CoinDepo is a platform for staking cryptocurrencies, offering unique conditions for earning. The main goal of the project: in the conditions of the unstable crypto market, regular scams of various projects and constantly changing conditions, to offer its investors highly profitable and, above all, safe solutions for passive income.

Firstly, CoinDepo is suitable for those who invest in cryptocurrencies on a long-term basis or simply hold assets on their balance sheet. Often, passive investors do not want to be involved in active trading or the constant search for platforms to staking, and this has to be done regularly, as most platforms only offer a flexible annual percentage rate that changes over time. As a result, instead of receiving a guaranteed passive income, investors must constantly monitor the current yield and, if the rate falls, find a new site with a higher APR and move their assets there.

The CoinDepo platform was created to solve the problem of floating interest rates when staking. It can offer a fixed interest rate for major cryptocurrency and stablecoin investments. The fixed rate will help to avoid market volatility and to always receive a stable and predictable income. Users can calculate their income in advance and then receive exactly that amount due to the fixed rate. When using CoinDepo, there is no need to transfer your assets between platforms, which greatly facilitates the work of investors and makes their income truly passive.

Furthermore, by insuring its investors’ deposits and using the Overcollateralization Mechanism due to additional funds of guarantors deposited in Liquidity Reserve Accounts, CoinDepo can offer a higher level of security compared to other platforms. This is particularly relevant in 2024, when cases of hacking of smart contracts, scams and ragpools between different projects have already become regular and no longer come as a surprise. All these events have a negative impact on the trust of the crypto community in the platforms. That is why the CoinDepo team has implemented the security system of Fireblocks, a leading institutional custody provider, and full deposit insurance to guarantee the safety of all its users.

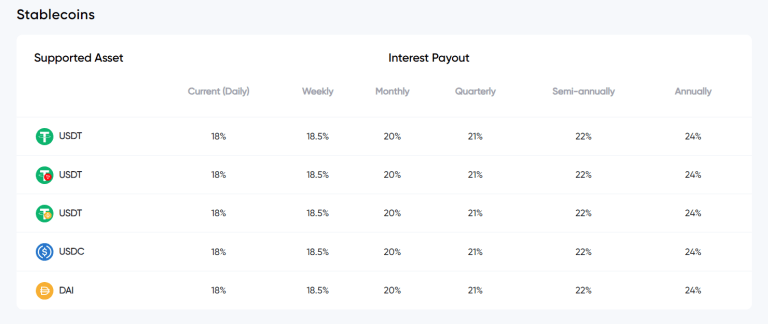

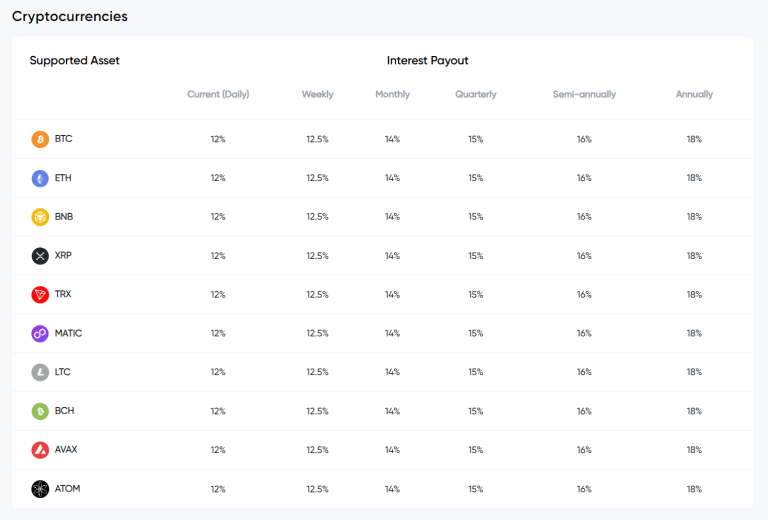

- CoinDepo offers higher returns than similar platforms. You can get up to 18% per annum plus compound interest on cryptocurrency and up to 24% per annum plus compound interest on stablecoins. The number of coins for staking is quite large – these are the main stablecoins (USDT, USDC, DAI) and cryptocurrencies with largest capitalization, such as BTC, ETH, BNB, XRP, TRX, etc. which are the most common in investors’ portfolios. There are several options for staking: the lowest rate with daily compound interest payouts, and then in ascending order – weekly, monthly, quarterly, semi-annually and annually, the less frequently interest is accrued, the higher the annual rate will be.

- Flexible deposit terms: there is no minimum deposit, you can withdraw funds at any time and the staking period can be from 1 day to 1 year.

- The platform uses the advanced Fireblocks security system and insurance of its users’ funds, which makes it safer than other platforms. The Fireblocks Enterprise-grade Multi-layer Security System protects the platform from hacks and other threats that crypto projects are regularly exposed to.

- Transparent terms of income generation. The interest rate is always fixed and users can always calculate their returns in advance. This transparency allows investors to minimize their risks and build a strategy for the long term.

