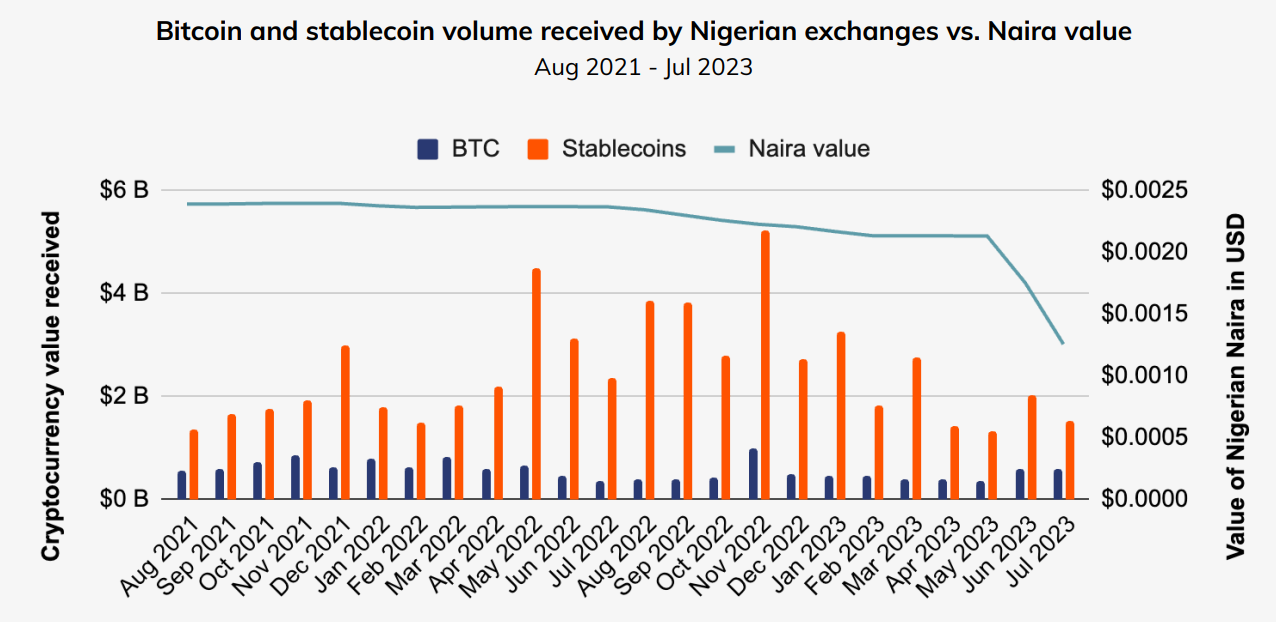

Taking Nigeria, the largest cryptocurrency economy in Africa, as an example, in 2022, the Central Bank of Nigeria announced plans to redesign the national currency (NAIRA) and issue new banknotes to combat inflation and exert more control over the money supply. Unfortunately, the resulting cash shortage put immense pressure on the unbanked population in the country in early 2023. The uncertain economic environment in Nigeria has encouraged more citizens to seek financial alternatives, leading to an increase in cryptocurrency holdings (primarily stablecoins).

Cryptocurrency transaction volume in Nigeria (Data source: Chainalysis)

