In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Summary

Due to the significant interest rate cut by the Federal Reserve, it has boosted the confidence of traders in various risk assets, leading to a surge in cryptocurrencies. Among them:

- Strong wealth creation sectors: Solana Meme, Restaking sector;

- User hot search tokens & topics: Tensor, Bonfida, APY crypto meaning;

- Potential airdrop opportunities: Owlto Finance, Major;

Data statistics time: September 20, 2024, 4:00 (UTC+0)

I. Market Environment

Due to the significant interest rate cut by the Federal Reserve, which has boosted the confidence of traders in various risk assets, and this move may signal the beginning of a loose monetary policy cycle by the U.S. central bank, cryptocurrencies have surged. The price of Bitcoin rose nearly 6% from its Wednesday dip below $60,000, reaching nearly $64,000 at one point yesterday. The S&P 500 index and the Nasdaq index rose by 1.7% and 2.5% respectively yesterday, also boosting the trading sentiment of cryptocurrencies.

According to TheBlock, CryptoQuant data shows that the 30-day increment of short-term Bitcoin holders (STH) has dropped to the lowest level since 2012. This also means a significant decrease in new demand in the Bitcoin market, as the need for new demand from short-term holders is necessary to maintain price increases. Currently, Bitcoin's upward momentum is relatively weak.

II. Wealth Creation Sectors

1) Sector Movement: Solana Meme (BILLY, MANEKI)

Main Reasons:

- Kyle Samani, co-founder and managing partner of Multicoin Capital, spoke at the main venue of TOKEN2049 on the first day, stating "Why SOL Will Flip ETH" during a roundtable discussion. He mentioned that the total validator fees paid to Ethereum holders and Solana holders in their respective systems are sometimes higher for Ethereum and sometimes higher for Solana. These metrics are now basically evenly matched.

- The price of SOL has rebounded, panic sentiment in the ecosystem has eased, and there are temporary signs of improved liquidity, driving an overall rise in ecosystem assets.

Rise Situation:

BILLY and MANEKI rose by 17.59% and 12.25% respectively in the past 24 hours;

Factors affecting future market:

Trend of SOL token: The trend of the SOL token in the Solana ecosystem will affect the prices of the entire ecosystem tokens, as many tokens are priced in SOL on DEX. Continue to monitor the price trend of SOL. If SOL maintains an upward trend, it may be advisable to continue holding SOL ecosystem assets.

Changes in open interest contracts: The open interest contracts of SOL rose yesterday, indicating an influx of hot money. By checking the contract data on the tv.coinglass website to understand the movements of major funds, first observe the increase in net long positions of the contracts; then observe whether there is a net increase in long positions of the contracts, an increase in open interest, and an increase in trading volume. If so, it indicates that major players are continuing to buy, and it may be advisable to continue holding.

2) Sectors to Focus on in the Future: Restaking Sector

Main Reasons:

Ether.fi has launched the EIGEN airdrop query portal, distributing a total of 16,480,753 EIGEN tokens to eETH re-staking users. The EIGEN token will soon enable transfers at the end of September, and the future Restaking projects may experience a wave of market trends;

Specific coin list:

ETHFI: The Restaking project was the first to TGE and conducted its first round of airdrop of its ETHFI token, bringing considerable wealth effects; EIGEN: The leading project with the highest TVL based on the Ethereum Restake protocol; REZ: One of the core projects in the Restaking track, currently with a TVL of 1 billion USD;

III. User Hot Searches

1) Popular Dapp

Tensor (Dapp)

Richard Wu, co-founder of the Solana ecosystem NFT trading platform Tensor, recently announced that:

- Tensor is now fully open source (including 5 protocols such as the NFT market) and has hosted free and fully customizable Web2 API.

- The NFT market fee of Tensor is set as follows: 50% of the Tensor fee goes to the developers, and 50% is allocated to the Tensor Foundation treasury.

- The Tensor Foundation has also opened a sponsorship program, and token sponsorship is currently available. Tensor has been developing a new product for the past month.

Tensor is the leading NFT trading market in the Solana ecosystem, with a current token price of $0.38 and is already listed on Bitget. The project is well-positioned, has strong product delivery capabilities, and the token may perform well in the future, so it may be advisable to continue monitoring.

