Written by: 0xEdwardyw

Introduction

Catizen and Hamster Kombat are two of the most promising game projects in the TON ecosystem. Catizen is a virtual cat café where players can earn CATI tokens by participating in fun games and activities, while Hamster Kombat is a rapidly growing Telegram tap-to-earn game where players take on the role of the CEO of a virtual crypto exchange.

Both projects have garnered significant attention in the crypto community. The tokens for both have just been launched, with Catizen's CATI token going live on September 20, 2024, and Hamster Kombat's HMSTR token launching on September 26, 2024, on the TON platform.

This article will explore the tokenomics and price performance of CATI and HMSTR.

Catizen (CATI) Token

The CATI token is the native utility and governance token of the Catizen ecosystem, which is a Telegram-based play-to-earn platform.

Token Utility:

- The CATI token has several important functions within the Catizen ecosystem:

- In-game currency: CATI serves as the universal currency within the Catizen ecosystem, allowing users to purchase in-game items, upgrades, and services such as the game center, Launchpool, and Open Task. By using CATI for these transactions, users can access premium content and features.

- Governance: As a governance token, CATI allows holders to vote on important decisions within the ecosystem, including upcoming Launchpool projects. Decentralized governance helps shape the future of the platform.

- Launchpool participation: Users can stake CATI tokens in Catizen's Launchpool to earn rewards, including exclusive airdrops and bonuses.

Staking and Earnings:

- Users can stake CATI tokens in Catizen's Launchpool to participate in yield-generating activities. Additionally, holders of CATI can earn future airdrop rewards through the Open Task platform. Staking offers multiple benefits:

- Payment discounts: Users can enjoy a 30% purchase discount when using CATI for payments in the game center.

- Staking rewards: By staking CATI in the Launchpool or Earn Pool, users can earn tokens from other high-value projects.

- Airdrop rewards: Users participating in the Open Task platform can earn points that can be redeemed for CATI every three months. The rewards pool releases over 1% of CATI tokens each quarter, along with airdrop rewards from other projects like Bombie and Vanilla.

- Transaction fee discounts: Users can also use CATI to pay for platform trading fees, such as those for the Vanilla TG trading bot, enjoying a 30% discount.

Token Distribution:

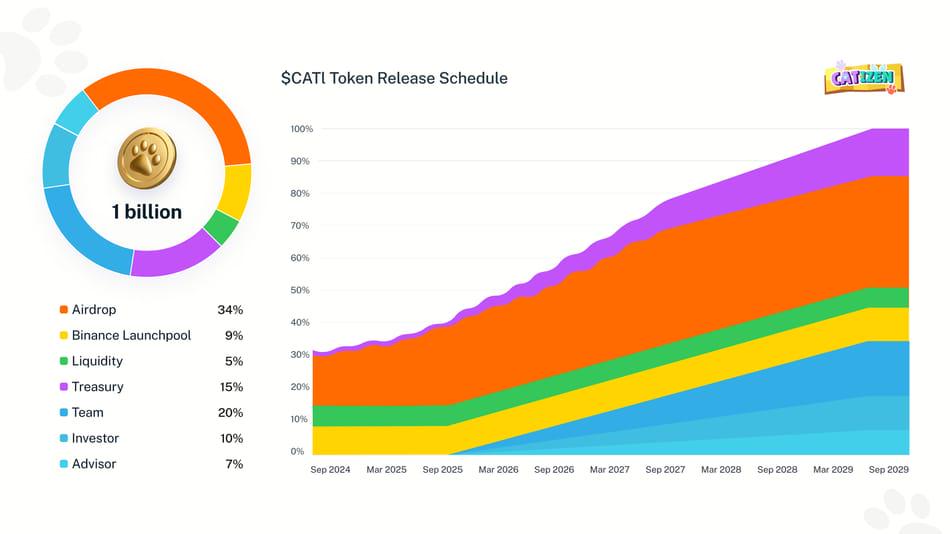

The total supply of CATI is fixed at 1 billion tokens, with the following distribution:

Airdrop and Ecosystem (34%):

- 15% will be 100% released at TGE (Token Generation Event) for Season 1 player rewards.

- 19% will not be released at TGE; the remaining portion will be used for quarterly seasonal airdrop activities to reward players in future seasons. 9,900,000 tokens (0.99%) will be airdropped at the beginning of the second quarter. This number will increase by 10% each quarter until the seventh quarter, after which the release will grow linearly. The entire airdrop will be completed over 12 quarters following TGE.

Launchpool (9%): Allocated for Launchpool, where users can stake tokens for additional rewards.

Team (20%): Allocated to the team, with tokens not released at TGE, starting to unlock after 12 months and then linearly over 48 months.

