In the long run, it will be a market worth trillions of dollars, capable of accommodating multiple large enterprises.

Author: Alana Levin, Variant

Translation: 1912212.eth, Foresight News

Stablecoins are the most revolutionary form of payment since the credit card. They are changing the way funds flow. With low cross-border transfer fees, near-instant settlement, and the ability to access globally demanded currencies, stablecoins have the potential to iterate the current financial system. For USD deposit-taking institutions that support digital assets, stablecoin business also presents a huge profit opportunity.

Currently, the global supply of stablecoins has exceeded 150 billion US dollars. The circulation of five stablecoins has reached at least 1 billion US dollars: USDT, USDC, DAI, First Digital USD, and PYUSD. I believe we are moving towards a world with more stablecoins—where every financial institution will issue its own stablecoin.

I have been thinking about the opportunities brought about by this growth. My conclusion is that observing the maturation process of other payment systems—especially credit card networks—may provide us with answers.

What similarities do credit card networks share with stablecoins?

For consumers and merchants, all stablecoins should feel like dollars. However, in reality, each stablecoin issuer handles dollars differently—due to different issuance and redemption processes, reserves supporting each stablecoin supply, different regulatory regimes, and the frequency of financial audits. Addressing these complexities will be a huge opportunity.

We have seen similar situations in the credit card field before. Consumers use assets that are almost equivalent to dollars but not completely interchangeable (they are dollar loans, but these loans are not interchangeable because everyone's credit score is different). Networks like Visa and Mastercard are responsible for coordinating payment processes within the system. And the stakeholders in both systems (or potentially the stakeholders) look very similar: consumers, consumers' banks, merchants' banks, and merchants.

An example might help to interpret the similarities in network structures.

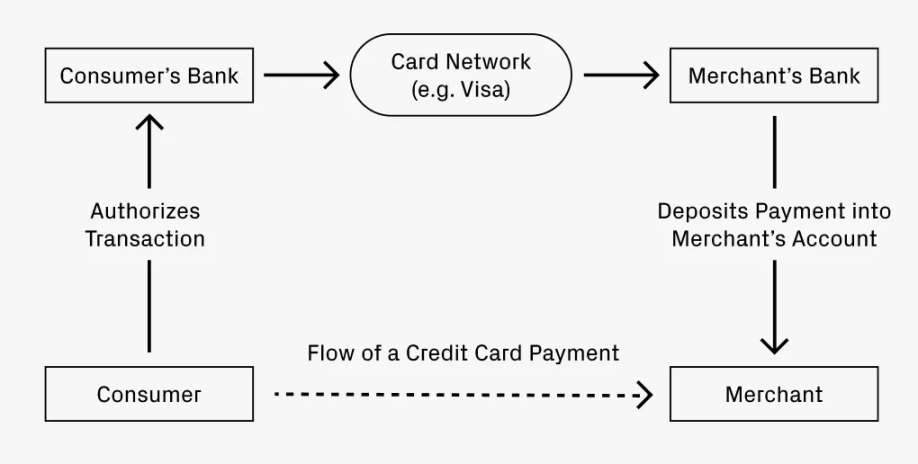

Suppose you go to a restaurant and pay the bill with a credit card. How does your payment enter the restaurant's account?

Your bank (the credit card issuer) will authorize the transaction and send the funds to the restaurant's bank (acquiring bank).

A clearing network—such as Visa or Mastercard—facilitates the exchange of funds and charges a small fee.

Then the acquiring bank will deposit the funds into the restaurant's account, but will deduct a certain fee.

