Monetary policy's initial intensification and whether subsequent fiscal policy can follow suit is a major factor affecting the upward rhythm and space of the stock market recently.

Author: Cycle Capital, Lisa

Since the "924" new policy, the Chinese stock market has experienced an epic surge. The policies from the three financial ministries and the unexpected boost from the Central Political Bureau meeting have lifted market sentiment, leading to a strong rebound in both the A-share and Hong Kong markets, outpacing global markets. However, after the National Day holiday, the market turned downward amid overly optimistic expectations. Is this round of market activity a fleeting moment or has a significant bottom already formed? This article will attempt to make a judgment from the perspective of analyzing the domestic economic fundamentals, policies, and overall valuation levels of the stock market.

I. Fundamentals

Overall, the domestic fundamentals remain relatively weak, with some signs of marginal improvement, but no clear turning signals have been observed. During the National Day holiday, consumer sentiment improved both year-on-year and month-on-month, but this has not yet been reflected in some key economic indicators. In the coming quarters, China's growth may show a mild recovery under the boost of policies.

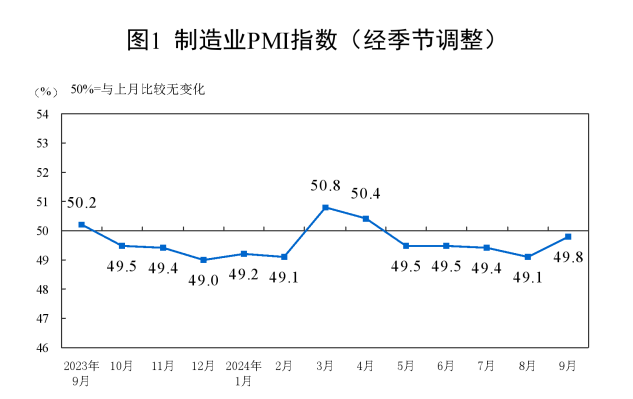

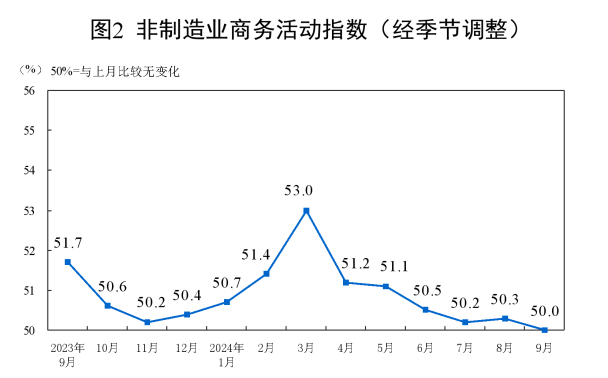

In September, the Manufacturing Purchasing Managers' Index (PMI) was 49.8%, an increase of 0.7 percentage points from the previous month, indicating a rebound in manufacturing sentiment; the Non-Manufacturing Business Activity Index was 50.0%, a decrease of 0.3 percentage points from the previous month, showing a slight decline in non-manufacturing sentiment.

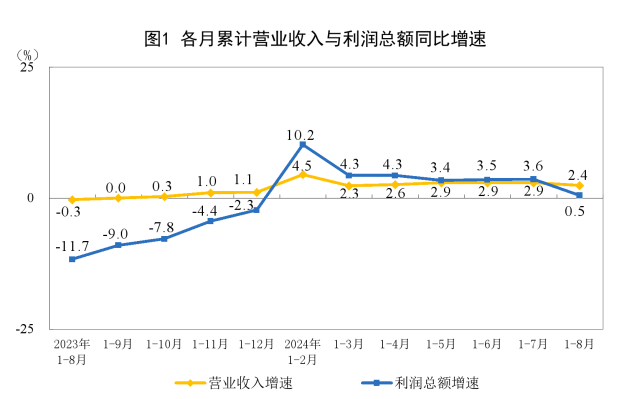

Affected by high base factors from the same period last year, in August, the profits of industrial enterprises above designated size fell by 17.8% year-on-year.

