What kind of market information does Binance want to convey in the newly launched tokens?

Author: WOO

Background

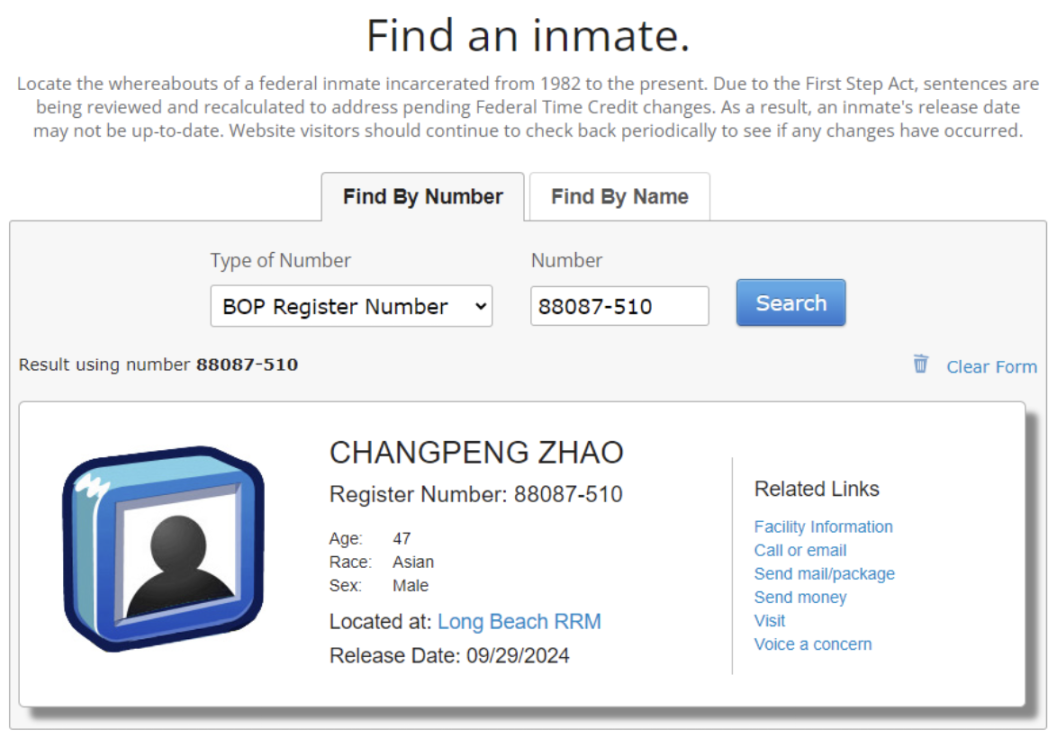

Binance founder Zhao Changpeng CZ was sentenced to 4 months in prison by the U.S. District Court in Seattle on April 30 this year for violating U.S. anti-money laundering laws. The prosecution originally requested a 36-month sentence, but due to receiving 161 letters of support from friends and family, emphasizing his good image in family and career, the judge's decision was positively influenced. The judge believed that although CZ had made mistakes in anti-money laundering, he did not intentionally engage in illegal activities, so he ultimately decided to give a light sentence of four months.

As time goes by, CZ is expected to be released on September 29, 2024, which will inevitably trigger another wave of related concept speculation in the meme market. Setting aside the expectation of speculation on new coins in the future, what tokens did Binance list during CZ's imprisonment? What are the patterns? How did the token prices perform? Most importantly, what kind of market information does Binance want to convey in the newly listed tokens? WOO X Research Institute will take you to explore.

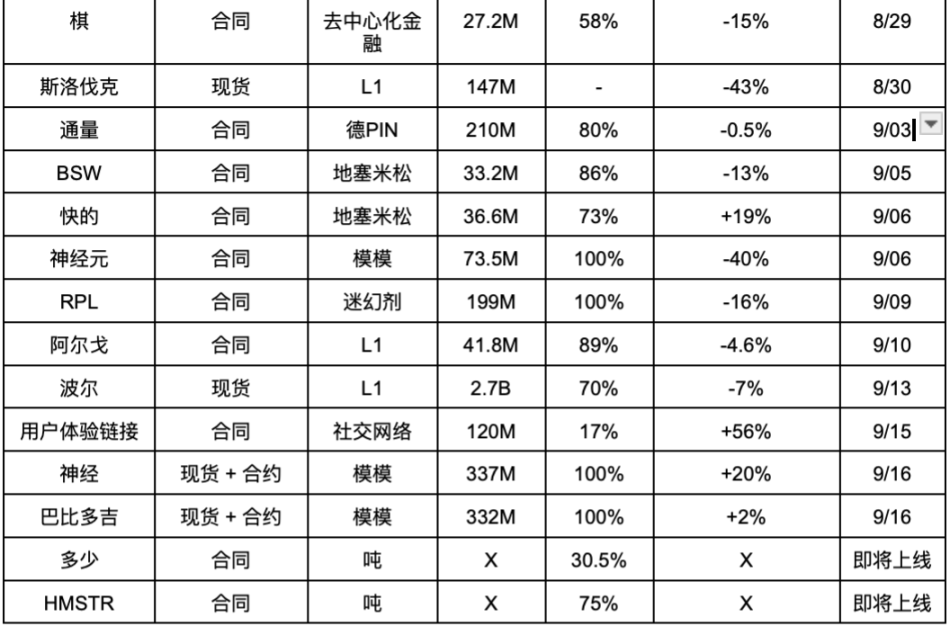

List of newly listed tokens on Binance

How to interpret Binance's token listing strategy?

