Standard Chartered Bank expects that by 2034, the overall demand for the tokenization of real-world assets will reach $30.1 trillion.

Written by: Standard Chartered Bank, Synpulse

Translated by: Web3 Xiaolu

This research report co-authored by Standard Chartered Bank and Synpulse is a comprehensive report on the tokenization of real-world assets in the context of cross-border trade. The report details how tokenization will become a game changer for global trade by transforming trade assets into transferable instruments, providing investors with unprecedented liquidity, divisibility, and accessibility.

Traditional financial assets can experience significant volatility due to macro market influences, while trade assets are different. Although trade is closely related to the economy, economic downturns will impact bank lending. However, the substantial trade financing gap still presents a good opportunity for investors to enter the market, as small and medium-sized enterprises continue to require significant financing even during economic slowdowns, creating ongoing investment opportunities. To some extent, trade assets can withstand global economic recessions.

At the same time, due to factors such as relatively short cycles, low default rates, and high financing demands, we believe that trade assets are more suitable to become the underlying assets for tokenization. In addition, the tokenization of trade assets can provide numerous benefits for various participants and processes in the complex scenarios of global trade, whether in 1) the payment of cross-border trade funds, 2) the financing needs between various trade participants, or 3) using smart contracts to enhance trade efficiency and reduce complexity, ensuring transparency.

Standard Chartered Bank expects that by 2034, the overall demand for the tokenization of real-world assets will reach $30.1 trillion, with trade assets becoming one of the top three tokenized assets, accounting for 16% of the total tokenized market in the next decade.

Therefore, we have compiled this report to provide reference for market participants and investors. The article explores the transformative power of trade asset tokenization and shares why now is the perfect time to adopt and expand trade asset tokenization. It also examines four key benefits of embracing tokenization and suggests actions that investors, banks, governments, and regulatory bodies can take now to seize this opportunity and shape the next chapter of finance.

Enjoy:

Tokenization of Real-World Assets: A Game Changer for Global Trade

In the past year, we have witnessed the rapid development of tokenization, reflecting a significant shift towards a more accessible, efficient, and inclusive financial system. In particular, the tokenization of trade assets represents both a shift in our understanding of value and ownership and a fundamental change in investment and exchange mechanisms.

Through Standard Chartered Bank's successful pilot in the Project Guardian initiative led by the Monetary Authority of Singapore, the feasibility of asset tokenization as an innovative "from initiation to distribution" structure has been demonstrated, along with the potential opportunities it presents for investors to engage in financing real-world economic activities.

Standard Chartered Bank further advanced this vision in the Project Guardian initiative by creating an initial token issuance platform for real-world assets. They successfully simulated the issuance of $500 million in asset-backed securities (ABS) tokens supported by trade financing assets on the public blockchain Ethereum.

The success of this project showcases how open and interoperable networks can be used in practice to facilitate access to decentralized applications, stimulate innovation, and promote growth within the digital asset ecosystem. This pilot project demonstrates the practical application potential of blockchain technology in finance, particularly in enhancing asset liquidity, reducing transaction costs, and improving market access and transparency. Through tokenization, trade assets can be accessed and traded more effectively by global investors, transforming trade assets into transferable instruments and unlocking previously unimaginable levels of liquidity, divisibility, and accessibility. It not only provides investors with a new opportunity to balance their portfolios with digital tokens that have traceable intrinsic value but also helps to close the global $2.5 trillion trade financing gap.

1. What is Asset Tokenization?

As the financial world undergoes rapid digitalization, digital assets stand at the forefront, fundamentally changing how we perceive and exchange assets. Traditional finance, combined with innovative blockchain technology, is leading us into a new era of digital finance, fundamentally reshaping our understanding of value and ownership.

Before 2009, the idea of transferring value through digital assets was still unimaginable. Value exchange in the digital realm relied on intermediaries acting as gatekeepers, creating inefficient processes. Although there is controversy in the financial industry regarding the precise definition of digital assets, it is undeniable that they are ubiquitous in our technology-driven lives. From the information-rich digital files we use daily to the content we consume on social media, they permeate every corner of our modern existence.

The introduction of blockchain technology has changed the game. It is fundamentally transforming financial markets. What was once unimaginable is becoming a reality, and tokenization has become a key element in expanding the digital asset market, shifting it from niche and experimental to widely accepted and mainstream.

