The results of the U.S. election will benefit the development of the cryptocurrency industry.

Written by: Zach Pandl, Will OgdenMoore; Grayscale Research

Translated by: Shaofaye123, Foresight News

TL; DR

- The results of the U.S. election could have a significant impact on the cryptocurrency industry. The next president and Congress may pass legislation specifically targeting cryptocurrencies and may adjust tax and spending policies that affect financial markets more broadly.

- Current polling data and implied odds from prediction markets like Polymarket indicate that the election competition is very fierce. As of October 15, this data suggests a higher likelihood of Republican control of the Senate. Given the Senate's role in confirming presidential appointments to key regulatory agencies (such as the SEC and CFTC), changes in Senate control are highly relevant to cryptocurrencies.[1]

- At the voter level, data shows that cryptocurrency is a bipartisan issue, with a slightly higher Bitcoin ownership rate among Democrats compared to Republicans. Additionally, candidates from both parties have expressed support for cryptocurrency innovation.

- Regardless of which party is in power, comprehensive bipartisan legislation may be the best long-term solution for the U.S. cryptocurrency industry.

Although the 2024 U.S. election involves many issues, the cryptocurrency industry has successfully captured candidates' time and attention. This can be attributed to changing voter preferences: in a national survey conducted by Harris Poll on behalf of Grayscale, we found that about half of U.S. voters are more inclined to vote for candidates who are more interested in cryptocurrency education/information. The increased voter attention to cryptocurrencies reflects the urgency for comprehensive legislation as the industry develops and innovates.

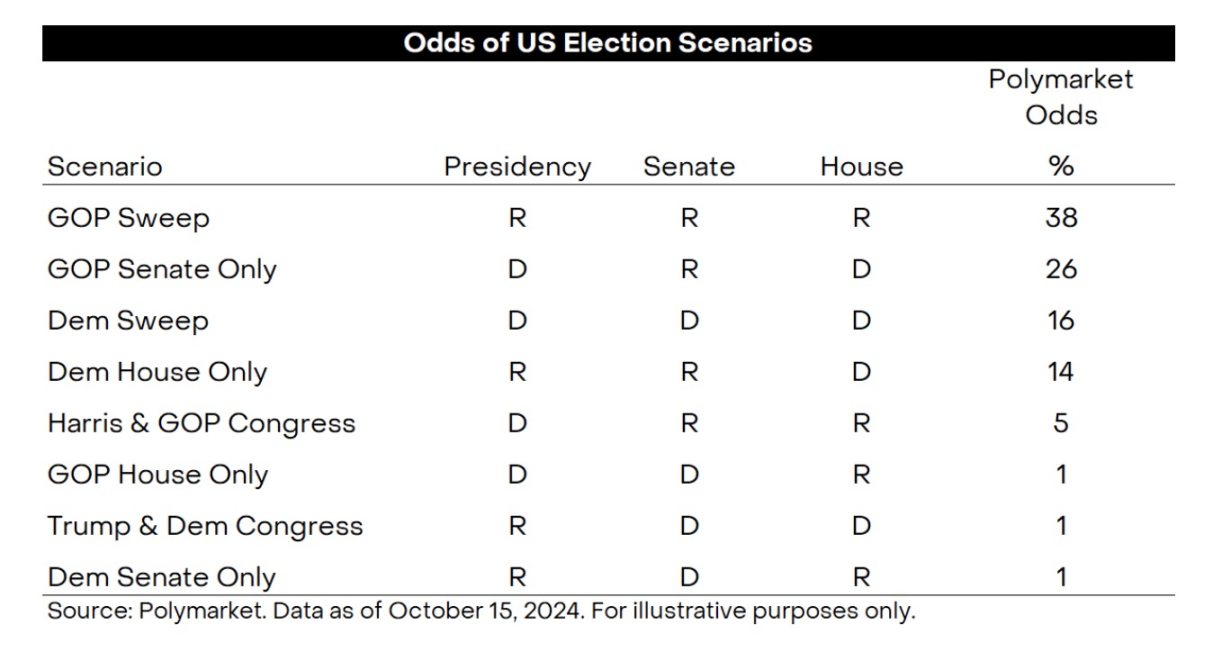

Below, we will consider potential election scenarios for the White House and Congress and their possible impacts on the cryptocurrency market. For each outcome, we will report the implied odds from Polymarket. "Polymarket is a blockchain-based prediction market that has seen a sharp increase in adoption this year."

