According to the Telegram audit disclosure, in 2023, Telegram had sold some of its TON holdings for a value of 243 million US dollars, but as of December 31, 2023, Telegram still had nearly 400 million US dollars of encrypted digital assets on its books.

Written by: JIM EDWARDS

Translated by: DetectiveTON

Telegram is not just an instant messaging application with over 950 million monthly active users; it is quietly transforming into a cryptocurrency company. Recently leaked Telegram audit reports revealed more revenue details of this social media giant. According to the Telegram audit disclosure, in 2023, Telegram had sold some of its TON holdings for a value of 243 million US dollars, but as of December 31, 2023, Telegram still had nearly 400 million US dollars of encrypted digital assets on its books.

Beyond its social business, TON supports nearly half of Telegram's revenue

The audit shows that in 2023, nearly 50% of Telegram's revenue was related to cryptocurrency business, making cryptocurrency business the largest source of revenue for Telegram.

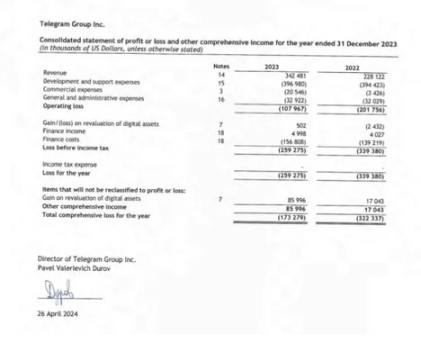

This audit, signed by Telegram founder Pavel Durov and conducted by the Dubai branch of PWC, revealed that in 2023, Telegram achieved revenue of 342 million US dollars, but incurred an operating loss of 108 million US dollars during the same period. In addition to the operating loss, the report also separately listed the "gain or loss on revaluation of crypto assets" item, which recorded a profit of 502,000 US dollars in 2023, while in 2022 it incurred a loss of 2.432 million US dollars.

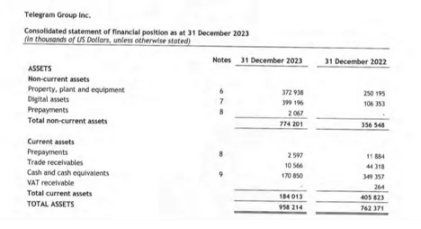

Of particular note is the "revaluation gain on digital assets" in 2023, which reached 85.996 million US dollars under the "excluding profit and loss" category, far exceeding the 17.043 million US dollars in 2022. As of the end of 2023, Telegram's "digital assets" on its books reached 399 million US dollars, a significant increase from 106 million US dollars in 2022. It is worth mentioning that in 2023, Telegram had already sold some of its TON tokens for a value of 243 million US dollars.

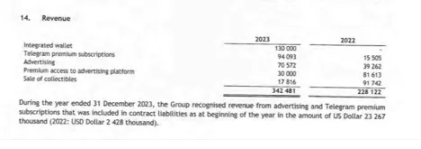

In terms of revenue composition, Telegram's cryptocurrency-related business has performed well. In 2023, the "Integrated wallet" project contributed 130 million US dollars in revenue, accounting for 38% of the total revenue. This new business mainly refers to the @Wallet widely used by users in the Telegram ecosystem. In addition, the "Sale of collectibles" (such as usernames, virtual phone numbers, etc.) contributed 17.816 million US dollars in revenue in 2023. The revenue from these two cryptocurrency-related businesses accounted for 43%, a slight increase from the 40% in 2022.

Telegram's other business revenues are also steadily growing. Paid subscription services generated 94.09 million US dollars in revenue in 2023, more than 5 times the revenue in 2022, accounting for 27.5% of the total revenue. Other sources of revenue include advertising revenue (70.572 million US dollars) and paid services for accessing the advertising platform (30 million US dollars).

The accounting treatment of crypto assets has always been a complex topic in financial reporting. Current accounting standards require these assets to be treated as "intangible assets" and recorded on the balance sheet at cost. This method requires companies to conduct "impairment tests" regularly, evaluating the value of digital assets each quarter. If the asset prices fall, the company must reflect this impairment on the books. However, even if the asset prices rise, current standards do not allow companies to correspondingly increase their book value.

This accounting treatment is widely used in the industry. For example, well-known companies such as Tesla and MicroStrategy hold large amounts of Bitcoin and use this "intangible asset" approach for accounting treatment. Although this approach is cautious, it may not accurately reflect the actual market value of crypto assets, especially in the case of frequent fluctuations in the crypto market.

The Financial Accounting Standards Board (FASB) in the United States issued new guidance at the end of 2023, aiming to improve the accounting treatment of digital currency assets. This new standard is planned to take effect on December 15, 2024, and its core reform allows companies to value crypto assets at fair market value. More importantly, changes in asset value can be directly included in the income statement for each accounting period.

Therefore, combining the above disclosures about "crypto asset" in Telegram's balance sheet and income statement, it can be roughly inferred that Telegram seems to have adopted the latest guidance on accounting treatment of digital currency assets issued by the Financial Accounting Standards Board (FASB) in the United States. This change was reflected in Telegram's 2023 financial report, with the appearance of the "revaluation gain on crypto assets" item.

Combining the above revenue composition, it is not difficult to see that cryptocurrency-related business has developed into a major pillar for Telegram, contributing to nearly half of its revenue. The core of this emerging business sector undoubtedly revolves around the TON cryptocurrency ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。