"Tokenization" essentially refers to the process of issuing a digital representation of traditional assets in the form of tokens on a distributed ledger.

These tokens are essentially digital certificates of ownership that can enhance operational efficiency and automation. Notably, it is closely related to the concept of fragmentation, where a single asset can be divided into smaller transferable units. But the most revolutionary aspect is that tokenization enhances access to new asset classes and improves financial market infrastructure, opening the door to innovative applications and entirely new business models in decentralized finance (DeFi).

2. The Development of Tokenization

Tokenization can be traced back to the early 1990s. Real Estate Investment Trusts (REITs) and Exchange-Traded Funds (ETFs) were among the first to achieve decentralized ownership of physical assets, allowing investors to own a portion of physical assets such as buildings or commodities.

It wasn't until 2009 that the world witnessed the birth of Bitcoin, a digital currency that challenged the concept of traditional third-party intermediaries. It sparked a revolution, followed by the emergence of Ethereum in 2015. Ethereum is a groundbreaking software platform powered by blockchain technology that introduced smart contracts supporting the tokenization of any asset. It laid the foundation for the creation of thousands of tokens representing various assets, such as cryptocurrencies, utility tokens, security tokens, and even non-fungible tokens (NFTs), showcasing the potential uses of tokenization in representing both digital and physical projects.

In the following years, a series of new phenomena emerged: Initial Exchange Offerings (IEOs) and Initial Coin Offerings (ICOs). In 2018, the U.S. Securities and Exchange Commission (SEC) coined the term "Security Token Offering (STO)," paving the way for regulated tokenized offerings and giving rise to compliant solutions.

These developments paved the way for the tokenization of real-world assets to take center stage. They continue to act as catalysts for transformation and technological improvement in the financial services sector, paving the way for ongoing new applications. The financial services industry continues to actively explore the potential of tokenization. Driven by customer demand and the potential opportunities that tokenization brings to banks and the global digital economy, financial institutions are increasingly seeking to integrate digital assets into their services.

A major example of such initiatives is the Guardian project, a collaborative effort between the Monetary Authority of Singapore (MAS) and industry leaders aimed at testing the feasibility of asset tokenization and DeFi applications. These industry pilots will further reveal the opportunities and risks brought about by the rapid innovation of digital financial tokenization.

Case A: Project Guardian Asset-Backed Securities (ABS) Tokenization Project

Standard Chartered Bank showcased a bold vision in the Project Guardian initiative: how to use blockchain networks to advance the development of a safer and more efficient financial network. This is a collaboration between MAS and industry leaders, where participating institutions conducted market case studies to design a blueprint for future market infrastructure that leverages the innovative potential of blockchain and DeFi.

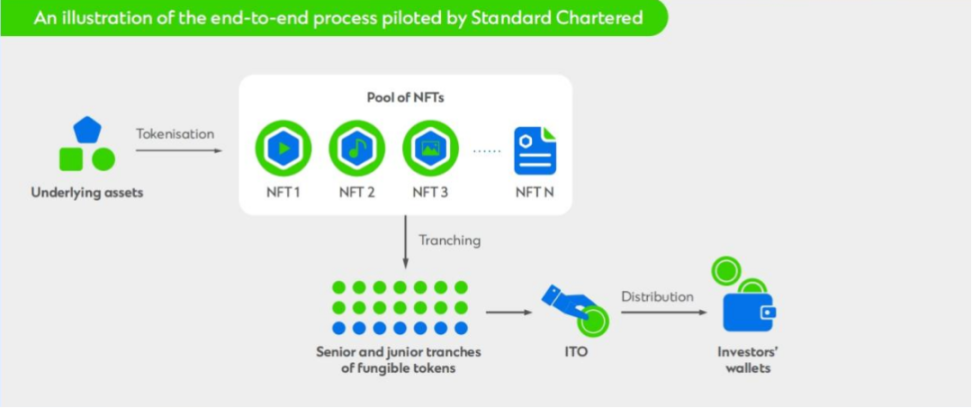

Standard Chartered Bank took this vision a step further by creating a token issuance platform for real-world assets, successfully simulating the issuance of $500 million in asset-backed securities (ABS) tokens supported by trade financing assets on the public blockchain Ethereum. Through this initiative, Standard Chartered Bank tested the end-to-end process from creation to distribution, including simulating default scenarios.

