In the past 10 years, the cryptocurrency market has experienced the "Santa Claus Rally" 8 times.

Author: Lim Yu Qian

Translation: Blockchain in Plain Language

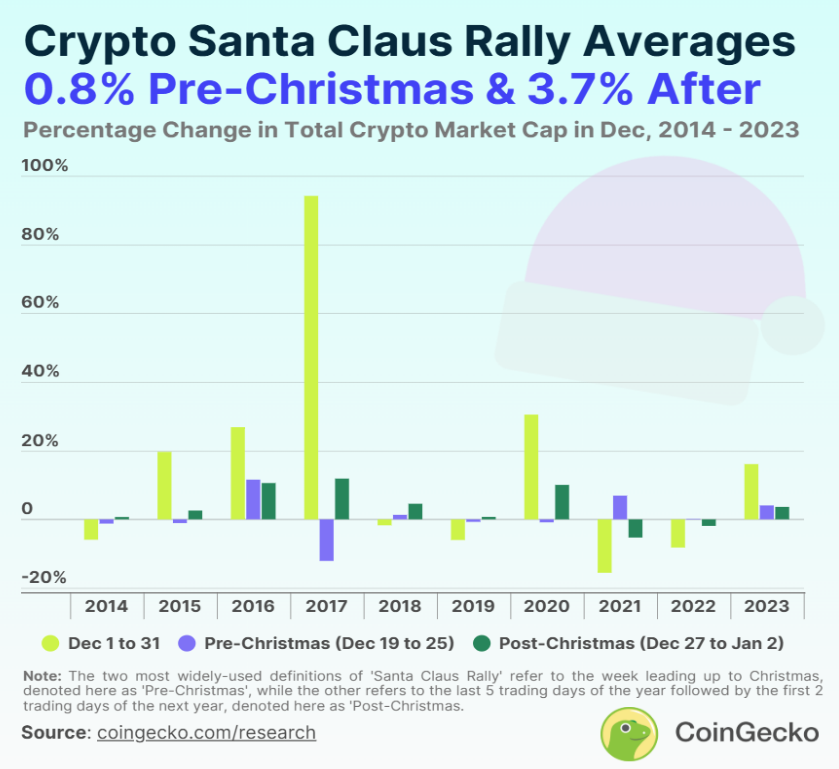

From 2014 to 2023, the crypto market has seen the "Santa Claus Rally" 8 times in the week after Christmas, with the total crypto market capitalization increasing by 0.69% to 11.87% from December 27 to January 2 of the following year. This phenomenon is based on the definition by Yale Hirsch, who is considered the originator of the term "Santa Claus Rally," originally referring to the market performance during the last five trading days of the year and the first two trading days of the next year.

On the other hand, the occurrence of the "Santa Claus Rally" in the week before Christmas in the crypto market has been less frequent, happening only 5 times in the past 10 years. Similar to the post-Christmas rally, these pre-Christmas increases ranged from 0.15% to 11.56%.

1. How does the "Santa Claus Rally" perform in the crypto market?

**In the years when the "Santa Claus Rally" did not occur, the crypto market experienced the largest *decline* before Christmas in 2017, dropping by 12.12%.** This decline was a result of the price crash following the ICO boom that year. Aside from that, the pre-Christmas corrections in the crypto market were relatively small, ranging from 0.74% to 1.25%. Meanwhile, the market corrections after Christmas in 2021 and 2022 were 5.30% and 1.90%, respectively.

Notably, in the past 10 years, only 3 years saw the "Santa Claus Rally" in both the pre- and post-Christmas periods. These years are:

2016, when the total market capitalization of cryptocurrencies rose by 11.56% before Christmas and by 10.56% after Christmas;

2018, where, despite the market being in a correction throughout the year, moderate increases of 1.31% and 4.53% were recorded before and after Christmas, respectively;

2023, where, in the context of a recovering bear market, the crypto market rose by 4.05% before Christmas and by 3.64% after Christmas.

