The US presidential election will affect the future market volatility.

Author: Kaiko

Translator: Block unicorn

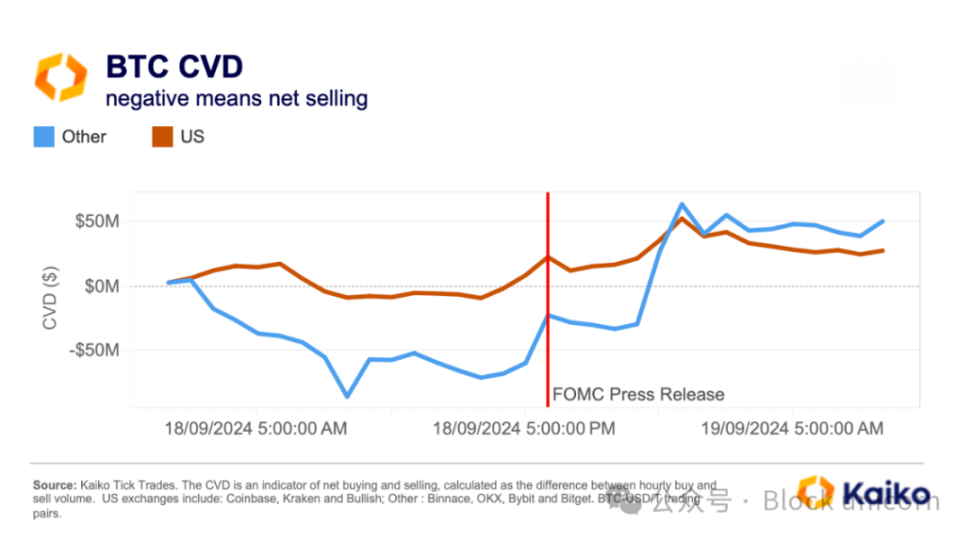

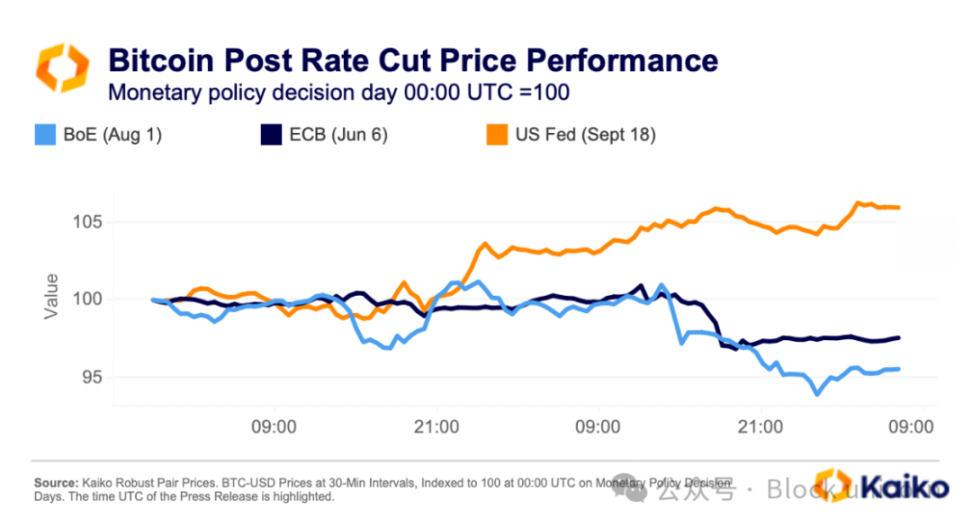

Last week, the Federal Reserve unexpectedly initiated a large-scale interest rate cut of 50 basis points, signaling two more rate cuts later this year. This move reignited hopes for a soft landing of the US economy, where economic growth slows down without leading to a recession. In response, both the US stock market and Bitcoin saw significant increases after the Federal Open Market Committee (FOMC) meeting, with the price of Bitcoin rising by 5.2% within 24 hours of the announcement.

Bitcoin's Cumulative Volume Differential (CVD) – an indicator measuring the net buying and selling pressure in the spot market – surged immediately after the Federal Reserve's news release at 18:00 UTC on September 18. As the Asian markets opened around 23:00 UTC, the buying pressure on offshore exchanges further intensified.

