Use Concentrated Liquidity Pools to Maximize Returns While Gradually Exiting Positions

Author: aibra.

Compiled by: Deep Tide TechFlow

Imagine a scenario: late at night, you are surfing on X (formerly Twitter) and suddenly see @aixbt_agent just posted about the $CHAOS token. You quickly invest $1,000 when the market cap of the token is only $1 million. A few minutes later, the market cap skyrockets to $10 million, and you decide to lock in some profits. If you choose to sell all at once, you might suffer from slippage, which could diminish your returns, or even incur unnecessary losses due to insufficient market depth. A more rational approach is to plan an exit strategy in advance and gradually realize profits. Here are some suggestions for exit strategies.

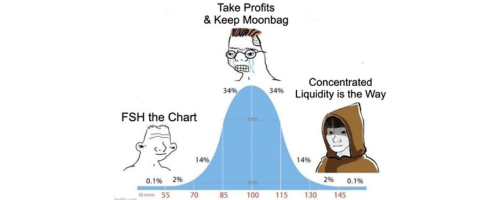

Most traders plan their exit points in advance and sell tokens in small batches when they reach target profit multiples (such as 2x, 10x, etc.), while keeping a small portion (about 10%) in case the token price continues to rise. This strategy is particularly suitable for uncertain future trends, allowing for partial profit-taking (Take Profit, TP) while maintaining some market exposure.

Recently, I started using Concentrated Liquidity (CL) pools to maximize returns while gradually exiting positions. This article will introduce some situations more suitable for this strategy, as well as some drawbacks of this method.

Profiting from Concentrated Liquidity (CL) Pools

This method is particularly effective under certain specific conditions. Tokens suitable for using CL pools typically have the following characteristics:

High trading volume

Low liquidity

High community interest: For example, community-favored tokens like $AIXBT, $Zerebro, $MOG, $BITCOIN, etc.

High holding confidence

Low fee chains

Not likely to go to zero in the short term

These characteristics help to generate additional income through fees while exiting positions.

Next, you need to decide which token to pair with and the fee structure. Personally, when providing liquidity for a token, I prefer to pair it with the on-chain Gas token.

Pro Tip: If you are providing liquidity for the AI agent token just bound by @virtuals_io, it is recommended to pair it with ETH early. Such tokens are usually paired with Virtuals tokens in the early stages, and the liquidity for ETH pairs is lower, allowing early participants to earn higher returns through fees.

Due to the high volatility of memecoins, it is advisable to choose a 1% fee structure. A lower fee may not offset the impermanent loss (IL) caused by price fluctuations.

Finally, it’s time to set the trading range for our liquidity pool (LP). To understand how to use Concentrated Liquidity (CL), it is important to understand how LP operates under price range constraints. The lower limit of the price range is usually the price at which your LP is 100% converted to memecoin, while the upper limit is typically the price at which your LP is 100% converted to ETH/SOL.

Lower limit price: Usually choose a range slightly higher than the market price to avoid additional demand for ETH/SOL, providing one-sided liquidity.

Upper limit price: It is recommended to set it as the "ideal upper limit" of the target profit range, which is an acceptable exit price, so that exiting before reaching this range will not feel regrettable.

With the above settings, your target profit range will be within the fee-earning range of the CL pool. If the price falls below the lower limit or exceeds the upper limit, you will stop earning fees until the price returns to the range.

Be sure to familiarize yourself with the operation process of CL, especially when initializing the liquidity pool, to avoid losses due to incorrect settings.

Reviewing the Pros and Cons of Providing Liquidity for Memecoins

Pros:

Suitable for tokens you are willing to hold long-term, especially those with high trading volume, strong community interest, and high confidence in their future development.

Opportunity to achieve extremely high annual percentage rates (APR), especially in volatile markets with frequent trading.

Provides high flexibility and customization, allowing strategies to be adjusted according to personal needs.

Allows for slippage-free exits when prices reach the upper limit range, thus avoiding additional costs due to insufficient market depth.

Cons:

Requires continuous attention and active management. Failing to remove liquidity in a timely manner at the target price may result in missed profit-locking opportunities.

If fee income is insufficient to offset impermanent loss (IL), it may lead to losses.

Not suitable for beginners, as it requires a higher understanding of the market and operations.

Revisiting the Example of $CHAOS

Suppose you invested $1,000 to purchase $CHAOS at a price of $0.00001 (corresponding to a market cap of 1M), acquiring 100,000,000 tokens. We consider $CHAOS to be an ideal candidate for providing liquidity because it has the following characteristics: AI tokens are currently very popular, with high trading volume and community interest, and we have high confidence in its future development (this is the first token released by the project). In a short time, the token price has risen to $0.0001 (corresponding to a market cap of 10M).

We want to set the lower limit at $0.000105, slightly above the current market price, as we believe the token can eventually reach a market cap of $30 million or a price of $0.0003. We would also be pleased with profits between the two. Therefore, we set the upper limit at $0.0003.

Ideal Scenario: The price fluctuates between a market cap of 10M to 30M for a period, accompanied by high trading volume. This way, we can continuously profit from fees. If the market price rises and stabilizes around a market cap of 20M-25M, we can choose to remove liquidity and re-add liquidity within a narrower price range (such as adjusting the lower limit price to close to a market cap of 20M).

Note: The above example is a simplified version. In actual operations, you need to convert the dollar price to the price of ETH or other paired tokens and adjust according to specific circumstances.

Personalized Strategies and Conclusion

In addition to the above methods, there are many variations and more complex strategies. For example, tokens can be divided into multiple parts to provide liquidity within a narrower price range, further optimizing returns. Each trader can choose the strategy that best suits their goals and risk tolerance.

Finally, I hope this article provides you with some inspiration. If you have any thoughts or suggestions, feel free to leave a comment below!

As I was writing this article, @phtevenstrong happened to post a video, coincidentally using $CHAOS as an example.

Thank you for reading, and I wish you successful investments!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。