Most outcomes carry a high degree of uncertainty: polling data and prediction markets show that the election results are closely contested. However, this data suggests that Senate control may be poised to shift (from Democrats to Republicans), which could be a change with direct implications for the cryptocurrency industry, given the Senate's role in confirming presidential appointments.

White House

Polymarket Odds: Trump 57% / Harris 43% (as of October 15, 2024)

Result: A Trump victory may mean more supportive regulators and an expanded budget deficit, both of which could be positive for Bitcoin and cryptocurrencies. However, Trump's fiscal policy plans require support from Congress, and tariffs could create market uncertainty.

The next president will set the cryptocurrency policy agenda, nominate key regulatory agencies, and push for broader economic policy decisions regarding taxes, spending, and tariffs. Former President Trump has shown great enthusiasm for the digital asset industry, claiming he wants to make the U.S. the "world capital of cryptocurrency and Bitcoin" [2]. He has also announced plans to launch a cryptocurrency lending platform called World Liberty Financial, although details of the project are yet to be disclosed.[3]

Vice President Harris has recently made more supportive statements regarding digital assets, explaining that her administration will "encourage innovative technologies like artificial intelligence and digital assets while protecting consumers and investors." [4] Reports indicate that her campaign team will also announce plans to protect crypto assets and develop a "cryptocurrency and other digital asset regulatory framework." [5]

However, the details provided by Harris's campaign team are limited. Notably, as some market participants and commentators in the cryptocurrency industry have observed, the current Biden/Harris administration has taken a confrontational stance towards industry oversight, such as filing a series of lawsuits, restricting the use of traditional banking services, and vetoing bipartisan legislation.[6] Therefore, a Trump administration is more likely to nominate regulators who support innovation in the cryptocurrency industry.[7]