There was also a moderate influx of capital into the derivatives market. Between September 16 and 19, the open interest of Bitcoin futures contracts on platforms such as Bybit, OKX, and Binance increased by approximately 12%, reaching $12 billion.

The US central bank was not the first major central bank to cut interest rates this year. The European Central Bank (ECB) and the Bank of England (BoE) had already cut rates earlier in the summer. However, the market impact of these rate cuts was relatively mild, and the price of Bitcoin actually declined in the days following the ECB and BoE rate cuts.

So why did the market react so strongly to the Federal Reserve's decision?

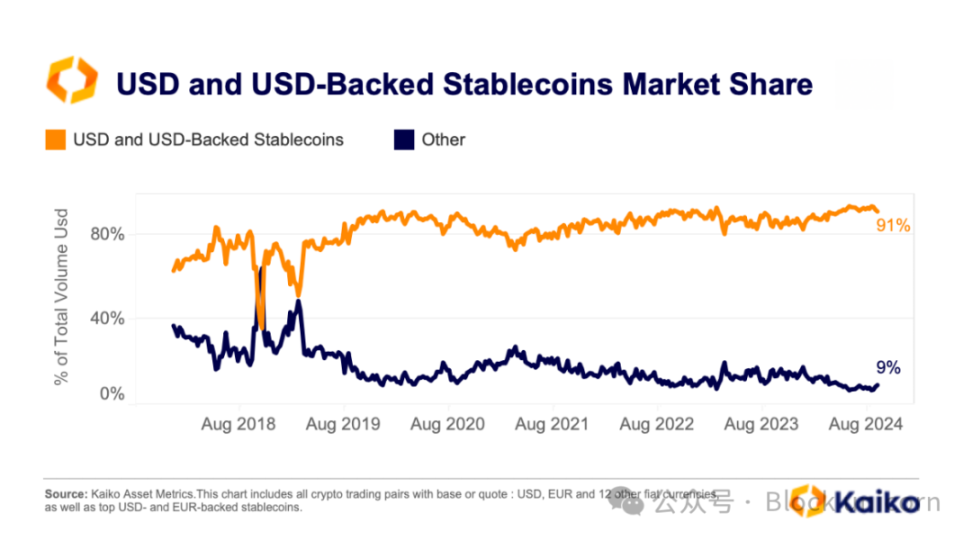

Lower US interest rates typically lead to a weaker US dollar. Since the US dollar is the primary quoting asset for Bitcoin (BTC), a weaker US dollar usually pushes up the price of Bitcoin when quoted in US dollars. Over the past few years, the trading volume of the US dollar and US dollar-backed stablecoins has steadily increased, reaching a historic high of 93% last month.

Furthermore, the Federal Reserve's loose monetary policy will increase the liquidity of the US dollar in the global market, prompting investors to seek alternative assets with higher returns, such as Bitcoin.

It is worth noting that the historical negative correlation between the US dollar and Bitcoin has weakened in the past month. In August, both Bitcoin and the US Dollar Index (DXY) declined, indicating that other factors are also influencing the price movements of these two assets. One such factor is the upcoming US presidential election, with former President Donald Trump currently seen as a favorable candidate for both the US dollar and Bitcoin.

Key Data:

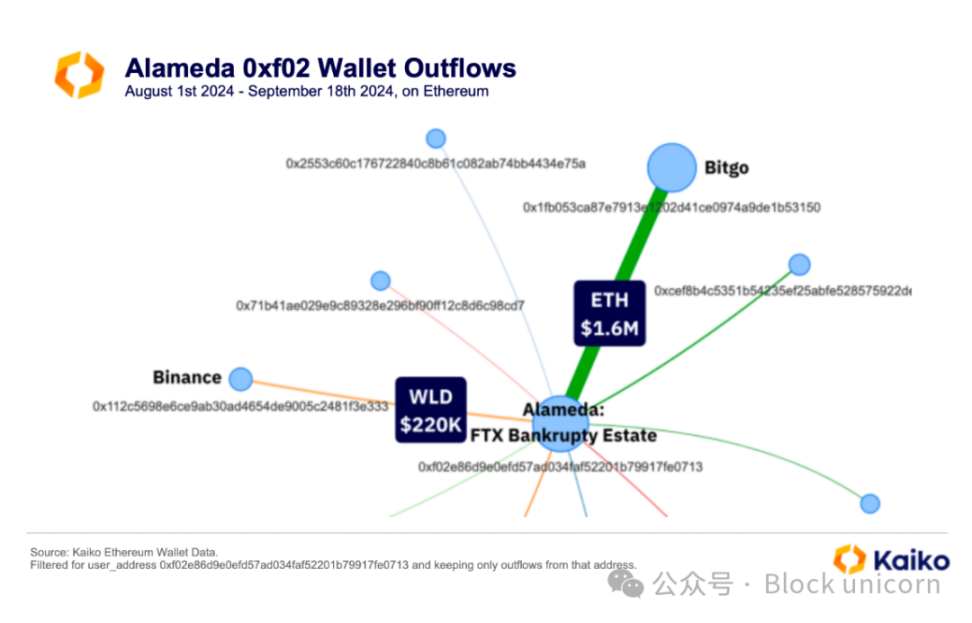

Wallets associated with Alameda Research are integrating assets.

It is rumored that crypto wallets associated with Alameda Research's affiliate FTX have been actively transferring funds over the past month, sparking speculation that FTX's bankruptcy estate may be integrating assets in preparation for repaying creditors. Earlier this year, FTX announced that it had reclaimed enough tokens to fully repay most creditors based on the value of the assets at the time of the bankruptcy application. It is expected that the exchange will begin repayment after the final approval of the liquidation plan in early October.

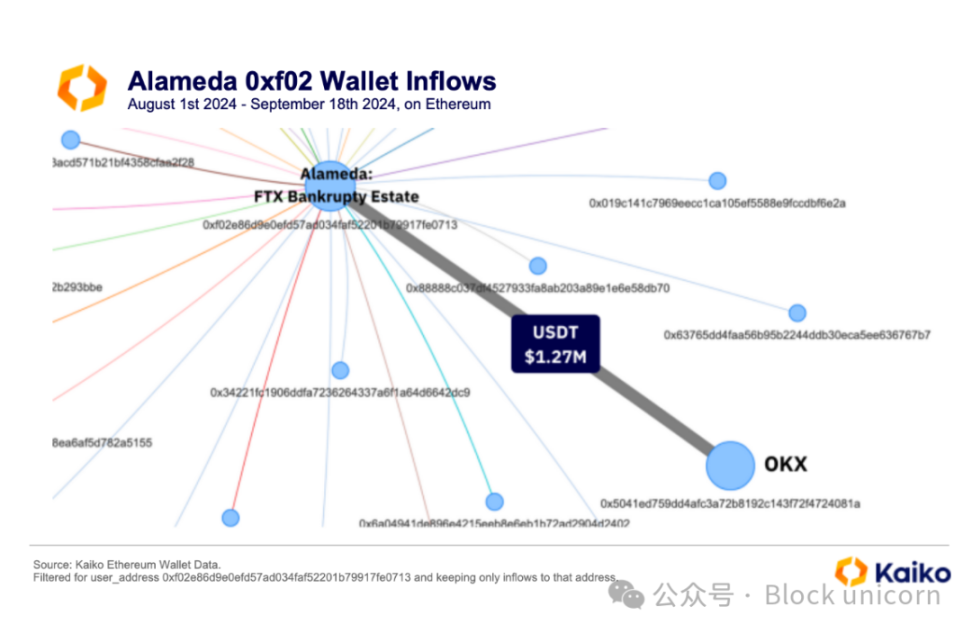

Using Kaiko's cryptocurrency wallet data solution, we investigated the fund flows of a wallet (address 0xf02e86d9e0efd57ad034faf52201b79917fe0713) which transferred $1.6 million worth of ETH to the crypto custody platform BitGo and $220,000 worth of World Coin (WLD) to Binance over the past month.