- Tokenization: Trade financing receivable assets are tokenized in the form of non-fungible tokens (NFTs).

- Risk-based Allocation: These NFTs are structured based on expected risks and returns (Senior and Junior Tranche), ensuring strict cash flow allocation.

- Token Creation: Based on the underlying asset's NFTs and structured design, two types of fungible tokens (FT) were created. Senior FT tokens provide fixed returns, while junior FT tokens offer excess spreads.

- Distribution and Access: Finally, these tokens were distributed to investors through an Initial Token Offering (ITO).

The successful pilot of Project Guardian demonstrated how open and interoperable blockchain networks can be used in practice to facilitate access to decentralized applications, stimulate innovation, and promote growth within the digital asset ecosystem. The application scenarios can be extended to the tokenization of financial assets such as fixed income, foreign exchange, and asset management products, enabling seamless cross-border trading, distribution, and settlement.

At the same time, by tokenizing the financing needs in cross-border trade scenarios, this new digital asset class has been introduced to a broader investor base, helping to enhance liquidity in the trade financing market.

3. What Else Can We See Beyond Trade Asset Tokenization?

Tokenization is not just about creating a new way to invest in digital assets and bringing much-needed transparency and efficiency to trade finance; it can also engage more deeply in trade finance, simplifying the complexities of supply chain finance.

Credit Transmission: Typically, trade finance is only available to established tier-one suppliers, while "deeper" suppliers—smaller, often under-scaled SMEs in the supply chain—are frequently excluded from trade finance. Through tokenization, SMEs can rely on the credit ratings of anchor buyers, thereby increasing the overall resilience and liquidity of the supply chain.

Creating Liquidity: Tokenization is often touted for its potential to unlock significant opportunities, especially in inefficient and illiquid markets. There is a growing consensus that due to reduced transaction costs and enhanced liquidity, investors are inclined to adopt tokenized assets. For supply-side institutions, the appeal seems to lie in attracting new capital, improving liquidity, and streamlining operational efficiency.

Moreover, Standard Chartered Bank believes that the true transformative power of tokenization is much greater. The next three years will be a critical juncture for tokenization, with new asset classes being rapidly tokenized, and trade finance assets taking center stage as a new asset class. Industry development is reaching a new level, where public efforts will yield more returns than isolated endeavors.

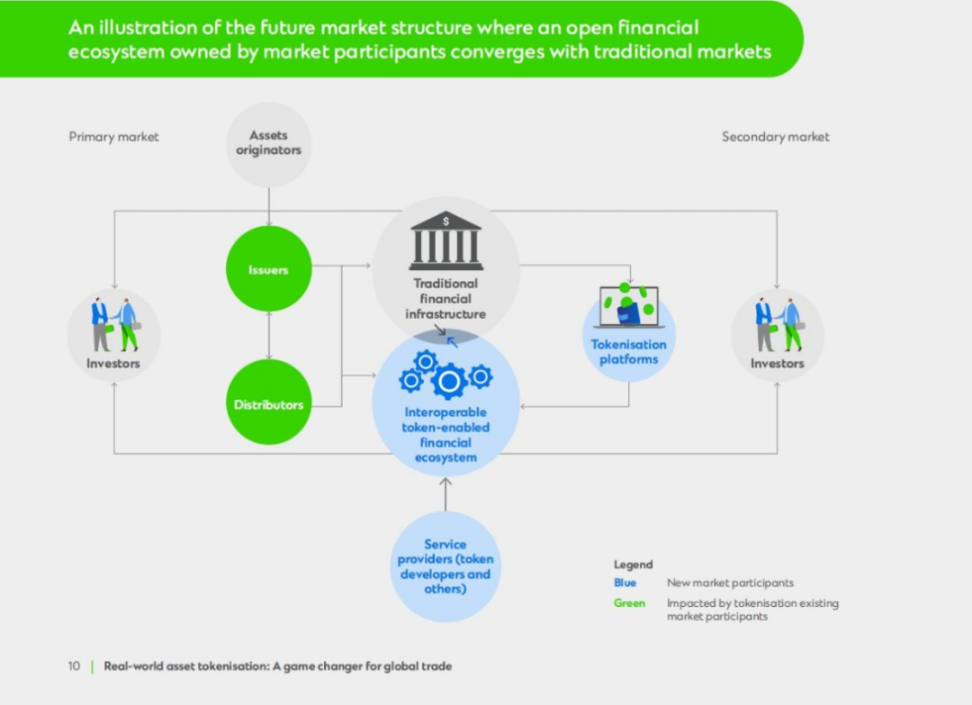

To provide access to new asset classes, banks play a key role in establishing trust and connecting existing traditional financial markets with new, more open, token-supported market infrastructures. Maintaining a position of trust is fundamental for verifying the identities of issuers and investors, conducting KYC/AML checks, and granting credentials to participate in this new interoperable financial ecosystem.

