The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

The short-term layout at 97,000 has finally welcomed a wave of closure again, and I really want to take a good rest for a while. As soon as I open my eyes, it’s a new day again. The problem we face today is still the choice between small coins and Bitcoin. Let’s review the overall volatility trend. Yesterday, with the release of the CPI, there was another wave of interest rate cut speculation, pushing Bitcoin to break the 100,000 mark again, and directly rushing above the 101,000 mark, almost heading straight for 102,000, with no significant pullback depth appearing. After several rounds of back-and-forth fluctuations, what do you all think? Is there anyone still insisting on a short position? The downward break is basically maintained at around 1,000-2,000 points daily, while the upward pressure break directly starts at 5,000 points. The bull market still exists in the coin circle. The speculation around interest rate cuts can only bring short-term effects; there are still nearly five days until the meeting on the 18th, during which the bears still have a chance to pull back. This viewpoint has long been established. The stabilization at the 100,000 mark must have the support of capital; without support, it is merely a phenomenal performance. Before this wave of interest rate cuts, the opportunity to enter the market may only come once, so I still advise everyone to seize the chance and try to persuade yourself!

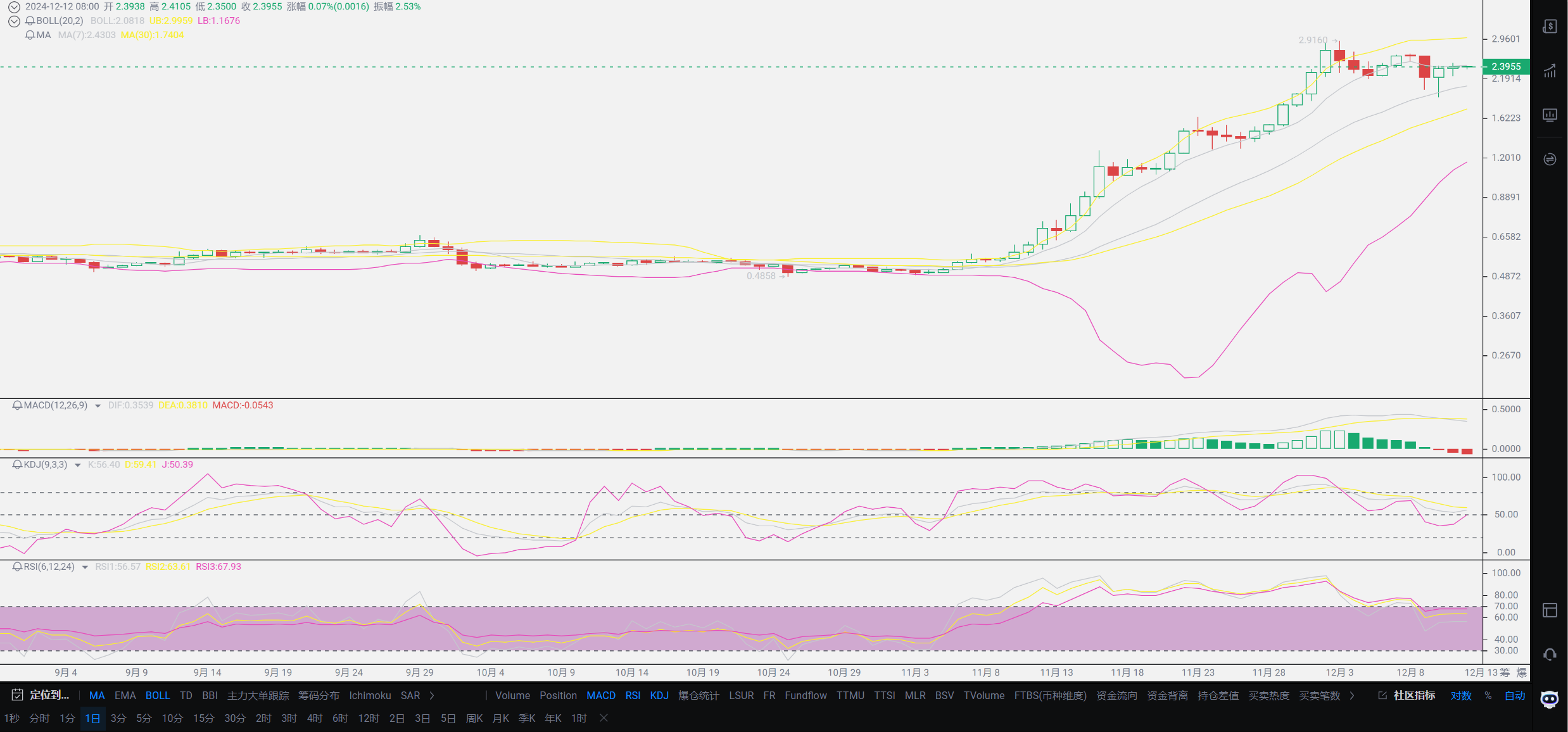

Let’s directly enter today’s thematic analysis. The topic has been opened, and many friends feel that Lao Cui has a deep prejudice against small coins, using recent growth data for critical rebuttal. Today, Lao Cui will reanalyze with everyone why I don’t let you touch small coins or even altcoins. The reasoning is simple; let’s take the most typical representative, DOGE. This coin has indeed increased by almost five times in a short period. The timing of the bull market's initiation is almost consistent, while Bitcoin's growth yield is only maintained at around 30% to 40%. Even Bitcoin's yield still requires short-term support to achieve such results. Comparing the yield of the two, it is indeed incomparable. However, the biggest question is, do you really dare to invest a large amount of capital in this coin's growth before the market starts? If you have 10,000, would you choose a stable return or gamble in a market that depends on others' moods? In comparison, both can be invested, and I also have users who, after my recommendation, have entered some small coins, with ADA and SOL being in the top ten by market cap. XRP and DOGE are not within my investment considerations.

The simplest reason is that there are ecological issues and capital allocation issues. The recent pull of Bitcoin seems to have little inflow of funds, and the authenticity of the data we can see needs to be considered because the statistics in the coin circle are too complex. It cannot be covered by just one exchange; there are American spot indices, private trades, and various dispatches from trading platforms, etc. This series of data is impossible to evaluate. What we can know is that Bitcoin's market cap has increased. The issue of market cap can reflect many clues, for example, the depth of the two recent pullbacks has not let it fall below the 1.90 market cap mark. What does this mean? It means that the flow of funds has not left the coin circle or even the Bitcoin market. Think about it; Bitcoin's peak is around 200 billion, and just a fluctuation of less than 100 billion can lead to a drop depth of 14,000-15,000 points. This kind of market is entirely a washout market and is not worth overthinking whether a reversal is happening. Funds are present while the market is falling, which only indicates that someone is manipulating the market. Look at other small coins; in the past thirty days, there has been almost no large capital inflow, while there has been a large capital outflow during the decline. This is almost indistinguishable from a pump-and-dump scheme. Such data fluctuations can very well reflect problems. The intuitive understanding is that not many people can profit. Don’t believe the users online who claim to have made many times their investment; such people exist, but the real data shows that not many can profit.