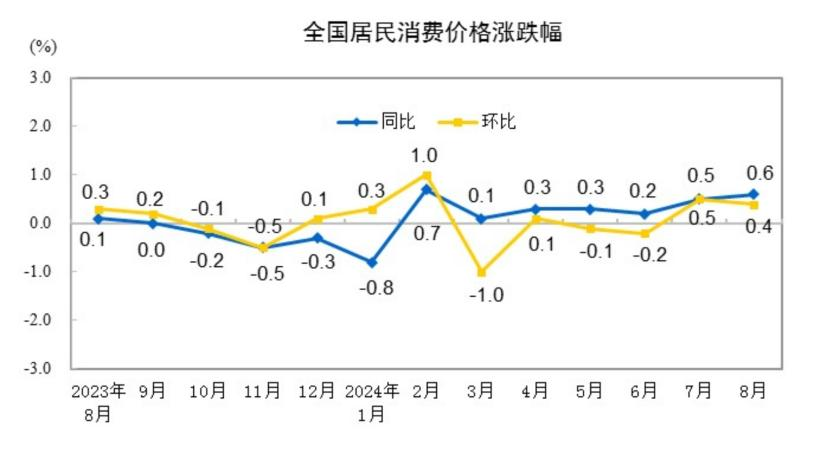

In August 2024, the national consumer price index rose by 0.6% year-on-year. Among them, food prices increased by 2.8%, and non-food prices rose by 0.2%; consumer goods prices increased by 0.7%, and service prices rose by 0.5%. From January to August, the average national consumer price index increased by 0.2% compared to the same period last year.

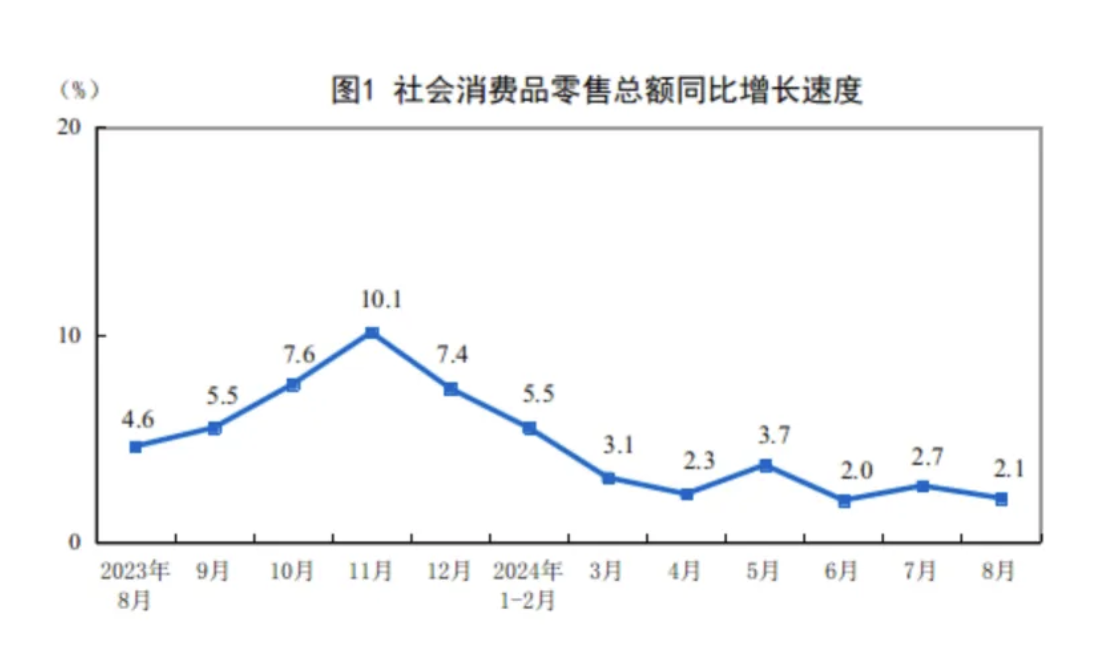

In August, the total retail sales of consumer goods reached 38,726 billion yuan, a year-on-year increase of 2.1%.

