BTC has finally crossed the $70,000 mark, reaching a high of $71,607, with an intraday increase of nearly 4.5%. AICoin market data shows that BTC's strong rally has led to a recovery in the entire cryptocurrency market, with the total market capitalization increasing by over $100 billion, breaking the new high since August.

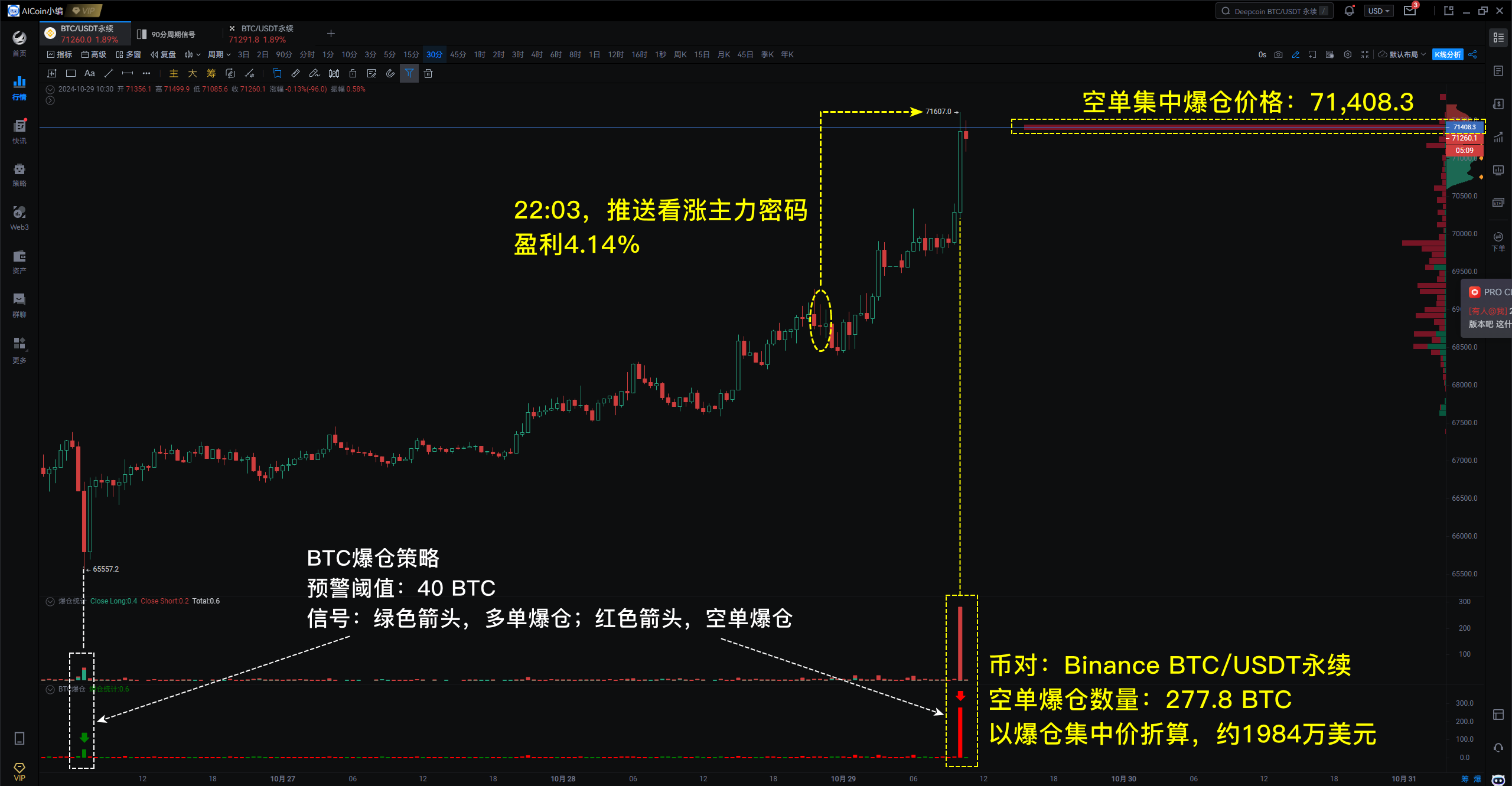

According to PRO liquidation statistics, during BTC's rise, there was a significant amount of short positions liquidated in the futures market, with the concentrated liquidation price at $71,408.3. Notably, between 10:00 and 10:30, the number of short liquidations for the Binance BTC/USDT perpetual pair reached 277.8 BTC, which, at the concentrated liquidation price, is approximately $19.84 million, triggering a 【BTC Liquidation】 strategy short liquidation warning.

