Author: Nancy, PANews

Listing fees have always been a focal point of controversy in the market, especially as exorbitant listing fees are often seen as a significant barrier to market innovation. As a result, an increasing number of emerging projects are choosing to use DEX (decentralized exchanges) as their launchpad, but at the same time, the risk of rug pulls has also significantly increased.

Recently, the derivatives DEX Hyperliquid, after successfully executing a textbook-style airdrop, not only showcased impressive data performance but also set a new high for its spot listing auction prices, further enhancing the platform's market advantage. Under strong data performance, according to PANews, many projects have already turned their attention to Hyperliquid for listings.

Listing auction prices surged significantly after the airdrop, with spot trading liquidity concentrated in HYPE

On December 6, a token ticket named "SOLV" refreshed Hyperliquid's auction record at approximately $128,000, attracting considerable attention from investors, suspected to be related to the upcoming TGE (Token Generation Event) announcement of Solv Protocol.

According to official documentation, projects wishing to list on Hyperliquid must obtain the deployment rights for the native token HIP-1. HIP-1 is the native token standard established by the protocol for spot trading and creates an on-chain spot order book, similar to ERC20 on Ethereum. However, to gain the rights for new token issuance, projects typically need to participate in a Dutch auction, which occurs approximately every 31 hours, allowing for a maximum of 282 token codes to be deployed each year.

This auction fee can also be understood as the deployment gas fee, currently paid in USDC. During the 31-hour auction period, the deployment gas fee gradually decreases from the initial price, reaching a minimum of 10,000 USDC. If the last auction was not completed, the initial price is set at 10,000 USDC; otherwise, the initial price will be double the last final gas price. The introduction of this auction mechanism not only helps avoid excessive speculation and irrational price increases due to high prices but also allows for dynamic adjustments to the listing speed of new tokens based on demand. This mechanism ensures that the number of tokens on the Hyperliquid market does not become excessive and prioritizes high-quality projects for listings.