Standard Chartered envisions a future where traditional markets and tokenized markets coexist and eventually merge, creating an urgent need for an open and permissioned multi-asset and multi-currency digital asset infrastructure to complement traditional markets. Compared to past closed-loop markets, ownership and utility are shared among a broader range of market participants, striking a balance between inclusivity and security. Such infrastructure can not only facilitate efficiency and innovation but also address current industry pain points, such as duplicate investments and isolated, fragmented developments that hinder growth and collaboration.

4. What Drives the Tokenization of Trade Assets?

Tokenization has brought unprecedented liquidity, divisibility, and accessibility to asset classes that have been viewed as complex over the past decade, and the current macro and banking environment serves as a catalyst for adoption.

4.1 SMEs: Unlocking Trillions of Dollars to Bridge the Trade Finance Gap

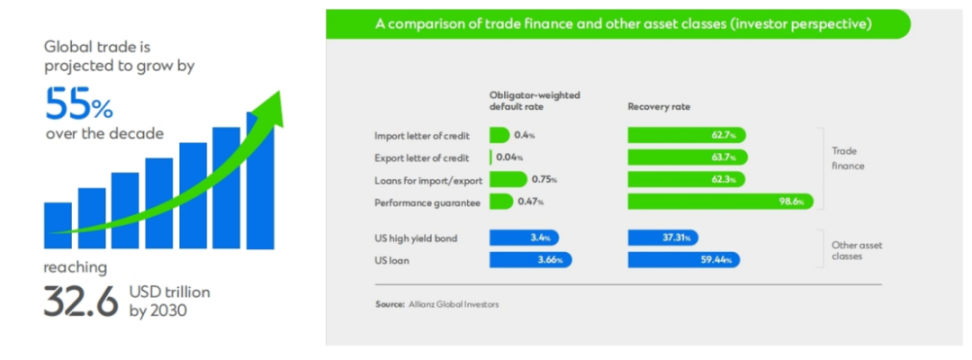

Standard Chartered Bank expects global trade to grow by 55% over the next decade, reaching $32.6 trillion by 2030. Factors driving this expansion include digitalization, the expansion of global trade, increased market competition, and improved inventory management. However, there is a significant gap between the demand for and supply of trade finance, particularly for SMEs in developing countries.

The trade finance gap has been sharply increasing—from $1.7 trillion in 2020 to $2.5 trillion in 2023. This growth represents a 47% increase in demand. This is the largest single-period increase since the metric was introduced, with various factors, including COVID-19, economic difficulties, and political instability, making it harder for banks to approve trade financing.

Additionally, the International Finance Corporation (IFC) estimates that there are 65 million enterprises in developing countries (40% of formal micro, small, and medium enterprises (MSMEs)) whose financing needs remain unmet. While the plight of SMEs and MSMEs has been widely recognized, a key segment remains overlooked: the "missing middle."

The "missing middle" or mid-market enterprises (SMEs) are a group that investors find difficult to access. SMEs sit between large investment-grade companies and small retail and micro enterprises, particularly active in rapidly developing regions such as the Middle East, Asia, and Africa. They represent a large and untapped market, offering significant opportunities for investors.

This investment opportunity can also withstand economic downturns. Since trade is closely related to the economy, economic recessions will impact bank lending. However, the substantial trade gap provides a good opportunity for investors to enter the market, as SMEs still require significant financing even during economic slowdowns, creating ongoing investment opportunities.

Notably, according to data from the Asian Development Bank, the $2.5 trillion global trade finance gap accounts for 10% of all trade exports. Current trade financing covers 80% of today's exports, while the remaining 10% may represent additional undisclosed trade finance gaps, as businesses either do not seek such financing or cannot obtain it. This means that the total undisclosed trade finance gap could potentially reach $5 trillion in total opportunity.

