Multiple reports from major financial institutions predict that the tokenization of real-world assets (RWA) will grow rapidly in the coming years, with the managed asset size potentially exceeding $600 billion by 2030.

Written by: Martin Young

Translated by: Koala, Mars Finance

A significant number of new research reports from major traditional financial institutions forecast substantial growth and adoption of real-world asset tokenization in the coming years.

According to several recent research reports from major traditional financial institutions, the tokenization of real-world assets (RWA) is expected to experience explosive growth over the next five years, with the managed asset size potentially exceeding $600 billion by 2030.

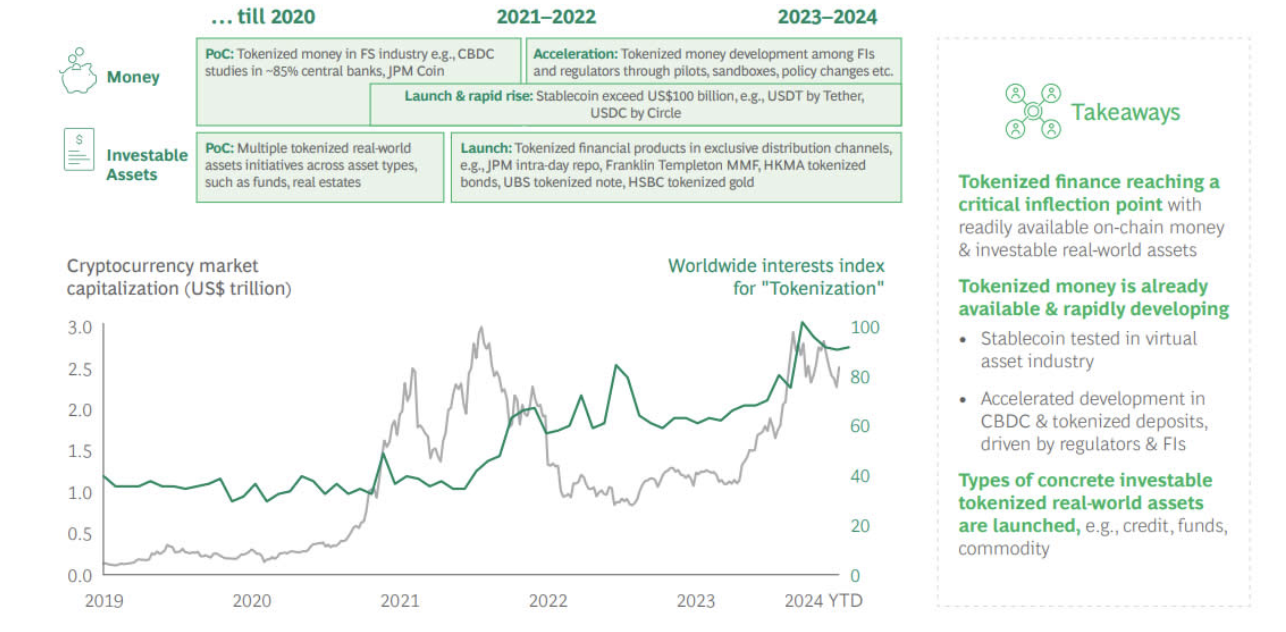

The global consulting firm Boston Consulting Group referred to RWA tokenization as "the third revolution in asset management" in a report released on October 29.

David Chan, Managing Director and Partner at BCG, stated, "We are seeing a growing trend in investor demand in the tokenized fund space."

The paper, co-authored by Aptos Labs and Invesco, estimates that the managed assets of tokenized funds could reach 1% of the global mutual fund and exchange-traded fund (ETF) AUM in just seven years.

The researchers noted, "This means that by 2030, AUM will exceed $600 billion."

Cointelegraph reported that the industry could grow 50 times by 2030.

"In the near term, we expect this trend to continue, especially as regulated on-chain currencies (such as regulated stablecoins, tokenized deposits, and central bank digital currency (CBDC) projects) come to fruition," Chan added.

The development of tokenized real-world financial assets. Source: BCG

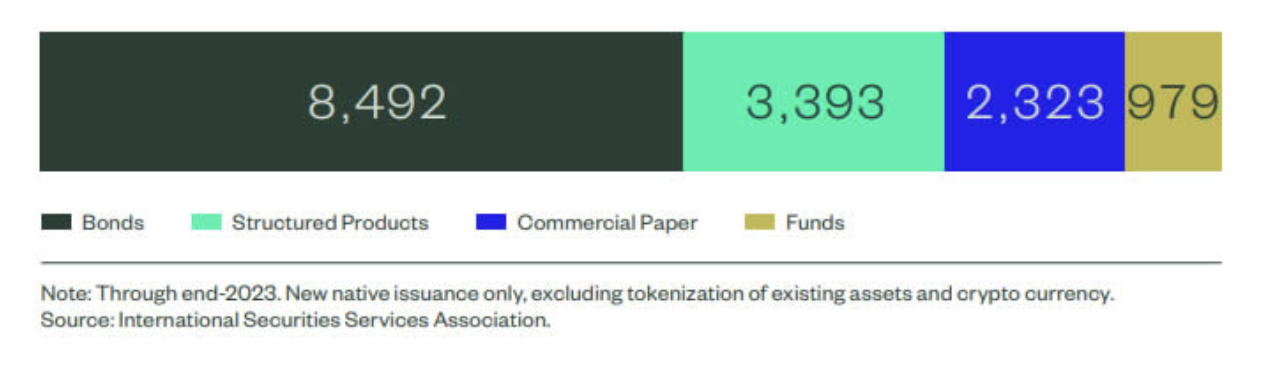

Additionally, another paper from State Street Global Advisors indicated that bonds are expected to lead the mass adoption of tokenized real-world assets, as the structural characteristics of bonds make them ideal candidates for blockchain issuance.

Researchers at State Street Global Advisors wrote in an October report on capital market asset tokenization, "The bond market is mature enough to adopt tokenized assets."

Elliot Hentov, Head of Macro Policy Research, and Vladimir Gorshkov, Macro Policy Strategist, stated, "The complexity of these instruments, the repetitiveness of issuance costs, and the intense competition among intermediaries support both rapid adoption and significant impact."

They added that blockchain technology could play a crucial role in "markets that value transaction speed, such as repos and swaps."

The report explained that bonds are essentially debt instruments with fixed maturities, possessing three main characteristics that make them highly suitable for tokenization: recurring costs that can be reduced through tokenization, complexities that can be automated via smart contracts, and collateral usage facilitated by on-chain transfers.

The bond market is a visible market for tokenization. Source: State Street

The report also noted that private equity funds exhibit higher transformative potential, but the adoption potential for public equity funds is lower due to the existing systems functioning well.

Researchers indicated that real estate and personal private equity tokenization face significant challenges, while commodities have the potential for direct ownership but face regulatory restrictions.

The Financial Stability Board also released a research report on asset tokenization this month. It stated that the adoption rate of RWA tokenization is low but growing, with most tokenization used for government debt, followed by debt funds, payment tokens, and equity in commodities.

The industry analysis platform rwa.xyz noted in an article on X on October 29 that there has been a recent increase in RWA research papers from institutions and asset management companies.

The platform stated that the total non-chain value of RWA is $13.25 billion, having grown 60% year-to-date.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。