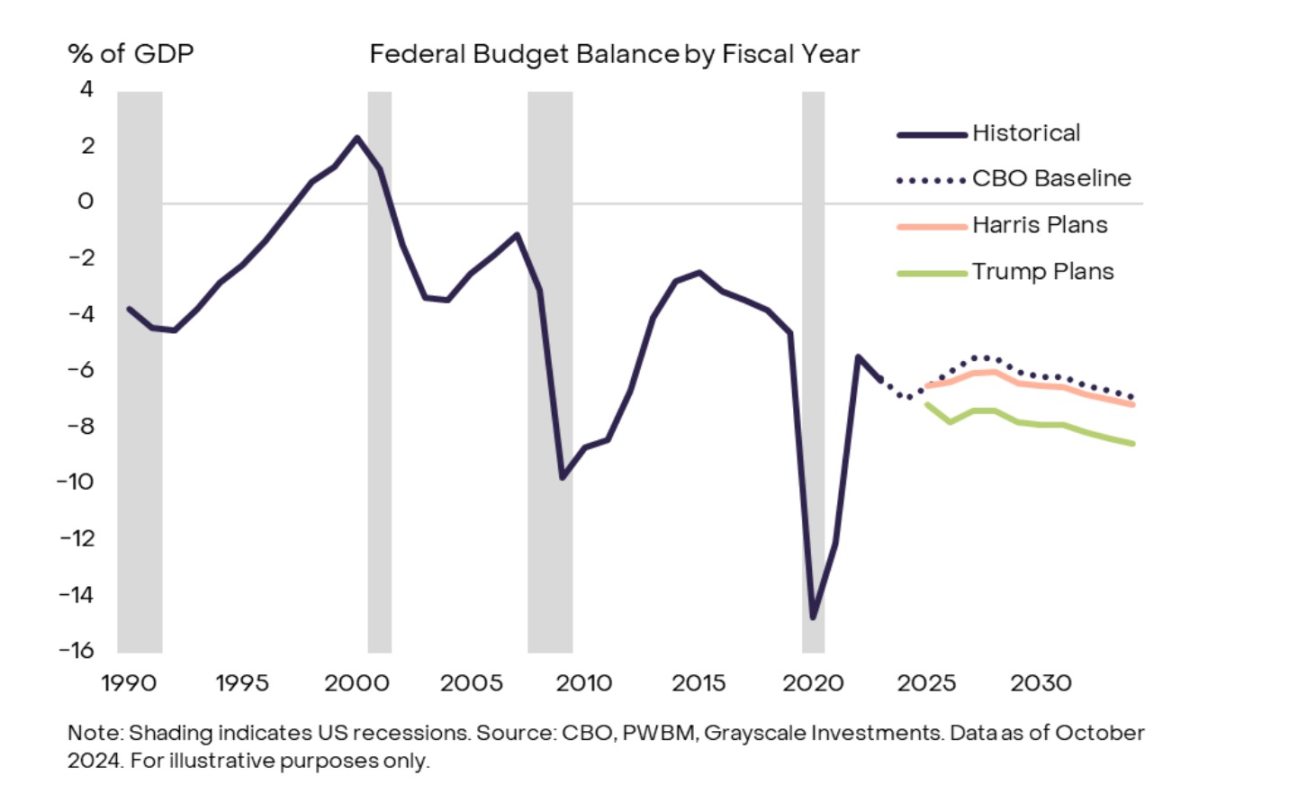

The outlook for Bitcoin may also depend on the macro policy choices of the next administration (for more details, see Bitcoin and Biden vs. Trump's macro policy issues). Research analysis indicates that both Trump and Harris's fiscal policy proposals would lead to larger budget deficits—despite the federal deficit already being quite large.[8] Before incorporating campaign proposals, the Congressional Budget Office (CBO) projects that the federal deficit will average 6.2% of GDP over the next 10 years. According to the Penn Wharton Budget Model (PWBM), although Harris intends to raise the corporate tax rate to 28%, her proposed expansion of the child tax credit and other reform proposals would increase the average budget deficit as a percentage of GDP over 10 years to 6.5%.[9] Meanwhile, PWBM analysis indicates that former President Trump's plan to extend the 2017 tax cuts and lower other tax rates would increase the average budget deficit as a percentage of GDP over 10 years to 7.8% (Chart 1).[10]

Grayscale Research believes that, all else being equal, a massive budget deficit in the medium term will have a negative impact on the dollar while positively impacting Bitcoin.

Chart 1: Neither candidate plans to reduce the federal deficit

However, in practice, the market impact remains uncertain. First, changes in fiscal policy must be approved by Congress, and it is currently unclear which campaign proposals can become law—especially in the case of a divided government. Second, former President Trump also intends to significantly raise tariffs. Tariff increases often boost the value of the dollar and may put pressure on risk assets, especially if other countries retaliate.[11] While tariffs do not directly affect Bitcoin, the valuation of crypto assets is related to broader market factors, so tariff increases could pose downside risks to prices.

Senate

Polymarket Odds: Republican Control 78% / Democratic Control 22%

Result: Although members of both parties express support for certain aspects of crypto policy, Republican control may have a more positive impact on the cryptocurrency industry due to the Senate's key role in confirming regulatory appointments.

The Senate, along with the House of Representatives, is responsible for passing changes to fiscal policy[12] as well as legislation targeting cryptocurrencies. The Senate is also responsible for confirming presidential appointments, including the heads of the SEC, CFTC, and the Federal Reserve Board. Given the uncertain regulatory status of many crypto assets, the Senate's oversight of agency appointments is crucial for the industry.