To put it bluntly, very few people can decisively sell when the market starts. Everyone is holding on, waiting for a historic performance. Not selling means they dare to pull the market; their investment is not much. Once a large sell-off begins, a collapse is not far away. The market fluctuations in the past two days can reflect these issues. Almost all altcoins have returned to their original state within two days under this round of downward trend, while only Bitcoin and Ethereum's declines are within a controllable range. The fluctuations of small coins can be compensated with small positions to make up for Bitcoin's gains, but large-scale investments are absolutely not advisable unless you have insider information. The situation of exponential growth does not belong to the first choice of the investment market. The simplest way to understand it is that even if a small coin increases five times, it is still not as good as Bitcoin's 30% return. Whether it’s a tenfold leverage or spot returns, Bitcoin's scale is still here. Overall, most of the users in my hands rely on the growth of Bitcoin for their returns. For users with insufficient capital, I have also mentioned that entering Bitcoin with tenfold leverage can maintain a fluctuation range of 10,000-20,000 points without liquidation. A friendly reminder: tenfold leverage can only be used for Bitcoin and Ethereum; do not touch small coins. If small coins spike, I can’t help it either.

As always, don’t just look at superficial data and only consider returns without discussing risks; that is speculation. Small coins do not have that many retail investors in the market. Once there are too many retail investors waiting in the market, all small coins will not see a violent doubling. The growth is because the manipulators can profit, not because your investment vision is better. Just like Bitcoin's pull, Bitcoin's pull is to bring large funds back to the coin market, while the pull of small coins is to attract large funds to look at small coins. The investment and marketing models of the two are the same. For everyone’s planning, it must be that 80% of the positions are in Bitcoin and Ethereum, and the remaining 20% should be used to seek opportunities. Do not blindly follow the trend of investing in other coins just because the returns are high; there are risks in investing. Finally, let’s briefly talk about the future trend. The current heat of interest rate cuts can only be speculated for five more days. What you need to do is to exchange time for space. This wave of public opinion trends is basically not much different from our previous estimates. In these five days, wanting to firmly stand on the two major thresholds will be somewhat challenging. The capital inflow situation yesterday was also average, and without large capital inflow later, there is a high probability of another downward wave. You don’t need to require deep layouts; entering at a price starting with 9 is already a profit. Just maintain low leverage in your operations, and do not have the obsession with hitting the lowest point. Whether it can return to a price starting with 9 depends on your personal psychological performance. After the interest rate cut, waiting for the high point position is our first take-profit position. Try to clear the market after the interest rate cut. The market fluctuations in December are indeed too large; spot users should not move, and short-term contract layouts should be cleared as much as possible, waiting for the next round of starting positions. The next position is Trump’s performance! Don’t think that a surge means a pullback. Today’s focus is still on the repair situation; do not easily enter short positions. Just wait for the bottom; the five days will give you an opportunity to enter! The exact position cannot be grasped; you can directly ask Lao Cui!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and plans for the big picture, not focusing on one piece or one area, aiming for the final victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。