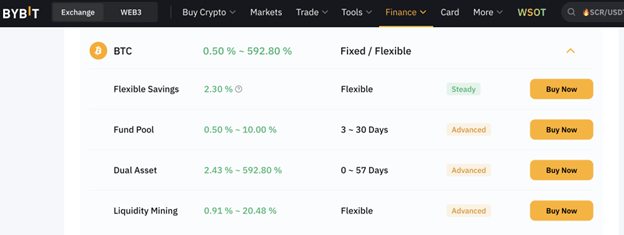

Let’s start by comparing CoinDepo with CEX exchanges. Let’s take the Bybit exchange as an example.

For BTC stakes, you can get a rate of 2.3% per annum, but this is a flexible rate that will change over time. Therefore, it will need to be monitored regularly to avoid a drop.

Meanwhile, BTCs can be staked on CoinDepo at 18% APR + compound interest with interest accruing once a year or 12% APR + compound interest with interest accruing daily.

So it is possible to get a rate 7 times higher than on the largest exchange. If we start comparing CoinDepo with other CEX exchanges, the situation will be similar. The differences will be 1-2% at best, which will not change the final picture.

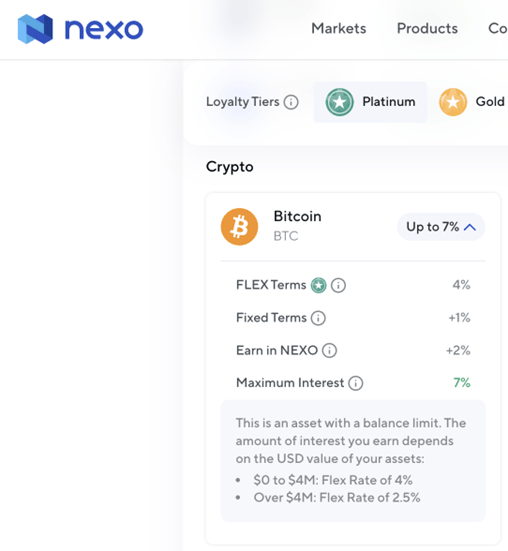

Completely different values can be obtained if you start comparing the platform with similar DEX platforms. Let’s take the NEXO platform as an example, as the most profitable and similar in functionality.

On NEXO for BTC staking with various bonuses you can get 7% per year.

However, this is not enough until you reach at least the 12% APR (with daily compound interest payouts) offered by CoinDepo.

You can repeat the comparison. Take your current platform on which you stake assets and compare it with the yield of CoinDepo. After analyzing 10 similar platforms, we still couldn’t find better conditions. So we can say that we have the platform with the best combination of security and high returns.

In order to increase the returns from staking, users can buy the native token (COINDEPO) on the CoinDepo platform and stake it, obtaining returns of up to 65% per year. Currently, users have the opportunity to purchase the COINDEPO token during the Private Sale with an impressive discount of 75%. However, it is worth weighing all the risks before buying, as tokens after listing are often subject to high volatility, which means that their purchase may be associated with increased risks.

Before investing in a project’s tokens, carefully study the tokenomics, especially the dates of unlocks, the total number of coins and the distribution among investors, and only make a decision to buy after independent in-depth research.

According to the roadmap, the project plans to introduce unsecured crypto micro-lending and larger crypto loans without a collateral account in the future. This means that users will be able to receive loans without freezing their assets in collateral accounts, where they are idle and do not generate interest income, unlike other similar platforms. These features will be the first of their kind in the crypto world. Such a solution will be able to increase the liquidity of users by releasing their own funds and acquiring borrowed assets.

It is important to note that with a credit line without a collateral account, users will be able to continue to earn interest on their staked funds on the CoinDepo platform even when taking out a loan.

The project team is also working on issuing a credit card that will allow crypto-assets to be used in everyday life within a credit line without having to sell them. The cards will offer crypto cashback for every purchase made, and the cards themselves will be available in metal, plastic and virtual form.

In conclusion, CoinDepo combines high and stable returns through fixed rates with reliable protection in the form of deposit insurance, which is extremely difficult to find in the current market reality. These advantages make the platform attractive to long-term investors and those looking for a truly passive way to make money from cryptocurrency.

If you are looking for such a platform, we advise you to explore CoinDepo for yourself and decide if it is worth investing here or if you can find a more profitable and secure platform.

Don’t forget to diversify your investments. Even if your funds are insured on the platform, it would be a good move to split your pot between several similar staking platforms or CEX exchanges.

In addition to diversification, research the project itself, especially the project whitepaper and website, as well as the background of the development team. This will help you understand how efficiently and quickly the current project can grow. And use this information to make your own forecasts.

Teams with no previous experience should be treated with skepticism, and investments in such projects should be considered high risk. Good luck with your investments!

This is a sponsored story. Please conduct your own due diligence and make an informed decision before taking any action. Bitcoin.com accepts no responsibility or liability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。