Only one week left until the election, BTC returns to $71,000.

Written by: Tuo Luo Finance

Only one week until the election.

As the U.S. presidential election approaches, by the afternoon of October 27 local time, over 41 million voters across the country have already cast their early votes for the 2024 presidential election. As a result, the volatility in the crypto market has been increasing, and under the stimulus of "election trading," Bitcoin has initiated a rally, returning to the long-awaited level above $71,000 this week. The crypto sector has seen a general rise, with the MEME market particularly indulging in PolitiFi.

Returning to the two candidates, Harris and Trump are in an increasingly tight competition. Due to recent issues such as the mishandling of Hurricane "Milton" and the Israel-Palestine conflict, Harris's approval ratings have rapidly declined, allowing Trump to successfully overtake her. Not only has he expanded his advantage in betting odds and swing state polls, but he is also closely following in traditional general polls. From the current situation, Trump seems more likely to become the next U.S. president, and thus the Trump trade is about to ignite.

Looking back at their policy strategies, both candidates focus on government subsidies, with the core aim of promoting capital return. However, their methods are slightly differentiated. Trump promotes private enterprise development through tax cuts, while Harris tends to directly distribute money to subsidize residents. The capital return also varies; Harris has inherited Biden's governance philosophy, focusing on key core industries such as chips and new energy, while Trump still adheres to radical tariffs and an America-first stance.

In the current context, Trump's chances of winning are higher, and the financial market is naturally more focused on his policy proposals. Specifically, citing the views of CICC, Trump's main governance directions include domestic tax cuts, external tariff increases, deregulation, expulsion of illegal immigrants, encouragement of fossil energy, emphasis on technology, and diplomatic isolationism. The cumulative impact of these governance directions may bring upward inflation risks if Trump takes office, which could lead the Federal Reserve to take measures to slow down the pace of interest rate cuts and regulate higher terminal rates. From the capital market perspective, if economic resilience is maintained, a soft landing would benefit U.S. stocks, cyclical goods, and Bitcoin, but in extreme cases, inflation could suppress the capital market, benefiting anti-cyclical assets like gold.

Estimated impact of Trump's policies on the U.S. economy, source: CICC Research

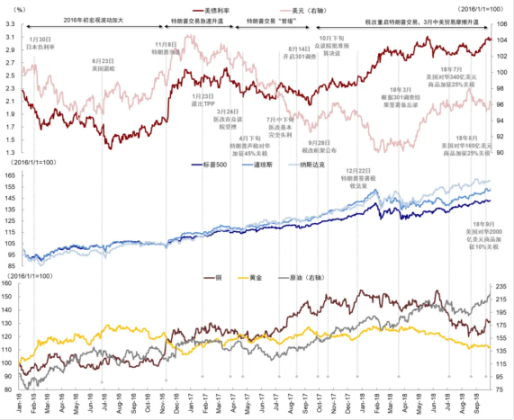

One can refer to the 2016 U.S. election, when the market also triggered the Trump trade, especially after his victory in November 2016, leading to a sharp rise in optimistic expectations. U.S. Treasury yields rose from 1.7% to 2.6% within a month, and the dollar index broke through 103 from 97. Looking at U.S. stocks, the three major indices rose by 10% during this period. In terms of commodities, inflation expectations drove copper and crude oil to surge, while gold reversed, dropping 3% within a month after the election.

Data source: Bloomberg, CICC Research Department

It is evident that Trump's victory in 2016 was a black swan event, but currently, the capital market has already priced in his potential victory. The most prominent asset is undoubtedly cryptocurrency. Trump has previously endorsed cryptocurrencies multiple times in public, and recently launched a family crypto project, leading the crypto market to have high hopes for him.

From the crypto prediction market Polymarket, the betting amount has exceeded $2.1 billion, with Trump's winning probability reaching 66.2%, far surpassing Harris by 33 percentage points, and the gap continues to widen. The Bitcoin market has reacted strongly to this, with Bitcoin continuing to rise as the election approaches, currently above $71,000, and expectations are undoubtedly one of the reasons for this increase.

What will happen to Bitcoin and the crypto market before and after the election? Major institutions and analysts have engaged in intense discussions on this topic.

Traders generally believe that the election presents an important trading opportunity, with many betting on a rebound related to the election. According to Matrixport data, the U.S. election is igniting market sentiment, with the funding rate for Ethereum perpetual futures reaching its highest level since May 2024, highlighting a strategy of buying on dips.

Top trader Eugene Ng Ah Sio also spoke on social media, stating that positioning has become clear, and an upward trend will open after the election. He emphasized that speculative long positions in October have largely been wiped out, and most people will avoid risks in the week following the election, with SOL being a clear asset choice.