According to liquidation statistics, after a large number of short positions are liquidated during an uptrend, the market is likely to pull back. After the short liquidation signal appeared, BTC has already dropped over 0.8%.

【BTC Liquidation】warning strategy (can be searched in community indicators by the same name): https://www.aicoin.com/link/script-share/details?shareHash=4mP9Wex0AZR5kxey

Additionally, according to statistics on large orders, this morning after BTC broke $69,900, large spot traders on platforms like Coinbase and Binance continued to sell, with a total of $132 million sold at an average price of $70,235.09. Among them, a rare large order on Coinbase amounted to as much as $11.28 million, while a large trader on Binance sold over $43.90 million at the $70,000 mark.

However, during the selling period of large spot traders, the OXK BTC long and short position count has been continuously declining, indicating that the main players still maintain a bullish outlook.

Track large trader behavior now: https://www.aicoin.com/vip

According to analysis by AICoin editors, today's BTC surge is mainly influenced by the following factors:

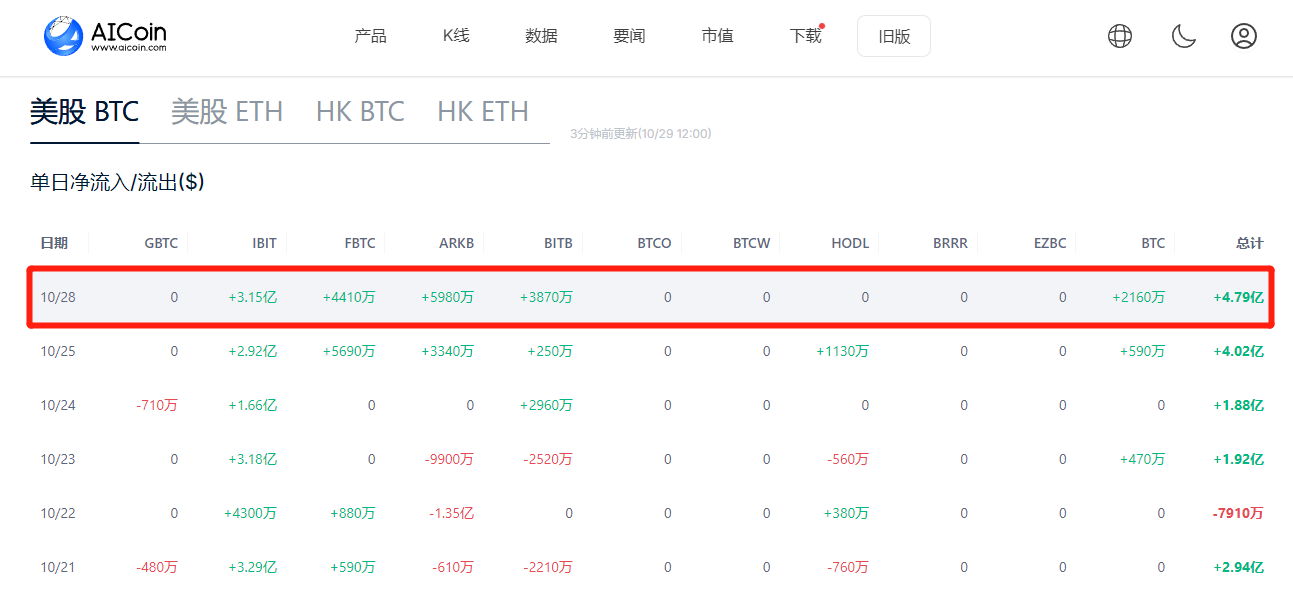

1. Continuous inflow of funds into the US spot BTC ETF market

According to AICoin monitoring, yesterday the net inflow of funds into the US spot Bitcoin ETF was $479 million, with IBIT being the main inflow source, amounting to $315 million; followed by ARKB with $59.8 million; and FBTC with a total of $44.1 million.

Based on past data performance, net inflows into the spot BTC ETF are bullish for BTC. Additionally, over the last four trading days, funds into the US spot BTC ETF have maintained an inflow trend, totaling $1.261 billion.

Track data now: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

2. The US election is approaching

With only 8 days left until the US election, Trump's chances of winning, who supports cryptocurrency, are higher.

3. Other factors: Expectations of a Federal Reserve interest rate cut in November, the narrative of the "Uptober" market (referring to the historical trend of rising markets in October), etc.

Recent market fluctuations have been significant, please manage risk accordingly; data is for reference only and does not constitute any investment advice!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。