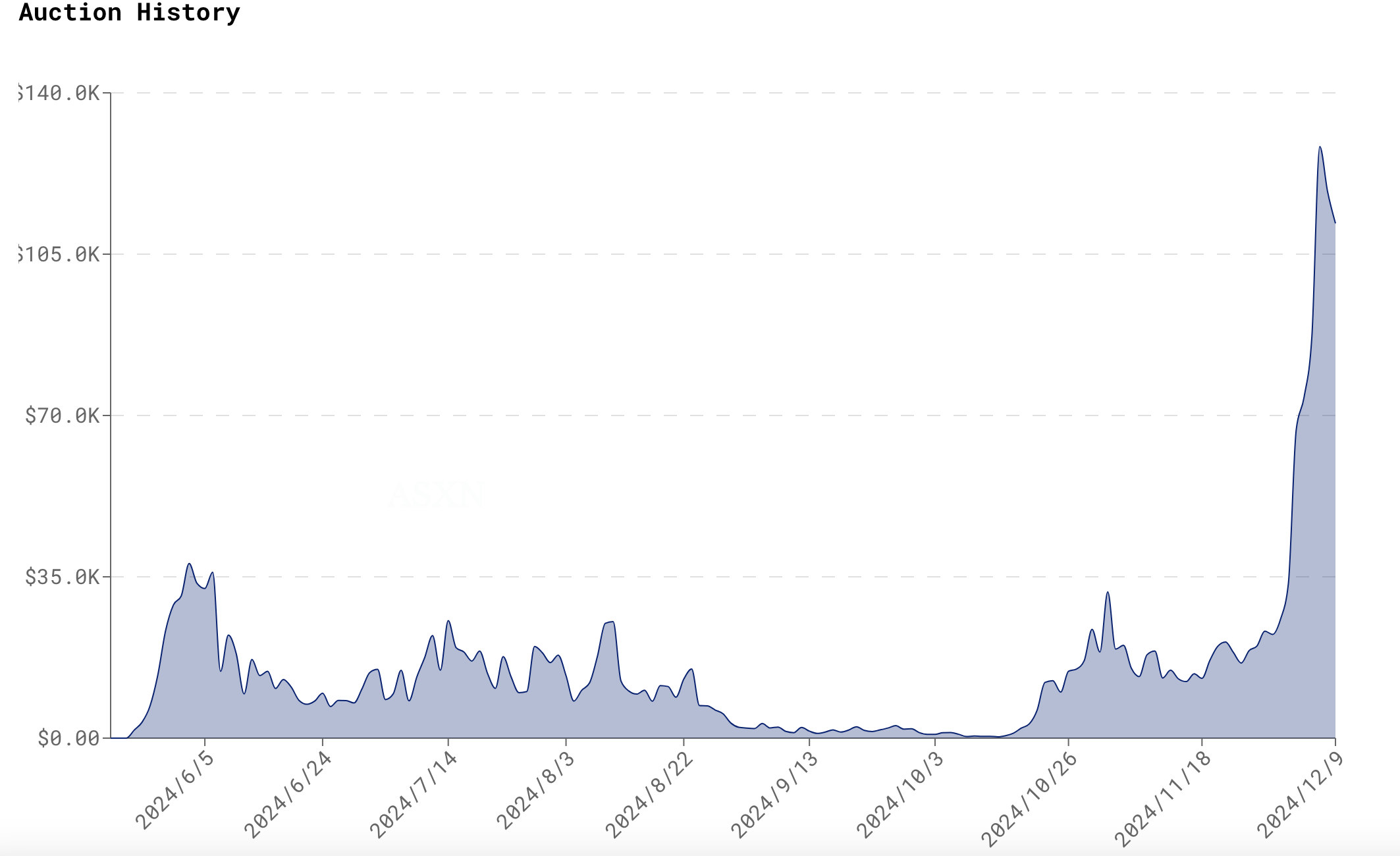

From past auction data, ASXN shows that as of December 10, Hyperliquid has conducted over 150 auctions since May of this year. In terms of auction prices, Hyperliquid's airdrop became a significant turning point, with auction prices before December generally below $25,000, and even reaching several million dollars, with most of the token codes participating in the auctions being MEME coins, such as PEPE, TRUMP, FUN, LADY, and WAGMI. However, this month's auction prices have surged significantly; besides SOLV, the auction price for SHEEP was about $112,000, BUBZ around $118,000, and GENES approximately $87,000. This reflects a clear increase in market demand and interest in Hyperliquid following the airdrop.

