Original | Odaily Planet Daily (@OdailyChina)

On December 10 at 8:30 AM Pacific Time (December 11 at 12:30 AM Beijing Time), Microsoft will advance a significant shareholder proposal regarding Bitcoin — to assess through shareholder voting whether incorporating Bitcoin into its balance sheet aligns with the long-term interests of shareholders. Coincidentally, as BTC hovers around $100,000, this vote is widely regarded by the market as another key event influencing the cryptocurrency market this week, alongside the CPI and the situation in South Korea.

Background of the Proposal

The shareholder proposal was initially submitted by the American conservative think tank National Center for Public Policy Research (NCPPR).

NCPPR stated that during ongoing inflation, a company's success depends not only on its operational performance but also on its ability to preserve profits. According to the Consumer Price Index (CPI), the average inflation rate in the U.S. over the past four years has been 5% (NCPPR believes the actual inflation rate may be higher). Therefore, companies have a fiduciary duty not only to increase profits but also to protect them from devaluation. However, since Microsoft has invested most of its assets in U.S. government securities and corporate bonds, it has failed to effectively protect its assets from devaluation.

NCPPR emphasized in the proposal that "while Bitcoin is somewhat volatile, it remains an excellent, if not the best, inflation hedge," and thus recommended that Microsoft evaluate allocating at least 1% of its assets to Bitcoin.

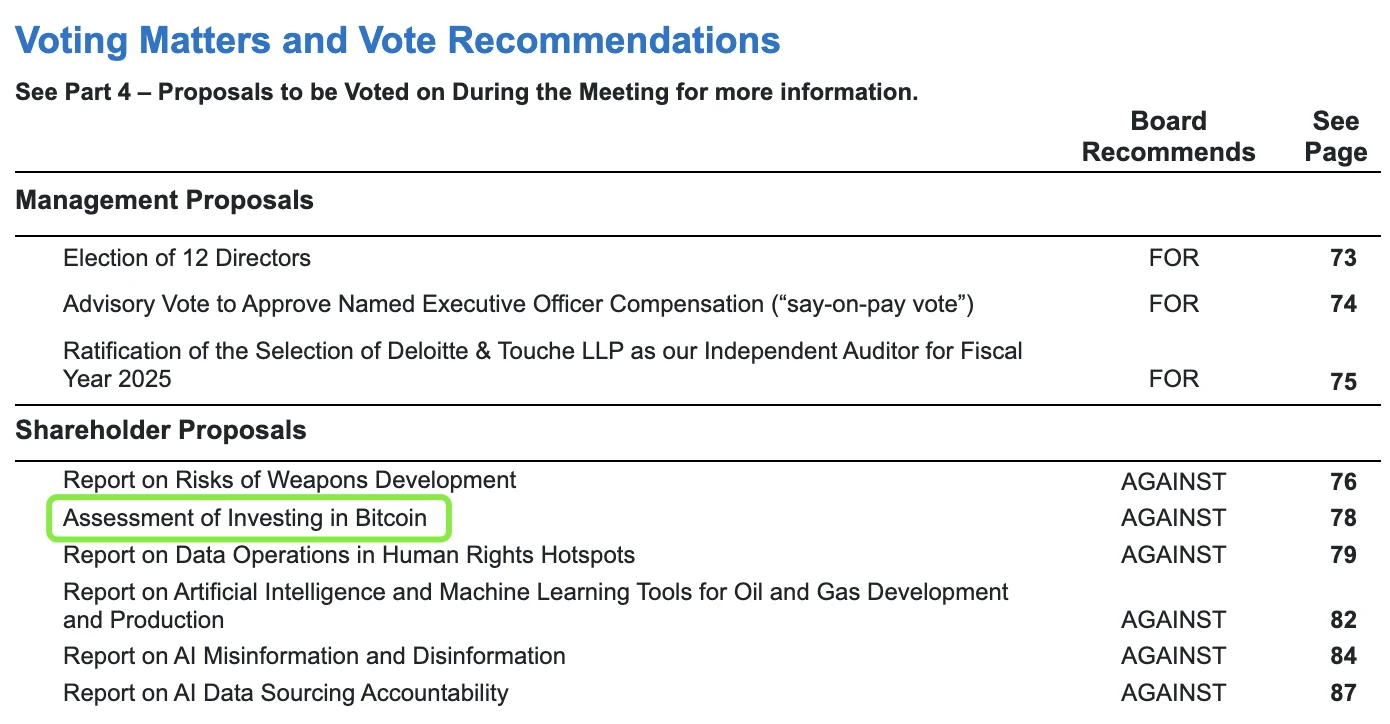

According to documents already filed with the U.S. Securities and Exchange Commission (SEC), the proposal is expected to open for shareholder voting on December 10, local time, along with several other proposals.