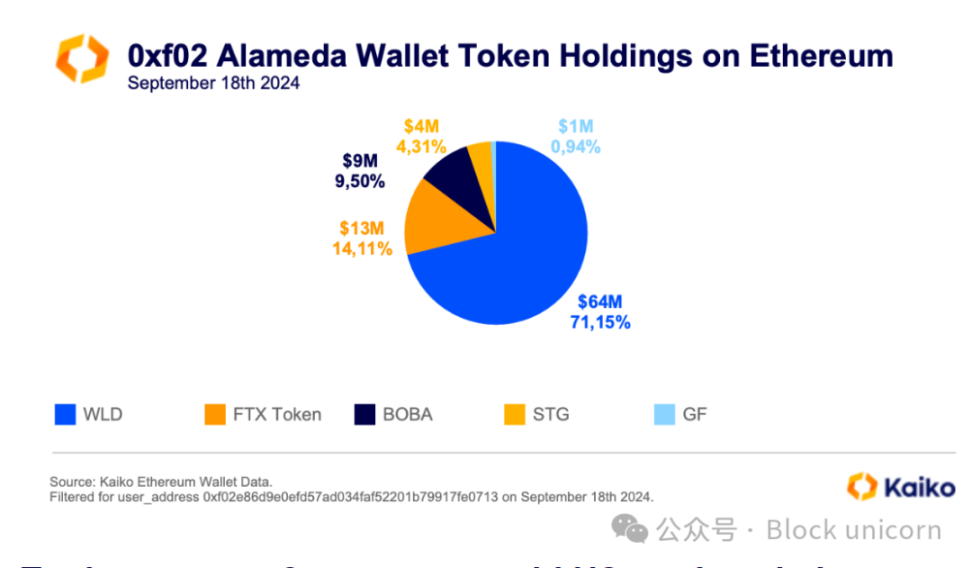

Transferring assets to exchanges is often seen as a bearish signal, as traders typically move assets to exchanges to sell. Alameda Research is an early investor in Worldcoin, holding 75 million WLD tokens worth $118 million. Since July, these tokens have been gradually unlocked by Worldcoin's developer, Tools for Humanity (TFH).

A detailed analysis of the wallet's fund inflows indicates that it consolidates assets through multiple small wallets, which are likely owned by Alameda Research. The largest inflow of funds is $1.27 million USDT from OKX.

As of September 18, Alameda's wallet still holds $64 million worth of WLD tokens. Selling these tokens could have a significant impact on the price, especially since the price has already dropped by 30% since the token unlock on July 24. Other major holdings include illiquid small-cap tokens such as FTX's FTT (worth $13 million) and Bona Network's BOBA (worth $9 million), with daily market depths of only $700,000.

Amidst the turmoil in the US market, traders are turning to Crypto.com. This year, changes in regulations and market structure have reshaped the landscape of cryptocurrency exchanges in the US. Cboe Digital closed its digital asset spot trading business in June, focusing on derivatives, despite announcing this plan as early as April.