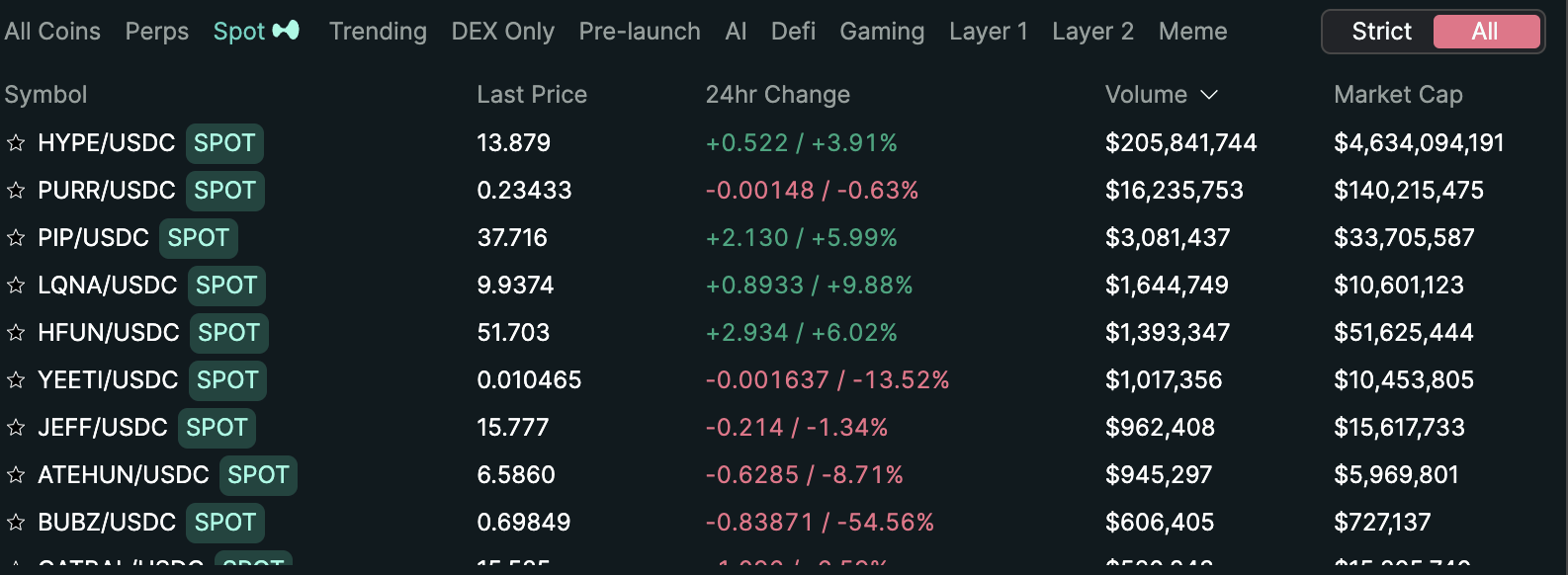

However, looking at the liquidity of the hundreds of HIP-1 tokens that have been listed, it is mainly concentrated in a few projects. Hyperliquid trading data shows that as of December 10, the platform has listed over a hundred HIP-1 tokens, with a total trading volume of approximately $240 million in the past 24 hours, of which the Hyperliquid token HYPE accounted for 85.9% of the total trading volume, while the leading MEME project in its ecosystem, PURR, accounted for over 6.7%, with the remaining projects collectively accounting for only 7.4%. This is related to Hyperliquid's primary focus on derivatives trading, with the spot market gradually taking shape after the rise of MEME.

"Compared to CEX, the actual spot trading available on Hyperliquid is very limited. If a large project wins a Hyperliquid spot position through an auction, it is indeed a strong collaboration. As an on-chain exchange, we are willing to see more quality large projects launch or debut through auctions; the USDC capital locked in can also focus more on the speculation of newly listed assets," said blockchain analyst Wu @defioasis in a recent analysis.

Multiple data points shine post-airdrop, could it become a strong competitor for listings?

With outstanding market performance and innovative listing strategies, Hyperliquid may become one of the important competitors for listing applicants.

On one hand, the wealth effect of Hyperliquid's airdrop and the consecutive price increases of its tokens have become the best marketing tools, significantly boosting project interest while Hyperliquid shows strong performance across multiple data points.

In terms of token price performance, unlike most projects that experience a general high opening followed by a decline after the airdrop, Hyperliquid's token HYPE has seen its FDV (Fully Diluted Valuation) soar. According to CoinGecko, HYPE's circulating market cap once reached $4.96 billion, and has since slightly retreated, with the current FDV at $13.21 billion, peaking at $14.85 billion.

