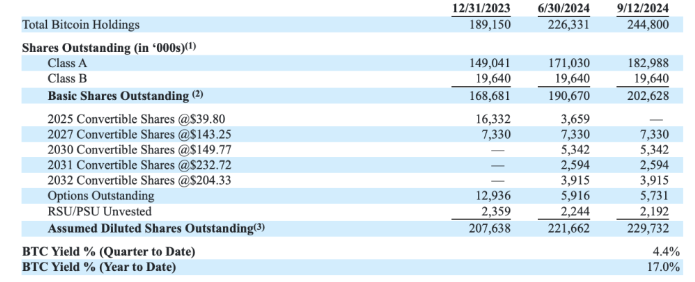

MicroStrategy is one of the largest independent publicly traded analytics and business intelligence companies in the world. Since 2020, MicroStrategy has gradually adopted Bitcoin as its primary financial reserve asset. As of now, MicroStrategy holds approximately 244,800 Bitcoins, accounting for about 1% of the total Bitcoin in circulation, with a market value of around $14.6 billion.

MicroStrategy's Sources of Funding

Its founder, Michael Saylor, believes that Bitcoin is "the most valuable and risk-resistant asset in the world, especially in the context of increasing global economic uncertainty and currency devaluation risks," and positions the company as a Bitcoin investment bank, purchasing Bitcoin through the issuance of debt and other financial instruments.

Additionally, Michael Saylor posted on social platform X, stating that MicroStrategy's Bitcoin yield for this quarter reached 4.4%, with a year-to-date yield of 17%.

Image source: Internet

The funds for this Bitcoin purchase mainly come from the proceeds of the company's stock issuance and sales. According to an agreement reached by MicroStrategy with sales agents in August this year, the company can issue up to $2 billion worth of stock. As of September 12, MicroStrategy had sold over 8.04 million shares, raising approximately $1.11 billion.

MicroStrategy initially used the free cash flow generated from its operations, which is also the most important source of funding for the company. With the initial free cash flow, MicroStrategy began its layout in the cryptocurrency market.

In addition to the previously mentioned operational cash flow and stock issuance, debt financing is also one of the important ways for MicroStrategy to obtain cash flow. As of June this year, MicroStrategy's total debt had reached $3.9 billion, while the current floating profit from its Bitcoin investments is approximately $4.89 billion. If we add the $700 million in new debt from September, its total debt is now very close to the floating profit.

According to news from MicroStrategy's founder in September, the company will issue a total of $700 million in convertible senior notes to qualified institutional investors through a private placement. These bonds can be converted into company stock under certain conditions, thereby avoiding potential stock price fluctuations that may arise from direct stock sales.

Image source: Internet

Impact of MicroStrategy's Continuous Bitcoin Accumulation

Data shows that MicroStrategy's stock price has risen as the company's Bitcoin holdings have increased. As of now, the company's stock price has more than doubled this year, exceeding the approximately 40% increase in Bitcoin's price during the same period. As a globally recognized company with Bitcoin as its primary asset reserve, MicroStrategy's continuous accumulation of more Bitcoin has enhanced market confidence in Bitcoin as an institutional-grade asset class, driving further adoption and acceptance of Bitcoin.

Image source: Xueqiu

Image source: AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。