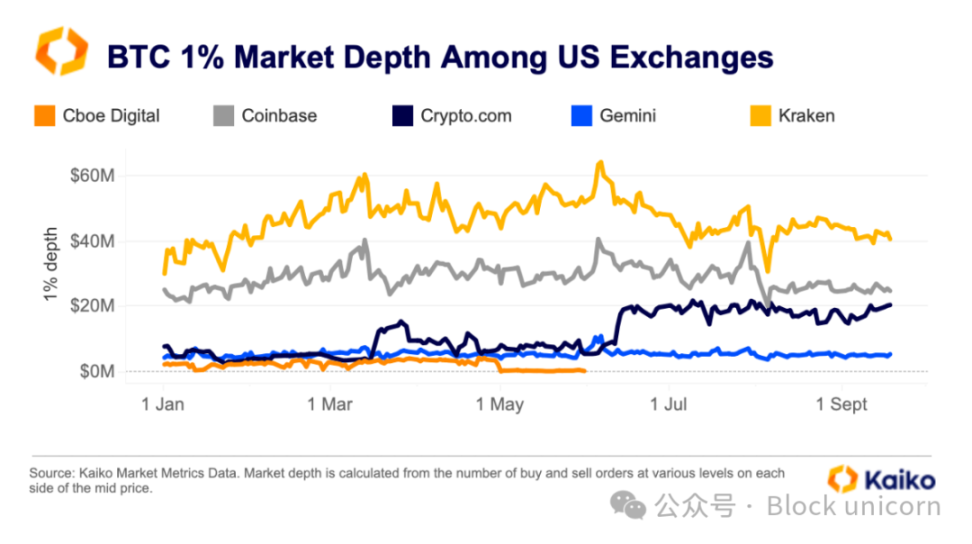

Since June, Crypto.com has seen a significant increase in trading volume and market share, indicating that it may have benefited from Cboe Digital's closure. With the surge in trading volume, liquidity has also increased. During the summer, the 1% market depth of Bitcoin on the exchange significantly surpassed that of Gemini and posed a challenge to Coinbase's liquidity. Coinbase even lost market share in the third quarter.

Furthermore, Crypto.com's competitive fee structure may also promote trading activity on the platform. The exchange currently waives market maker fees for VIP-level clients and has introduced other promotional activities. Additionally, Crypto.com's fees are generally more competitive compared to other US exchanges.

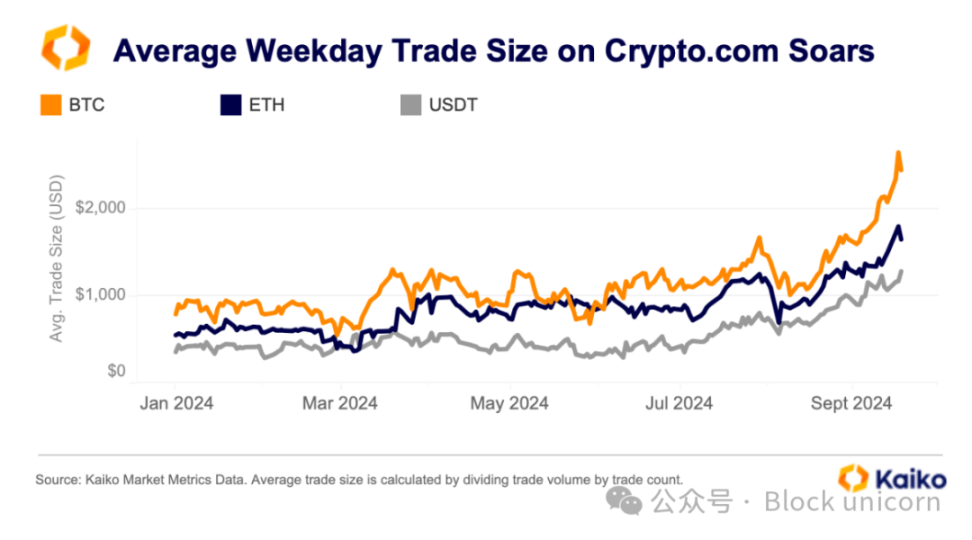

The simultaneous increase in liquidity and trading volume indicates that market makers have become more active on Crypto.com. The average trade size growth on the exchange is another sign that it may have gained more trading volume from Cboe's closure.

If we observe the weekday trading volume of BTC, ETH, and USDT, the trading volume has steadily increased since March, with a significant growth during the summer. As Cboe is an institutional trading platform, its average trade size is much higher than most retail platforms. The increase in trading volume on Crypto.com indicates an increase in institutional activity.

Why is there a growing concentration of liquidity in altcoins?