4.2 Untapped Yield Markets for Investors

Trade finance assets are attractive but underinvested. They generate strong risk-adjusted returns and possess some unique characteristics:

- Allowing Risk Diversification. Trade assets have short durations and can self-liquidate, making them low-risk investments with relatively low correlation to equity and bond markets. This makes them a more stable asset class while still providing strong risk-adjusted returns.

- Wide Range of Investment Options. There is a variety of trade assets available to meet specific risk preferences of investors. Coupled with emerging markets and frontier markets that are hard to access, such as Ghana, Côte d'Ivoire, Bangladesh, or Saudi Arabia, this asset class can cater to a broad range of investor needs.

- Low Default Risk and High Recovery Rates. Most importantly, trade finance assets have an impressive track record. Compared to public credit, trade finance has a relatively low default rate, and recovery rates in the event of default are higher, indicating that the risk-adjusted returns of trade assets outperform other debt instruments.

Despite institutional investors underinvesting in such assets due to a lack of understanding, inconsistent pricing, lack of transparency, and operational intensity, tokenization can help address this issue.

4.3 Banks Are Incentivized to Adopt Tokenization and Utilize Blockchain-Based Digital Origination and Distribution Models to Unlock Capital in Frontier Markets

Basel IV is a comprehensive set of measures that will significantly impact how banks calculate risk-weighted assets. Although full adoption is not expected until 2025, banks will need to modernize their distribution business models to formulate growth strategies under Basel IV.

Through blockchain-based origination and distribution, banks can derecognize assets from their balance sheets, thereby reducing regulatory capital to cover risks and facilitating efficient asset origination. Banks can leverage tokenization by distributing trade finance instruments to capital markets and emerging digital asset markets. This "digital origination and distribution" strategy for their trade finance assets can enhance banks' return on equity, expand funding sources, and increase net interest income.

The global trade finance market is vast and ready for tokenization. Most trade finance assets between banks can be tokenized and converted into digital tokens, allowing global investors seeking returns to participate.

4.4 Real Demand Drives Growth

According to a report by EY Parthenon, demand for tokenized investments is set to soar, with 69% of buying companies planning to invest in tokenized assets by 2024, up from 10% in 2023. Additionally, by 2024, investors plan to allocate 6% of their portfolios to tokenized assets, rising to 9% by 2027. Tokenization is not a fleeting trend; it represents a fundamental shift in investor preferences.

However, the supply side of the market is still in its infancy, with the total value of real-world asset tokenization (excluding stablecoins) expected to be around $5 billion by early 2024, primarily involving commodities, private credit, and U.S. Treasury bonds. In contrast, Synpulse estimates that the reachable scale, including the trade finance gap, could reach $14 trillion.

Based on current market trends, Standard Chartered Bank expects that by 2034, the overall demand for the tokenization of real-world assets will reach $30.1 trillion, with trade finance assets becoming one of the top three tokenized assets, accounting for 16% of the total tokenized market in the next decade. As demand may exceed supply in the coming years, there is potential to help address the current $2.5 trillion trade finance gap.

5. Four Benefits of Embracing Tokenization

Asset tokenization has the potential to transform the financial landscape, providing increased liquidity, transparency, and accessibility. While it holds promise for all market participants, realizing its full potential requires the collective effort of all stakeholders.

Trade finance stimulates the global economy, but traditionally, these assets have primarily been sold to banks. Tokenization opens the door to a broader investor base and ushers in a new era of growth and efficiency.

5.1 Improving Market Access

Today, institutional investors are eager to enter new, fast-growing markets. Emerging markets can be an attractive option for diversified investments. However, due to a lack of necessary local expertise and effective distribution networks, investors are unable to fully capitalize on the opportunities offered by emerging markets.

This is where the advantage of tokenization lies. By distributing trade finance assets through digital tokens, banks can enhance net interest income and optimize capital structures, while investors, businesses, and communities relying on trade finance can benefit from improved accessibility. A close examination of Standard Chartered Bank's early collaboration with the Monetary Authority of Singapore on Project Guardian highlights the transformative power of tokenization. This pilot demonstrates how open, interoperable digital asset networks can unlock market access and allow investors from different ecosystems to participate in this tokenized economy, paving the way for more inclusive growth.