Will the Vote Pass?

Although the current cryptocurrency community has high expectations for this vote, the likelihood of Microsoft shareholders agreeing to the proposal remains uncertain.

In the documents submitted to the SEC, Microsoft's board explicitly expressed opposition to the proposal, stating that the management had previously assessed this topic but believed that corporate funds require stable and predictable investments to ensure liquidity and operational funds.

Despite the upper management's clear stance, relevant institutions/individuals supporting the proposal are still actively advocating to push it forward.

On one hand, BlackRock, which holds 7% of Microsoft shares, is expected to participate directly in the vote and is likely to cast a supportive vote; MicroStrategy co-founder Michael Saylor has also presented a 44-page PPT to Microsoft CEO Satya Nadella and the board, emphasizing the changes in the Bitcoin regulatory environment, hoping to sway the upper management's attitude.

On the other hand, on the more radical Reddit forums, many supporters of the proposal are actively calling for Microsoft's small and medium shareholders to vote in favor.

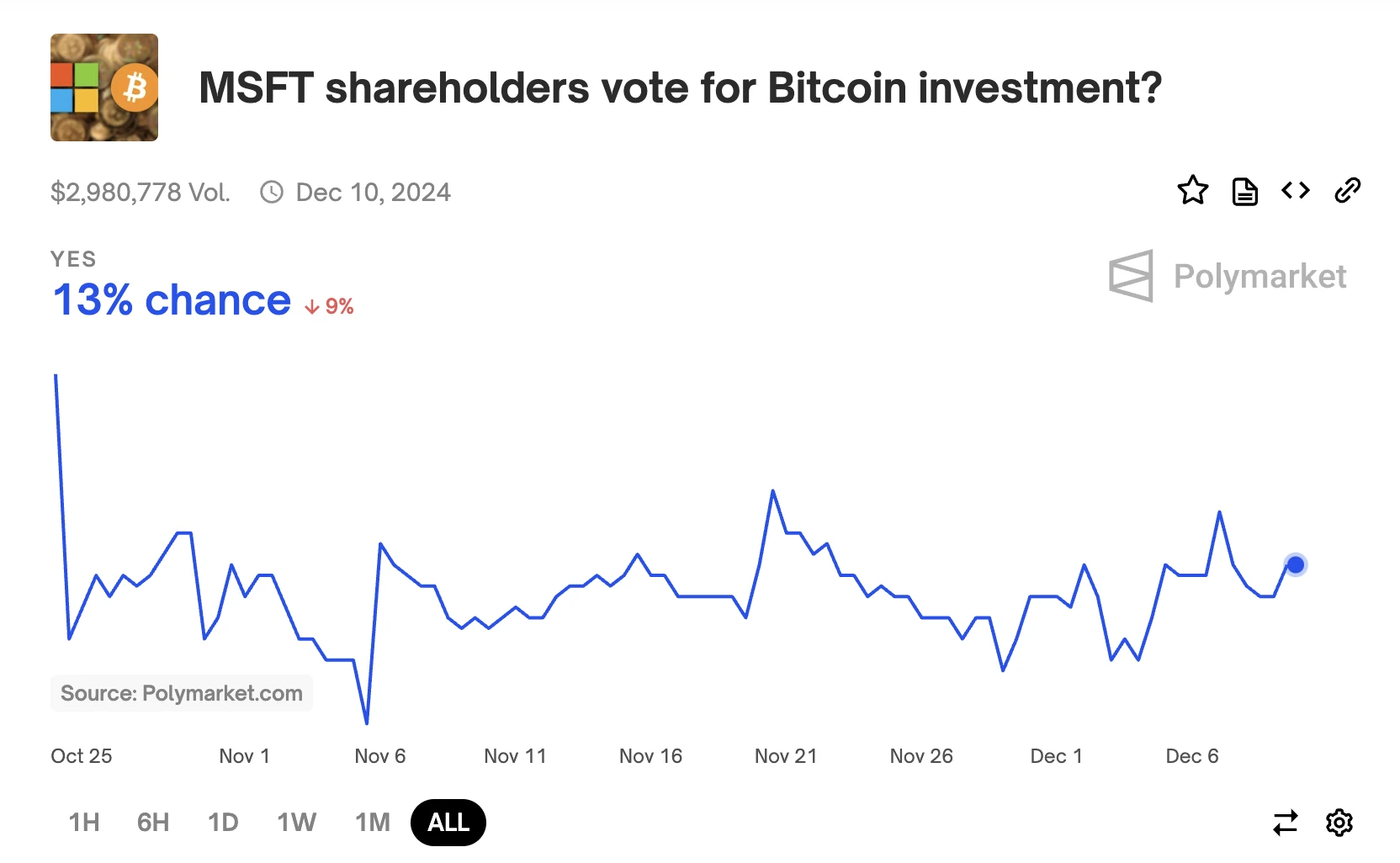

However, even so, the market's expectations for the proposal's passage are still not optimistic. Polymarket's real-time betting data shows that the probability of the proposal passing is only 13%.