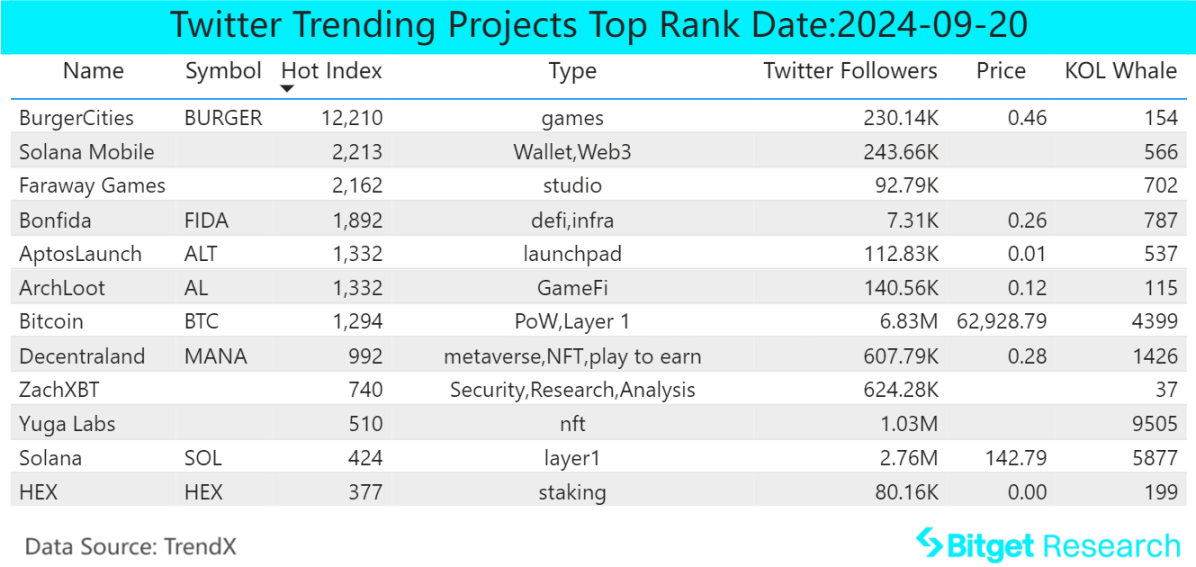

2) Twitter

Bonfida (FIDA)

The project is a leading domain service provider in the Solana ecosystem, providing the Solana Name Service. The Solana public chain is characterized by high performance, and in the future application era, the project may become an important infrastructure. In the past 24 hours, Binance has listed FIDA's contract trading pairs, attracting widespread attention from the community and causing the token price to rise. Combined with improved macro liquidity, the token price may rebound for a period of time. Bitget has already listed this asset, so it may be advisable to continue monitoring.

3) Google Search & Region

Global Perspective:

APY crypto meaning:

APY stands for Annual Percentage Yield, and in the market environment of volatile trends, there is a high level of user interest in crypto asset financial products. Bitget provides structured products such as dual-currency financial management and range hunters, offering high-yield coin-based products to users. In addition to structured products, the returns from Bitget's staking, time deposits, and other products are also higher than those of similar competitors in the market.

Regional Hot Searches:

(1) Grass is the main focus in CIS and other regions, and Crypto Bubble has become a hot search in Ukraine, Russia, and other regions, indicating a high level of attention to the secondary market in CIS.

(2) Hot searches in Europe and the United States are diverse, mainly focusing on projects with recent strong performance, including: FIDA, FTM, GALA, AERO, and other projects;

(3) Asian users have a high level of interest in weighted coins, including BTC, SOL, ETH, MATIC, and the Middle East region has seen an increase in searches for Crypto Exchange.

IV. Potential Airdrop Opportunities

Owlto Finance

Owlto Finance is a decentralized cross-rollup cross-chain bridge focused on Layer2. It currently supports users to cross-chain between more than 15 L2s such as the Ethereum mainnet, zkSync Era, and Starknet.

Owlto Finance's valuation has reached $1.5 billion, ranking first in cross-chain volume on DefiLlama within 24 hours, with a market share of 33%.

Specific participation method: The project started the Metaverse Owlypics cross-chain airdrop activity on August 28, with a prize pool of $34,000. The event will last for two weeks and supports interaction and earning rewards on the Arbitrum, Optimism, Linea, Scroll, Base, Blast, Taiko, and BOB networks.

Major

Major is a minimalist-style game based on Telegram, where the player's sole objective is to collect more stars. The more stars a player has, the higher their ranking, and the more generous the rewards they can receive. Players can earn stars through standard methods such as daily tasks, referrals, and completing profiles. Bitget has launched pre-market trading, allowing users to place pre-market sell orders to lock in profits.

In the game, the sole objective of Major players is to collect more stars. The more stars they have, the higher their ranking, and the more generous the rewards they can receive. Currently, Major rewards TON tokens to the top 100 users on the weekly leaderboard: 1st place receives 150 tokens; 2nd place receives 100 tokens; 3rd place receives 70 tokens; 4th to 4th place each receive 50 tokens; 6th to 10th place each receive 20 tokens; and 11th to 100th place each receive 5 tokens.

Specific operation method: 1) Upon entering the game, players can receive initial stars; 2) Further stars can be obtained through daily tasks, referrals, and completing profiles in the task bar.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。