Article: Arain, ChainCatcher

The shoe has finally dropped. In the early morning of September 19th, Beijing time, the Federal Reserve announced a 50 basis point cut in the federal funds rate target range, lowering it to a level between 4.75% and 5.00%. This is the first time the Federal Reserve has initiated a rate cut since March 2020. Prior to this, in order to alleviate domestic inflation in the United States, the Federal Reserve raised interest rates 11 times from March 2022 to July 2023, with a cumulative increase of 525 basis points.

This means that the monetary policy in the United States has shifted from tightening to easing. Bitcoin bid farewell to its slump, rebounding near the rate cut decision, returning to $60,000 per coin, and subsequently surged to near the high point of the past 20 days. Before the stock market opened today, stocks related to cryptocurrencies rose, with Coinbase (COIN.US) up over 3% and MicroStrategy (MSTR.US) up over 4%.

Unusually Large Rate Cut, Mixed Market Reaction

Historically, a significant rate cut by the Federal Reserve often leads to economic growth, stimulates inflation, and gives rise to asset bubbles.

The announcement of a 50 basis point rate cut by the Federal Reserve this time is historically rare. Bank of America had previously warned that a 50 basis point rate cut "makes no sense, is difficult to communicate, and may trigger a flight to safety."

In the history of the United States, there have only been three instances of rate cuts without an economic recession: during the Greenspan era from 1994 to 1996, during the Asian financial crisis from 1998 to 1999, and during the money shortage in 2019. Each of these three rate cut cycles consisted of three 25 basis point cuts. Some analysts believe that this rate cut may be compensating for the rate cut in July, showing that the Federal Reserve's action is not lagging behind the economic situation. However, Federal Reserve Chairman Powell denied that the rate cut was delayed and stated that it is a demonstration of the Federal Reserve's commitment to not lag behind the economic situation.

Nomura Securities studied the performance of assets in several historical cycles of significant rate cuts and found that three months after a 50 basis point rate cut by the Federal Reserve, the S&P 500 index remained basically unchanged, small-cap stocks surged, technology stocks performed well, value stocks outperformed growth stocks again, the US dollar rose, metal prices soared, and the yield curve showed a steepening bull market trend.

JPMorgan Chase expects the Federal Reserve to continue cutting rates and also points out that the beginning of a loose monetary policy by the Federal Reserve often coincides with poor performance of risk assets.

On the day the rate cut information was announced, the US stock market reached new highs but ultimately closed lower. The Dow Jones Industrial Average fell by 0.25%, the S&P 500 index fell by 0.29%, and the Nasdaq Composite Index fell by 0.31%.

Based on the current market reaction, the performance of the cryptocurrency market has benefited from the Federal Reserve's rate cut. Tradingview data shows that the technical aspect of Bitcoin is in a buying state, while the moving average indicates a strong buying state.

Leena ElDeeb, a research analyst at 21Shares, stated, "Retail sales exceeding expectations and being well received have temporarily alleviated people's concerns about an economic recession. We may see investors' interest in risk assets such as cryptocurrencies recover, thereby stimulating more funds flowing into Bitcoin spot ETFs."

Ki Young JuX, the founder of CryptoQuant, stated that institutions are no longer actively shorting Bitcoin. CME futures net positions have decreased by 75% over the past 5 months.

