Although using a Hong Kong credit card for virtual currency withdrawals provides convenience for cryptocurrency players in specific situations, the compliance of cross-border withdrawals remains a concern in the current increasingly strict financial and anti-money laundering regulatory environment.

Written by: Mankun Lawyer

"Safe deposit and withdrawal" is a challenge that cryptocurrency players, especially those from mainland China, cannot avoid. Under the current legal framework, how to avoid scams, card freezes, and reduce friction losses is a topic of concern for every cryptocurrency player. Mankun Lawyer often hears friends discussing "how to safely deposit and withdraw." From the market perspective, although the answers vary widely, the methods generally fall into a few categories:

- Familiar person / referral for withdrawal

- Offline face-to-face transactions

- Using U cards / VCC cards

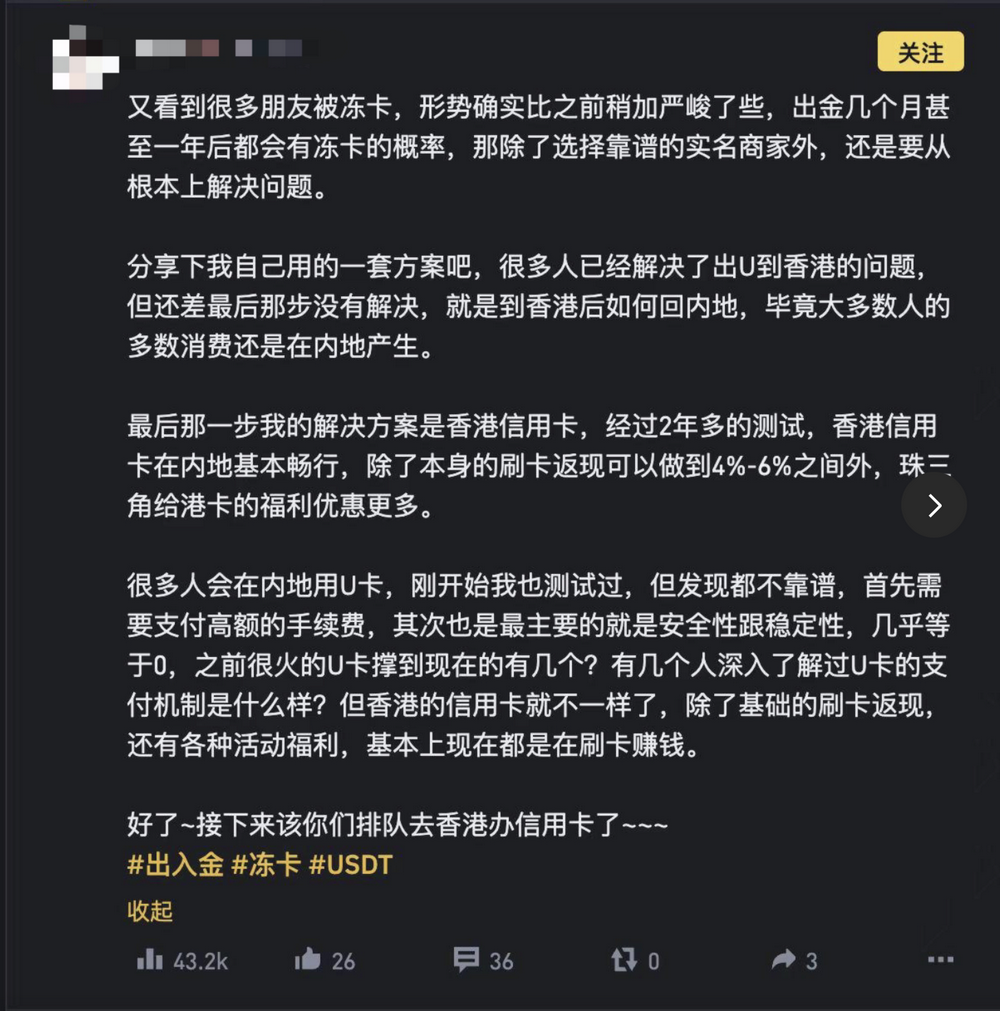

Recently, with the opening of virtual currency exchange policies in Hong Kong, Mankun Lawyer has heard another answer: directly withdrawing funds in Hong Kong. Additionally, while surfing the internet at a certain square, Mankun Lawyer came across a very "interesting" withdrawal plan, which I would like to share here.

Using Hong Kong Credit Cards in Mainland China

According to the shared information, cryptocurrency players looking to withdraw funds can do so using a Hong Kong credit card. The specific process is roughly as follows: players can apply for a Hong Kong credit card at a bank in Hong Kong and then use it for consumption in mainland China. According to the user's experience, he has been using a Hong Kong credit card for over two years, and this type of card is generally unobstructed in mainland China, while also enjoying some banks' cashback or points rewards of 4%-6%.

