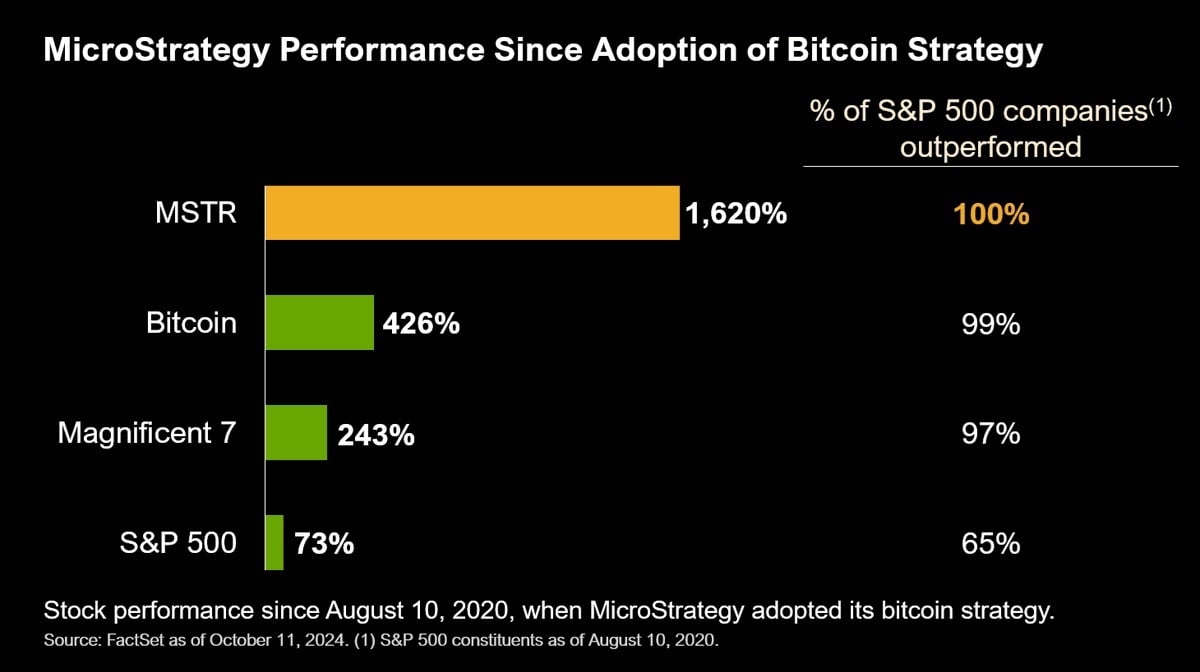

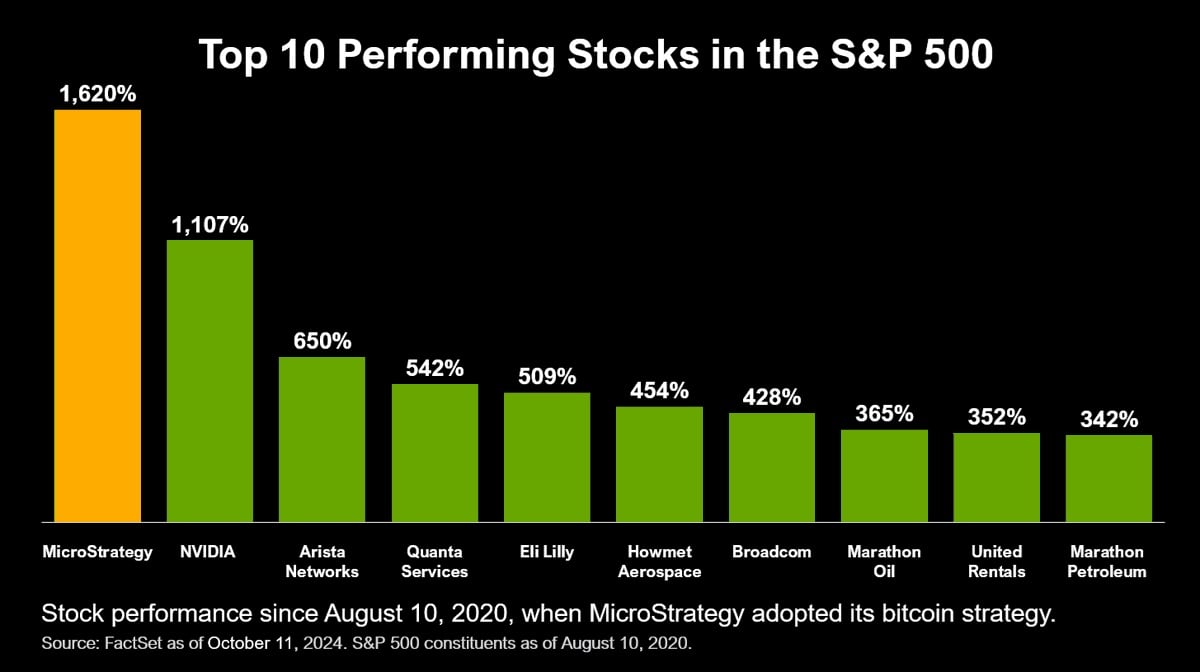

Microstrategy’s stock (Nasdaq: MSTR) has surged 1,620% since the company adopted its bitcoin-focused strategy, eclipsing the gains of BTC, the S&P 500, and major tech stocks. Over the weekend, executive chairman Michael Saylor highlighted this performance on social media platform X, comparing Microstrategy’s growth to bitcoin, the “Magnificent 7” tech giants, and the broader market over the past three years.

Since August 2020, Microstrategy has significantly outperformed, with MSTR up 1,620% compared to bitcoin’s 426%, the Magnificent 7’s 243%, and the S&P 500’s 73%. Reaffirming his bullish stance on BTC, Saylor wrote:

The only thing better than bitcoin is more bitcoin … If you want to win, you need a bitcoin strategy.

The Magnificent 7 refers to Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA), which have driven much of the recent market rally. Despite their success, MSTR’s gains have far outpaced these tech leaders. Saylor’s second chart shows MSTR’s gains significantly outpacing Nvidia’s 1,107% increase and Arista Networks’ 650% rise.

As of September, Microstrategy holds 252,220 bitcoins. On Sept. 20, the company acquired 7,420 BTC for $458.2 million at an average price of $61,750 per coin. This purchase, funded through a convertible note offering, solidified the software intelligence firm’s position as the largest corporate holder of bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。