1.2.2 Applications of Stablecoins in Africa

Remittances

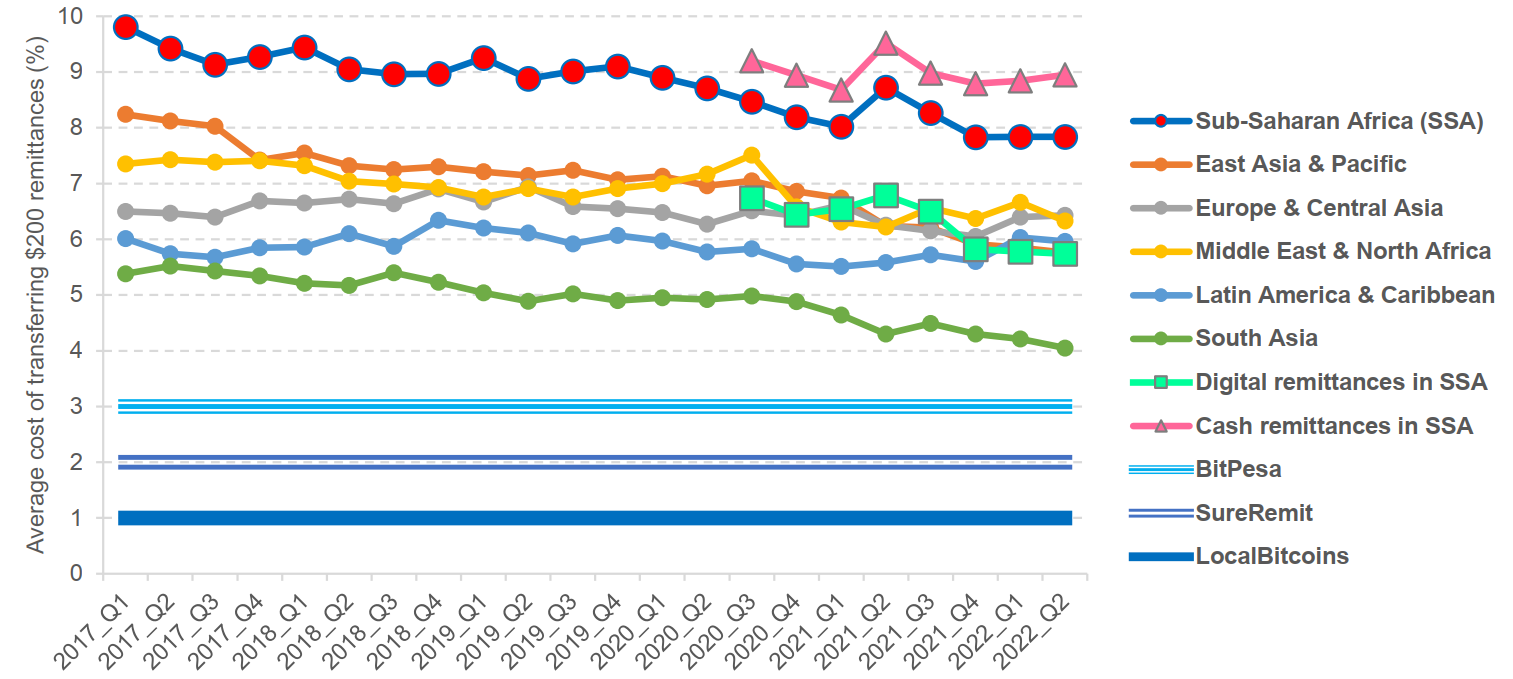

Over the past few decades, the inflow of funds into the African continent has continued to grow, but the people of Africa still face the challenge of high remittance costs. According to the United Nations Development Programme, in the second quarter of 2022, the cost of remitting $200 to Africa was as high as 7.8%, far exceeding the global average cost of 4%-6.4%. Using cryptocurrencies for remittances can significantly reduce costs (even to one-twentieth of traditional remittance methods). For example, Nigeria's SureRemit charges a fee of 0%-2% for remittances. Additionally, using stablecoins for remittances can avoid potential losses from asset price fluctuations. Mainstream African trading platforms such as Paxful, BuyCoins, Luno, and Quidax have seen a surge in stablecoin trading demand for remittance purposes in recent times.

Remittance costs (Data source: UNDP)

Cross-Border Trade

Using stablecoins for payments in cross-border trade offers low fees and fast transaction speeds. In traditional cross-border trade, banks play a crucial role, and since African trade is primarily composed of small and medium-sized enterprises, the decline in bank-supported cross-border trade activities is due to stricter regulations, risk management, KYC, and exchange rate risks. Furthermore, the underdeveloped financial infrastructure in Africa generally relies on international banks, limiting the development of trade activities. However, using stablecoins combined with blockchain smart contracts can effectively address this issue.

Inclusive Finance

According to the United Nations Development Programme, as of 2021, approximately 60% of the population aged 15 and older in sub-Saharan Africa did not have a bank account (compared to a global average of 26%). The proportion of women without bank accounts is 12% higher than that of men. In terms of financial infrastructure density, Africa has an average of only 4.5 commercial banks per 100,000 people (compared to a global average of 10.8).

Many cryptocurrency service providers are integrating resources from various industries to offer more comprehensive services to those lacking basic financial services. For example, Nigeria's SureRemit not only provides users with remittance functions but also has over 1,000 merchant partners in its global network. Utilizing blockchain payment technology, users can purchase goods, pay tuition, settle utility bills, and make donations, addressing the challenges faced by the unbanked population.