Treasury (15%): As a strategic reserve, 10% will be released at TGE, with the remaining portion following a 12-month lock-up period and a 48-month linear release schedule.

Investors (10%): These tokens will unlock linearly over 48 months after a 12-month lock-up period.

Advisors (7%): The same unlocking method as investors, with no initial release at TGE and linear unlocking after a 12-month lock-up period.

Liquidity (5%): These tokens will be fully unlocked at TGE to ensure immediate liquidity.

CATI Price Analysis

After the Catizen (CATI) token launched on September 20, 2024, it experienced significant price volatility. Initially, the token price surged rapidly, reaching an all-time high (ATH) of $1.11 on the first trading day, reflecting strong early demand. However, this upward momentum quickly faded, and the price fell back to near the opening price of $0.75 within a few days. By the end of September, CATI was trading at approximately $0.79, down 31% from its historical peak.

Currently, CATI's circulating supply is about 30.5%, and it is expected to gradually increase to 40% by September 2025, meaning that approximately 10% of new CATI tokens will enter the market within a year. This could create some selling pressure, and the Catizen team is developing new staking features to incentivize users to hold and stake tokens, thereby alleviating selling pressure.

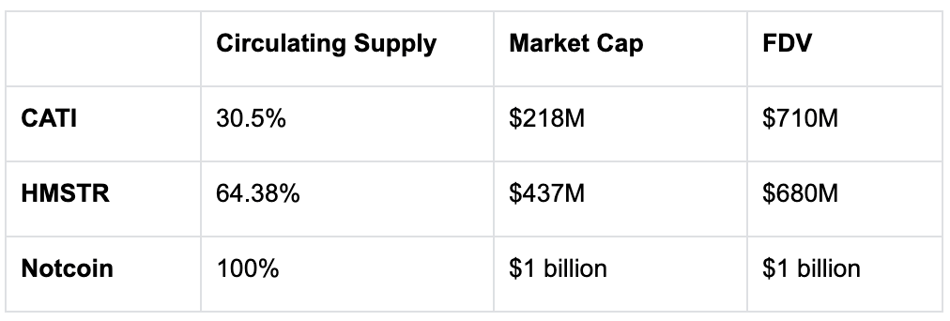

To better understand CATI's positioning within the TON ecosystem, its market capitalization can be compared to other major projects. For instance, as of September 28, the leading tap-to-earn project Notcoin had a market cap of $1 billion, while CATI's market cap was $218 million, only one-fifth of Notcoin's. However, considering the fully diluted valuation (FDV), CATI's FDV is $720 million, which is closer to Notcoin's $1 billion.

Potential and Risks

Catizen is more complex compared to some simpler tap-to-earn games. Unlike those that only require clicking the screen to earn in-game currency, Catizen's gameplay requires players to slide and merge cats of the same level to earn rewards. This additional layer of gameplay makes Catizen more engaging than simple click-based games. As of September 2024, Catizen has over 34 million users, with 800,000 paying users contributing an average revenue per user (ARPU) of $33, according to a report by Cointelegraph. These strong fundamentals support its current valuation as a top game project on TON.

