The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens.

Many friends who read Lao Cui's articles will form observations about the world economy. Just this morning, a fan asked Lao Cui about the domestic 10 trillion debt conversion and whether it would affect the coin circle. Regarding domestic economic strategies, Lao Cui has always been cautious in speaking. To put it bluntly, debt conversion actually has no impact on the coin circle, but it has a huge impact on domestic practitioners. This may be the only time everyone can see that debts are being repaid. Once this is done, it is hard to say if there will be another chance. Currently, the domestic economic situation will not be greatly affected by this, especially after Trump took office, the suppression is likely to be maximized. We can only endure this wave to see the dawn. Let's not discuss this topic; we only talk about the coin circle. The growth of the coin circle is evident, and the current trend is a one-sided upward movement. If you are unsure about the market, you can wait for Bitcoin to grow before investing in Ethereum, which is more stable.

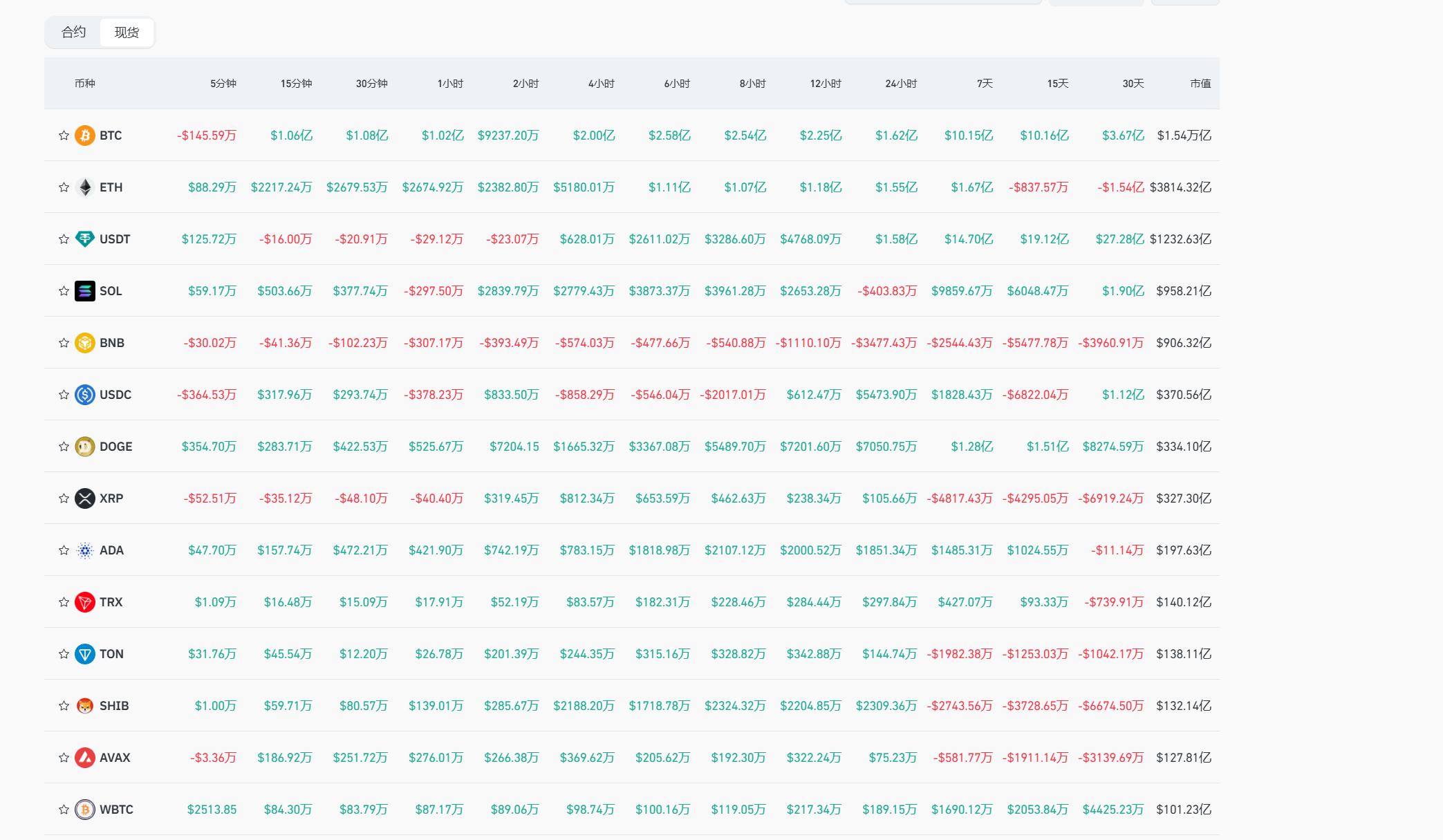

From a data perspective, Bitcoin maintains a daily market value growth of 0.01 trillion, basically keeping a daily increase of 1000 points. The overall ratio is relatively reasonable; there is growth only with inflow. However, the data ratio for Ethereum is somewhat unbalanced, showing a net outflow for both 15 days and 30 days, yet maintaining a growth pattern. This is entirely due to retail investors holding on tightly without selling, leading to short-term growth. Moreover, the inflow for 7 days and 24 hours shows a trend of net inflow, with a net inflow of 155 million in 24 hours and 167 million in 7 days. This figure proves one thing: the big players are crazily offloading. The inflow for one day is surprisingly proportional to the inflow for seven days, appearing in a 1:1 ratio. The biggest problem lies here; the inflow for seven days does not correlate with growth, meaning that this 167 million directly caused Ethereum to rise from 2356 to 3184. Everyone should have a sense of how much bubble there is; once a collapse occurs, Ethereum's drop will likely far exceed Bitcoin's decline. Moreover, this kind of collapse will make it impossible for everyone to escape. The risk of Ethereum is far greater than that of Bitcoin; everyone should have a measure in their hearts!