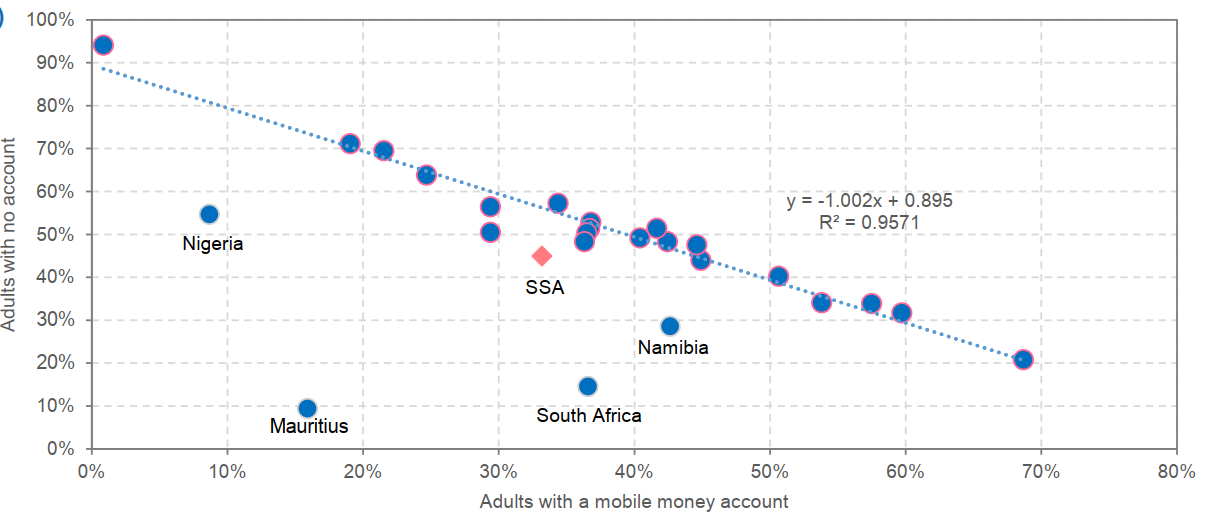

The following statistics also indicate that as mobile phone usage increases in Africa, there is a clear negative correlation between the proportion of adults with mobile money accounts and those who have never had a financial account. This suggests that countries with a higher proportion of mobile money account holders exhibit greater financial inclusion.

Cryptocurrencies improve financial inclusion (Data source: UNDP)

Value Preservation and Inflation Hedge

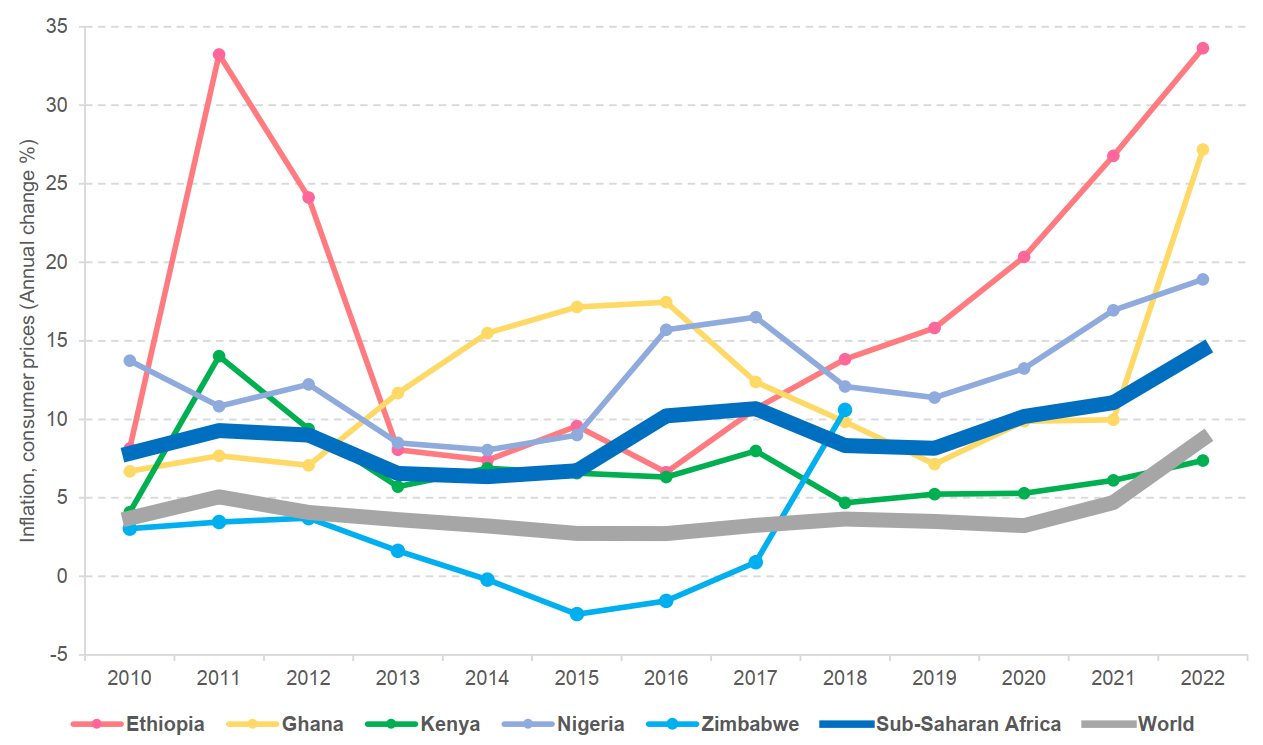

Many African countries have long been plagued by high inflation (with double-digit annual rates), significantly exceeding the global average inflation rate. The currencies in these countries face continuous and substantial depreciation. The situation worsened after the COVID-19 pandemic; in 2021, due to supply chain crises and resource shortages, the overall inflation rate in sub-Saharan Africa rose by 3%. Using stablecoins pegged to the US dollar can significantly alleviate this issue, and many mainstream centralized exchanges offer stablecoin savings services to African users.

Inflation rates in some sub-Saharan African countries (Data source: UNDP)

1.2.3 Major Stablecoins in Africa

The main stablecoins used in African countries include the following:

Tether (USDT): Currently the largest stablecoin by market capitalization (over $110 billion) and the most widely used stablecoin in Africa and globally. According to Christoper Maurice, founder of the major African crypto trading platform Yellow Card, USDT on the Tron network is one of the most popular cryptocurrencies among users across Africa. Many Africans prefer to use USDT and other dollar-pegged stablecoins on low-cost networks like Tron to avoid domestic inflation.

