Author: Poopman

Compiled by: Deep Tide TechFlow

Another RWA stablecoin backed by treasury bills? Sigh, this is so boring.

Every time I mention @usualmoney to my friends, they have this reaction.

Nowadays, many stablecoins choose to use treasury bills as collateral because their yields are relatively attractive and the risks are low. For example:

- Tether holds $81 billion in treasury bills.

- MakerDAO / Sky has heavily invested in treasury bills and has earned considerable returns from them (sorry, I can't recall the exact numbers).

- There are more RWA participants like Ondo, Hashnote, Blackrock, and Franklin joining this competition. However, to be honest, most treasury bill stablecoins operate in a similar manner.

Institutions that have passed KYC can directly mint stablecoins by depositing real treasury bills into a designated fund. The token issuers then collaborate with the fund managers to issue the corresponding amount of stablecoins.

The yields may vary since these treasury bills have different maturities, but the differences are not significant, usually ranging from 4% to 6%.

So, is there a way to achieve higher yields and make it more interesting?

The Problem?

A simple and effective way to increase yields is to issue more governance tokens to attract more deposits and total value locked (TVL).

However, these tokens often lack practical utility and are usually heavily sold off at launch due to high inflation. Many times, they are merely tools for users and investors to exit, or the tokens themselves are not closely tied to the actual revenue generated by the product.

In many cases, the revenue flows directly to the product itself rather than the governance token. For example, sDAI earns DAI, not $MKR.

Tokens that do have a connection typically adopt the ve3.3 model to initiate a positive flywheel effect (shoutout to @AerodromeFi, @CurveFinance, @pendle_fi). If the flywheel gets going, they can grow rapidly in a bull market. However, when the flywheel stops, its dilution effect can cause trouble.

A new approach is to enhance the utility of the token or reposition it as an L2 token, like @EthenaNetwork / @unichain. But this strategy usually only works for large enterprises.

$Usual has chosen a different approach by allocating 100% of the protocol's revenue to the governance token, making these tokens "fundamentally backed by real dollars."

At the same time, they control inflation and issuance by incorporating some PVP elements (like early vs. late, staking vs. unstaking) to make it more engaging.

However, you might be disappointed to learn that $usual is not the high-yield product you might imagine; it is more like a safer product (SAFU) that is more interesting than its competitors.

To help you understand better, let's take a look at the user flow.

$Usual

$Usual Token Economics and User Flow

Usual Money Token Economics

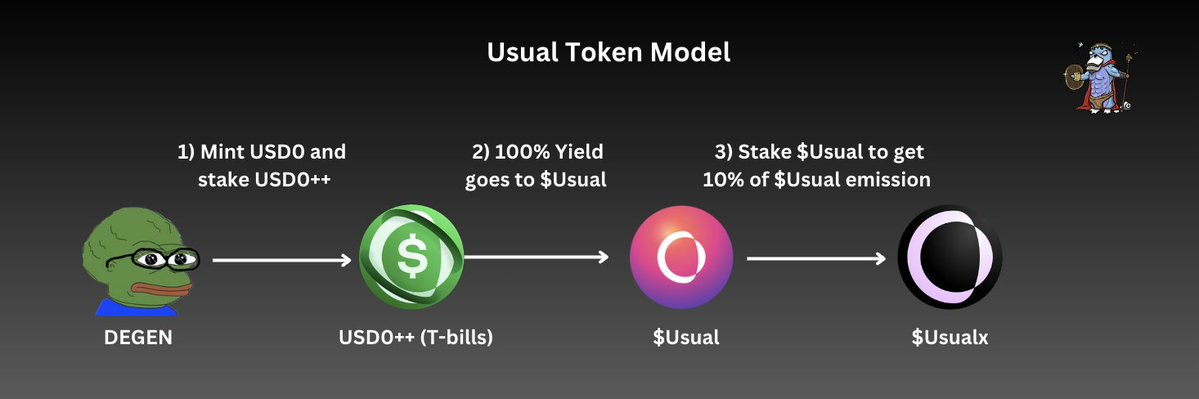

- First, as a user, I can mint USD0 with stablecoins. If I don't want to provide liquidity or participate in other yield farms, I can stake USD0 into $USD0++.