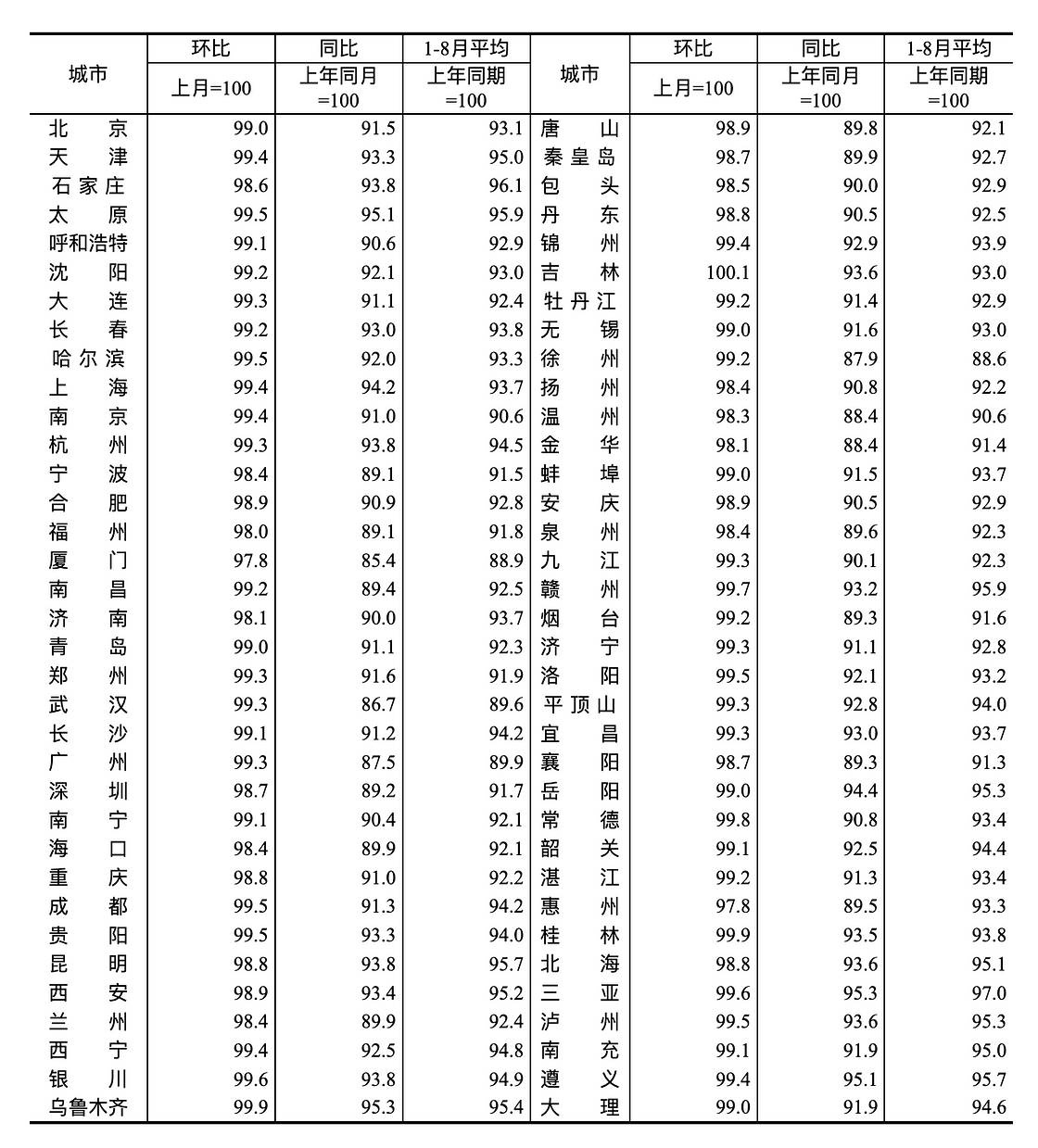

In August 2024, the sales price index of second-hand residential properties in 70 large and medium-sized cities