USD Coin (USDC): USDC is the second-largest dollar stablecoin by market capitalization, issued by Circle. Like USDT, USDC is actively expanding into the African market. In January 2024, cryptocurrency exchange Coinbase partnered with Yellow Card to expand its product usage to 20 new African countries, focusing on increasing the adoption of the USDC stablecoin. This move will help millions of users access USDC and conduct fast, reliable, and cheaper transactions on the decentralized, open L2 Base through Coinbase and Yellow Card products.

WSPN USD (WUSD): WUSD is a dollar stablecoin issued by the stablecoin infrastructure company WSPN, aimed at providing users with safer, more efficient, and transparent payment solutions by establishing a global compliance system and a new payment ecosystem. In July 2024, WSPN reached a strategic partnership with African fintech pioneer CanzaFinance. WUSD integrates with CanzaFinance's ecosystem to provide users with convenient financial services, allowing them to conduct various financial transactions, including remittances, payments, and savings, while enjoying a smooth exchange experience between WUSD and African fiat currencies, thereby accelerating the implementation of real-world assets (RWA) and decentralized finance (DeFi) solutions in emerging markets like Africa.

PayPal USD (PYUSD): PYUSD is a dollar stablecoin issued by PayPal, the world's largest third-party payment platform.

Celo USD (CUSD): CUSD is a dollar stablecoin issued by Celo. Unlike the three stablecoins mentioned above, CUSD is primarily collateralized by cryptocurrencies, including BTC, ETH, and Celo. In 2023, Celo announced a partnership with Opera to launch the stablecoin wallet MiniPay, initially promoting it in Nigeria. This wallet is integrated with the Opera Mini mobile browser, aiming to help African mobile internet users access Web3 products. Opera's mobile payment institution OPAY is also a major mobile payment provider in Africa, with over 35 million registered users.

1.2.4 Regional Differences

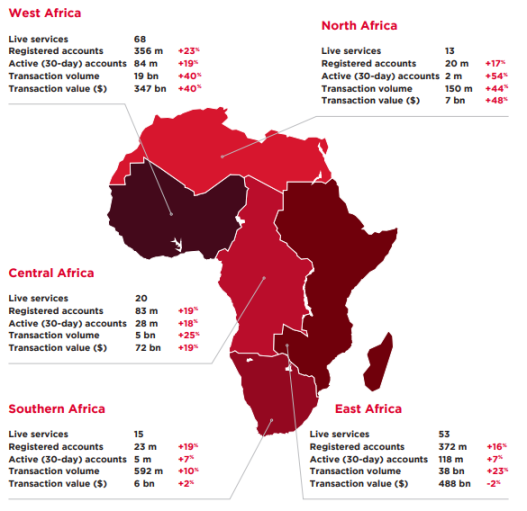

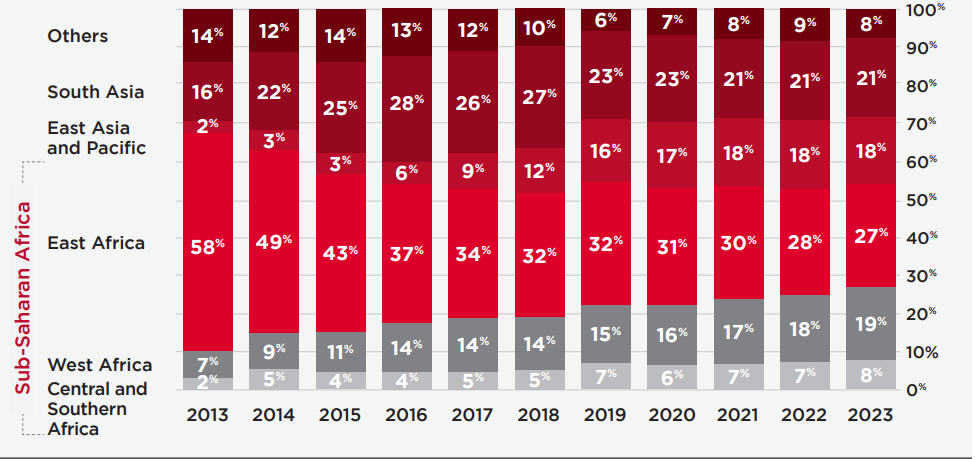

Africa's digital economy exhibits significant regional disparities and differentiation. In 2023, the entire African continent had 856 million mobile money accounts, with a transaction volume of $919 billion. East and West Africa are leading in mobile money development, with active accounts in these regions accounting for 85% of the total in Africa and transaction volumes making up 90.8%. From the active account data, it can be seen that East African countries had a better foundation early on, while West African countries have experienced the fastest growth over the past decade.

Overview of mobile money in Africa in 2023 (Data source: GSMA)

Regional share of active mobile money accounts in Africa from 2013 to 2023 (Data source: GSMA)

West Africa: Countries in West Africa, such as Nigeria, Ghana, and Senegal, are rapidly developing cryptocurrency economies. According to a Statista survey in 2020, 32% of Nigerians had held or used cryptocurrencies—this rate ranks first globally. Nigeria is also the country receiving the most cryptocurrency in Africa in 2023 (over $56 billion). On one hand, the Nigerian naira and Ghanaian cedi have depreciated continuously in recent years, and domestic inflation remains high, prompting citizens to seek safer dollar-pegged stablecoins. On the other hand, Nigeria is the most populous and economically significant country in Africa, accounting for 38% of remittance flows in sub-Saharan Africa in 2023, leading to substantial remittance and payment demands.