- After staking USD0, my $USD0++ will earn 90% of $Usual rewards, which are $USUAL, not USD0 or USDC. The issuance rate of $Usual depends on the amount of $USD0++ minted and the yield from the treasury bills.

- 100% of the treasury bill earnings earned by USD0++ will go into the protocol treasury, and the $Usual token is responsible for managing the treasury.

- To earn the remaining 10% $Usual rewards, I can stake $Usual into $Usualx. Every time new $Usual is minted, this 10% will be automatically distributed to stakers. Additionally, $Usualx holders have the right to participate in voting and other governance decisions, such as adjusting the issuance rate.

Throughout the user flow, we can see that the governance token ($Usual) actually receives all the earnings from the RWA product itself, while stablecoin holders and stakers are incentivized through rewards supported by the earnings.

Since Usual is an RWA product, it is difficult to achieve extremely high annual percentage yields (APY) or annual interest rates (APR) because the earnings are closely tied to the actual interest rates and the supply of USD0++.

More details will be introduced in the following paragraphs.

Token Utility Overview:

- The token represents all the earnings of the protocol.

- By staking, one can earn 10% of the total issuance of $Usual and enjoy voting rights to influence the direction of issuance.

- Participate in governance decisions regarding treasury management (such as reinvestment, etc.).

- Burn $Usual to unstake LST USD0++ early.

Fun in the Issuance Mechanism

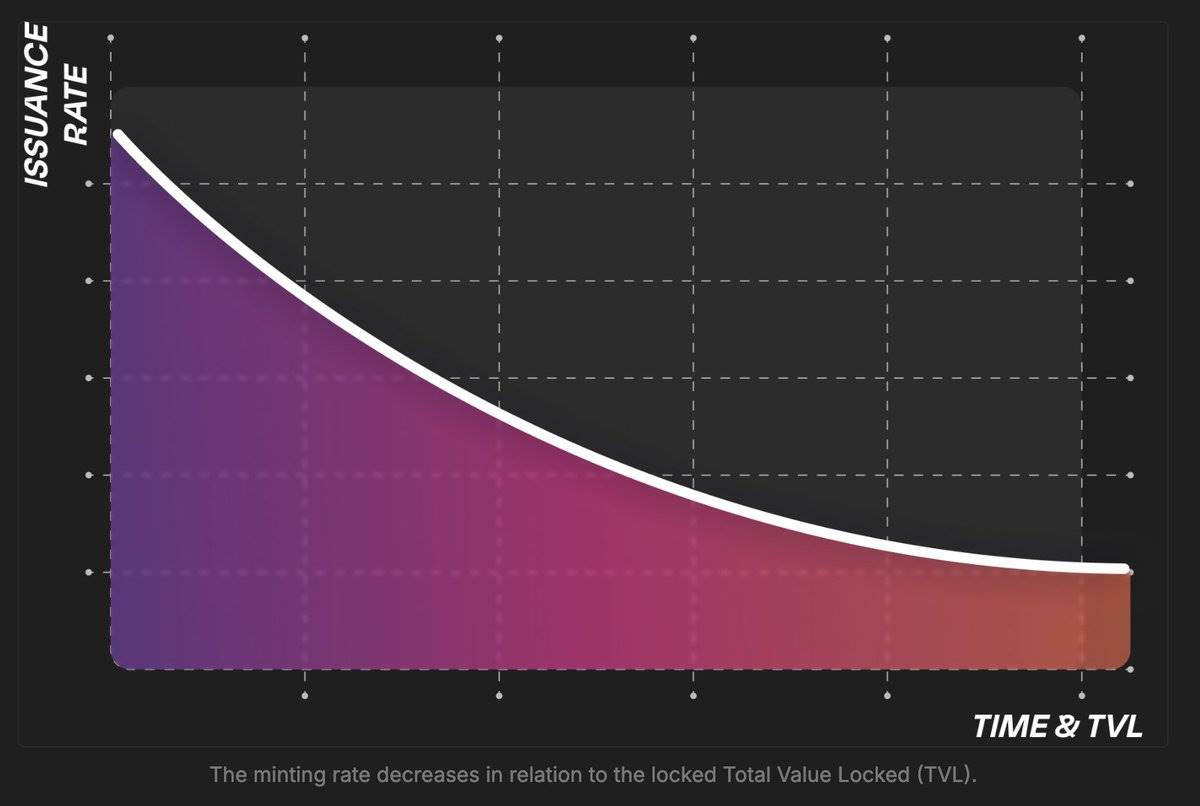

- The issuance of $Usual is adjusted based on dynamic supply, which means:

- When TVL increases, the issuance of $Usual decreases.