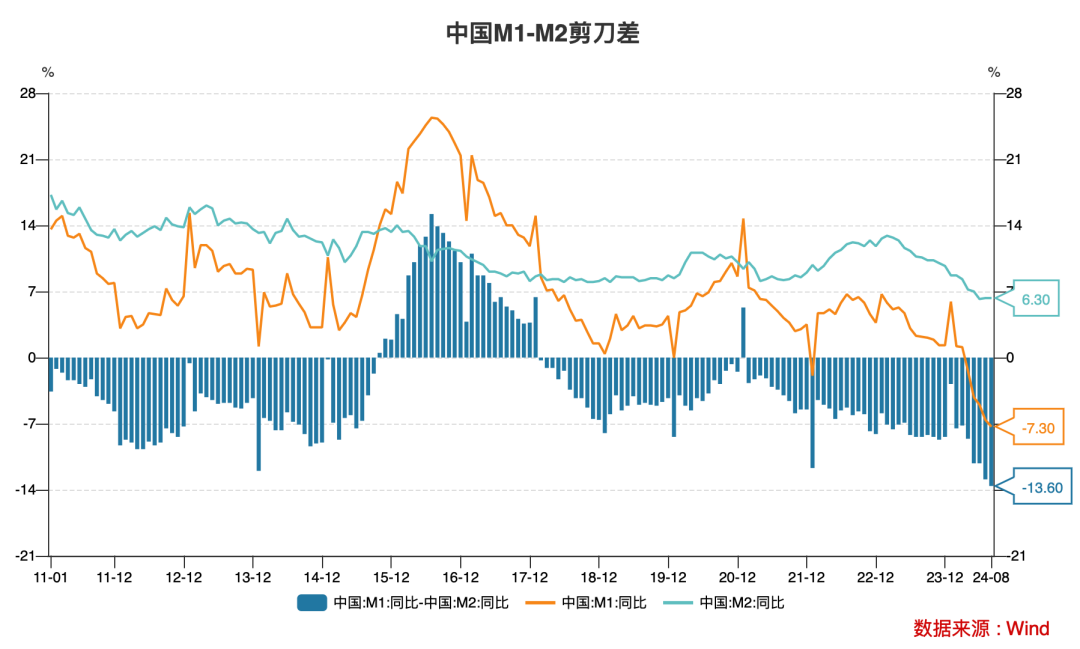

From the perspective of financial leading indicators, the overall financing demand in society is relatively insufficient. Since the second quarter, the year-on-year growth of M1 and M2 has slowed, and the gap between the two has risen to historically high levels, reflecting insufficient demand and some inefficiencies in the financial system. The transmission effect of monetary policy is hindered, and the short-term economic fundamentals still need improvement.

II. Policy

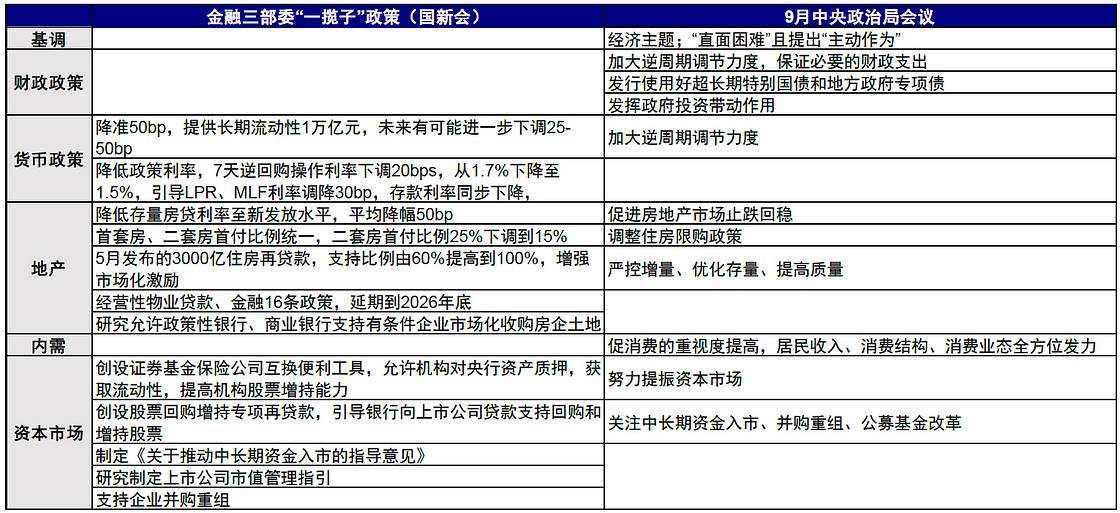

Combining the characteristics of past market bottoms in the A-share market over the past 20 years, policy signals generally need to be strong and exceed investors' expectations at the time. Historically, this has been a necessary condition for the stabilization and rebound of A-shares. Recently, policies have exceeded expectations, and policy signals have already emerged.

