Original | Odaily Planet Daily ( @OdailyChina )_

Author | Golem ( @web3_golem )_

Fractal's mainnet has been online for over half a month. From the perspective of ecological tools such as BRC20 and CAT20 and community development, it has been successful. However, from the perspective of mining and price performance, Fractal's current performance is not satisfactory.

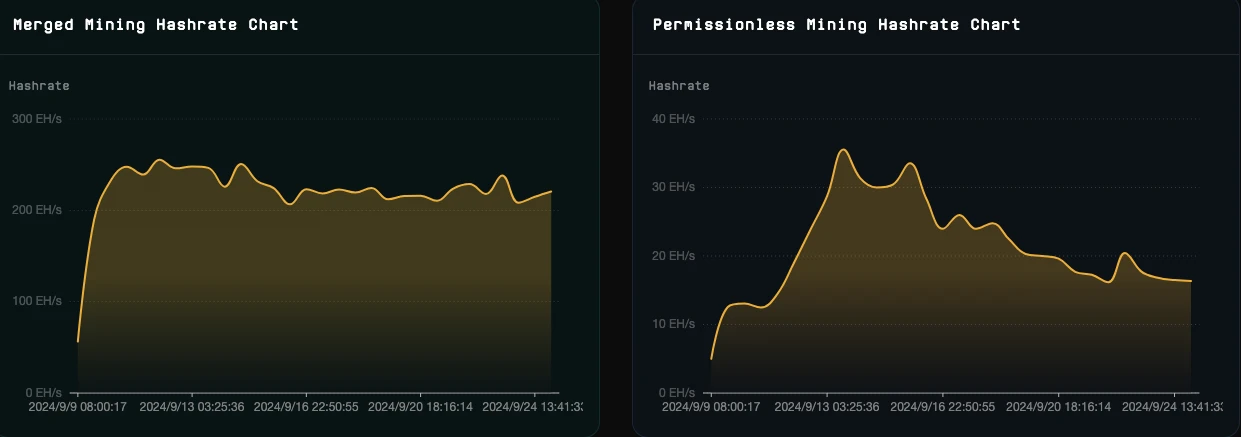

According to official data from Fractal's browser, since its launch, its merged mining has remained relatively stable, maintaining a hash rate of over 200EH/s. However, the hash rate for permissionless mining began to oscillate and decrease after reaching 35.5EH/s on September 13th, and currently, the hash rate for permissionless mining is only around 16EH/s. At the same time, according to CoinGecko data, the price of Fractal's governance token FB rose to a high of $40 on September 15th before beginning to decline, plummeting to $13 at one point.

Fractal's merged mining and permissionless mining hash rates, sourced from: Fractal Official Browser

Due to the short time since the launch of Fractal's mainnet and the insufficient circulation of tokens, Fractal miners are the most affected by the decline in FB price. Now, with the decline in hash rate for permissionless mining and the drop in price, how are the survival conditions for miners who use mining machines exclusively for mining FB? Should miners bear responsibility for the continuous decline in FB price? As an ordinary user, is it still a good time to participate in FB mining?

To explore the above questions, Odaily Planet Daily interviewed 散修, the founder of the Fractal mining pool MoonX. As a firsthand participant in Fractal mining, he provided a more professional perspective. Based on our interview with 散修, the preliminary conclusions we can draw are:

For permissionless mining miners, the price of FB has almost reached the cost, while merged mining miners are still profitable;

From the perspective of selling pressure, miners (permissionless mining) may not be the main source, but rather the profit-making projects within the ecosystem;

In terms of mining participation opportunities, whether it's small mining pools or individual miners, the cost-effectiveness of participation is currently relatively low.

Here is the full interview with 散修 for Odaily Planet Daily

Odaily Planet Daily: Can you briefly introduce MoonX?

