Unveiling the Mystery of Bitcoin: An In-Depth Analysis of BTC's True Value (Must-Read)

Hello everyone, this is AICoin Information!

To help everyone better understand how the value of Bitcoin is generated, today we will do a quick science popularization!

Next time friends or family ask, please like, and share this article!

Before we start, feel free to follow @AICoinzh (https://x.com/AICoinzh), you will receive our latest articles as soon as they are published!, you will receive our latest articles as soon as they are published!)

We will continuously share more valuable knowledge to safeguard your trading journey in the crypto world!

1) "Digital Scam" or "Modern Gold"?

Whether you are a novice or a veteran in the cryptocurrency field, there is often skepticism and confusion about the value of Bitcoin, with some believing it is just a string of numbers with no real significance, purely hype.

The root of the "Bitcoin has no value" viewpoint lies in its apparent lack of "real-world significance," making it difficult to perceive its existence in daily life, lacking a physical touch, unlike gold bars that can be touched.

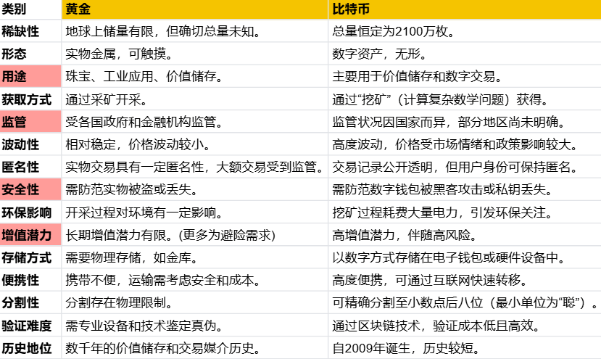

Bitcoin is often seen as "digital gold," rather than being directly compared to gold, for the following reasons:

The total supply of Bitcoin is fixed at 21 million, similar to the scarcity of gold.

Bitcoin exists in digital form, cannot be touched, and has high liquidity, similar to stocks.

Thus, Bitcoin combines the scarcity of gold with the electronic digital characteristics of ordinary securities.

In general, any commodity (whether it is everyday fruits, bananas auctioned by Sun Yuchen, or luxury items like diamonds and Rolls-Royces) can have value (whether practical or emotional) as long as it gains market recognition and forms a consensus.

2) Supply and Demand Shape Prices

The total supply of Bitcoin is permanently capped at 21 million, similar to the limited reserves of gold on Earth (approximately 59,000 tons remain to be mined). As of December 3, 2024, the current circulating supply of Bitcoin is 19,790,568 BTC. This means there are approximately 1,209,432 BTC yet to be mined.

Approximately every four years, the Bitcoin block reward is halved, leading to a gradual decrease in the rate of new Bitcoin generation, similar to the increasing difficulty of gold mining. The most recent halving occurred on April 20, 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. The next halving is expected to take place in the first quarter of 2028, at which point the block reward will be halved again.

It is estimated that about 20% of Bitcoin may have been permanently lost, equivalent to approximately 3.84 million BTC. These lost Bitcoins are primarily due to users losing their private keys or not using them for a long time. Based on the current circulating supply (approximately 19.79 million BTC), this means that about 19% of Bitcoin may no longer be usable.

Bitcoin is viewed as "digital gold," serving as a store of value, attracting investors seeking to preserve their wealth.

Large companies like Tesla and MicroStrategy have incorporated Bitcoin into their balance sheets as reserve assets, driving market demand.

In economically and monetarily unstable countries like Venezuela, Argentina, Zimbabwe, and Turkey, Bitcoin is used as a tool to combat inflation, further increasing its demand.

Due to the limited growth in Bitcoin supply and the continuous rise in market demand, its price has grown from single digits to its current highs.

3) Legalization of Bitcoin: How Businesses and Governments Shape Market Confidence?

On the business side:

Microsoft began accepting Bitcoin payments as early as 2014, allowing users to recharge their accounts with Bitcoin to purchase digital content on platforms like Windows and Xbox.

AT&T, as a major mobile carrier in the U.S., started accepting Bitcoin payments through BitPay in 2019, becoming one of the first telecom companies to accept cryptocurrency payments.

The Chicago Mercantile Exchange (CME) launched Bitcoin futures contracts in 2017, providing investors with regulated Bitcoin trading tools, lowering the entry barrier for ordinary investors into the cryptocurrency market.

Asset management companies have successively launched ETFs, such as Grayscale's Bitcoin Trust (GBTC) and BlackRock's iShares Bitcoin Trust (IBIT). These ETFs allow investors to easily invest in Bitcoin through traditional financial platforms without needing to learn high-threshold blockchain knowledge, making the crypto investment difficulty curve smoother.

On the government side:

U.S. President Trump announced the inclusion of Bitcoin in the national strategic reserves. El Salvador became the first country in the world to designate Bitcoin as legal tender in 2021, marking significant recognition of Bitcoin at the sovereign state level.

When large and credible institutions participate in the Bitcoin market, their recognition and support further establish Bitcoin's legitimacy and enhance market acceptance, boosting public and investor confidence and promoting Bitcoin's integration into the mainstream financial system.

As individual investors, we should adopt an open and inclusive attitude towards this trend, rationally assessing Bitcoin's role and potential in the global economy.

4) The Value Consensus of Bitcoin

In countries with extreme hyperinflation like Venezuela and Turkey, Bitcoin is often used to protect asset value against the depreciation of the local currency.

Professional investors, and even the general public, are gradually considering incorporating Bitcoin into their personal investment portfolios as a means of diversifying risk, similar to holding traditional safe-haven assets like gold.

Of course, an AICoin fan raised the point: “Bitcoin is a coin of consensus and fair value accumulated over time, carrying the value supported by numerous miners. Even Satoshi Nakamoto himself had to mine or purchase it, and that is where its value lies!”**

Whether individuals, institutions, or governments, the attitude towards BTC Bitcoin is often one of both fear of missing out (FOMO) and cautious observation, hesitant to invest heavily.

In the face of new phenomena, many people worry that it might be a Ponzi scheme and hesitate, but they also fear missing out on opportunities, especially when those around them and large institutions have begun to participate, which further increases its credibility.

“Crypto for a moment, human for a year,” human nature is vividly reflected in the crypto market!

Like any investment target, we do not recommend anyone to invest all their assets in a single target (even if it is considered risk-free government bonds), as this can lead to extremely unsafe asset allocation, with risks of unilateral decline (leading to rapid shrinkage of overall assets) and liquidity risk (complex withdrawal, causing issues when money is urgently needed).

Investors should first clarify their investment needs and current financial situation, reasonably allocate assets, and then proceed with investments.

Feel free to continue following AICoin for the latest investment intelligence!

Note: Recently, we have discovered that some criminals are impersonating AICoin, posting false order tool advertisements on social media. These ads claim to provide professional market watching and ordering functions, but may actually pose security risks. It is important to note that these fake websites are very similar in design and content to our official website, which can easily cause confusion.

**Please be sure to recognize our only *“.com”* official website: www.aicoin.com**

If you have any questions or find suspicious information, please contact us promptly.

· Telegram: t.me/aicoincn

· Twitter: x.com/AICoincom

· Group chat: Customer service Yingying, Customer service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。