5.2 Simplifying Trade Complexity

Due to the multi-party and cross-border nature of global capital and goods trade flows, trade finance is often viewed as a complex scenario. This asset class has a low degree of standardization, with varying ticket sizes, timelines, and underlying commodities, making large-scale investments difficult.

Tokenization provides a platform that can address this complexity.

Tokenization is not just a new way to obtain investments; it is also a driver of deep financing. Typically, trade finance is only applicable to mature tier-one suppliers, while "deeper" suppliers are often excluded from trade finance. As a solution, token-supported deep supply chain financing can eliminate complexity.

In addition to bringing much-needed transparency and efficiency to trade finance, tokenization can enhance the overall resilience and liquidity of the supply chain by enabling SMEs to rely on the credit ratings of anchor buyers.

Case B: Project Dynamo: Using Digital Trade Tokens to Address Trade Complexity

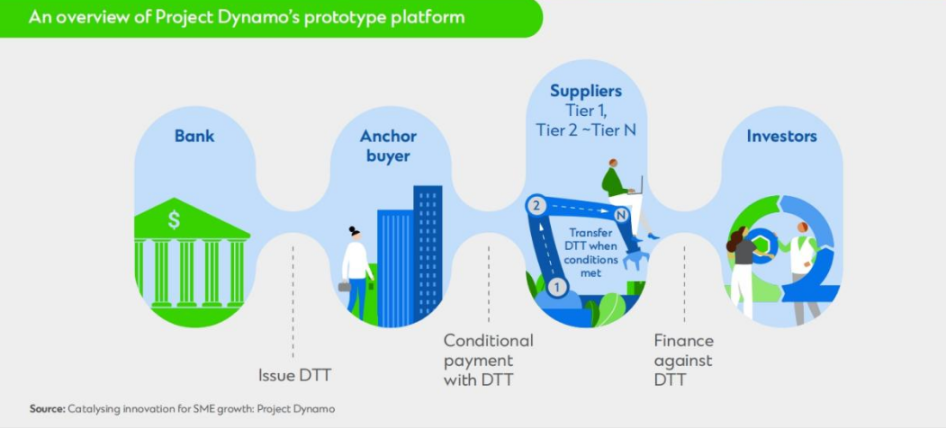

Project Dynamo is a collaborative initiative between Standard Chartered Bank, the Bank for International Settlements Hong Kong Innovation Hub, the Hong Kong Monetary Authority, and technology companies, serving as a typical example of using digital trade tokens to address trade complexities.

This collaborative effort has led to the development of a prototype platform where major buyers use tokens to make programmable payments to suppliers across their entire supply chain. Smart contract technology is employed to automatically execute and redeem these tokens based on specific events (such as triggering eBL or ESG conditions), thereby enabling efficient and transparent trade processes. Major buyers can also use tokens to make conditional payments to their SME suppliers, with tokens only being converted to cash when preset conditions (such as proof of delivery or electronic bills of lading) are met.

Token holders have various ways to handle their tokens. They can hold the tokens, sell them for financing, or use them as collateral for loans. The transfer of ownership through tokenization provides deeper suppliers with greater flexibility in managing their funds efficiently.

The benefits are not limited to individual participants. Digital trade tokens are issued in the form of "stablecoins" and are backed by dedicated bank funds or bank guarantees. Coupled with the programmability and transferability provided by blockchain infrastructure, institutional investors' confidence in investing in SMEs and supply chain financing (previously viewed as high-risk areas) is enhanced.

Project Dynamo is just the beginning. It lays out a blueprint to address the challenges faced by suppliers (especially SMEs) in obtaining deep supplier financing by providing more adaptive and efficient financing and payment methods. Ultimately, it creates a new financing channel for those who previously lacked access to traditional financing options.

