In recent years, Bitcoin has gradually evolved from a niche digital asset to the focal point of global capital markets. As major countries and institutions begin to include it in discussions about strategic reserve assets, the global competition surrounding "digital gold" has intensified. At the Bitcoin MENA conference at the end of 2024, former Binance CEO Zhao Changpeng sparked an intriguing topic: Will China quietly join this Bitcoin reserve competition? If the answer is affirmative, what profound impact will it have on the global cryptocurrency market?

Is the World Quietly Hoarding Bitcoin? The International Trend of Bitcoin Reserves

As a "hard" asset, Bitcoin is increasingly attracting the attention of governments worldwide. Zhao Changpeng's remarks at the Bitcoin MENA conference revealed some clues. He mentioned that the new U.S. President Donald Trump has explicitly proposed a strategic cryptocurrency reserve plan, and this trend may compel other countries, especially China, to reassess Bitcoin's strategic position in national reserves.

Trump's plan is not an isolated case; in fact, several countries and institutions around the world have begun to adopt similar strategies. For example, El Salvador was the first to adopt Bitcoin as legal tender and continues to increase its national holdings. According to 10xResearch, the driving factors behind Bitcoin's price have gradually shifted from mining to demand, with institutional and national accumulation being a major source of this demand.

China's Attitude Towards Cryptocurrency: Is There Hidden Enthusiasm Beneath the Cold Exterior?

In recent years, China's regulatory policies towards cryptocurrency can be described as "high-pressure." From a complete ban on virtual currency mining to suppressing trading activities, Beijing's series of actions demonstrate its high vigilance against financial risks. However, behind the cold policies, China may not have completely ruled out the strategic value of cryptocurrency.

Since 2021, China's regulatory policies have taken a blanket ban approach towards cryptocurrency. This includes considerations for the stability of the financial system, as well as broader issues such as the internationalization of the renminbi and energy consumption. However, as Zhao Changpeng pointed out, the Chinese government is known for its low profile and lack of transparency. If China truly plans to hoard Bitcoin, it could very well do so quietly without public disclosure.

It is worth mentioning that despite the strict regulations, China has not completely closed the door on blockchain technology. On the contrary, China has invested heavily in the research and application of blockchain technology, even launching its own central bank digital currency (DCEP). This indicates that China is not entirely rejecting cryptocurrency technology; it is simply taking a more cautious approach to how this technology is applied.

QDII Mechanism: A Bridge to Overseas Crypto Assets or an Insurmountable Barrier?

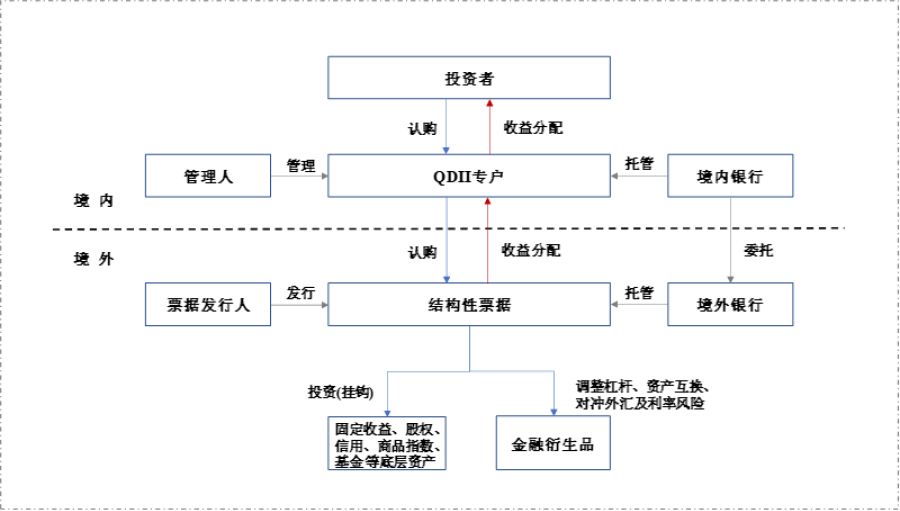

For ordinary investors, one potential way to legally access crypto assets is through the QDII mechanism. QDII (Qualified Domestic Institutional Investor) allows domestic financial institutions to design products that invest in overseas markets, providing investors with opportunities to participate in international financial markets. However, at this stage, QDII has not explicitly included crypto assets in its investment scope, making the allocation of Bitcoin through this channel fraught with uncertainty.

Although QDII theoretically provides a compliant path for Chinese investors to enter the Bitcoin market, the reality is far from simple. First, the high volatility of the crypto asset market fundamentally contradicts the stable investment orientation emphasized by QDII. Second, policy uncertainty is also a significant obstacle. Even if a QDII product is approved, future policy changes may still lead to the product being forced to cease operations, posing significant risks to investors.

In addition, designing a compliant QDII product for crypto assets requires substantial time and resources. Especially in China's current policy environment, such attempts may face higher compliance costs and longer approval cycles. For financial institutions, whether such investments are proportional to the returns remains a question worth pondering.

Will China Secretly Hoard Bitcoin? The Underlying Strategic Game

Zhao Changpeng's views lead one to ponder more about China's future Bitcoin policies. He mentioned that China might secretly hoard Bitcoin and then announce this news at a future strategic juncture. Such an operation not only aligns with China's consistent low-profile style but could also grant it more initiative in international financial games.

From a strategic perspective, establishing Bitcoin reserves indeed has certain attractions. First, Bitcoin's decentralization and scarcity make it a high-quality means of value storage. In the context of increasing global economic uncertainty, Bitcoin can provide a tool for countries to hedge against currency depreciation and foreign exchange risks. Second, if China can seize the initiative in Bitcoin reserves, it may also occupy a favorable position in future digital economy competition.

However, this strategy also faces significant challenges. In addition to policy uncertainty and market volatility, the Chinese government's high emphasis on energy consumption and environmental protection is also a factor that cannot be ignored. This was one of the main reasons for China's comprehensive ban on cryptocurrency mining. If the Chinese government truly plans to hoard Bitcoin, how to balance this issue will be a complex challenge.

Risks and Opportunities Coexist: The Future Path of China's Bitcoin Reserves

If China truly decides to join the international competition for Bitcoin reserves, it will undoubtedly be a significant event in the global cryptocurrency market. However, the current policy and market environment still set many obstacles for this possibility. From the limitations of the QDII mechanism to the volatility of the Bitcoin market itself, and the uncertainty of Chinese policies, these are all challenges that must be overcome.

For investors, paying attention to China's policy dynamics in this field is undoubtedly crucial. As major global economies gradually explore the strategic value of cryptocurrency, China's future policy direction may become an important variable determining the trend of the Bitcoin market. If China can find a path that aligns with its own interests while not contradicting the global green development trend, then the future of Bitcoin in China may be brighter than we expect.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。