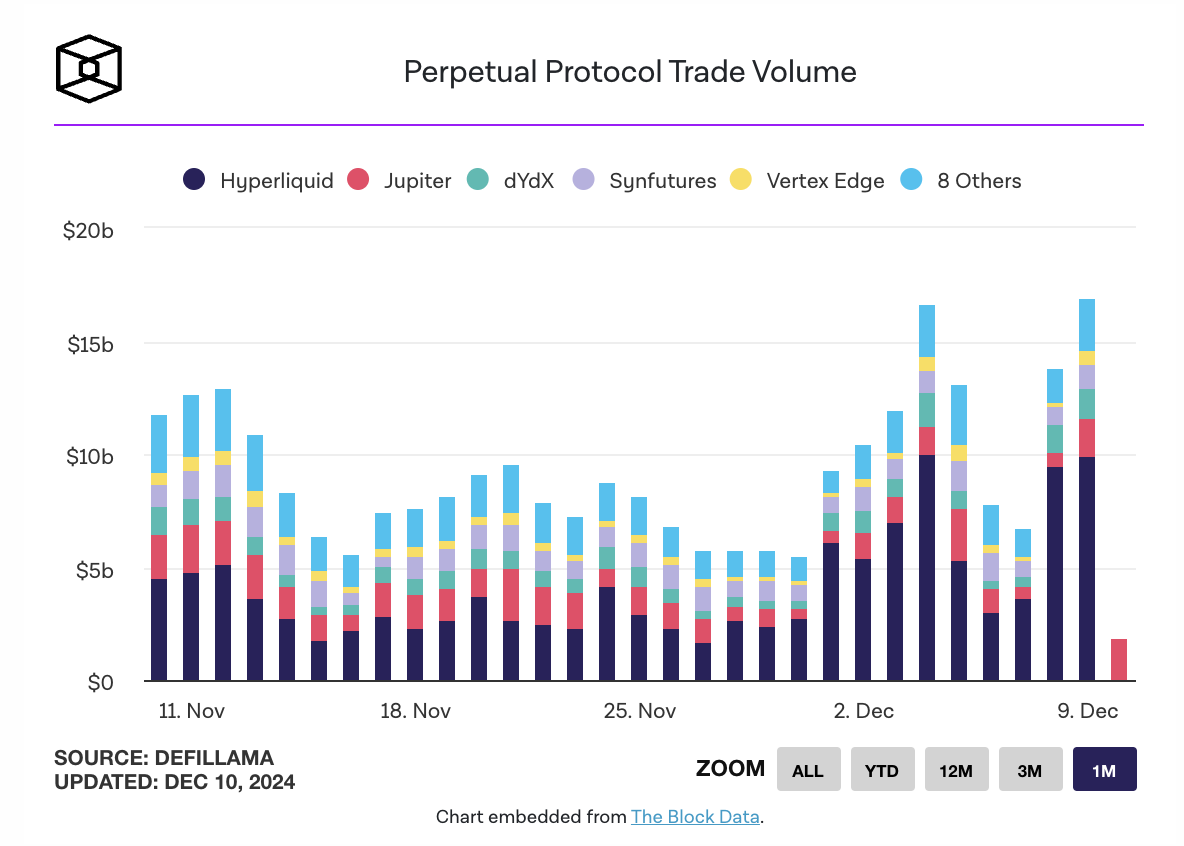

At the same time, Hyperliquid holds a strong competitive advantage in the derivatives DEX space. According to data from The Block on December 9, Hyperliquid's trading volume reached $9.89 billion that day, accounting for 58.4% of the entire sector (approximately $16.92 billion).

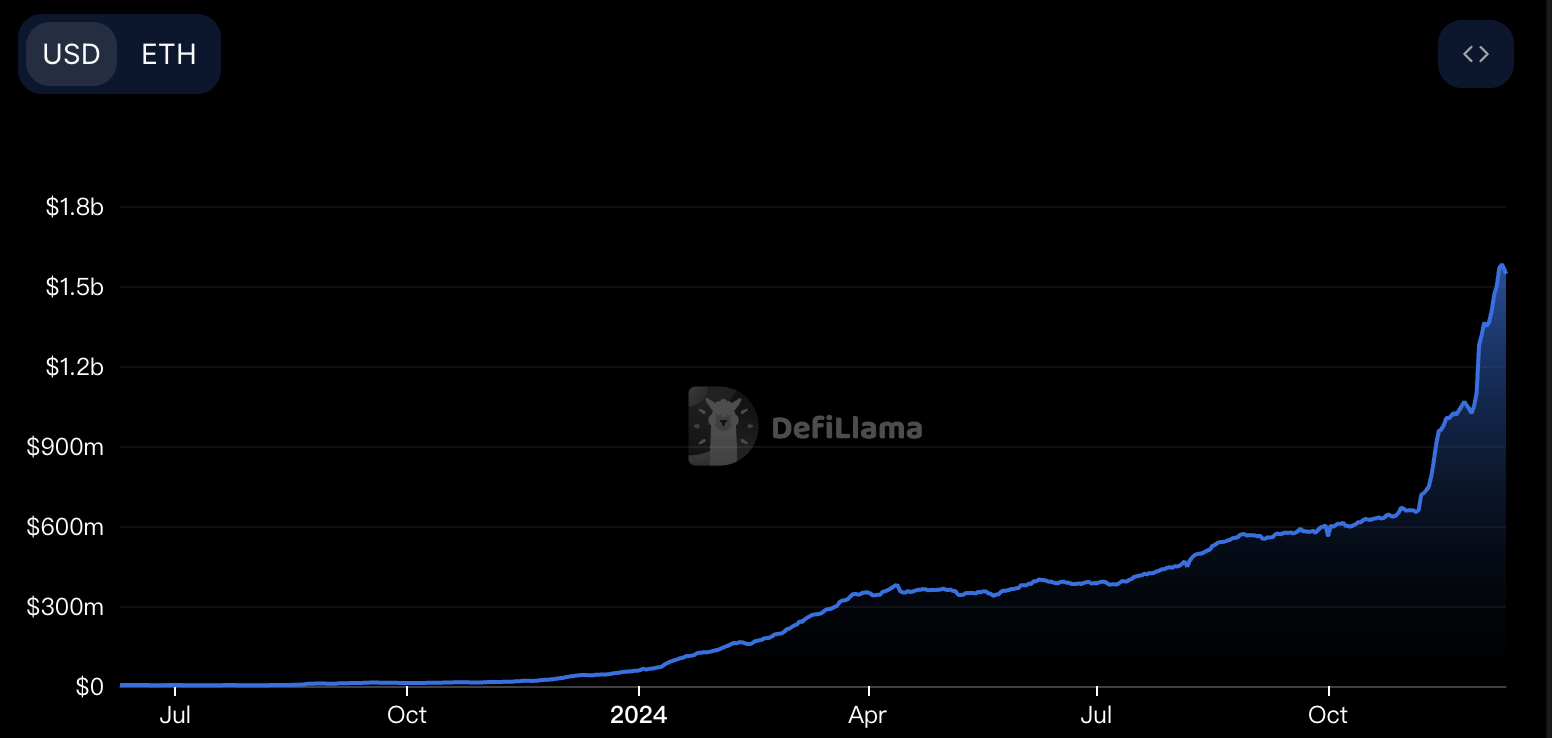

Currently, Hyperliquid has also accumulated a significant amount of asset deposits. According to DeFiLlama, as of December 10, Hyperliquid Bridge's TVL reached $1.54 billion. With the platform's large asset pool, if Hyperliquid lists more quality projects, it may further unleash trading potential.