East Africa: Countries in East Africa, such as Kenya, Tanzania, and Mauritius, are also active cryptocurrency economies. M-Pesa has become Kenya's largest mobile payment platform, enabling ordinary citizens to conduct cross-border payments, short-term loans, salary collections, bill payments, and wealth management services through mobile phones and networks. This has provided convenient financial experiences for those underserved by traditional financial services, significantly improving the overall livelihood and economic conditions in Kenya.

Southern Africa: In Southern Africa, South Africa has seen rapid development in the cryptocurrency industry in recent years. In addition to providing cheaper and faster remittance options, South Africa's well-developed financial infrastructure means that over 80% of the population has bank accounts, and the general public has relatively high financial literacy. Therefore, the development and adoption of the cryptocurrency industry and stablecoins are primarily reflected in investments. A study by cryptocurrency exchange Kucoin shows that about 22% of South Africa's adult population (7.6 million people) are cryptocurrency investors, with many users preferring to use digital assets as their favored savings method to achieve stable returns.

1.2.5 Growth Prospects

The rapid growth of e-commerce, widespread application of digital services, revolutionary development of mobile payments, and the uneven development of African countries will all drive stablecoins to play an important role in the future digital economy and the overall financial system of Africa.

In recent years, Africa's e-commerce market has been growing at an astonishing rate, with the entire market expected to reach $939.8 billion by 2030. Local platforms like Jumia (the first African tech company to be listed on the NYSE) and Konga are rising, while international giants like Amazon are also actively entering the African market. This is primarily due to the enormous consumer potential brought by Africa's demographic dividend. Africa is currently one of the fastest-growing regions in the world, with a population exceeding 1.2 billion, projected to reach 2.5 billion by 2050. The large population base provides significant consumer potential, especially with a high proportion of young people, gradually increasing internet penetration, and shifting consumption habits towards online platforms, laying a solid foundation for the development of e-commerce. Additionally, in recent years, African governments and private enterprises have invested heavily in internet infrastructure, with increasing coverage of fiber optic and mobile communication networks. The penetration rate of smartphones is also rapidly rising, with an estimated 675 million smartphone users in Africa by 2025, providing the necessary technical support for the development of e-commerce platforms. The success of mobile payment platforms like Kenya's M-Pesa has promoted the adoption of cashless payments. As payment systems continue to improve, the convenience and security of online shopping for users are ensured, further promoting the growth of e-commerce.

Currently, Africa has 1.22 billion mobile network users, of which 676 million are smartphone users, accounting for 55.32%. Major mobile payment platforms include M-PESA, Airtel Money, Orange Money, and MTN Mobile Money, which are widely popular in Africa, providing convenient financial services and addressing the challenges faced by the unbanked population. It is expected that by 2028, the value of Africa's digital payment market will further grow to $314.8 billion.

Other digital services such as online education and telemedicine are also experiencing rapid development. According to a report by Expert Market Research, the African e-learning market is expected to reach $20.35 billion by 2028, with a compound annual growth rate of 39.2% from 2023 to 2028. This growth is primarily driven by the increasing demand for online education and training solutions, the rise in mobile device usage, and government initiatives promoting digital education. The African healthcare market is projected to grow at an average annual rate of 8.3%, reaching a market size of $259 billion by 2025. The rapid rise of the digital health market, including mobile health applications, telemedicine services, and electronic health record systems, provides new solutions for improving the accessibility and quality of healthcare services.

In addition to the rapid development of the digital economy, the current economic development in Africa faces challenges such as high inflation rates, currency volatility, low coverage of banking services, and weak financial infrastructure. Stablecoins offer a relatively stable medium of exchange, helping African individuals and businesses cope with these economic challenges.

2. How Stablecoins Support Africa's Digital Economy

Stablecoins are designed to maintain a relatively stable value. The most widely circulated stablecoins, such as USDT and USDC, are pegged to the US dollar. As the largest and most important currency in global trade, the value of the US dollar remains relatively stable compared to major currencies of other countries. Therefore, using stablecoins like the US dollar can effectively hedge against the volatility risks of local currencies in some African countries. Due to unstable monetary policies and high inflation, most African currencies have been on a long-term depreciation trend against the US dollar.