In contrast, the total market capitalization of cryptocurrencies showed more extreme performance throughout December. In the past 10 years, there were 5 years where the market overall grew by 16.08% to 94.19% in December. In the other 5 years, during corrections, the market decline in December ranged from 1.73% to 15.56%.

Overall, the "Santa Claus Rally" in the crypto market is not a stable phenomenon, with significant variations in performance, making it difficult to predict.

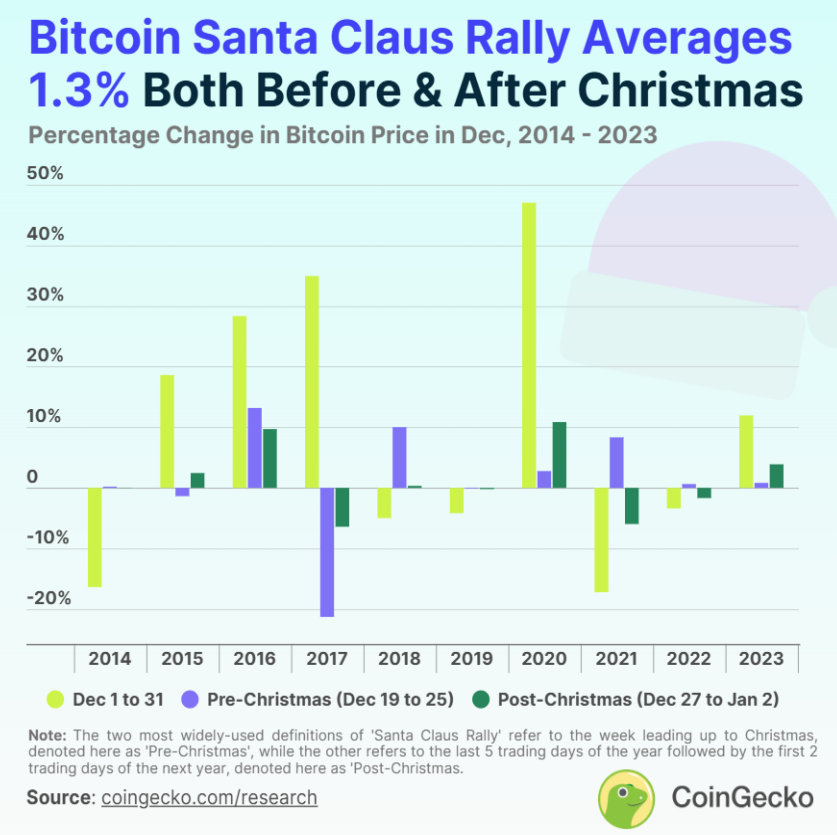

2. Will Bitcoin rise during the Christmas period?

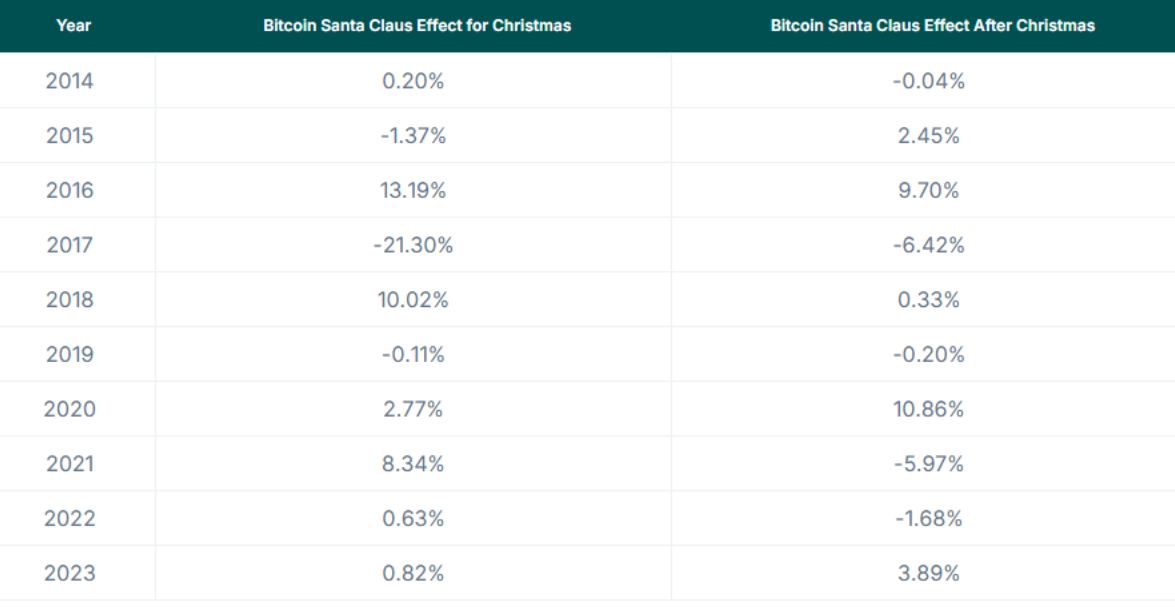

In the past 10 years, Bitcoin experienced the "Santa Claus Rally" 7 times in the week before Christmas and 5 times in the week after Christmas. Specifically, Bitcoin's increase before Christmas ranged from 0.20% to 13.19%, while the increase after Christmas ranged from 0.33% to 10.86%. This is consistent with the broader crypto market's "Santa Claus Rally" performance.

The largest "Santa Claus Rally" for Bitcoin occurred in the week before Christmas in 2016, when the price rose by 13.19% and broke through the $1,000 mark.

The largest decline for Bitcoin occurred in 2017, not during the "Santa Claus Rally." At that time, Bitcoin's price dropped by 21.30% before Christmas. Additionally, Bitcoin experienced smaller declines before Christmas in 2015 and 2019, at 1.37% and 0.11%, respectively. After Christmas, Bitcoin's price decline ranged from -0.04% to -6.42%.

In other words, if a speculator participated in Bitcoin's "Santa Claus Rally" every year from 2014 to 2023, buying in the week before Christmas and selling afterward, their average return would be 1.32%; while doing the same in the week after Christmas would yield an average return of 1.29%. In contrast, if the speculator chose to participate in Bitcoin price fluctuations throughout December, their average return rate would be 9.48%, at least 7 times the returns from the "Santa Claus Rally."

