China's proactive monetary measures, coupled with the recent 50 basis point rate cut by the Federal Reserve, indicate a global easing trend.

By BitpushNews

With the release of a comprehensive stimulus plan by the People's Bank of China, the financial markets have regained optimism.

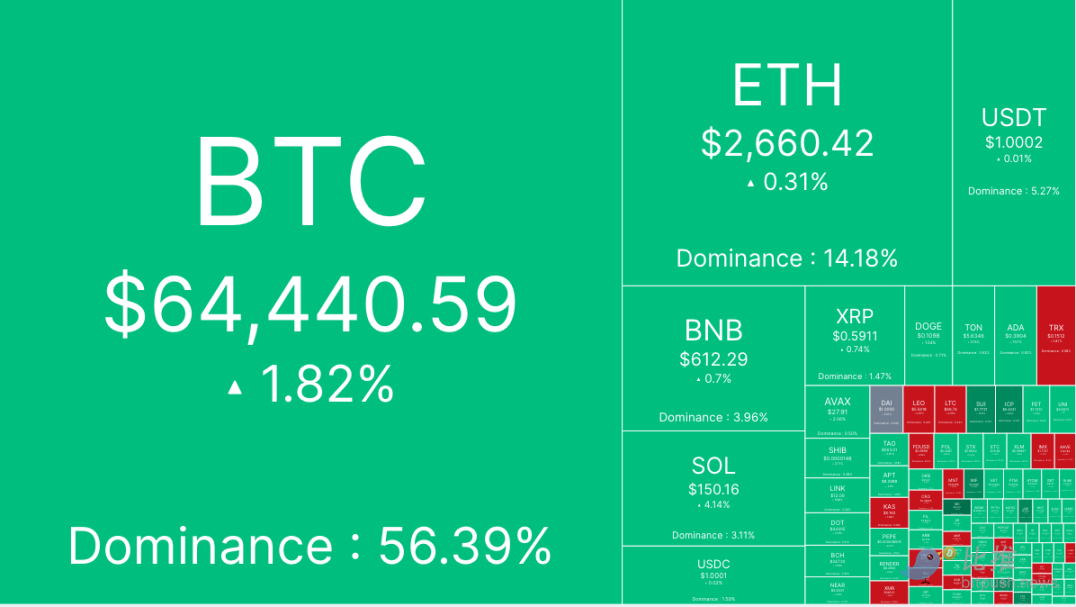

According to Bitpush data, Bitcoin fluctuated around $63,200 on the day, then broke through the $64,000 resistance level, with a trading price of $64,440 at the time of publication, representing a 1.8% increase over 24 hours.

The upward trend of altcoins continues, with most of the tokens in the top 200 experiencing gains.

The largest increase was seen in Echelon Prime (PRIME), with a rise of 21.3%, followed by dogwifhat (WIF) with a 14.9% increase, and Altlayer (ALT) with a 12.4% increase. The largest decreases were in Aave (AAVE), down 6.6%, Catizen (CATI), down 6.6%, and MX Token (MX), down 5.3%.

The current total market value of cryptocurrencies is $2.25 trillion, with Bitcoin's share at 56.3%.

In the U.S. stock market, as of the day's close, the S&P 500 Index, the Dow Jones Industrial Average, and the Nasdaq Index all rose by 0.25%, 0.20%, and 0.56% respectively. Spot gold continued its record-breaking rise, breaking through $2,660 per ounce for the first time in history.

Global Easing Trend

The U.S. Conference Board reported on Tuesday that consumer confidence in September fell significantly, with its overall index dropping from 105.6 to 98.7, marking the largest monthly decline since August 2021.

Possibly influenced by this news, according to data from the Chicago Mercantile Exchange's FedWatch, the market expects the Federal Reserve to cut the benchmark interest rate by 50 basis points at the November meeting, with this expectation rising from 50% the previous day to 61%.