In traditional cross-border trade, banks play a crucial role by providing a range of services, including payment settlement, trade financing, risk management, and foreign exchange trading. Small and medium-sized enterprises (SMEs) dominate economic activities and cross-border trade in African countries, making trade financing very important for import and export businesses. Bank-mediated trade financing has averaged 40% of total trade in Africa over the past decade. However, due to increasingly stringent KYC, anti-money laundering, and risk-based capital regulatory requirements, bank-supported trade financing has steadily declined, disproportionately reducing support for SMEs. Other factors such as liquidity constraints, currency risk, credit risk, and time and currency costs also add to the challenges of trade financing in Africa. The use of stablecoins can significantly address these issues by enabling payments to be completed within seconds through blockchain technology, facilitating faster movement of funds among supply chains, buyers, shipping companies, and sellers. SMEs engaged in cross-border trade can obtain funds more quickly from banks and other financial institutions to ensure liquidity. Stablecoins like USDT and USDC have been reported to be increasingly used in international trade by African SMEs. Additionally, decentralized finance (DeFi) systems based on stablecoins are now able to offer relatively mature financial products and services, such as credit and deposits. This underutilized trade finance potential can encourage SMEs to participate more in trade opportunities within the African continent and sub-regions (such as the Economic Community of West African States, Southern African Development Community, and Intergovernmental Authority on Development in East Africa).

By integrating stablecoin applications with current mobile payment platforms, transaction efficiency can be improved and costs reduced. The use of stablecoins can significantly lower payment costs and time, which is a huge attraction for users. It can also enhance financial inclusion, as stablecoins and the decentralized financial systems (DeFi) built on them will provide access to a wide range of financial services for the unbanked population.

The low-cost and fast transaction characteristics of stablecoins can further improve various aspects of digital services, enhancing convenience and attracting a larger user base. In the micropayment sector, the use of stablecoins can significantly reduce the costs of micropayments, making small transactions more economical. This is particularly important for the African market, where traditional payment methods are costly. The fast transaction speed allows for instant or near-instant payments, which is crucial for micropayment scenarios, as users prefer a seamless payment process. In the subscription sector, stablecoins can simplify the payment process for subscription services, allowing users to set up automatic payments once without needing to perform manual operations each time. This is especially useful for African users, who may be more accustomed to using mobile devices for transactions. Additionally, due to the relatively stable value of stablecoins, they reduce the risk of payment failures caused by currency fluctuations, ensuring that subscription services can continue to be provided. Furthermore, stablecoins can be used for various digital services, such as in-game purchases, online education, and health services, providing a smooth payment experience and encouraging African developers and service providers to explore new business models, such as microtransaction-based profit models. This also helps promote economic integration within Africa, facilitating trade and investment.

3. Challenges Facing Stablecoin Adoption

The large-scale adoption of stablecoins in Africa currently faces several challenges, including government regulation, compliance, infrastructure, public concerns, and trust.

Regulation and Compliance:

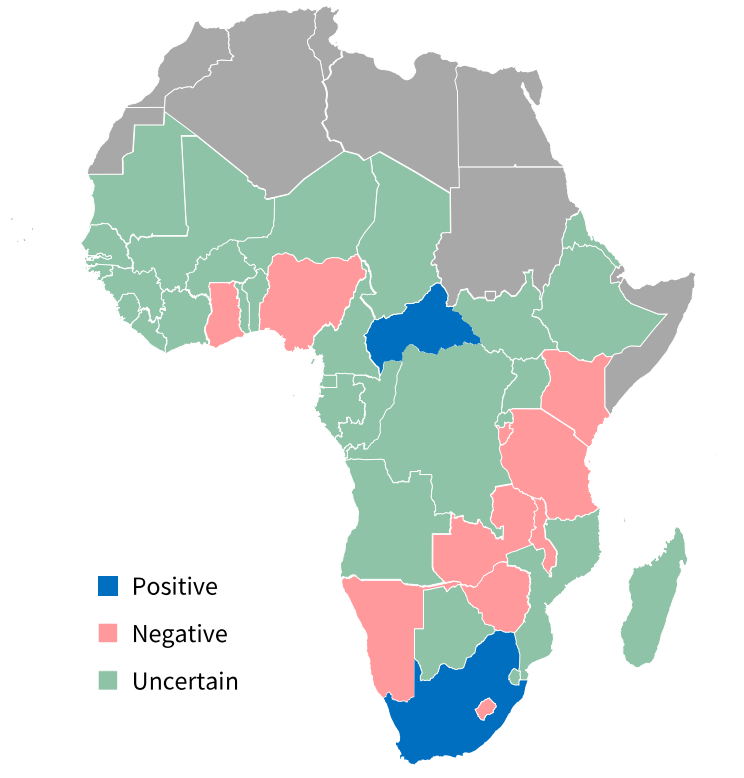

Currently, most African countries are still in the exploratory stage regarding cryptocurrency regulation, lacking clear legal definitions and asset classifications. Government concerns primarily stem from financial stability risks, particularly how to properly manage the relationship between non-local currency-pegged stablecoins and fiat currencies. For example, the Central Bank of Nigeria is worried that the widespread adoption of stablecoins may weaken its control over monetary policy, leading to capital outflows and further diminishing the value of the fiat currency, the naira. Some stablecoins are pegged to assets like the US dollar, and if the reserve assets of these stablecoins are not properly managed, it could trigger potential financial panic and introduce instability into the financial system, especially when stablecoins are widely used for transactions or savings. Additionally, the anonymity associated with certain cryptocurrencies may facilitate criminal activities, potentially being used for money laundering or funding illegal transactions, impacting financial stability and security. Clearly, a well-defined regulatory framework for stablecoins and corresponding legal protections are crucial for the development of stablecoins.