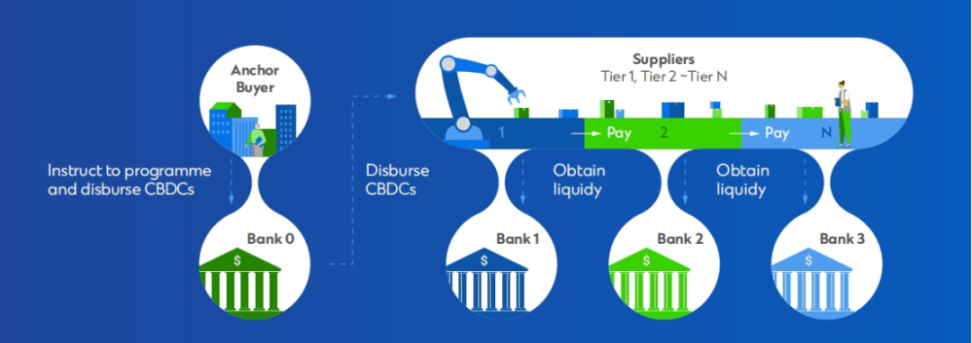

Case C: Optimizing Trade Processes / Financing Using CBDC Programmability

While tokenization brings exciting possibilities for addressing the complexities of the trade ecosystem, the programmability of central bank digital currencies (CBDCs) introduces another game-changing factor. These digital versions of fiat currency issued by central banks can leverage the automatic execution capabilities of smart contracts to further streamline trade and supply chain financing processes.

Imagine a scenario where a large company (anchor buyer) with a good credit record has a network of suppliers, many of whom are SMEs that struggle to obtain loans. With programmable CBDCs, the anchor buyer can instruct their bank to program future payable CBDCs and directly distribute them to suppliers, who can then use these CBDCs to enhance operational capital efficiency or make payments to lower-tier suppliers.

This simplified process offers numerous advantages for deep supply chain financing:

- Enhanced Flexibility: Deeper suppliers can use digital currency as collateral for borrowing fiat currency, unlocking new financing options and improving operational flexibility.

- Smoother Credit Assessment: Banks can simplify the credit assessment process for SMEs by utilizing customer information collected through payment data, reducing operational costs and risks associated with data collection.

- Scalability and Transparency: CBDCs make SME operations more scalable, and all parties in the supply chain can more easily report on ESG management and sustainability.

- Stability and Confidence: On a broader scale, CBDCs enhance the stability and transparency of the entire supply chain.

In the above scenario, smart contracts play a crucial role in automating payment and financing processes:

- Pre-Defined Contract: By utilizing smart contracts, CBDCs can be programmed, combining payment and trade information into a new trade financing tool.

- Purpose-Bound Payment: Deeper suppliers that do not meet credit requirements can use tokens as collateral to obtain financing related to the issuance purpose.

- Purpose-Bound Financing: Such CBDCs can be transferred by the anchor buyer to their suppliers, who can immediately use them as a form of payment to deeper suppliers.

- Obligation Fulfilment: Once the conditions in the smart contract are met, the smart contract will execute automatically, and the CBDC restrictions will be lifted.

5.3 Digital Securitization

While traditional finance effectively securitizes trade assets into financial products, it only applies to a limited subset of assets, such as working capital loans and import/export financing assets. Tokenization significantly expands this investable asset set.

Due to the short duration of trade assets, the entire process is operationally inefficient, and trade asset classes require comprehensive management solutions to track underlying assets, assess performance, and determine funding and payments.

These challenges can be fully addressed through the programmability of tokenization and smart contracts, along with the complexity and diversity handled by AI automation. By automating processes, data management can be simplified and automated. Each token is traceable as it is linked to accounts receivable. This aids in status monitoring, minimizes human error, enhances transparency for all parties involved, and supports the assessment of accounts receivable and financing amounts.

Programmability also simplifies the transfer of ownership during transactions, improving transaction efficiency.

As tokenization involves the standardized representation of accounts receivable, it creates a common language that makes accounts receivable management across jurisdictions more straightforward.