The cryptocurrency legislation currently under consideration in this Congress is bipartisan, including the Digital Commodities Act from the Senate Agriculture Committee and stablecoin legislation from the Senate Banking Committee.[13] In contrast, Republican senators are more supportive of the cryptocurrency industry. For example, the crypto industry lobbying group Stand With Crypto[14] gave an "A" grade to 39 of the 49 Republican senators on crypto issues, while only 6 of the 51 Democratic senators received an "A" grade.[15] Additionally, voting patterns also indicate that Republicans are more supportive of the cryptocurrency industry: when the Senate voted to repeal SEC Staff Accounting Bulletin (SAB) 121[16], 48 Republicans voted in favor, while only 12 Democrats did.

Currently, the Democrats control the Senate, thus holding the committee chair positions, determining legislative priorities, and ultimately having decisive voting power over some presidential appointments. Given that Republicans generally support crypto innovation more, Grayscale Research believes that a change in Senate control could have a positive impact on the crypto market—while also considering the critical role of regulatory oversight, this could be said to be the most important electoral outcome for the industry.

House of Representatives

Polymarket Odds: Republican Control 44% / Democratic Control 56%

Result: Control of the House is crucial for determining whether the government is unified or divided, which will, to some extent, determine whether the next president can achieve their fiscal policy goals, thereby having a broader impact on financial markets.

Like the Senate, any changes in fiscal policy or the passage of cryptocurrency-specific legislation require support from the House. The legislation currently under consideration in this Congress has received bipartisan support, but Republican support is higher. For example, for the FIT21[17] bill from the House Financial Services Committee, 208 Republicans voted in favor, while only 71 Democrats did, including former Speaker Pelosi and Democratic Executive Clark.

Control of the House will determine the tasks of committees and legislative priorities, which may impact crypto policy. But the most significant impact is whether one party controls both the White House and both chambers of Congress—a "unified government"; or whether control is split between the two parties—a "divided government." Under a divided government, changes in fiscal policy may be difficult to achieve.

Eight Scenarios

For the upcoming U.S. election, there are three institutions (the White House, Senate, and House of Representatives) involved, each with two possible outcomes (Republican or Democratic control). Therefore, there are eight different possible scenarios, each with different impacts on the cryptocurrency industry. Chart 2 provides the implied odds from Polymarket for each scenario.

Chart 2: The election is highly uncertain according to prediction markets

Grayscale Research highlights several key points. First, among the four more likely scenarios, none is clearly dominant—in other words, the balance of power post-election remains highly uncertain. Second, observers are divided on whether we will have a unified or divided government: the combined odds of either the Democrats or Republicans sweeping the election remain close to 50%. Third, according to Polymarket data, the only specific outcome with a relatively high probability is Republican control of the Senate. As long as this situation persists, we believe the election results will trend in a direction favorable to the crypto market, given the Senate's critical role in confirming presidential appointments.

Cryptocurrency is a bipartisan concern

At the voter level, cryptocurrency is a bipartisan concern. The results of a national survey conducted by Harris Poll on behalf of Grayscale show that among self-identified Democrats, the Bitcoin ownership rate and familiarity with cryptocurrencies are higher than among Republicans, and Democrats' interest in cryptocurrencies has generally increased this year.[18] Additionally, any new cryptocurrency legislation will require an absolute majority in the Senate, necessitating bipartisan support.

Nevertheless, given the Senate's critical role in confirming presidential appointments to regulatory agencies, Grayscale Research believes that Republican control of the Senate is a significant positive for the cryptocurrency industry. Therefore, current polling and the implied odds from prediction markets indicate that the cryptocurrency market is likely to see favorable outcomes.

However, there are many uncertainties regarding the next administration's legislative prospects for cryptocurrencies or possible adjustments to fiscal policy. In Grayscale Research's view, the best outcome for the long-term development of the cryptocurrency industry would be for both parties to continue working towards more comprehensive legislation.

