A new day, a new round of inflows into BlackRock's Bitcoin ETF IBIT, and correspondingly new purchases by the hedge fund giant of cryptocurrency in its wallets.

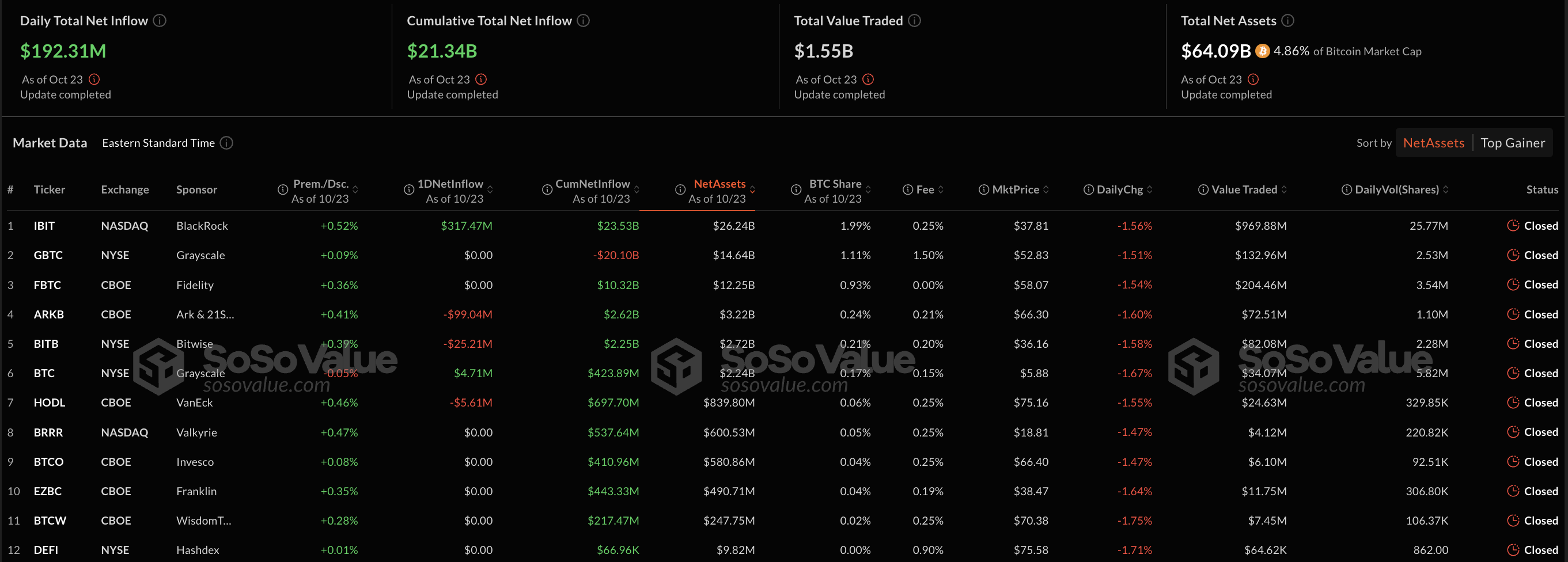

According to SoSo Value, the IBIT Bitcoin ETF has seen inflows of more than $317 million in the past 24 hours. By comparison, the day before, inflows into this instrument totaled $42.98 million, so we can literally say that inflows increased by a little over 737% in one day.

Related

Wed, 10/23/2024 - 11:53BlackRock Bets Big on Bitcoin, While Fear Takes Over Market

Gamza Khanzadaev

HOT Stories Satoshi’s Bitcoin Vision to Be Realized by 2030 – Details from CryptoQuant CEOEthereum Keeps Plunging Against BitcoinTesla Confirms It Still Holds BitcoinShiba Inu (SHIB) Very Close to Failure, XRP Returns to July Level: What to Expect, Bitcoin (BTC) Has to Avoid Falling Below This Level

Inflows into ETFs directly from BlackRock have continued unabated for almost two weeks now. During this time, the amount of money raised by IBIT is already approaching a staggering $2 billion.

Source: SoSo Value

It is natural that such inflows into ETFs are accompanied by purchases of cryptocurrency from the issuer for the same amount.

BlackRock's Bitcoin

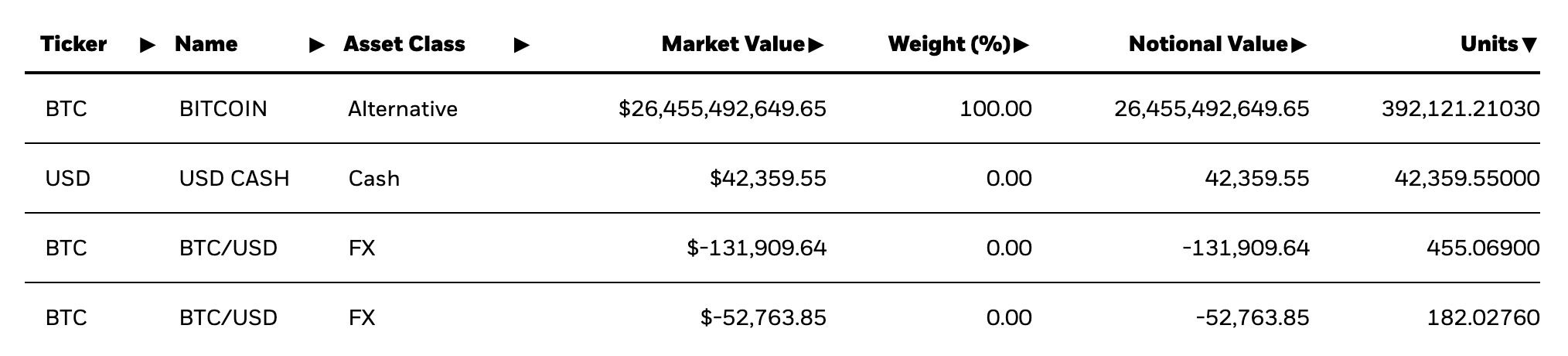

For instance, prior to today's $317 million net inflow data, it was known that BlackRock's iShares Bitcoin Trust ETF held 392,121,2103 BTC as collateral. At current prices, this is equivalent to approximately $26.27 billion. With the new inflows, it is clear that this amount will exceed $27 billion today if approximately 637 BTC are added.

Source: iShares Bitcoin Trust ETF

Related

Thu, 10/24/2024 - 07:52Ethereum Keeps Plunging Against Bitcoin

Alex Dovbnya

As long as inflows into Bitcoin ETFs continue, we can expect BlackRock to continue to suck up the market. However, already one of the largest holders of cryptocurrency in general, it seems that the instrument is just an excuse, and the hedge fund's real interest is in owning Bitcoin itself.

Where BlackRock will stop in its crypto ambitions is the major question.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。