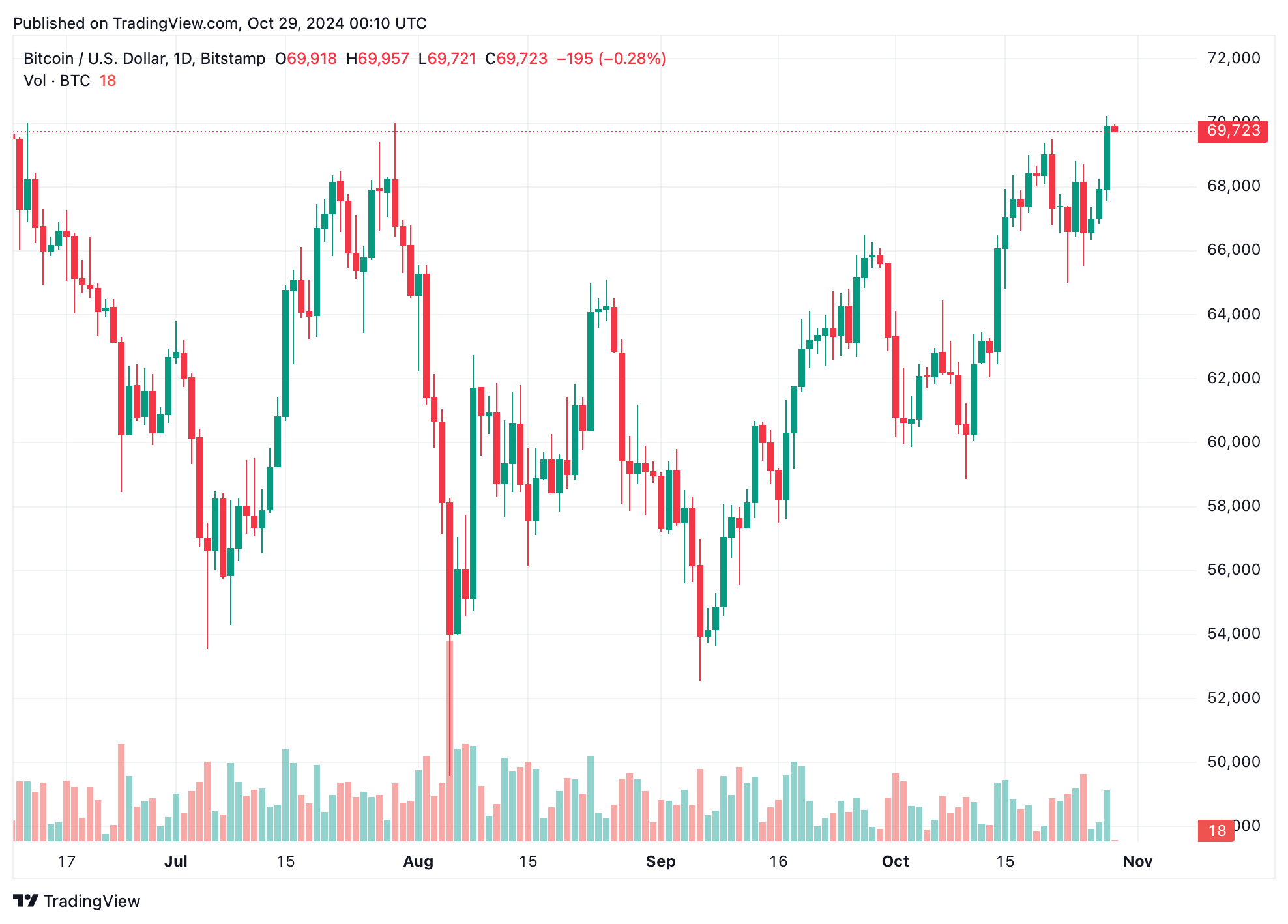

By 6:10 p.m. ET, bitcoin (BTC) had climbed 2.6% against the U.S. dollar, hitting the $70,218 mark. As of 8:10 p.m. ET, the price cooled slightly, hovering at $69,723, just under that $70K psychological barrier. Notably, bitcoin hasn’t revisited the $70K range since July 28, 2024.

The week ahead is loaded with impactful events, including the U.S. election on Nov. 5, Wednesday’s U.S. Gross Domestic Product (GDP) report, and the Federal Open Market Committee (FOMC) meeting set for two days after the election. Moreover, it’s not just bitcoin basking in gains; several altcoins joined the rise.