In practice, cardholders can use their Hong Kong credit cards for daily expenses in mainland China, such as shopping and dining, and then repay by selling virtual currencies (like USDT) in Hong Kong. Ideally, this withdrawal method can meet most of the withdrawal needs of mainland users:

Reduce transaction friction costs. Through cashback or discounts from credit card spending, players can reduce friction costs and improve the efficiency of fund usage.

Avoid financial regulatory issues. By using a Hong Kong credit card for consumption and repaying in Hong Kong, it can circumvent some of the mainland's regulations on large fund flows, reducing the risk of freezing or investigation.

Relatively high security. Since Hong Kong has opened virtual currency trading, cryptocurrency players generally believe that withdrawing funds from licensed virtual currency exchanges in Hong Kong not only alleviates concerns about encountering scams but also reduces the risk of having their cards frozen due to receiving illicit funds.

However, at the end of the day, the core point of this method is: for cryptocurrency players in mainland China, is withdrawing funds in Hong Kong safe, and consequently, can this credit card usage method be truly reliable?

Is Withdrawing Funds in Hong Kong Safe?

Although the Hong Kong Securities and Futures Commission (SFC) has implemented the latest virtual asset regulatory policies, all licensed virtual asset service providers (VASP) can legally provide virtual asset trading services to retail investors in Hong Kong. However, it is important to note that the definition of retail investors in Hong Kong is very limited.

On one hand, according to the relevant regulations of the Hong Kong SFC, the services of licensed exchanges primarily target local residents holding Hong Kong identity cards or overseas individuals holding long-term visas, which means that residents from mainland China cannot be directly classified as retail investors in Hong Kong. In practice, even if residents from mainland China can register at virtual currency exchanges, including OSL, HashKey Exchange, and HKVAX, they currently cannot undergo KYC due to stringent conditions.

On the other hand, mainland China has very strict regulations on virtual asset trading. The notice issued in September 2021 titled "Notice on Further Preventing and Dealing with Risks of Virtual Currency Trading Speculation" clearly prohibits mainland residents from participating in virtual currency trading. Therefore, even if mainland residents can register and participate in virtual asset trading in Hong Kong through certain means, they may still face the impact of policy changes, such as account freezes during the compliance process of virtual asset exchanges, especially concerning large cross-border fund transfers.

If you think you can withdraw funds through unlicensed virtual asset exchanges, such as Bybit, which previously allowed Chinese residents to register, or through offline face-to-face transactions or referrals, then the safety of the players may also be significantly reduced.

- First, if a transaction dispute occurs, users may lack legal protection.

- Second, such platforms or OTC services may have significant risks regarding transparency, fund security, and account privacy.

- Additionally, they are more susceptible to the influence of illicit funds, leading to accounts being monitored by regulatory authorities, and may even trigger money laundering risks, resulting in more severe legal consequences.

If you have completed registration and passed KYC through certain means, you should also pay attention to some compliance issues related to credit card usage.

Are Hong Kong Credit Cards Reliable?

According to the above sharing and analysis, a Hong Kong credit card can be used as a tool and pathway for withdrawals. However, you may not know that using credit cards also has restrictions and compliance issues.

Monitoring of Frequent Cross-Border Consumption

Large and frequent cross-border consumption may trigger risk monitoring by banks.

If mainland cryptocurrency players need to use Hong Kong credit cards for daily expenses, or make large purchases in mainland China, or frequently use credit cards within a short period, it may attract the attention of the bank's risk control. The transaction monitoring mechanism of credit cards will identify such abnormal consumption patterns and may trigger the bank's review or restriction measures, such as requiring supplementary information on the purpose of the transactions.

You might think that applying for several credit cards could avoid this issue. However, according to the "Foreign Exchange Management Regulations" and "Anti-Money Laundering Law" in mainland China, the annual foreign exchange limit for individuals is capped at $50,000 per person. This means that if your total annual spending exceeds this limit, the credit card route becomes unusable.

Scrutiny of Repayment Fund Sources

Although repaying in Hong Kong dollars avoids direct use of virtual currencies, banks still have compliance requirements for large repayments. Banks may trace high-value repayments identified as abnormal to ensure the legality of the fund sources. If the source of funds is unclear or poses a money laundering risk, banks may temporarily freeze the account or restrict transactions and may require cardholders to provide proof of the legality of the funds.

Additionally, during the tracing process of repayment funds, if it is found that the source of USDT funds involves RMB or other foreign currencies, forming a "fiat currency - USDT - Hong Kong dollar" link, it may trigger foreign exchange violations and even touch on criminal risks.

Mankun Lawyer's Summary

Although using a Hong Kong credit card for virtual currency withdrawals provides convenience for cryptocurrency players in specific situations, the compliance of cross-border withdrawals remains a concern in the current increasingly strict financial and anti-money laundering regulatory environment. For cryptocurrency players in mainland China, the legal risks of virtual currency trading and the strict monitoring of fund flows may trigger fund freezes or legal investigations at any time. When deciding whether to participate in virtual currency trading and any withdrawal methods, do not focus solely on immediate convenience while ignoring potential legal risks. A prudent strategy should be legal and compliant, and one should not pay a high legal price due to momentary negligence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。