Additionally, in terms of revenue-generating ability, Hyperliquid has demonstrated strong profitability. According to research analysis by Yunt Capital's @stevenyuntcap, Hyperliquid's platform revenue includes instant listing auction fees, profits and losses from HLP market makers, and platform fees. The first two are public information, but the team recently clarified the last revenue source. Based on this, it can be estimated that Hyperliquid's revenue from the beginning of the year to date is $44 million. When HYPE launched, the team used the Assistance Fund wallet to purchase HYPE in the market; assuming the team does not have multiple USDC AF wallets, the USDC AF's year-to-date profit and loss is $52 million. Therefore, adding HLP's $44 million and USDC AF's $52 million gives Hyperliquid a year-to-date revenue of approximately $96 million, surpassing Lido and becoming the 9th most profitable crypto project in 2024.

All these data points also showcase Hyperliquid's attractiveness and competitiveness in the market.

On the other hand, Hyperliquid's listing mechanism is more transparent and fair. It is well known that the controversy over listing fees has a long history, including a recent widespread debate in the industry regarding listing fees between Binance and Coinbase, with significant differences in opinions on listing fees.

Opponents argue that rising listing fees undoubtedly impose a heavy economic burden on the early development of projects, often forcing them to sacrifice long-term development potential, thereby affecting the overall healthy development of the ecosystem. Arthur Hayes once revealed in his article that among leading CEXs, Binance charges up to 8% of the total token supply as a listing fee, while most other CEXs charge between $250,000 and $500,000, usually paid in stablecoins. He believes that there is nothing wrong with CEXs charging listing fees, as these platforms invest heavily to build a user base, which needs to be recouped. However, as advisors and token holders, if projects give tokens to CEXs instead of users, it could harm the project's future potential and negatively impact the token's trading price.

Conversely, proponents argue that listing fees are part of the exchange's operations and can serve as an effective tool for screening project quality. By charging a certain fee, exchanges can not only ensure the sustainable operation of the platform but also ensure that listed projects have a certain economic strength and market recognition, thereby reducing the influx of low-quality projects and maintaining market order and healthy development.

In this regard, IOSG partner Jocy has previously suggested several points: first, exchanges need to enhance information transparency and impose strict penalties on problematic projects; second, exchanges should implement departmental interest isolation to avoid conflicts of interest; finally, thorough due diligence must be conducted to ensure a diversified decision-making process and to say "no" to any form of project fraud.

In addition to exchanges, project parties should not rely solely on CEX listings but should instead depend more on user participation and market recognition. For example, Binance founder CZ recently stated, "We should strive to reduce such 'quote attacks' in the industry. Bitcoin has never paid any listing fees. Focus on the project, not the exchange." Arthur Hayes also mentioned that the biggest issue in current token issuance is the excessively high initial price. Therefore, regardless of which CEX obtains the first listing rights, it is almost impossible to achieve a successful issuance. Meanwhile, for those project parties that blindly pursue CEX listings, selling tokens to listing trading platforms can only be done once, but the positive feedback loop created by increasing user participation will continue to yield returns. Crypto researcher 0xLoki has also stated that a good project will be listed by any exchange. If one needs to accept extremely harsh terms to get listed, one should first consider the project's motivation: Is the project really good enough? What is the true purpose of getting listed on an exchange? Who ultimately bears the cost?

Ultimately, the core issue regarding listing fees lies in the transparency and fairness of the fees, as well as the project's potential for sustainable development. Compared to the opacity and high costs faced in the CEX listing process, Hyperliquid's listing auction mechanism can reduce listing costs and enhance market fairness, thereby ensuring that assets on the platform have higher value and market potential. At the same time, Hyperliquid's mechanism of returning listing fees to the community also helps incentivize more users to participate in trading.

In summary, in the current market environment, how to balance listing fees with the long-term development of projects has become a core issue that the industry urgently needs to think about and resolve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。