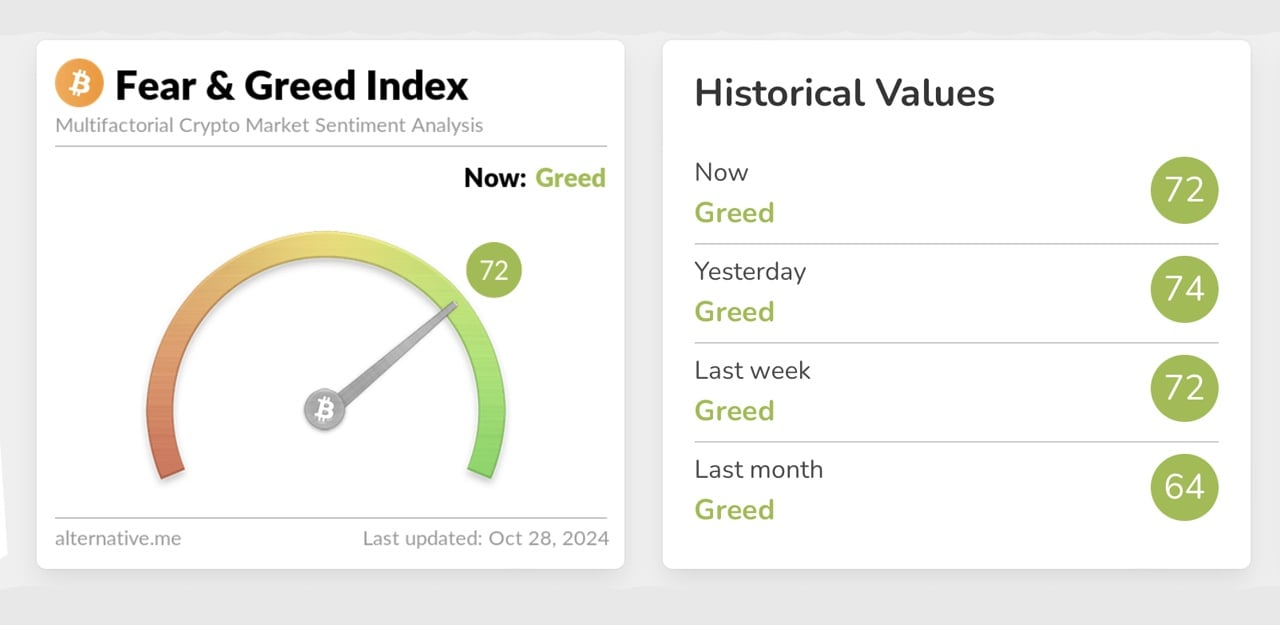

The crypto market as a whole now boasts a $2.31 trillion valuation, with $84.06 billion in trade volume over the past 24 hours—a strong 86% jump from Sunday’s figures. Current data from coinmarketcap.com places bitcoin dominance at 59.8% of the crypto economy. Meanwhile, the Crypto Fear and Greed Index (CFGI) from alternative.me is signaling “greed” with a score of 72 out of 100.

Interestingly, in South Korea, Upbit shows a premium, with bitcoin priced at $70,427 as it holds steady in the $70K range. Bitcoin futures are also buzzing, with open interest (OI) soaring to $40.91 billion, led by CME Group’s share of $11.49 billion. Binance follows with $8.73 billion in OI, Bybit takes $6.29 billion, and Bitget holds $4.06 billion.

On the derivatives front, activity seems cautious, as only $168.69 million in positions were liquidated over the past day, according to coinglass.com. Most liquidations hit short positions, with $95.81 million lost on shorts—$39.59 million for BTC shorts and $16.76 million for ETH shorts. The $70,000 mark carries psychological weight, and even a touch below that level, BTC sits only 5.3% shy of its all-time high of $73.7K, reached on March 14, 2024.

Should BTC break through this range, it would enter uncharted territory, with the potential for anything to unfold. As bitcoin edges closer to its historic peak, anticipation is palpable within the crypto space. With the U.S. election, economic indicators, and critical Federal Reserve decisions just days away, investors are bracing for potential shifts. Whether bitcoin sustains momentum or faces resistance, the unfolding week promises to shape market sentiment, potentially setting the tone for year-end dynamics in digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。