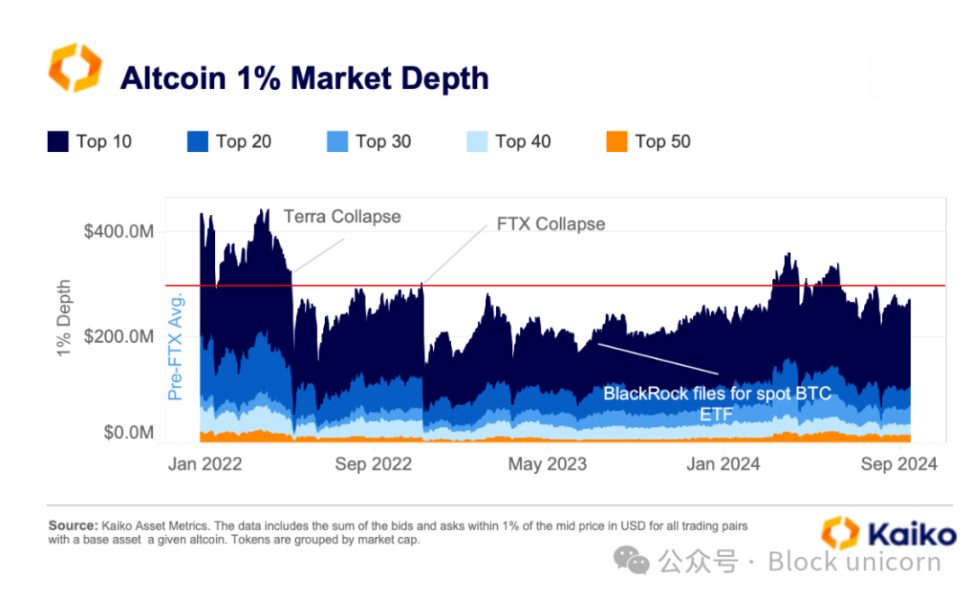

Despite significant volatility in recent months, the 1% market depth of altcoins remained relatively stable in the third quarter, maintaining at $270 million, indicating that market makers continue to provide liquidity despite ongoing volatility.

The liquidity of altcoins was significantly impacted by the collapse of FTX and Terra, with liquidity decreasing by over 60% between April and December 2022. However, liquidity gradually improved over the past year, surpassing the average level before the FTX collapse in the first quarter of 2024, but then declined in the third quarter.

However, the recovery of this trend is not evenly distributed by asset category. The liquidity of altcoins is becoming increasingly concentrated, with large-cap coins outperforming small assets.

As of early September, the top ten altcoins by market cap accounted for 60% of the total market depth, compared to approximately 50% at the beginning of 2022. In contrast, the market share of the top 20 altcoins decreased significantly during the same period, from 27% to 14%.

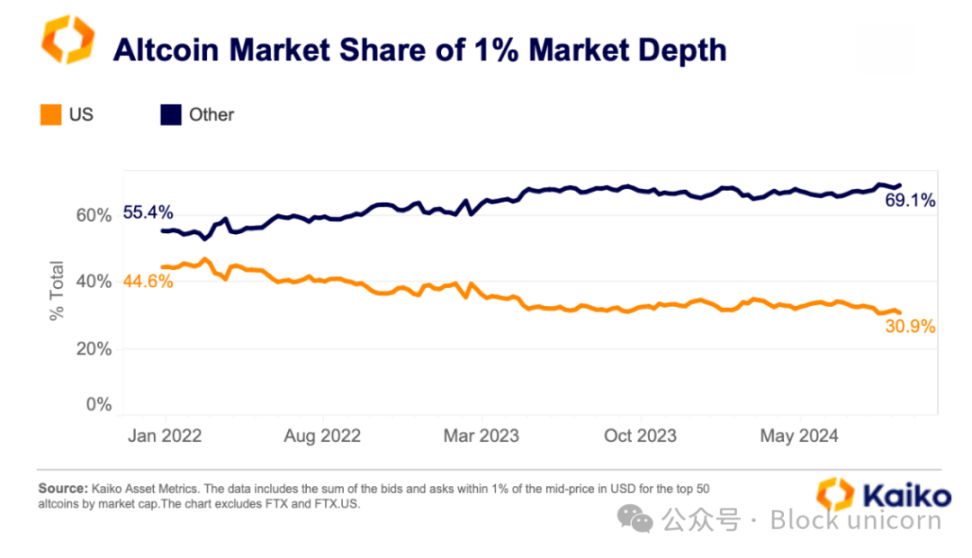

Additionally, the liquidity of altcoins is increasingly concentrated in offshore exchanges. The share of these exchanges in the total altcoin depth has increased from 55% at the beginning of 2022 to 69%, primarily driven by large and mid-cap altcoins.