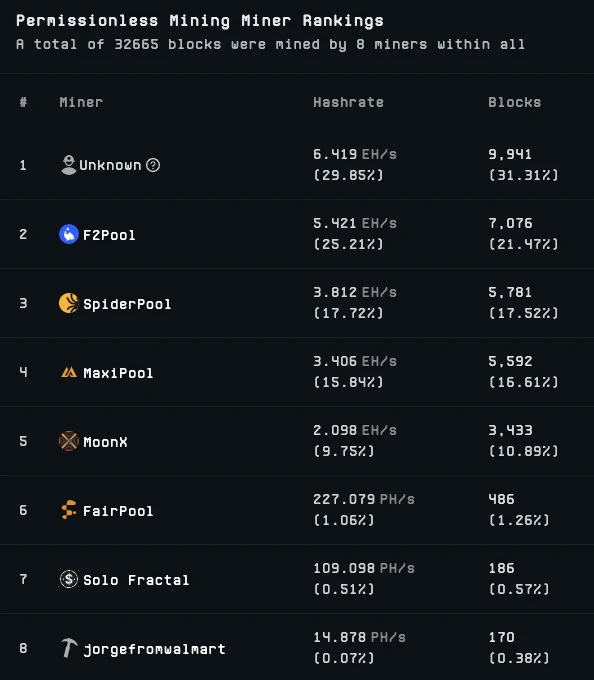

散修: MoonX was one of the first teams to test mining on the Fractal testnet early on and also worked with the official team to address various issues during the testnet period. When the Fractal mainnet went live on September 9th, MoonX mining pool went live at the first opportunity and ranked first in block production efficiency in the first week. Although there was fierce competition among mining pools later on, according to official data from Fractal's browser, MoonX's hash rate and number of blocks still rank fourth among permissionless mining pools.

Odaily Planet Daily: What is the current cost of mining FB, and are permissionless mining miners already operating at a loss?

散修: Taking the Ant S21 (hash rate 473T, power consumption 5676W) as an example, assuming an electricity price of $0.13 per hour, the daily electricity cost is approximately $17.7. Based on the official pool data of 1T = 0.0042 FB/DAY, the daily mining income is: 473 * 0.0042 = 1.9866 FB, which is approximately $25.8 at the current FB token price of $13.

In the example given above, at the current price, the mining electricity cost can still be covered, but this calculation is based on the most efficient machine model. However, these types of machines usually choose to mine BTC for higher returns, while most FB miners typically choose older mining machines, resulting in relatively lower efficiency and output ratio.

For example, let's compare it with the S19 pro (hash rate 110T, power consumption 3250W). The daily cost is about $10, but with 110T, it can only mine approximately 0.462 FB per day, equivalent to about $6, which is already operating at a loss.

Therefore, for the majority of miners, the price of FB is already close to the shutdown price.

Odaily Planet Daily: Does Fractal's merged mining have no additional costs other than mining BTC, and is the 1/3 share of merged mining output too high?

散修: The initial purpose of Fractal's merged mining was to maintain stability on the chain, which is a result we must accept. The basic cost of BTC and FB dual mining is very low, although it consumes a little more and causes more wear and tear on the mining machines.

There are many considerations for the share of merged mining output, although it is not clear why the official team set it this way. Personally, I think if the share of merged mining is too low, for example, 1/5, then when the number of permissionless miners decreases sharply as it is now, the reduced block production can easily lead to problems with malicious activities on the chain.

In short, if the share of merged mining output is too low, it will not only reduce the attractiveness to large miners, but also, a 1/5 share means a block is produced only every three minutes, which will have an adverse effect on the stability of the chain.

Odaily Planet Daily: Is the selling pressure from miners the main cause of the FB price drop?

散修: Miners may engage in mining and selling, but I believe this is not the main cause of the price drop. There are many interesting projects currently running on the chain, and these projects will have profit-taking, which will definitely lead to profit-taking and selling. This should be the main cause.