Current state of cryptocurrency regulation in sub-Saharan African countries (Data source: UNDP)

Limited Infrastructure:

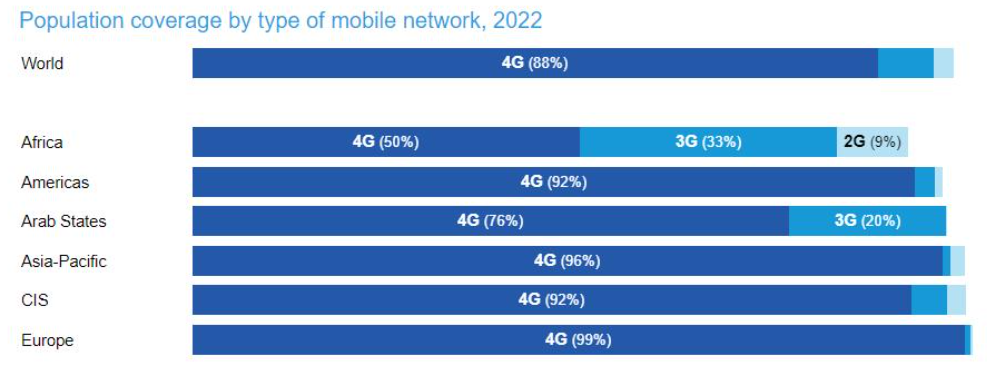

Mobile networks (4G/5G) and the internet are essential infrastructures supporting the digital economy. Currently, Africa's 4G network coverage is only 50%, far below the global average, and in some areas, only 2G networks are available. Except for relatively developed economies like South Africa, the internet penetration rate across Africa is only about 30%, which somewhat limits the development of the digital economy and the stablecoin economic ecosystem.

Global mobile network coverage (Data source: International Telecommunication Union)

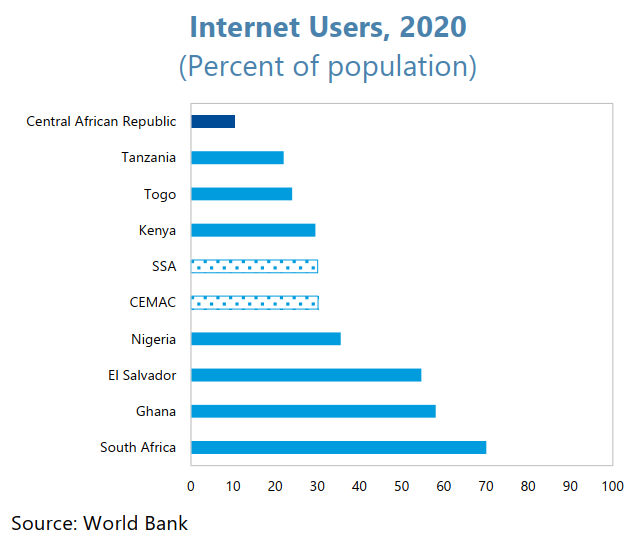

Proportion of internet users in the population (Data source: World Bank)

Social Concerns and Education:

The anonymity associated with cryptocurrency transactions often raises concerns about criminal activities. Social engineering scams, phishing attacks, and fraudulent investment schemes targeting stablecoins can significantly impact newcomers. Particularly, those living in rural areas or with limited exposure to technology may not be very familiar with stablecoins or cryptocurrencies. This lack of awareness may hinder the large-scale adoption of stablecoins and make them susceptible to fraud or misinformation. Understanding how stablecoins work, their risks and benefits, and how to use them safely requires a certain level of financial literacy, which necessitates increased government or institutional outreach and targeted basic financial education. Furthermore, even stablecoins pegged to fiat currencies may experience some degree of price volatility. This volatility may raise concerns among potential users, especially for those unfamiliar with the cryptocurrency market or with limited financial resources.

4. Case Studies

OnAfriq (MFS Africa)

OnAfriq (formerly MFS Africa) is Africa's largest cross-border payment platform, established in 2009, dedicated to promoting the development of Africa's digital economy through digital payment solutions and financial services. OnAfriq has branches in major economies such as Nigeria, South Africa, and Ghana, with core businesses including digital wallets, cross-border payment solutions, stablecoin services, and fintech products.

As of 2024, OnAfriq has over 500 million users across more than 40 African countries. Individual users utilize OnAfriq for daily transactions, cross-border remittances, and small payments, while business users leverage its cross-border payment solutions and merchant collection services, particularly for transactions with overseas suppliers and customers. OnAfriq supports various stablecoins, including USDC, USDT, DAI, and EURC, and has issued a stablecoin pegged to the US dollar, AfriqCoin, specifically for cross-border payments, with transaction fees as low as 0.5% to 1%.

OnAfriq collaborates with international financial institutions and local banks, including Visa, Mastercard, Ecobank, and Stanbic Bank, and partners with stablecoin providers like Circle to expand its business in Africa by leveraging the stability and wide acceptance of USDC. The OnAfriq platform supports USDC payments, transfers, storage, and offers DeFi products such as high-yield deposits, lending, and asset management.