However, similar to the crypto market's "Santa Claus Rally," Bitcoin's "Santa Claus Rally" effect also exhibits inconsistent characteristics.

3. The "Santa Claus Effect" in the crypto market over the past 10 years

Below are the "Santa Claus Effect" data based on the percentage change in daily total market capitalization of cryptocurrencies:

Bitcoin's annual "Santa Claus Effect" data, based on the daily percentage change in Bitcoin price during each specific period:

4. Summary: Methodology

This study is based on data from CoinGecko, examining the percentage change in daily total market capitalization of cryptocurrencies over the past ten years (from December 1, 2014, to January 2, 2024). The study references the two most commonly used definitions of the "Santa Claus Effect" or "Santa Claus Rally" from Investopedia:

Pre-Christmas Period: Refers to the week before Christmas, from December 19 to 25.

Post-Christmas Period: Refers to the last five trading days of the year plus the first two trading days of the next year.

This study is for illustrative and informational purposes only and is not financial advice. Please conduct your own research and exercise caution before investing in any cryptocurrency or financial asset.

Article link: https://www.hellobtc.com/kp/du/12/5586.html

Source: https://www.coingecko.com/research/publications/santa-claus-rally-crypto?utmcampaign=Data%20Visualization&utmsource=x&utm_medium=social

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。