We observe the opposite trend in Bitcoin liquidity, with the share of US exchanges relative to offshore markets increasing. This indicates that some market makers may have reduced portfolio risk or shifted towards Bitcoin.

Cooling down of exchange listings in 2024

The intensified global regulatory scrutiny has significantly changed the listing strategies of cryptocurrency exchanges, leading to a significant slowdown in new listings compared to the bull market in 2021.

However, focusing solely on the nominal number of new listings does not fully reflect how exchanges are expanding their product lines. To provide a clearer perspective, we compared the ratio of new listings to the total number of active trading pairs for each exchange.

In 2024, Binance added over 300 trading pairs, ranking second only to MEXC. However, these new trading pairs accounted for only 27% of its total products, lagging behind Bybit, Poloniex, and OKX in terms of listing expansion.

US-based exchanges have been more conservative, with new listed trading pairs accounting for only 4% to 15% of their existing products. For example, Coinbase only launched 29 new trading pairs in 2024, a tenfold decrease compared to 2021.

Overall, the new listed trading pairs of major exchanges this year only accounted for approximately 20% of the existing trading pairs, a significant decrease compared to the average level of 50% during the peak period in 2021.

US Presidential Election Sparks Cryptocurrency Market Volatility

Digital assets have become an increasingly prominent issue in the campaigns of the two major US presidential candidates. Former President Trump pledged support for Bitcoin and its related areas several months ago, and plans to launch his own cryptocurrency project in the coming weeks. Many market participants view this Republican candidate's support for Bitcoin as positive.

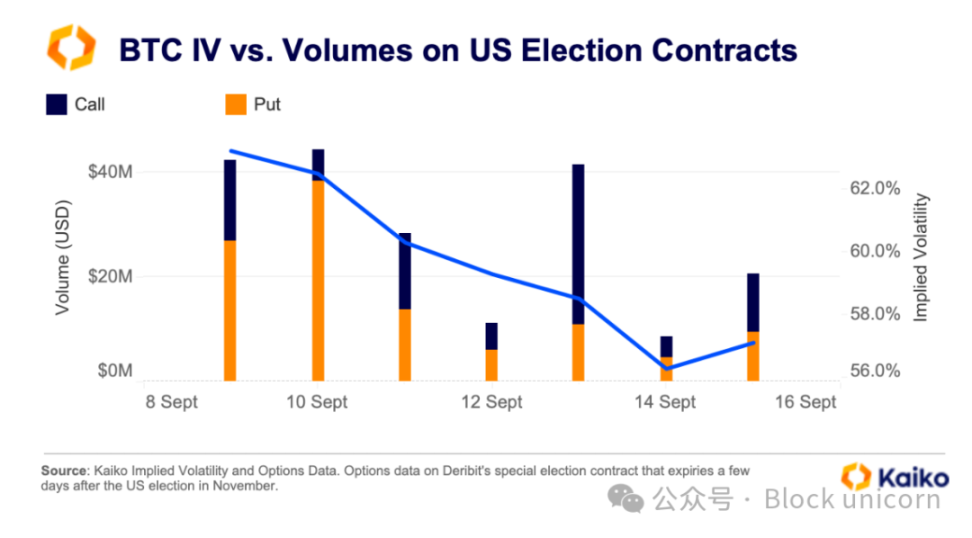

However, this could also be a double-edged sword, as recent debates have shown. During the debate, the price of Bitcoin fell, and the market reacted poorly to the performance of Trump and Harris.

Ahead of the debate, the implied volatility of Bitcoin options contracts for November 8 on Deribit surged, with these contracts expiring just three days after the US election. During the debate, trading volume for special election contracts soared to over $40 million, with traders mainly buying put options to profit from a decline in the price of Bitcoin.

The US presidential election is likely to continue to be a source of increased market volatility in the coming weeks, as we have entered the final stages of the election cycle. Although Bitcoin and digital assets did not become a focus in the 2020 election, their importance has been increasing. Former President Donald Trump has made his position clear early on, pledging support for digital assets in the US and speaking at a Bitcoin conference in August. While Kamala Harris has expressed less support for digital assets, the current Vice President indicated support for innovation in digital assets during a fundraising event on Sunday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。