QCP Capital analysts stated that China's proactive monetary measures, coupled with the recent 50 basis point rate cut by the Federal Reserve, indicate a global easing trend, which may provide support for risk assets, including cryptocurrencies, in the near future.

Best Performance in September?

Despite a difficult start for Bitcoin in September, as the end of the month approaches, it has rebounded by 7.25% so far this month, potentially setting the stage for its strongest September performance in history.

From a technical perspective, Joel Kruger, market strategist at LMAX Group, believes that the initial resistance level for Bitcoin is at $65,000: "We need to see this psychological barrier clearly broken to initiate the next upward momentum, retest, and break through the all-time high."

Many analysts expect that bulls will easily break through $65,000 in the coming months, especially if Bitcoin shows positive momentum at the end of September. Historical data suggests that in years when Bitcoin has risen in September, it typically performs strongly in the fourth quarter.

Kruger concluded, "October and November are the best months for crypto assets, so the market should expect to enter the fourth quarter."

Cryptocurrency analyst Will Clemente wrote, "From seeking to cut gains during volatility to letting winners continue to rise, this is very difficult psychologically. In my view, a precise change in BTC market structure above $65,000 is the threshold for risk appetite and shifting this bias."

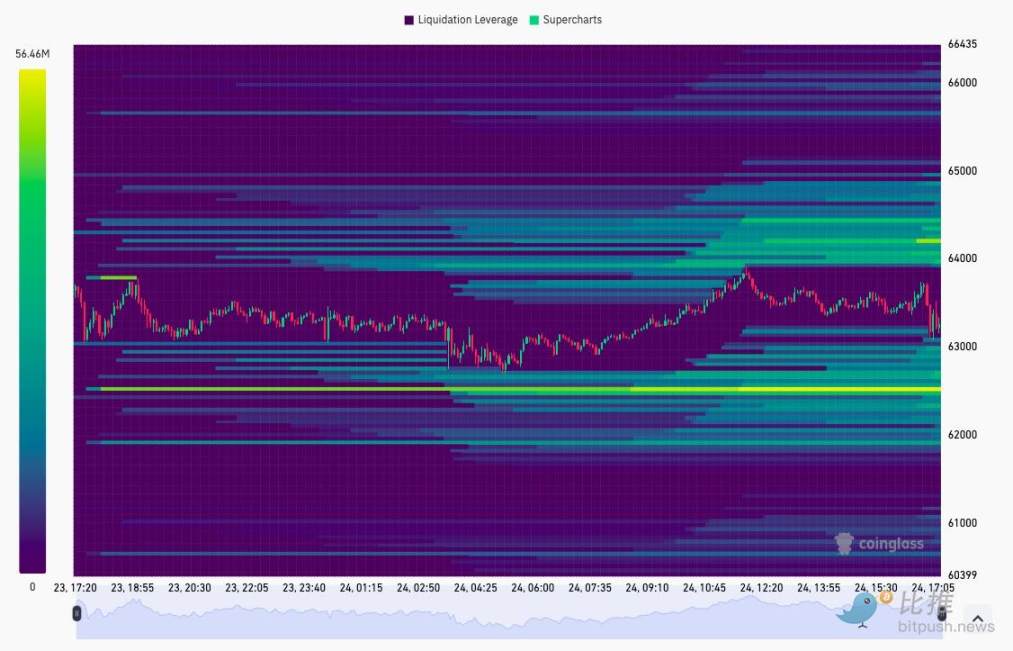

According to CoinGlass data, due to price range fluctuations, the liquidity of both long and short positions in the BTC/USD exchange order book is increasing, with $62,000 and $65,000 still being key levels of interest for traders.

Renowned trader Daan Crypto Trades expressed optimism about the next move: "Bulls know where the liquidity is, breaking through the $65,000 level will create higher highs and disrupt market structure. After that, the $70,000 level will be significant, with plenty of liquidity in that area. We have to take it step by step."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。