I just wanted to say that Bitcoin reaching 80,000 is just around the corner, but a wave of market movement directly pushed Bitcoin to 79,803. Now witnessing 80,000 is no longer enough to satisfy everyone's inner desire. Looking back now, Lao Cui's grasp of the big trend has indeed been quite accurate. At the beginning of the year, I promised everyone that Bitcoin would see 80,000 this year, and now it has basically become a foregone conclusion. Congratulations to those who chose to trust Lao Cui. Don't think that once Bitcoin reaches 80,000, this wave of bull market will end. The process from start to finish is still very long. Do you all remember the three elements Lao Cui mentioned at the beginning of the year? Listing, interest rate cuts, and Trump's rise to power. Meeting two of these three points can trigger a bull market for Bitcoin, and meeting all three will create a new historical high. This high point is hard to predict; after all, Bitcoin is a representative of emerging finance, and it has no historical data to refer to. Every upward path Bitcoin takes at this stage is a miracle. It can be said that Bitcoin represents the speculative market. How to help everyone grasp this speculative market, Lao Cui really has no way. It's a simple logic; when Lao Cui started promoting the arrival of the bull market in June and July, encouraging everyone to enter Bitcoin and Ethereum's spot market, those who did not follow this wave of operations basically said goodbye to this wave of bull market growth. The returns from spot trading at this stage are certainly not accessible to large capital. If you want to catch up with this wave of trends, you can only choose to play in a short-term manner. You may not be able to eat the meat, but you can still drink a bit of the soup.

Regarding the current trend response methods, I have already mentioned to everyone that in the short term, we can only focus on going long. Don't think that after setting a historical high, there will be a correction. It can be said that since Trump took office, the coin circle has been on a one-sided trend. The profit from short positions has always been maintained at 500-1000 points, while long positions are almost always above 1000 points in profit. Moreover, the risk of being trapped in short positions is far greater than that of long positions. Currently, if you are trapped in short positions, you can almost forget about getting out; you can only cut losses by going long to make up for the losses from short positions. Don't be distressed; the bullish trend only needs to grasp one or two waves, which is enough for everyone to have a good year. Remember one thing: Lao Cui has always emphasized that short position profits can be let go, while long position profits can be expanded. Currently, long positions cannot trap everyone's funds, and not even for a day can they reach that point. As long as you go long, everyone's returns can be expanded. The short-term turning point for Bitcoin is during the period from mid-month to before the interest rate cut in December, mainly depending on the influx of funds. This period may be a test for the funds in the coin circle. Everyone is very clear that the strong performance is not only in the coin circle; the US stock market and the A-shares also require a large amount of capital to nurture them. We cannot attract large capital; we can only rely on small amounts of capital to create myths in the coin circle.

As for the true peak of the coin circle, it is far from being reached. This trend shows that Bitcoin has already broken free from the constraints of other coins; it is completely a representative of the vanguard. Even if all other coins do not rise, Bitcoin will not stop its growth. The main point of this article is to clarify that at this stage, the return on investment for Bitcoin is always the first choice. For those who lack sufficient capital, it is definitely the most prudent way to choose to follow the rise of other coins later. Investing in other coins does not mean that you are gambling. The current growth of the coin circle has indeed attracted some novice users into the market. Users with a few hundred or a few thousand US dollars who want to try for profit should look at Ethereum and SOL; do not engage in contracts. Contracts are a market that tests capital levels extremely; if you don't have 20,000 to 50,000 to engage in contracts, you are essentially gambling. The result of this gamble is something that users with small capital cannot accept. Investment also emphasizes a good start; the first loss leads to a direct decline in trust in the coin circle, which Lao Cui also feels regretful about. Before this article was even sent out, Ethereum's rise had already arrived. You could say Lao Cui is a bit late to the party, but indeed, the speed is too fast.

Lao Cui summarizes: Contract users should still go long, and the point that can be synchronized with spot trading is the exit point. I have already had detailed discussions with each spot user about their arrangements. Just follow Lao Cui's estimates. I will also notify everyone in advance when to exit. For contract users, after entering, focus on going long. 80,000 will not temporarily become a fatal threshold; this wave of growth will far exceed everyone's expectations, and there is currently no pressure above. The depth of the correction around mid-month and before the interest rate cut is within a manageable range; the bull market will not end. After the correction, everyone can still choose to go long. The interest rate cut in December will definitely arrive on time. At this stage, the A-shares and the US stock market are the competitors. Both are fighting for breath; whoever shows signs of decline first will have problems in their stock market. Therefore, the means by which the Americans stimulate the economy will never be cut off in Trump's hands. You may say that Trump has not truly taken over yet, but you must understand that he will be the future master. All current measures will be referenced or even based on his opinions; his voice has already gained a certain status. Do not believe in the American smokescreens; after every wave of interest rate cuts, the Americans will always be tough-talking, with the aim of driving retail investors away, making them the biggest winners. Firmly believe in your own convictions. If you have any questions that you cannot grasp, feel free to ask Lao Cui. All long positions are still in the market.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, but aiming to win the game. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。