On September 24, 2024, the State Council Information Office held a press conference where the central bank governor, Pan Gongsheng, announced the establishment of new monetary policy tools to support the stable development of the stock market.

The first measure is the establishment of a swap facility for securities, funds, and insurance companies, supporting eligible securities, funds, and insurance companies to use their own bonds, stock ETFs, and stocks from the CSI 300 index as collateral to obtain liquidity from the central bank. This policy will significantly enhance institutions' ability to access funds and increase their stock holdings. The initial operation scale of the first swap facility is 500 billion yuan, with the possibility of expanding the scale in the future.

The second measure is the establishment of a special relending facility for stock repurchases, guiding banks to provide loans to listed companies and major shareholders to support stock repurchases and increases. The initial quota for the repurchase tool is 300 billion yuan, which can also be expanded based on circumstances.

On September 26, 2024, the Central Financial Office and the China Securities Regulatory Commission jointly issued the "Guiding Opinions on Promoting Long-term Funds to Enter the Market," which includes measures such as 1) cultivating a capital market ecosystem for long-term investment, 2) vigorously developing equity public funds and supporting the steady development of private equity funds, and 3) improving supporting policies for long-term funds entering the market, totaling three main points and 11 key details.

The root cause of the current growth issues in China is the ongoing credit contraction, with the private sector continuing to deleverage, and the government sector's credit expansion failing to provide effective counterbalance. The reasons for this situation are primarily low expected investment returns, especially the sluggish prices in the real estate and stock markets, and the financing costs are still not low enough. The core of this round of policy changes is focused on reducing financing costs (by lowering multiple interest rates) and boosting expected investment returns (by stabilizing housing prices and providing liquidity support for the stock market). This is a targeted approach, but whether it will effectively address the issues and achieve sustainable re-inflation in the medium to long term will require subsequent structural fiscal stimulus and actual policy implementation. Otherwise, the market's recovery may be short-lived.

On October 8 (Tuesday) at 10 a.m., the National Development and Reform Commission held a press conference where the director, Zheng Zhanjie, and deputy directors Liu Shushe, Zhao Chenxin, Li Chunlin, and Zheng Bei introduced the situation regarding "systematically implementing a package of incremental policies, solidly promoting the economy upwards, optimizing the structure, and ensuring a continuous positive development trend," and answered reporters' questions. The upward sentiment was fully fermented during the National Day holiday, and the market generally believes that A-shares have bottomed out and reversed. Morgan Stanley believes that the policy volume needed to rebalance the economic structure from investment to consumption is approximately 7 trillion yuan within two years. Market participants have high expectations for fiscal policy, so there was significant attention on this press conference by the Development and Reform Commission. However, there were no large-scale counter-cyclical fiscal adjustment policies as widely expected, which is a major reason for the market's reversal after the National Day holiday.