Based on the above information, the following facts can be concluded:

- Frequent token listings, mainly contracts: A total of 38 tokens were listed, and after the listing of the RARE contract, Binance became more active in listing tokens, mostly listing contract tokens for which spot tokens already existed, with a frequency of almost one token per day. Furthermore, on September 16, three meme contracts (Neiro, Babydoge, Turbo) were listed at once.

- Breaking low circulation, high FDV impression: Except for new tokens (IO, ZRO, BB, LISTA), the circulation rate of listed tokens is above 40%, generally reaching 70% to 100%.

- Poor market environment: Most newly listed tokens experienced varying degrees of decline, but there were also a few outstanding performances, such as UXLINK, which rose by 56%. Overall, it did not bring wealth effects to users.

During these four months, the price of Bitcoin remained sluggish, fluctuating between 56,000 and 60,000, while BTC.D rose by 20%, reaching as high as 58%, indicating that during this period, most altcoins performed poorly, and overall market liquidity dried up.

Currently, the overall market lacks liquidity, the narrative is ineffective, and the market sentiment is low and pessimistic. Based on past experience, whenever Binance lists tokens, whether spot or contract, it can drive overall market optimism. Since the listing of the RARE contract, Binance has increased the frequency of token listings, even though most of the tokens are "old tokens" that no one cares about. This can be interpreted as Binance attempting to inject the market with "life-saving injections" time and time again, trying to stir up a ripple in a stagnant market.

However, after more than a month of attempts, it is clear that it can only achieve a "brief excitement" effect, with most of them being Pump and Dump, and with a very short lifecycle. Subsequently, Binance even rarely listed the NEIRO contract in uppercase, which was questioned by the community, and then listed Neiro spot and contract, Turbo, and Babydoge, these three meme tokens.

The reversal of the case sizes also caused the market value of the originally lowercase Neiro to soar from 18 million to 180 million in an instant, achieving a 10-fold increase in a short period, and then rising all the way to a high market value of 400 million US dollars. It is the only token listed on the exchange in recent times that has a wealth effect.

Token has a wealth effect -> Attracts more users from outside the circle -> Brings incremental funds -> Market liquidity improves -> Funds drive more different tokens to rise -> Token has a wealth effect

The above is a positive flywheel cycle.

Binance's active listing of tokens is the first step in starting the flywheel, creating stories of wealth, and attracting users.

Recent controversies related to token listings

However, Binance's recent large-scale listing of meme tokens and TON ecosystem-related tokens has sparked widespread criticism in the community, including serious front-running issues and lax token listing review by Binance. In response to these accusations, Binance co-founder He Yi responded in an article on September 17.

She pointed out that the principle of token listing on Binance is to meet user needs and admitted that the platform's lack of attention to meme tokens in the past led to a slow response when listing meme tokens such as Shiba Inu and PEPE. The listing standards prefer projects that have been around for a long time and have business logic.

Finally, in the article, she also stated, "If we disagree, maybe you are right." She believes that although everyone sees the world differently and can only see their own future, Binance will continue to explore the future and also appreciates all the community's guidance.

The whole article was neither humble nor overbearing, and the whole incident can be considered closed.

Market future expectations

On September 19, the Federal Reserve announced a 50 basis point rate cut, the first double-digit rate cut since 2020, signaling the start of a rate cut cycle, and it can be expected that hot money will gradually flow into the risk market, and the cryptocurrency market will regain liquidity.

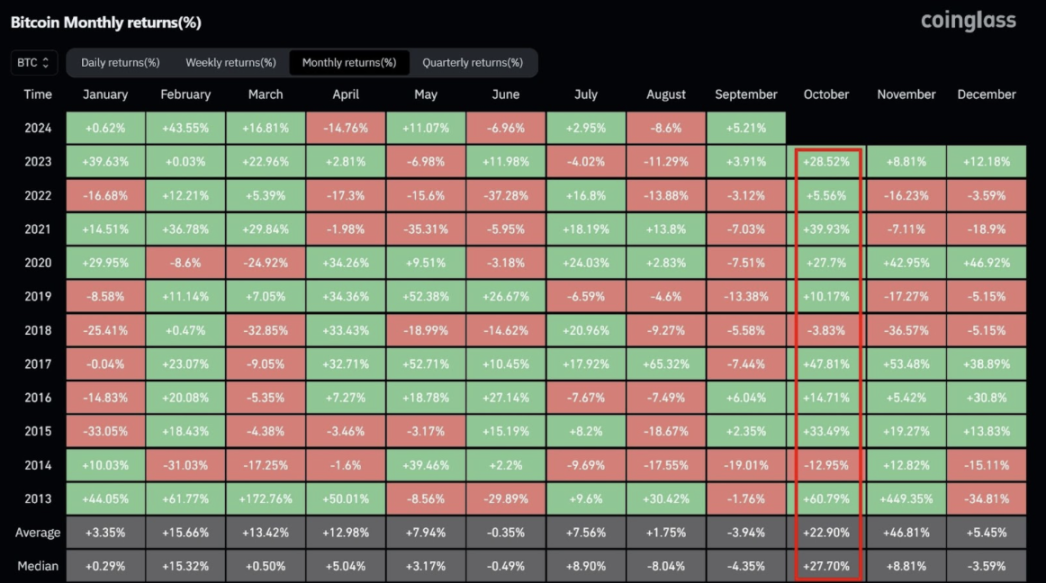

In addition, October has been referred to as "Uptober" in the crypto circle in recent years. According to the historical data of the crypto circle over the past 11 years, October has only seen two declines, while the other nine times have seen increases, with an 82% chance of an increase.

Currently, the macro conditions have improved, coupled with Binance's "artificial bull market," the cryptocurrency market is expected to emerge from the gloom in Q4 and Bitcoin is expected to reach a new all-time high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。