Harris Poll Methodology

This survey was conducted online in the United States by Harris Poll on behalf of Grayscale using its Harris On Demand comprehensive product, from September 4 to 6, 2024, targeting 1,841 adults (aged 18 and older) who plan to vote in the 2024 presidential election. The data was weighted as necessary by age, gender, race/ethnicity, region, education, marital status, household size, household income, employment, and internet usage tendencies to align with actual population proportions. Respondents for this survey were selected from those who agreed to participate in our surveys. The sampling accuracy of Harris online polls is measured using Bayesian credible intervals. For this study, the precision of the sample data is within +/- 2.8 percentage points, with a confidence level of 95%. In the subset of the population of interest surveyed, this credible interval will be wider. All sampling surveys and polls, whether or not they use probability sampling, are subject to various other sources of error that are often unquantifiable or unestimable, including but not limited to coverage error, non-response-related error, question wording and response option-related error, and post-survey weighting and adjustments.

References

[1] Grayscale takes no position as to the accuracy or reliability of polling data and implied odds from prediction markets like Polymarket. Throughout this piece, Grayscale uses data from Polymarket to suggest general directionality of potential election outcomes.

[2] Source: Barron’s.

[3] Source: NY Times.

[4] Source: Bloomberg.

[5] Source: NPR.

[6] See, for example, WSJ, Unchained Crypto, Reuters, TechCrunch, Axios, Reuters.

[7] On regulation, former president Trump has said, for example, “The rules will be written by people who love your industry, not hate your industry.” Source: CNBC.

[8] This statement from the CBO sums up the current budget picture: “Over the 10-year projection period, primary deficits in CBO’s baseline average 2.5 percent of GDP. In the 62 years from 1947 to 2008, primary deficits exceeded 2.5 percent of GDP only twice. In the past 15 years, though, they have exceeded that percentage 10 times—in part because of legislation enacted in response to the 2007–2009 financial crisis and in the wake of the coronavirus pandemic that began in early 2020.” Source: CBO.

[9] PWBM estimates are based on the primary (before interest) deficit; Grayscale incorporated CBO estimates of interest expense before the campaign’s proposals to calculate the total deficit impact. Estimates of the budget impact of campaign proposals differ across sources, and figures presented here should be considered illustrative. For alternative estimates see, for example, Committee for a Responsible Federal Budget.

[10] PWBM estimates of the Trump proposals do not include the potential impact of tariffs on customs revenue. However, projections that do include tariff revenue, like those from the Committee for a Responsible Federal Budget, find a broadly comparable net impact on the deficit. Estimates of the revenue impact of Trump’s tariffs plans over a ten-year period, if maintained, range from roughly $2 trillion to $5 trillion. Source: Committee for a Responsible Federal Budget, Tax Policy Center, Tax Foundation.

[11] A variety of research has examined the impact of tariff increases on the US Dollar. See, for example, The multifaceted impact of US trade policy on financial markets and To What Extent Are Tariffs Offset By Exchange Rates. For the impact on risky assets see, for example, The Effect of the U.S.-China Trade War on U.S. Investment.

[12] Changing tariffs does not typically require Congressional approval.

[13] Specific bills are the Digital Commodities Consumer Protection Act of 2022 (S.4760) and the Lummis-Gillibrand Payment Stablecoin Act (S.4155).

[14] The Stand With Crypto Alliance is a 501(c)(4) nonprofit funded by donations. Grayscale takes no position as to the accuracy or reliability of data from The Stand With Crypto Alliance. Throughout this piece, Grayscale uses data from The Stand With Crypto Alliance to suggest general directionality of where members of Congress stand with respect to crypto policy.

[15] Counting independent senators who caucus with Democrats.

[16] SAB 121 is a financial guideline requiring companies to report customer-held crypto as both assets and liabilities, affecting how they manage crypto custody services.

[17] Financial Innovation and Technology for the 21st Century Act (H.R.4763).

[18] Across the three waves of polling, 18% of self-identified Democrats said they owned Bitcoin, compared to 15% of Republicans. Similarly, 51% of Democrats said they were “very familiar” or “somewhat familiar” with crypto, compared to 45% of Republicans. Lastly, in the third wave of polling (September 4-6, 2024), 37% of Democrats said they have become more open to learning more about investing in crypto this year, compared to 30% of Republicans. Source: The Harris Poll.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。