OnAfriq has significantly enhanced financial inclusion in Africa, with over 500 million digital wallet users, most of whom previously lacked bank accounts. OnAfriq has provided financial education and training to over 1 million people, helping users improve their financial literacy. Its digital payment platform and stablecoins (like AfriqCoin) have increased the efficiency of cross-border payments, reduced costs, and promoted trade both within and outside the region, with processing times reduced to 2 minutes. OnAfriq also provides payment gateway services for local e-commerce and merchants, supporting online transactions and the development of digital markets. In the future, OnAfriq plans to launch more innovative products, such as digital insurance and decentralized finance loans, to continue driving the digital transformation of the African economy.

AZA Finance

AZA Finance, founded in 2013, is a leading fintech company in the African market, focusing on providing cross-border payment and foreign exchange solutions. The company optimizes cross-border payment processes through its innovative technology platform, enhancing the liquidity of funds between Africa and other regions of the world. As of 2024, AZA Finance's cross-border payment transfer platform has processed over 15 million transactions, totaling $9 billion, with more than 1.5 million users across over 183 countries.

AZA Finance's cross-border payment solutions support the implementation of the African Continental Free Trade Area (AfCFTA). By streamlining cross-border payment processes and reducing transaction costs, AZA Finance provides strong support for trade activities among AfCFTA member countries, thereby promoting the integration of Africa's regional economy.

AZA Finance supports USDC and USDT on its payment platform. In 2023, the trading volume of stablecoins accounted for 30% of the total trading volume on the AZA Finance platform, demonstrating strong market demand and acceptance for stablecoins.

WSPN

WSPN (Worldwide Stablecoin Payment Network) is a global digital payment company dedicated to providing transparent, fast, and efficient digital payment solutions through the latest distributed ledger technology (DLT), promoting the future development of digital payments and financial inclusion. The company successfully raised $30 million in seed funding, with investors including renowned institutions such as Foresight Venture and Folius Ventures.

In the global digital payment landscape, WSPN has successfully opened the African market through collaboration with the innovative AA wallet, StableWallet. This partnership lays a solid foundation for WSPN's market penetration and financial inclusion goals in Africa, marking an important milestone in its globalization strategy.

In this collaboration, WSPN and StableWallet attracted a large number of new users to register and use WUSD through diverse promotional activities. These users not only experience the convenient payment features of WSPN's stablecoin but also enjoy generous WUSD rewards.

Additionally, WSPN will further enhance user experience and promote the adoption of WUSD in the African market through innovative methods such as collaborating with more projects and building a Telegram miniapp community. Wallets based on account abstraction technology make WSPN's WUSD easier to use while providing users with a seamless cross-chain payment experience.

Through this collaboration, WSPN's success in the African market is reflected not only in the rapid growth of user numbers but also in the financial inclusion brought to the local market through stablecoin technology. In the future, WSPN will continue to drive digital payment innovation in Africa and global markets through collaboration with global partners, building a more transparent, efficient, and user-friendly digital payment ecosystem.

Future Outlook

The successful experiences of OnAfriq, AZA Finance, and WSPN demonstrate how stablecoins can improve financial services in Africa and drive the development of the African economy. For other industries and tech companies in Africa, key entry points include the following aspects:

1. Focus on Enhancing Financial Infrastructure

Develop local blockchain technology infrastructure to improve transaction processing capabilities and security to support more stablecoin transactions. At the same time, promote interoperability among financial institutions, enhance cooperation between banks and non-bank financial institutions, and create a broader payment network. Promote the use of digital wallets among the public to support the storage and transfer of stablecoins, and further introduce on-chain financial infrastructure such as DeFi to improve convenience.

2. Promote the Improvement of Policy and Regulatory Frameworks

For example, while supporting stablecoin payments, AZA Finance strictly adheres to international and local financial regulations to ensure compliance. Encourage governments to establish regulations for the use and trading of stablecoins, providing a legal operating space to prevent illegal activities. At the same time, encourage regional cooperation to develop common regulatory standards, promoting the legalization and standardization of cross-border stablecoin payments.

3. Enhance Public and Business Awareness and Acceptance of Stablecoins

OnAfriq has improved public awareness and acceptance of stablecoins through extensive user education and promotional activities. Through online and offline educational activities, media promotion, and financial literacy initiatives, help the public understand the advantages and usage of stablecoins. Collaborate with local businesses to encourage them to accept and use stablecoins as a payment option, increasing the usage of stablecoins in commercial transactions. Encourage the use of stablecoins in various everyday transactions, such as paying bills and purchasing goods and services, to enhance their prevalence in public life.

4. Strengthen Cooperation and Build Strong Partnerships

OnAfriq's collaboration with global stablecoin issuer Circle has enhanced its competitiveness in the global payment market. Partnering with stablecoin issuers like Circle and Tether to introduce more stablecoin options and expand application scenarios. Collaborate with blockchain and fintech companies to enhance technological capabilities and optimize payment and transaction systems. Establish partnerships with international financial institutions to promote the use of stablecoins and expand the global payment network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。