- When TVL decreases, the issuance of $Usual increases.

Question:

So, Poopman, are you saying that when TVL is high, Usual does not encourage deposits?

Answer:

No, not at all. When TVL is high, Usual can actually earn more from the increased treasury bills. Therefore, as the treasury grows, the value of $Usual should be higher.

Conversely, when TVL is low, the issuance of $Usual will increase because treasury earnings decrease, and they need to pay more compensation. High issuance helps Usual attract more TVL to the platform.

Additionally, to prevent excessive inflation of $Usual:

- The issuance rate will be adjusted based on interest rates.

- A maximum issuance threshold has been set (determined by the DAO).

This is because Usual wants to ensure that the growth rate of the token does not exceed the growth rate of the treasury to maintain the value of $Usual while adhering to the principle of "project growth = token value growth." Of course, the DAO can make adjustments as needed.

For early and late participants:

In this model, early participants benefit the most because they acquire the most $Usual at a higher price when TVL is high.

For later participants, while they receive fewer tokens, they do not incur substantial losses aside from opportunity costs, as they can still earn returns.

In simple terms, $Usual is a form of token that represents the earnings generated by Usual.

$Usual adds some fun by introducing PVP elements, allowing users to earn 10% of others' $Usual issuance by staking, while early participants can gain more rewards from later participants.

Token Distribution:

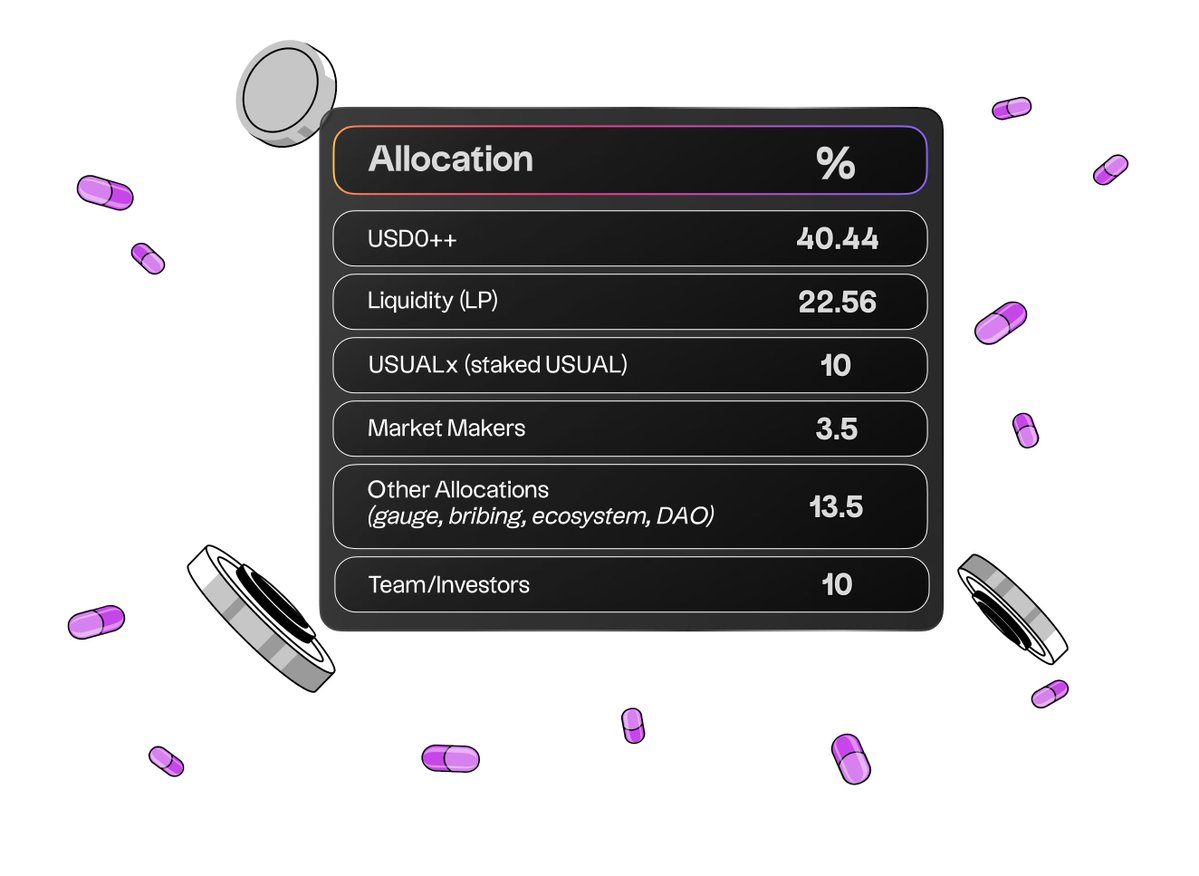

The distribution of $Usual is community-centered:

- 73% of the tokens are allocated for the public and liquidity provision.

- 13.5% is allocated to MM / team and investors.

- 13.5% is for DAO / buybacks / voting, etc.

It's great to see that this DeFi design prioritizes the community. The team has done a good job.

What issues should be noted?

The $Usual token is fun, valuable, and meaningful, especially emphasizing inflation control. However, Usual and users may need to be aware of some risks.

Liquidity issues and decoupling risk of USD0++

Currently, over $320 million of USD0 is staked in USD0++, while the liquidity of USD0 on Curve is only about $29 million. In other words, less than 10% of the USD0++ available for exit in the market, and a large-scale exit could lead to an imbalance in the pool's assets, potentially causing decoupling. Although this ratio is not too bad (the worst case is only 2-3% liquidity), it is a risk we must consider as we enter the TGE window, as short-term investors may choose to exit.

Yield competitiveness in a bull market

It may sound a bit naive, but attractive yields during a bull market often come from the crypto assets themselves (like ETH, SOL, etc.), rather than stable real-world assets like treasury bills.

In contrast, I expect stablecoins like sUSDe to yield substantial returns during market upswings, attracting more TVL than Usual, as their yields can reach 20-40% or higher. In this case, without new products to enhance USD0's yield, Usual's growth may stagnate.

Nevertheless, I believe about 80% of people in the DeFi circle understand the risks that USDe holders need to bear. As a "conservative stablecoin," Usual can provide a better and more resilient option for those seeking stability.

DAO issues: low participation rate

Low participation rates have always been a common issue in DAOs. Since Usual is DAO-centric, ensuring sufficient and effective participation is crucial. Here are some thoughts:

- Delegation might be a solution, but the decisions made by the DAO are not always optimal. Collective wisdom is often used to support the construction of DAOs, but based on the outcomes of the Arbitrum DAO, not everyone possesses the understanding or vision to build a meaningful future for the project.

- Most participants are self-directed and tend to vote in favor of matters that benefit themselves. This can lead to monopolistic practices or unequal reward distribution issues.

Therefore, giving too much decision-making power to the DAO also carries risks, potentially resulting in undesirable outcomes.

Conclusion:

- The token economic model is robust and interesting. The governance token has real value as it is supported by revenue.

- Stakers of $Usual can earn 10% of all minted amounts as rewards, incentivizing users to stake. This model injects fresh vitality into the RWA stablecoin space, and I believe it is the right approach.

- It performs excellently in controlling inflation. The minting amount is strictly limited by the available supply of USD0++ and real-world interest rates, ensuring that inflation does not dilute the value of $Usual.

However, the downside is that one cannot expect extremely high annual percentage yields, which may be a disadvantage compared to other products in a bull market.

- Liquidity issues. Currently, the liquidity of USD0 and USD0++ on Curve is less than 10%. This could pose risks to liquidity providers during the TGE window, especially during large-scale exits.

Nonetheless, I believe most holders are willing to hold long-term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。