If Passed, How Much Buying Power is There?

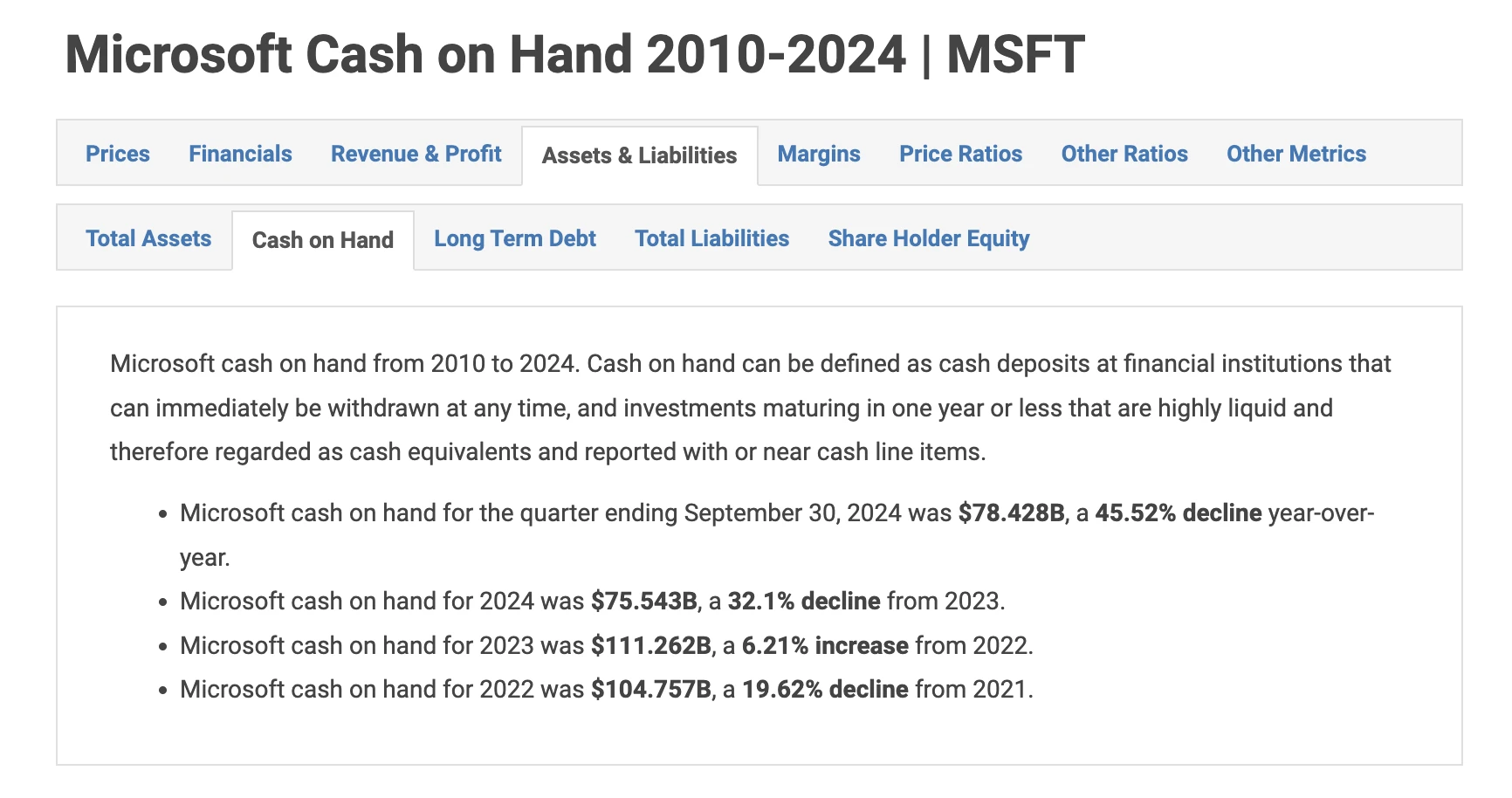

Although the voting expectations remain unclear, we can still get a preliminary glimpse of how much money Microsoft could allocate to purchase BTC if the proposal passes by looking at its reserves.