III. Valuation

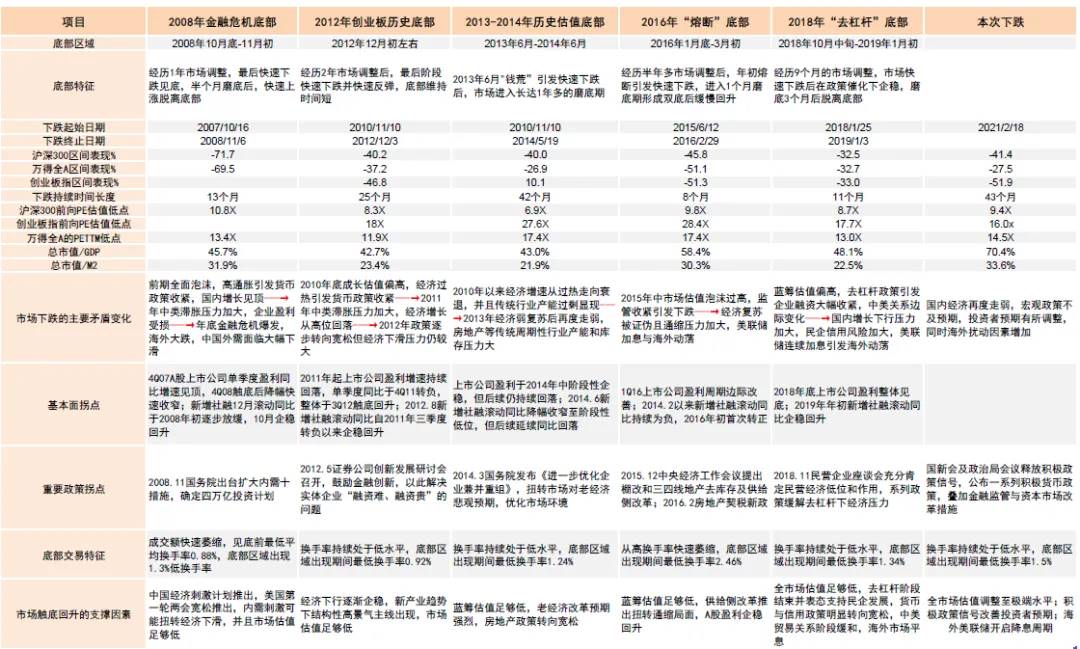

Reviewing the characteristics of past market bottoms, this round of market activity has already shown bottoming characteristics in terms of the duration of the decline, the degree of decline, and valuation levels.

Note: This decline involves market data as of September 27, 2024. Source: Wind, CICC Research Department

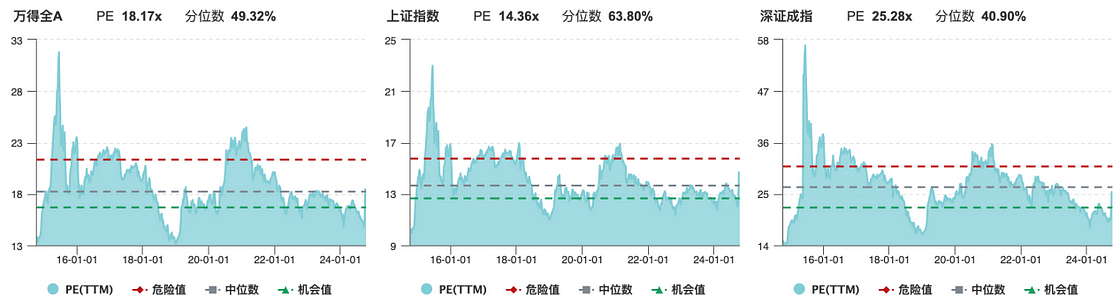

As of October 9, the valuation levels of A-shares have been restored to near the median.