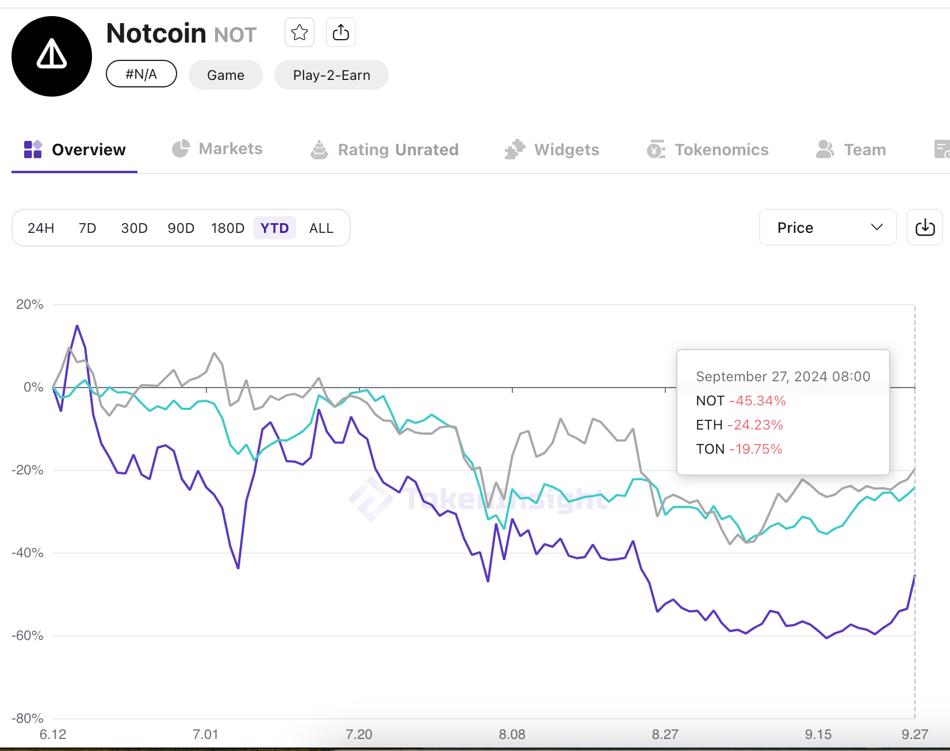

It is noteworthy that the leading tap-to-earn project in the TON ecosystem, Notcoin, has a fully distributed token, thus not subject to the ongoing selling pressure from unlocked tokens. Despite this advantage, Notcoin's price has been on a downward trend since peaking in June, showing no significant recovery even during the recent broader market rebound. Notcoin's performance has lagged behind ETH and TON, despite its smaller market cap, as smaller cap projects typically experience larger rebounds during market recoveries. This underperformance may indicate a waning interest from investors in tap-to-earn tokens compared to earlier in the year, posing a potential challenge for similar projects in the space.

In this context, CATI's current valuation may face challenges, especially with the launch of similar game projects on the TON chain. These new tokens could dilute liquidity for CATI, as investors may choose to allocate funds across multiple game projects within the ecosystem, intensifying competition for market share and attention.

To justify a higher valuation, closely monitoring Catizen's product development is crucial. A higher valuation can only be supported if Catizen can provide a significantly better gaming experience within the TON ecosystem. In a competitive and rapidly evolving ecosystem, strong product performance is key to maintaining investor confidence and capturing market share, especially as new game projects continue to launch on the TON chain.

Hamster Kombat (HMSTR) Token

HMSTR is the utility token of the Hamster Kombat ecosystem, primarily used for in-game rewards, customization, and participation in various activities within the Hamster Kombat ecosystem.

Token Utility:

The $HMSTR token has multiple uses within the Hamster Kombat ecosystem:

- In-game currency: The HMSTR token is the primary currency for various transactions within the game, allowing players to buy, sell, and trade items, characters, and upgrade content.

- Access to exclusive content: Players can use HMSTR tokens to unlock special content that is not available in the regular game, including rare items and unique characters.

- Event participation: The token allows players to participate in limited-time events and tournaments that offer unique rewards, creating a competitive yet fun gaming environment.

- Unlocking advanced features: Players can use HMSTR tokens to access advanced customization options and accelerate upgrade mechanisms, gaining a competitive edge in the game.

Token Distribution:

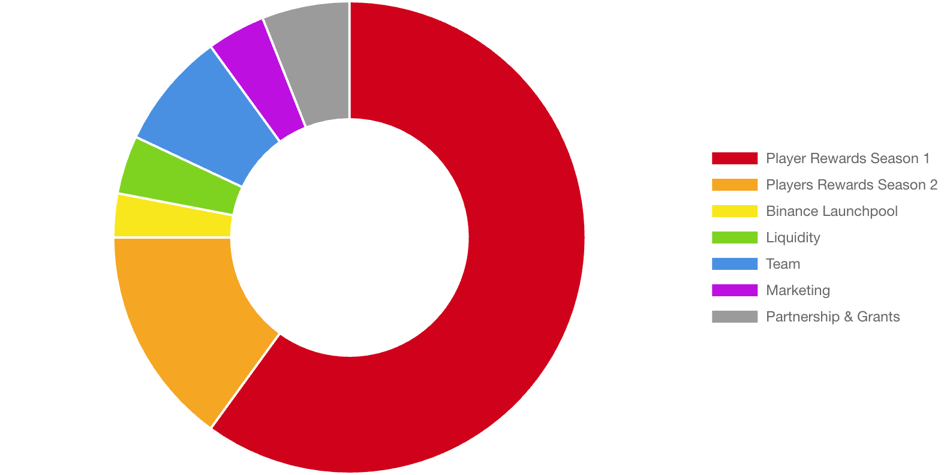

The total supply of Hamster Kombat (HMSTR) tokens is 100 billion, with a significant portion allocated for player rewards and ecosystem growth. The following is a detailed breakdown of the token distribution:

Initial allocation: 64.38% of the total supply (6.4375 billion HMSTR) will be released during the Token Generation Event (TGE).

