In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Author: Bitget Research Institute

Abstract

The Federal Reserve held an FOMC meeting early Thursday morning Beijing time, announcing a 50bp rate cut, officially starting a rate cut cycle. Among them:

- The sectors with strong wealth creation effects are: public chain sector (SEI, SUI), modular sector (TIA, SAGA, DYM);

- User hot search tokens & topics: MomoAI, KDA, Bigtime;

- Potential airdrop opportunities: Symbiotic, Polymarket;

Data statistics time: 4:00 on September 19, 2024 (UTC+0)

I. Market Environment

The Federal Reserve held an FOMC meeting early Thursday morning Beijing time, lowering the federal funds rate by 50 basis points to 4.75%-5.00%, officially starting a rate cut cycle. The market feedback is quite obvious, with Bitcoin stabilizing at $61,000 and other cryptocurrency sectors becoming active.

In terms of ETFs, Bitcoin ETFs saw a net outflow of $52.7 million yesterday, and Ethereum ETFs saw a net outflow of $9.8 million. From the perspective of ETF funds, it can be seen that ETF traders mainly adopted a risk-averse strategy yesterday and did not actively trade the rate cut.

In the cryptocurrency ecosystem, the public chain sector collectively rebounded significantly, with some upcoming public chain tokens experiencing increases. With the 50bp rate cut, market sentiment is gradually warming, and traders are actively participating.

II. Wealth Creation Sectors

1) Sector Dynamics: Public Chain Sector (SEI, SUI, TAIKO)

Main Reasons:

The recent price increases of SEI, SUI, and TAIKO are mainly due to the overall market boom, technological innovation, and ecosystem development of the public chain sector. SEI has shown outstanding performance in decentralized exchanges, with a price increase of over 20% in the past 24 hours. SUI's efficient transaction speed and the thriving development of the DeFi ecosystem have led to a 17.2% price increase. The performance of these projects not only reflects investors' confidence in new public chain technology but also demonstrates the market's demand for high performance, scalability, and new application scenarios.

Price Increases:

SEI, SUI, and TAIKO have increased by 22.1%, 14.5%, and 24.1% respectively in the past 24 hours;

Factors Affecting Future Market:

- Market and institutional support: SUI has received USDC support, Grayscale has launched SUI trust, and suspected large-scale trading purchases, all of which have provided strong market endorsement and liquidity support.

- Thriving ecosystem: SUI's TVL in the DeFi field has exceeded $600 million, demonstrating its competitiveness in this field. The healthy development of the ecosystem usually brings higher market recognition and investment interest. Macroeconomic and policy environments, such as the impact of the FOMC meeting on market sentiment, although indirect, may also affect the price trends of these tokens.

2) Sector Dynamics: Modular Sector (TIA, SAGA, DYM)

Main Reasons:

The DA layer led by Celestia continues to receive continuous attention and active attempts from many developers as an ecosystem, and the market continues to see DA projects in various sub-fields airdropping to TIA stakers. On the other hand, TIA tokens have almost returned to the initial TGE price after a long period of washing, indicating a situation of significant undervaluation. Therefore, some funds have started to increase their investment in various DA tokens to restore their valuations.

Price Increases:

TIA, SAG, and DYM have increased by 16.3%, 23.2%, and 14.5% respectively in the past 24 hours;

Factors Affecting Future Market:

- Healthy ecosystem and user growth: These projects have shown signs of healthy ecosystem development and user growth, directly affecting their market value. The overall rise of modular blockchain projects also reflects recognition of the overall trend in this area.

- Market sentiment and speculative factors: From social media and investor discussions, market sentiment significantly affects the future growth potential of these tokens and short-term market fluctuations. For example, news about Eclipse Labs' financing has sparked short-term upward sentiment for TIA and DYM.

III. User Hot Searches

1) Popular Dapps

MomoAI:

MomoAI is an AI-driven social gaming platform focused on the Web3 ecosystem. Its main features include rapid user growth and deep engagement achieved through viral propagation mechanisms and AI technology. Recent developments, including a successful user attraction through an airdrop activity and game called MOMO, have shown effectiveness in growth strategies and user engagement. MomoAI has achieved significant user growth in a short period, surpassing 1 million users in just 50 days and ranking high on DappRadar, demonstrating its leading position in the Web3 gaming ecosystem.