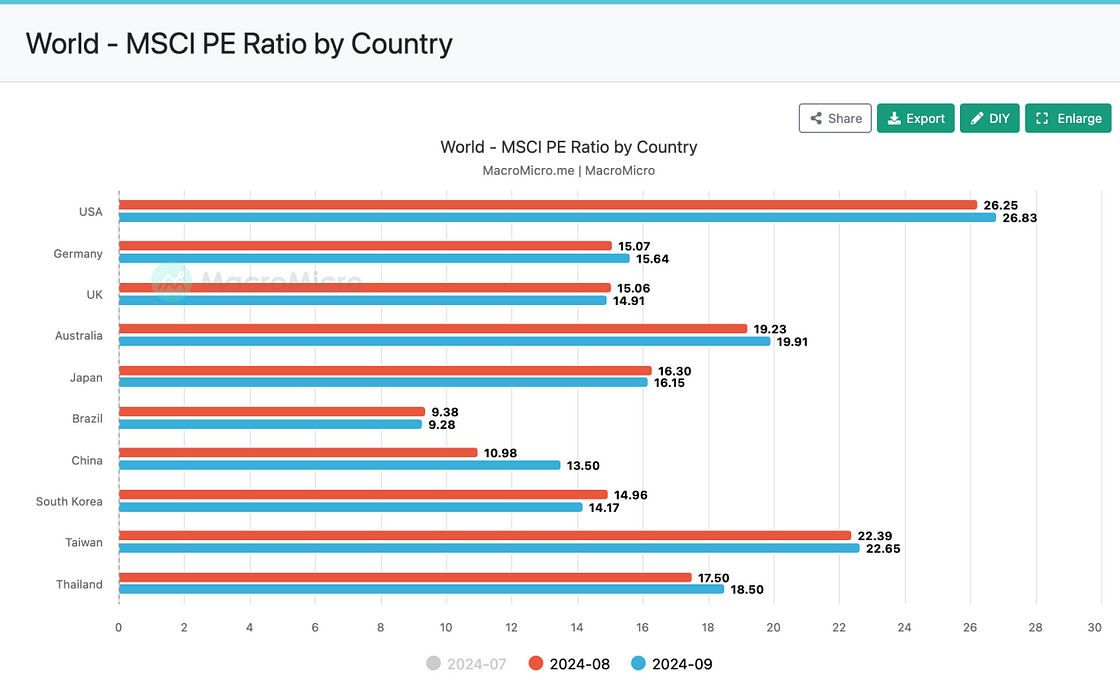

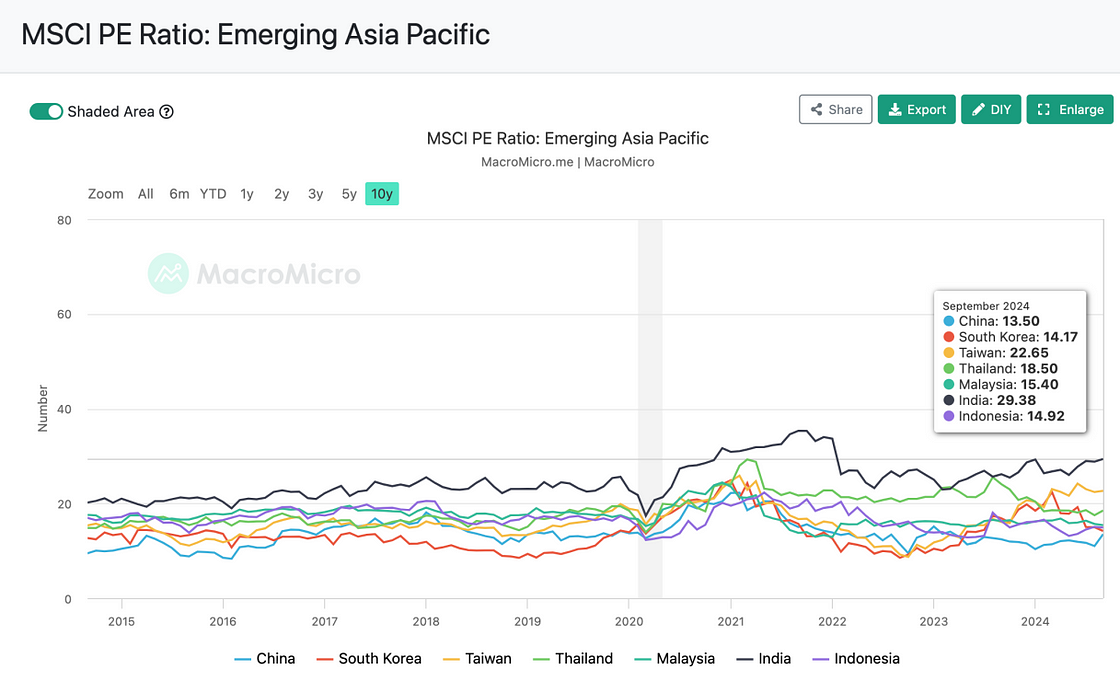

Historically, the rebound at the end of September was relatively high, reaching the PE multiples expected for economic acceleration post-pandemic restart at the beginning of 2023. In a horizontal comparison with major global markets, the valuation of the Chinese market relative to emerging markets remains the lowest in the Asia-Pacific region, close to that of South Korea.

In summary, the key to the market reversal lies in the confirmation of mid-term fundamental signals, which have not yet been evident in the fundamental data. The recent short-term rise has mainly been driven by expectations and capital, with fears of missing out (FOMO) causing sentiment to adjust very quickly. Technical indicators such as the RSI (Relative Strength Index) are somewhat "overdrawn" in the short term. Markets with high volatility often experience excessive reactions, and a pullback after a historic surge is both a technical necessity and a reasonable expectation. After the initial intensification of monetary policy, whether subsequent fiscal policy can follow suit is a major factor affecting the upward rhythm and space of the stock market. Just like the art of expectation management by the Federal Reserve, in a wildly aggressive market environment, it is inappropriate to add fuel to the fire. However, as things settle, what should happen will happen. From a long-term perspective, the author believes that the recent decline is an adjustment rather than the end of a trend, and the significant bottom of A-shares has been seen, while the main rise has yet to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。