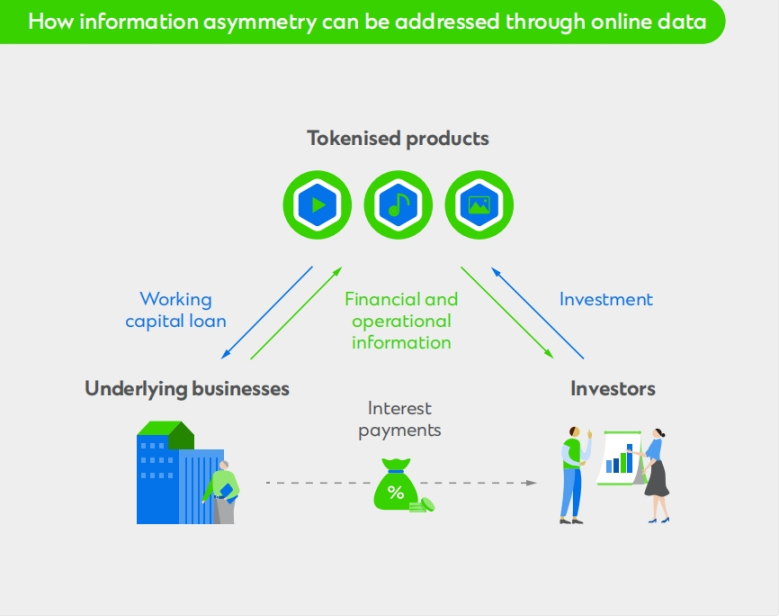

5.4 Reducing Information Asymmetry

Utilizing blockchain to trace underlying assets helps reduce information asymmetry between issuers and investors, thereby enhancing investor confidence.

Establishing a listing framework for tokenized assets is an important step in encouraging adoption and enhancing investor confidence, as publicly disclosing issuance documents makes it easier for investors to access the relevant information needed for due diligence. Listing tokens can also ensure that issuers maintain a certain level of transparency and meet regulatory disclosure requirements, which is crucial for many institutional investors.

Today's investors are more sophisticated and demand higher levels of transparency and control. We will soon see tokenized products emerge as a new method for reducing information asymmetry. In addition to representing underlying assets, tokens can also include other functionalities, such as providing online access to operational and strategic data from the aforementioned assets. For example, in the tokenization of working capital loans, investors can access operational parameters of the underlying business, such as profit margins or the number of potential customers in sales channels. This model has the potential to enhance investment returns and elevate transparency to a new level.

6. How to Participate in the Tokenization Market?

Asset tokenization has the potential to transform the financial landscape, providing higher liquidity, transparency, and accessibility. While it offers hope to all market participants, realizing its full potential requires the collective effort of all stakeholders.

5.1 Adoption

For institutional investors seeking to access new asset classes or enhance returns, tokenization can provide more specific and differentiated solutions to meet their clients' particular risk-return profiles and liquidity preferences.

Family offices and high-net-worth individuals (HNWIs) can benefit from more effective wealth growth through diversified and transparent product structures, unlocking previously inaccessible opportunities.

To seize this investment opportunity, investors should start with a solid foundation. As this is an emerging and evolving field, understanding new risks is crucial, so education should begin to build expertise.

For instance, participating in pilot programs will enable investors and asset managers to experiment and build confidence in tokenized asset allocations.

5.2 Collaboration

The industry is at a turning point in fully embracing asset tokenization. Market-wide collaboration is essential to realize the benefits of tokenization. Overcoming distribution challenges and achieving better capital efficiency requires collaborative efforts. Banks and financial institutions can expand their reach through collaborative business models, such as developing tokenized industry utilities. Similarly, intermediaries like insurance companies can serve as alternative distribution channels to broaden market access. Recognizing the transformative impact of tokenization on capital efficiency and operational efficiency, the industry must unite to leverage the power of shared infrastructure.

Beyond financial institutions, a broader ecosystem that includes technology providers and other participants must work together to create a supportive environment. Achieving interoperability, legal compliance, and efficient platform operations through standardized processes and protocols is crucial.

Tokenization efforts are currently in their infancy and fragmented, necessitating urgent collaboration across the industry to address these critical issues, combining the robustness of traditional finance (TradFi) with the innovation and agility of DeFi. This strategy will pave the way for a more stable, unified, and mature digital asset ecosystem, balancing technological advancement with regulatory consistency and market stability.

5.3 Promotion

Finally, not only market participants but also governments and regulators play a key role in promoting the responsible growth of the digital asset industry. By formulating policies that encourage global trade and support communities (such as job creation), they can foster industry development while mitigating risks.

A clear and balanced regulatory framework can promote innovation while guarding against the pitfalls emerging in the crypto space.

Establishing public-private partnerships with banks and other financial institutions is also crucial. These collaborations can accelerate industry development by promoting responsible and sustainable growth.

Through such collaboration, regulators can ensure that the growth of the digital asset industry benefits the economy, enhances global financial integration, creates jobs, and maintains market integrity and investor protection.

Report Link:

Real-world asset tokenisation: A game changer for global trade by Standard Chartered & Synpulse

https://www.hkdca.com/wp-content/uploads/2024/07/rwa-tokenization-game-changer-global-trade-synpulse.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。