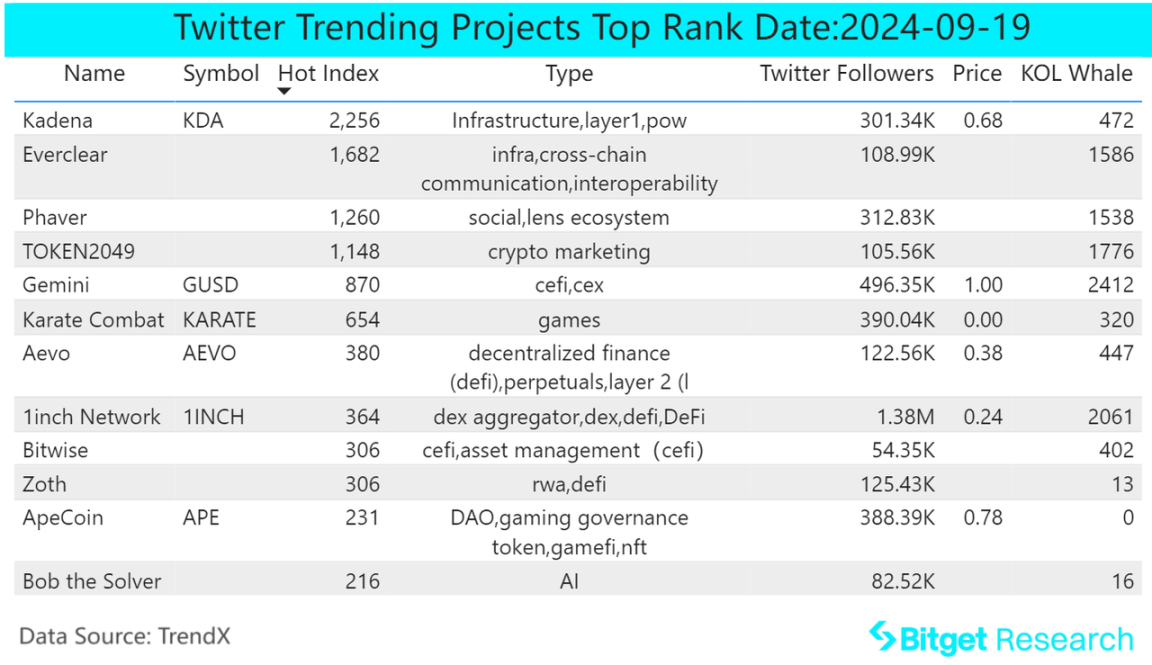

2) Twitter

Kadena (KDA)

Kadena is a POW-based blockchain network that primarily focuses on network expansion to help developers create a more stable on-chain development environment. In the past 24 hours, Binance has launched KDA's contract trading pairs, attracting widespread community attention and causing a price increase in the token. Combined with improved macro liquidity, the token price may rebound for a period. Bitget has listed this asset, so it is worth continuous attention.

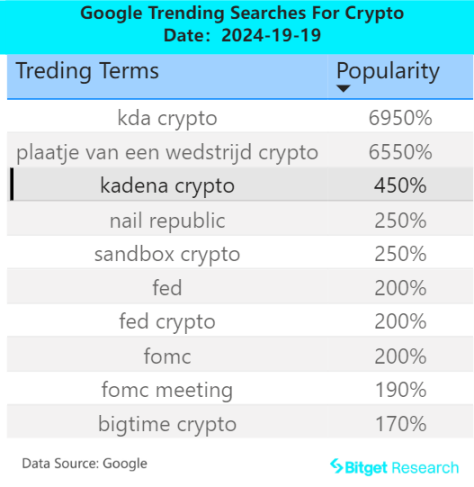

3) Google Search & Regions

- Global Perspective:

Bigtime: Recently opened the third phase of the Clockie Chaos event, and the project's user popularity continues to rise. The project's token has doubled in the past two weeks and has shown stable trends. From the contract data, Bigtime saw a significant increase in open interest on September 3 and September 12, mainly reflected in the reduction of net short positions and the increase in net long positions. The token has risen nearly twofold in the past 2 weeks and has good popularity, so it is worth continuous attention.

- Regional Hot Searches:

(1) Blum is a major focus in CIS and other regions, and Grass and Sandbox have also become hot searches in Ukraine, Russia, and other regions.

(2) Hot searches in the European and American regions are diverse, mainly focusing on projects with recent strong performance, including: KDA, HNT, NEIRO, FLOKI, among others. Additionally, projects in this region are also concerned about interest rate meetings, with keywords such as FOMC and FED appearing in hot searches.

IV. Potential Airdrop Opportunities

Symbiotic

Symbiotic is a universal restaking project that enables decentralized networks to guide powerful, fully sovereign ecosystems. It provides a method for decentralized applications called "Active Validation Services" or "AVS" to jointly ensure each other's security.

Symbiotic recently completed a seed round of financing, with participation from Paradigm and Cyber Fund, raising a total of $5.8 million.

Specific participation method: Visit the project's official website, link your wallet, deposit ETH and ETH LSD assets.

Polymarket

Polymarket is a project that operates prediction markets, where all predicted events are initiated by the community, and users can participate in predictions and receive corresponding rewards if their predictions are correct.

The centralized prediction market Polymarket completed a total of $70 million in two rounds of financing, with the most recent round led by Founders Fund, completing a $40 million Series B financing in 2023 and a $25 million Series A financing in 222.

Specific participation method: There is currently no public airdrop participation method. According to community speculation, it is recommended that users first register an account, link their wallet, deposit USDC via the Polygon network, and participate in predictions to be eligible for the project's airdrop opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。