Master Discusses Hot Topics:

Let's continue discussing the trends of Bitcoin and Ethereum mentioned in yesterday's article. Recently, Bitcoin has indeed followed an upward trajectory, and with the support of ETFs, it has become a hybrid asset—more crypto than stocks, yet with some fundamental support from the traditional market.

On the other hand, Ethereum seems like a lost little brother, facing the market's harsh realities alongside altcoins. Not long ago, Bitcoin was surviving on liquidity, thriving with every influx of funds. However, now that ETFs are in play, it has started to stabilize based on fundamentals.

ETH: Is it Inevitable to Fall Below $2000?

Looking at ETH and the altcoins, the situation is completely different! With the dollar rebounding and liquidity being scarce, they are shivering in the market's winter, becoming the best interpreters of the market's weather patterns.

Ethereum's two-and-a-half-month rebound seems to have reached its peak, and the next step appears to be a drop below $2000. Don't worry, ETH seems to be telling us that it is already accustomed to a steady downward path, falling steadily.

Will Bitcoin Reach New Highs? Market Seems to Be on Standby

As for whether Bitcoin will fake a breakout and reach new highs, many retail investors are anxious. It might stage a false breakout to attract some enthusiasm before dropping again. Does this strategy look familiar? Be careful not to get trapped by looking back!

Summary: The Big Brother is Steady, Little Brother Should Take Care

So the big brother remains the big brother, at least the fundamentals are holding up; as for the little brother, don't get too excited, take it slow. Diversify risks and enter the market rationally, avoiding diving headfirst into the ups and downs. Remember, a market full of drama loves to reverse, but what remains unchanged is the warmth and coldness of the human experience!

Master Looks at Trends:

Bitcoin was steadily moving upward, but unexpectedly, a series of left and right punches caught it off guard—Israel is staging a revenge drama while Tether faces scrutiny from U.S. prosecutors. The price also disappointingly took a "high-altitude dive," dropping sharply.

We know that such unforeseen events can often derail Bitcoin's trajectory. Therefore, when investing, it's wise to be prepared for sudden changes. Flexibly adjust your positions to be ready for unexpected situations.

Resistance Levels Reference:

First Resistance Level: 67200

Second Resistance Level: 68000

If the weekend market wants to return to the 68K position? That's wishful thinking, but if it unexpectedly rebounds to 67.2K, everyone should pay attention to whether it can hold that position.

Also, don't expect a V-shaped reversal; there won't be any significant volatility. It is advisable to maintain a short-term consolidation mindset around the 20-day moving average resistance level and near 67.2K, and reassess based on trading volume if it truly breaks through.

Support Levels Reference:

First Support Level: 66200

Second Support Level: 65300

If the first support level can be held, one might consider entering the market at a rebound angle. But don't rush to call a bottom; the upper resistance is still lurking. Additionally, the 120-day moving average is our guiding indicator; observing its movement will help avoid getting lost!

In the short term, bearish sentiment is clearly increasing. To maintain a rebound, it's best to hold the first support level and always keep an eye on not falling out of the safe zone during a converging pattern.

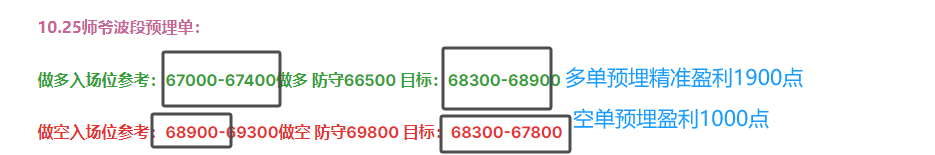

Yesterday, Master set a buy order in the 67000-67400 range, and the market dropped to around 66900 at about 5 PM. Subsequently, it peaked at around 68842 in the early morning, and all buy targets were fulfilled, netting 1900 points!

Meanwhile, for friends who shorted around 68900-69300, the short target of 68300-67800 was also reached, totaling a profit of 1000 points!

Today's Trading Suggestions:

Bearish sentiment is growing, and the short-term rise is merely a flicker before the fall. In short, near the 20-day moving average, one can consider shorting, while near the 120-day moving average, consider light long positions.

10.26 Master’s Wave Trading Orders:

Buy Entry Reference: 65800-66200, Stop Loss: 65300, Target: 67200-68000

Sell Entry Reference: 67200-67600, Stop Loss: 68100, Target: 66200-65300

This article is exclusively planned and published by Master Chen (WeChat: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans and community live broadcasts are now available!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Any other advertisements at the end of the article or in the comments are unrelated to the author! Please be cautious in discerning authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。