Macrotrends data shows that as of September 30, 2024, Microsoft holds cash reserves of $78.428 billion.

This means that if the proposal passes smoothly and Microsoft allocates at least 1% of its funds as suggested by NCPPR, it would represent a buying power of at least $780 million.

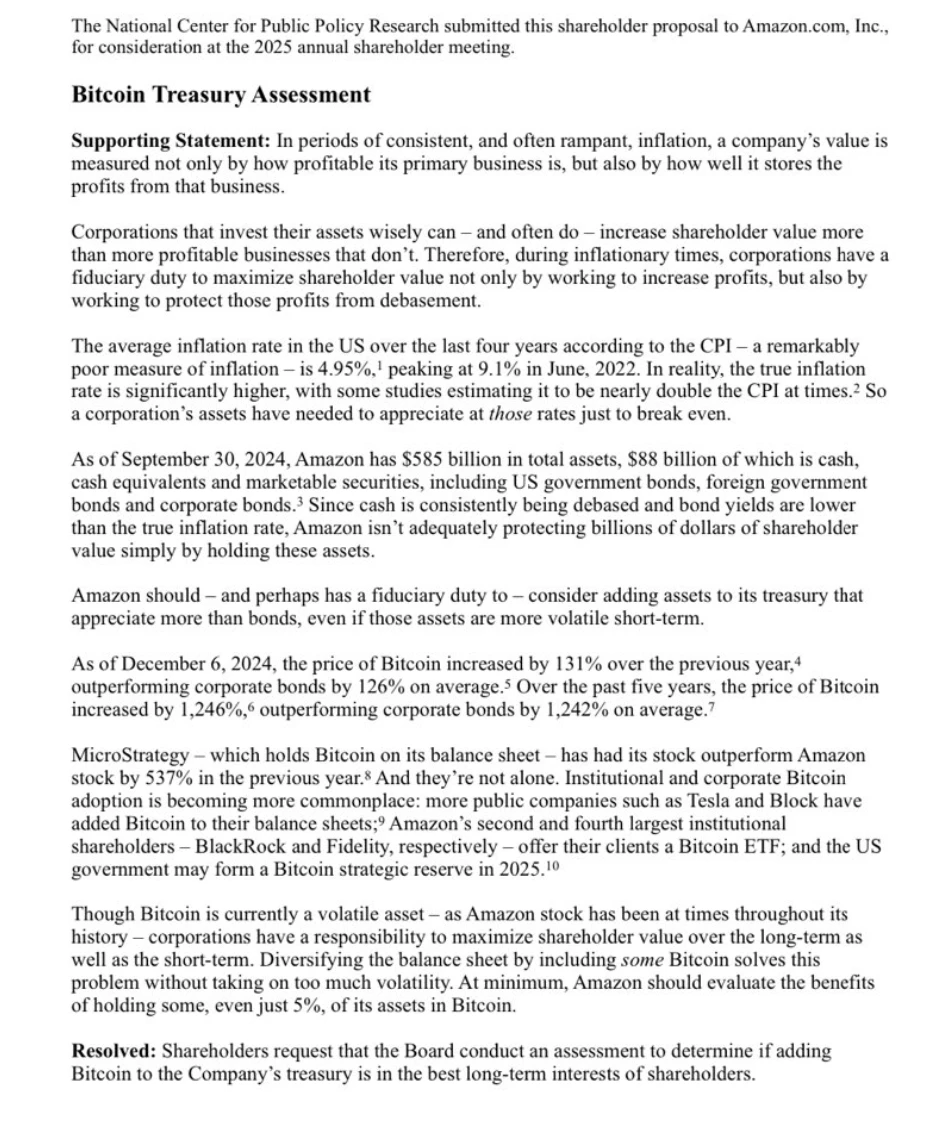

NCPPR Continues to Push, Is Amazon Next?

This morning, NCPPR submitted a similar shareholder proposal to another tech giant, Amazon, suggesting that Amazon evaluate incorporating Bitcoin into its asset reserves. This time, NCPPR recommends that Amazon invest at least 5% of its total assets.

CZ also commented on this event through his personal X account, asking when Amazon would accept Bitcoin payments.

Although the SEC has not yet outlined the progress of this proposal, Jubilee Royalty founder and CEO Tim Kotzman stated that a related announcement is expected to be released in April 2025, and thus it may be reviewed at the 2025 annual shareholder meeting.

From the already involved MicroStrategy and Tesla to the potential involvement of Microsoft and Amazon, Bitcoin's expansion into the mainstream world seems to be accelerating. Although the upcoming Microsoft meeting may not immediately pass this vote, it appears to be just a matter of time based on the trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。