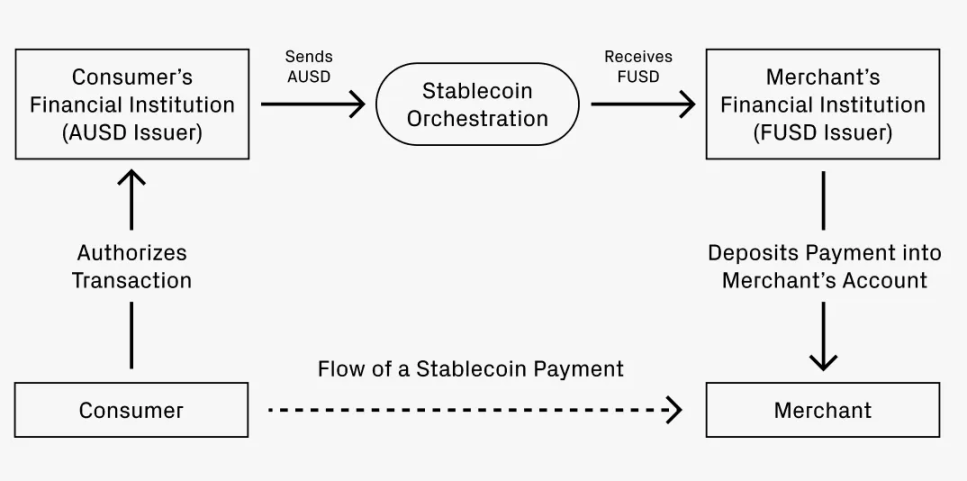

Now, suppose you want to pay with stablecoins. Your bank A issues AUSD stablecoin, and the restaurant's bank F uses FUSD. Although both stablecoins represent dollars, they are different. The restaurant's bank only accepts FUSD. So, how does the payment in AUSD convert to FUSD?

This process looks very similar to the process in credit card networks:

- The consumer's bank (issuer of AUSD) authorizes the transaction.

- A coordinating service will facilitate the conversion from AUSD to FUSD and may charge a small fee. There are at least several possible ways for this conversion process:

Option 1: Use decentralized exchanges for stablecoin-to-stablecoin exchanges. For example, Uniswap provides many such liquidity pools with fees as low as 0.01%.

Option 2: Convert AUSD to USD deposits, then deposit these USD into the acquiring bank and issue FUSD.

Option 3: Coordinating services settle the net funds through the network, which may require a certain scale to achieve.

- FUSD is deposited into the merchant's account, possibly deducting a fee.

Where does the analogy start to differentiate?

The above content shows the clear similarities I see between credit card and stablecoin networks. This also provides us with a framework to consider when stablecoins will start to significantly upgrade and surpass credit card networks in certain aspects.

First is cross-border transactions. If the scenario above is a US consumer paying at an Italian restaurant, where the consumer wants to pay in dollars and the merchant wants to receive euros, existing credit cards will charge up to 3% in fees. However, by exchanging stablecoins on DEX, the fees could be as low as 0.05% (a difference of 60 times). Applying this scale of fee reduction to widespread cross-border payments, the productivity boost that stablecoins can bring to the global GDP becomes obvious.

Second is the flow of payments from businesses to individuals. The time between payment authorization and the actual departure of funds from the payer's account is very fast: once funds are authorized, they can leave the account immediately. Instant settlement is both valuable and highly anticipated. Additionally, many businesses have globalized workforces. The frequency and amount of cross-border payments may be much higher than the daily transactions of ordinary consumers. As the workforce continues to globalize, this will provide strong momentum for this area.

Looking ahead: Where might the opportunities arise?

If the analogy between network structures has some reference value, it can reveal areas where entrepreneurial opportunities may arise. In the credit card ecosystem, major enterprises have developed from payment coordination, issuance innovation, and form factor support. For stablecoins, similar situations may also arise.

The previous examples mainly described the role of payment coordination, as the flow of funds itself is a huge business. The market value of Visa, Mastercard, American Express, and Discover is at least hundreds of billions, totaling over 1 trillion US dollars. The ability of these card networks to maintain balance in the market indicates that competition is healthy, the market is large enough to support large enterprises. It is reasonable to speculate that in mature markets, there will also be similar competition in the stablecoin coordination field. The development of stablecoins currently has only a foundation-building period of 1 to 2 years, leaving ample time for new startups to seize this opportunity.

"Issuing stablecoins" is also an area of innovation. Similar to the popularity of corporate credit cards, we may see more and more companies wanting to have their own stablecoins. Having control over the payment unit can give companies greater control in end-to-end accounting processes, from expense management to handling foreign taxes. These could become direct business lines for stablecoin coordination networks, but could also create opportunities for entirely new startups (such as companies like Lithic). The by-products of corporate demand may give rise to more new businesses.

"Issuing stablecoins" can also become more specialized. For example, the tiered system in credit cards: many credit cards allow customers to pay upfront fees to get a better reward structure. For example, Chase Sapphire Reserve or AmEx Gold. Some companies (usually airlines and retailers) even offer their own exclusive credit cards. If similar stablecoin reward tier experiments also emerge, I would not be surprised. This could also open up a new path for startup companies.

All of these trends drive each other's growth. As the forms of issuance diversify, the demand for payment coordination services will also increase. As coordination networks mature, they will lower the barriers for new issuers to enter the market. These are all huge opportunities, and I really hope to see more startups enter this field. In the long run, it will be a market worth trillions of dollars, capable of accommodating multiple large enterprises.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。