Player Rewards:

- 60% is allocated for Season 1 player rewards: Players can only claim 88.75% of their HMSTR token allocation on Day 1, with the remaining 11.25% being released linearly over 10 months. This means that approximately 53.24 billion tokens will be airdropped to users at the time of token issuance, while 6.75 billion tokens will be released over the 10 months following the listing.

- 15% is reserved for Season 2 player rewards: These tokens are set aside for the Season 2 airdrop, which has not yet begun.

Other Allocations

By allocating a significant amount of tokens for player rewards, Hamster Kombat aims to incentivize user participation and drive ongoing interest in the platform. The HMSTR token does not have investors. According to the white paper, the project does not involve any investment firms or venture capital (VC). This is explicitly stated to reduce selling pressure and ensure that the token remains community-driven.

The project emphasizes that the value of the token will be determined by the community, demand, and engagement within the ecosystem, rather than relying on external investors seeking liquidity. This approach helps avoid common exit strategies employed by investors, which often create selling pressure and negatively impact token prices.

HMSTR Price Analysis

The trading price of the HMSTR token at launch was approximately $0.009758, quickly rising to a high of about $0.01004, achieving a market cap of $646 million in a short time. However, this upward momentum was short-lived, and the token sharply fell to $0.007 within a few hours.

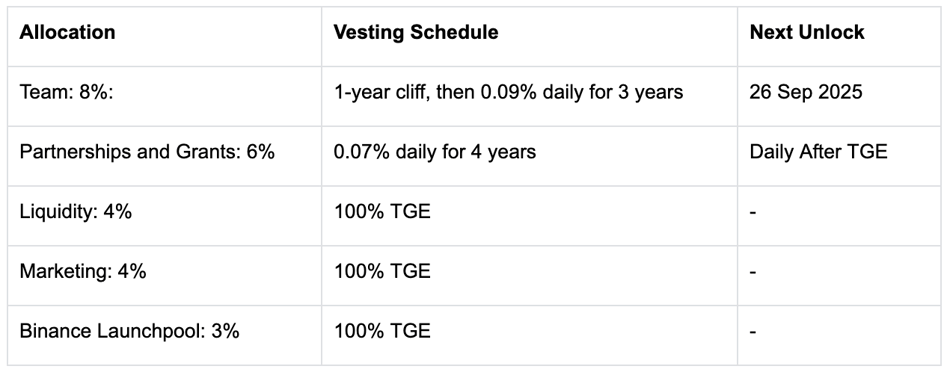

At the time of token issuance, HMSTR had a high circulating supply of about 64%. The team's token allocation will be locked until September 2025, with the only tokens unlocking in the next year being those reserved for partners and rewards, totaling only 1.5% of the supply. Additionally, the project has reserved 15% of the total supply for the Season 2 airdrop, but specific plans for Season 2 have not yet been determined.

As of now, HMSTR's market cap is approximately $437 million, about half of the market cap of Notcoin, the leading tap-to-earn project in the TON ecosystem. In contrast, HMSTR's fully diluted valuation (FDV) is $680 million, similar to CATI's $710 million. Both FDVs are below Notcoin's $1 billion.

However, the high circulating supply of over 64% for HMSTR (compared to CATI's 30.5%) means that airdrop participants may quickly sell their tokens after issuance, leading to higher short-term selling pressure. Nevertheless, due to the lower pressure from future token unlocks, its price may stabilize more quickly. This may also explain why HMSTR's current fully diluted valuation (FDV) is slightly lower than CATI's.

HMSTR faces similar challenges as CATI, as the leading tap-to-earn token, Notcoin, has not shown significant price recovery since peaking in June. This indicates that the tap-to-earn space may be losing investor interest. Additionally, with the increasing number of similar projects launching in the TON ecosystem, HMSTR and CATI may face intensified competition.

Conclusion

CATI and HMSTR are newly launched tap-to-earn game tokens in the TON ecosystem, with both currently having a fully diluted valuation (FDV) of around $700 million, lower than the $1 billion of the leading tap-to-earn token, Notcoin.

CATI has a more aggressive token unlock schedule, which may lead to greater long-term selling pressure as more tokens enter circulation. In contrast, HMSTR has a higher initial circulating supply, resulting in greater short-term selling pressure, especially from airdrop participants looking to sell their tokens. However, this means that after the initial activity ends, long-term selling pressure for HMSTR may decrease.

Both face similar challenges, including a market narrative shift from tap-to-earn to other areas and increased competition from new game projects on the TON blockchain. These factors may affect investor interest and market liquidity, so CATI and HMSTR must differentiate themselves and maintain user engagement to remain competitive in this rapidly evolving market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。