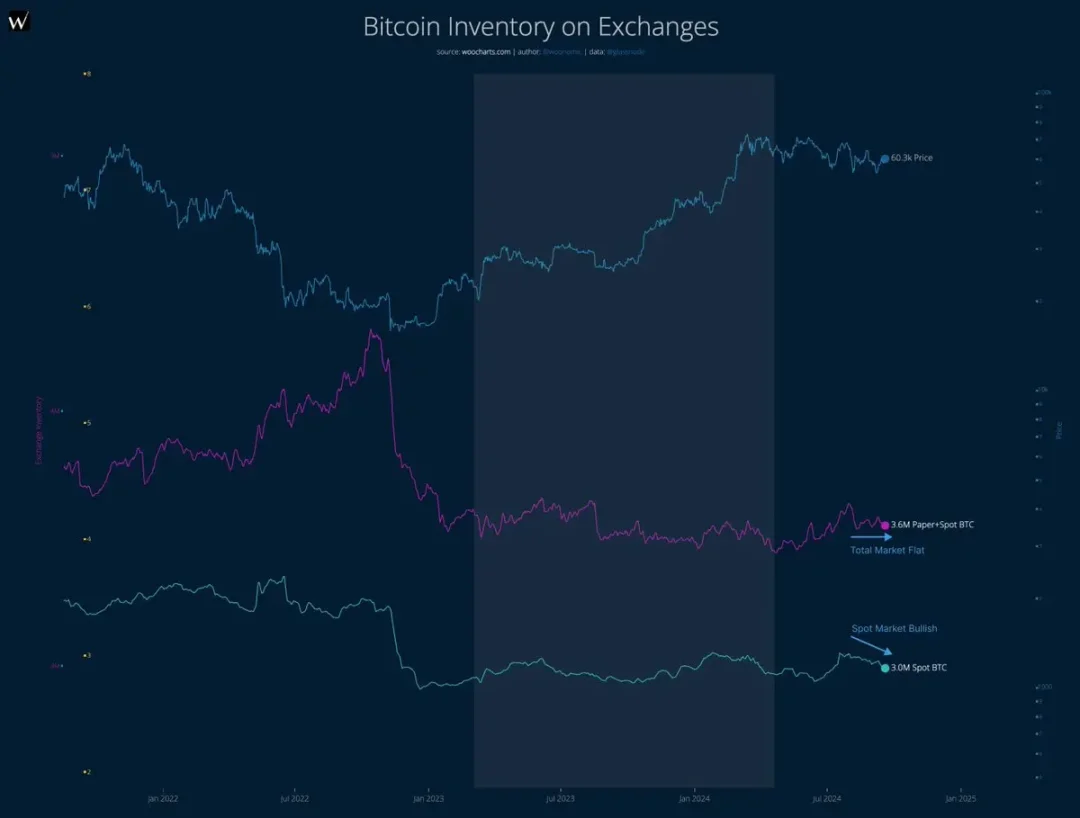

Bitcoin on-chain analyst @Willy Woo expressed his views on the latest X, stating that the bullish trend in the short term remains, but "there may be only a week left": "We see a large amount of spot BTC being bought up, and the proportion of exchange derivative inventory remains stable, but if there is a short squeeze, this situation may change rapidly. Chart patterns are forming a bullish flag. The current demand and supply are neutral to bearish, but if there are some liquidations, there are signs that it may enter a bullish structure. Cautiously optimistic."

The latest report from Glassnode states that based on on-chain data, the Bitcoin market is currently in a balanced state, with investors mainly holding, but future market volatility may intensify: "The supply side is tightening, and the amount of stablecoins available is significantly decreasing. However, the increase in the supply of stablecoins brings greater future purchasing power, creating tension between current inactivity and potential future demand in the market. This has created a spring-like effect in the market, implying that future volatility will further intensify."

It should be noted that institutions need to continue monitoring the subsequent net inflows of ETFs following the rate cut information. According to data from SoSoValue, on September 18th, the US spot Bitcoin ETF reported a net outflow of $52.83 million, ending a streak of net inflows exceeding $500 million for four consecutive days, with Ark Invest and 21Shares' ARKB leading the outflow, with an outflow amount of $42.41 million.

Focus on Subsequent Rate Cut Pace and US Presidential Election

The Federal Reserve may continue to cut rates in the future.

19 members of the Federal Open Market Committee expect the Federal Reserve to further cut rates by the end of this year, with 9 members expecting a 50 basis point cut and 7 members expecting a 25 basis point cut.

Several institutions have expressed the view that the Federal Reserve will continue to cut rates. Brian Coulton, Chief Economist at Fitch Ratings, stated that this round of loose policy will continue with 10 rate cuts over 25 months, totaling a 250 basis point cut. JPMorgan Chase and Citigroup expect the FOMC to cut rates by 50 basis points at the November meeting, with JPMorgan Chase believing that subsequent meetings will each involve a 25 basis point cut. Bank of America Global Research expects the Federal Reserve to implement a 75 basis point cut in the fourth quarter of this year.

The size of the rate cut in this round by the Federal Reserve has sparked discussions, as it is associated with the topic of "whether the US economy is in good shape."

Biden stated on social media X, "We have just reached an important moment: the inflation rate and interest rates are falling, and the economy remains strong… Our policies are reducing (consumer) costs and creating job opportunities."

US Vice President Harris also stated that the rate cut is welcome news. She said in a statement, "While the statement is good news for Americans who are facing high prices, my focus is on continuing to lower prices."

Former US President Trump questioned the rate cut by the Federal Reserve. When asked about his reaction to the rate cut during a campaign event in New York on the 18th, Trump responded that it either reflects that "the economy is very bad": "I think, if they are not just playing politics, such a large rate cut indicates that the economy is very bad. Either the economy is very bad, or they are playing politics, there are only these two possibilities. But this is a very large rate cut."

Powell stated at a press conference on the same day that there are currently no signs indicating a high likelihood of a downturn in the US economy.

Emmanuel K. of Barclays Capital Securities believes that after the first rate cut, it may take two to three quarters for economic growth to rebound, so it is uncertain whether the US economy can avoid a recession.

It is worth noting that the phenomenon of "US economic recession" will also affect the future price trend of Bitcoin. Grayscale predicts that if the US economy avoids a recession and maintains a path of controlled slowdown, Bitcoin may retest its previous historical highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。