Derivatives have drawn similar conclusions. Deribit CEO Luuk Strijers stated that derivatives traders are preparing for a bullish trend in Bitcoin in the days following the U.S. election on November 5. For options expiring on November 8, the open interest value exceeds $2 billion, with the main strike prices at $70,000, $75,000, and $80,000, and the put/call ratio is 0.55, indicating that the number of open call options is twice that of put options. Compared to Mark IV, Forward IV has shown a significant increase, especially during the election week, indicating that traders expect higher volatility. The forward implied volatility is at 72.29%, suggesting that prices may fluctuate by about 3.78% in the days following the presidential election. In contrast to put options, demand for call options is strong, indicating that investors are less concerned about managing downside risks.

Institutions also maintain a more optimistic attitude. Just half a month ago, Standard Chartered, often labeled as outrageous by the market, stated that Bitcoin is showing strong upward momentum and may approach its historical high of $73,800 on election day. They believe that factors driving Bitcoin's rise include the steepening of the U.S. Treasury yield curve, inflows into spot Bitcoin ETFs, and the increasing probability of Trump's victory. Based on the current Bitcoin price, it seems Standard Chartered may be right this time.

Matthew Sigel, head of digital asset research at VanEck, also predicted in an interview that investors are preparing for the U.S. election, mentioning that this election will follow a similar path to 2020, with Bitcoin starting to rise after a brief period of volatility following the announcement of the winner, and that Trump's chances of winning are higher. Bernstein also reiterated that if Trump wins the U.S. election next month, Bitcoin's price could reach historical highs of $80,000 to $90,000.

In this regard, hedge fund manager Paul Tudor Jones stated that one should not be limited to the presidential candidates, as he believes that regardless of who takes the presidency, the policies will all lead to "inflation," further driving up BTC and other commodity prices.

Bitfinex has also added quarterly factors based on the election, believing that Bitcoin will experience turbulence in the coming weeks, with the uncertainty of the election, the "Trump trade" narrative, and historically favorable fourth-quarter conditions creating a perfect storm for market trends. A report released by Bitfinex shows that options expiring on key dates before and after the election have higher premiums, with implied volatility expected to peak at 100-day volatility shortly after election day on November 8. Historically, the fourth quarter has ended with gains, with a median quarterly return of 31.34%, potentially pushing Bitcoin to reach or even exceed historical highs after the election.

Of course, although most institutions and traders express optimism, some analysts believe that betting on short-term volatility is a short-sighted approach. Jean Boivin of BlackRock Investment Research mentioned that the market underestimates the risk of a candidate contesting the election results next month, and a controversial election victory usually leads to weeks of legal battles, affecting risk assets.

Copper analysts directly pointed out that the market may be at a temporary top before the U.S. election, as according to on-chain data for Bitcoin, 98% of short-term holders' wallet addresses are currently in profit. Historically, when this ratio rises significantly, investors tend to lock in profits, often leading to rapid selling pressure.

Overall, in the entire crypto market, it can be seen that market sentiment remains unchanged, but the macro factors influencing cryptocurrency performance are shifting from monetary policy to the results of the U.S. election. The crypto market favors a favorable Trump, and his policy proposals will, to some extent, drive up Bitcoin and its strong correlation with U.S. stocks, leading many analysts to predict that Bitcoin is likely to break new highs in this trading cycle.

Even excluding the crypto sector, in other financial sectors, since September, when Trump's chances of winning increased, the market has also shown similar signals. Given Trump's more aggressive tariff policies, he has claimed that he may impose a blanket 10% baseline tariff on all goods entering the U.S. and impose tariffs of 60% or higher on China. Recently, the exchange rates of the renminbi, Mexico, and Vietnam have weakened. In the traditional energy sector supported by Trump, according to CICC Research Department data, as of October 24, oil and gas energy has surged by 5.8% since September 26, while the clean energy index has dropped by 9.4%. On social media, since September 23, the Trump Media Technology Group (DJT) has surged an astonishing 289.79%, clearly indicating a betting trend.

Of course, this currently only reflects the market's pre-election trading sentiment, and expectations are an important part of the current situation, but this means that expectations have also been taken into account, and once expectations materialize, a short-term pullback is very likely. On the other hand, even if Trump takes office, governance will also need to consider the House of Representatives, which dominates fiscal policy; otherwise, he will face governance constraints like Biden. However, according to the latest poll from the senior political observation site 538 (fivethirtyeight), Trump's chances of winning this year's presidential election have risen to 53%, with an 87% chance of the Republican Party taking the majority in the Senate from the Democrats, and a 53% chance of the Republican Party maintaining the majority in the House of Representatives, increasing the probability of a complete Republican victory. In this regard, the competitive pressure on the Democratic Party from both the White House and Congress has reached its peak.

Regardless, the intense volatility before and after the U.S. election has become inevitable, and any group betting on trading opportunities should remain vigilant. For the election, until the end, the outcome is never determined; even after the voting is completed, discussions regarding the validity of the results will not cease.

During this period, the most active in the crypto market may only be Bitcoin and MEME.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。