For old miners, holding coins long-term is also a form of belief. Currently, apart from the airdrop of 1 million FB tokens, the biggest source of income is mining. So I believe the selling pressure from miners in the future will definitely be significant, but the current price drop is not caused by miners.

However, although the FB price is an important factor, I still recommend everyone to pay more attention to the Fractal ecosystem, where there may be even greater returns.

Odaily Planet Daily: With the decline in permissionless mining hash rate, is the mining pool competition still intense?

散修: Taking MoonX as an example, although we had some advantages at the beginning, we also fell behind in the competition among various mining pools. Some large mining pools, such as F2Pool and AntPool, already have a large number of miners and stronger trust. As a small mining pool, we are easily questioned and easily eliminated from the market.

MoonX is not originally from the mining industry and has not signed long-term contracts with mining farms (we do not want to hold miners hostage), but we are still providing services until there are no more miners.

Odaily Planet Daily: Is it still a good time for individual miners to participate in FB mining?

散修: It is generally difficult for ordinary users to enter the mining field, mainly because Fractal uses the BTC Sha256 algorithm, which gives a significant advantage to miners who already have BTC mining machines, making it much more difficult for ordinary people.

Now, for individual miners, apart from buying hardware mining machines, there are also cloud mining and other models, but I believe everyone will calculate the cost and choose a way to participate that they are responsible for.

Closing Words

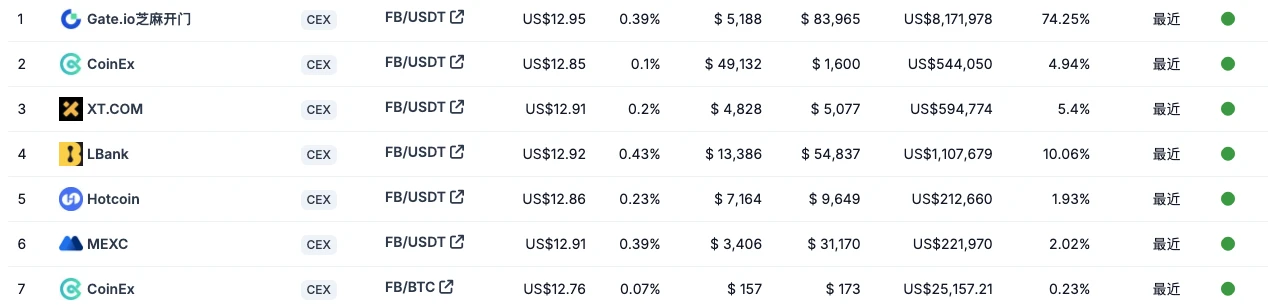

The current circulation of FB is only about 2.28 million, and at a price of $13, its circulating market value is only $29.64 million, with a total market value of $2.73 billion. According to CoinGecko data, the exchange with the highest FB trading volume is currently Gate Exchange.

In the short term, after the recent frenzy of new releases of FLUX, CAT20, BRC20, various new protocols, and NFTs, the Fractal ecosystem has relatively entered a period of calm development. The user demand for FB has decreased, and the market cannot absorb the daily output of miners and the selling pressure generated by individual project profits. With the decline in FB price, miner costs have also relatively increased, leading to some miners shutting down their machines and a decrease in permissionless hash rate. Therefore, during this period of quiet on the chain, FB may not make much of a splash; even if the price has reached the shutdown price for most miners, it may not be the lowest bottom price, and participating in mining and selling may not be a good choice.

In the long term, if you believe that FB will be listed on mainstream exchanges in the future and increase liquidity, and have hope for the future development of the Fractal ecosystem and BRC20, CAT20, and firmly believe that the next outbreak in the Fractal ecosystem will drive the market's demand for FB consumption, then the current price of FB may be a relatively good time to participate—whether it's accumulating to participate in on-chain projects consuming FB, or participating in mining and holding for a relatively long term.

Recommended Reading:

" How is the First-Day Revenue of Fractal's Head Mining, Can Leasing Hash Power Make Money? "

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。