Over the past year, the performance of altcoins in the cryptocurrency market has shown significant differentiation, and successful investment relies on a deep understanding of token unlocking schedules and asymmetric market information.

Author: DeFi Education

Translation: Plain Blockchain

If you have traded or invested in the cryptocurrency market in the past 12 months, you will notice a common theme: the differentiated performance of altcoins. In other words, as the market becomes more mature, the number of altcoins has surged, while the total capital invested in these altcoins has remained roughly the same or slightly decreased. These factors combined make the selection of altcoins a key factor for success in the cryptocurrency market.

We have recently emphasized that the cryptocurrency market tends to favor active strategies, and simply "buying and holding" often does not lead to significant excess returns. For Bitcoin or Ethereum, anyone can easily obtain them now. If you are not planning to compete with Citadel and Jane Street, your advantage should focus on on-chain altcoins, which are the areas that market participants can most easily enter.

Side note: As of now, the performance of Ethereum ETF is mediocre. We believe that the inherent reflexivity of the cryptocurrency market has not disappeared because of the existence of ETFs. The broad market demand for risk assets (such as cryptocurrencies) will positively impact the inflow of funds into ETFs, while the sharp sell-off of Bitcoin will have a negative impact on the inflow of funds into ETFs. In simple terms: you will see a surge in fund inflows into the market at high points, just as interest in cryptocurrencies increases when prices rise. There may be some sustained institutional buying at value prices (especially for Bitcoin), but retail fund inflows will react to the reflexive rise in prices, just like in past cycles.

In today's article, we want to provide some analysis and a framework for DeFi readers to invest/trade in altcoins. Note that for today's article, when we talk about altcoins, we exclude "MemeCoins" because MemeCoins have a completely different framework/approach, which we will not discuss here.

1. Understanding the Altcoin Market

Altcoins refer to tokens that are part of underlying protocols, applications, or other cryptocurrency projects. Typically, these tokens are transferable and tradable. On-chain tokens use liquidity pools for trading, and some of these tokens will be listed on trading platforms, usually due to scale/trading volume or payment of listing fees to the trading platform.

1) Altcoin Lifecycle

Understanding the process of token creation and ownership is key to understanding altcoins. Are there venture capitalists and angel investors holding a large amount of profit in a bear market and entering the market, waiting for a small exit opportunity? This may mean either giving up the token or looking for short-term opportunities.

Early investor base is crucial to the success of the token. The valuation at the launch of the token (i.e., at what price you can obtain the token) will be significantly influenced by the token issuance market.

Tokens typically come from private markets (venture capital, angel investment, private presales, etc.) or are directly listed on public markets (on-chain stealth issuance, public presales, ICOs, farms, etc.).

Private market transactions involving venture capitalists and angel investors are usually executed in the form of SAFE + Token subscription or SAFT, which provide investors with a proportional token allocation at a (usually unspecified) future date. Like traditional startups, investors provide funding to cryptocurrency projects at a defined valuation to obtain shares. Then at a later date, the project will allocate token supplies to various stakeholders and launch to the public. This is the on-chain version of "going public".

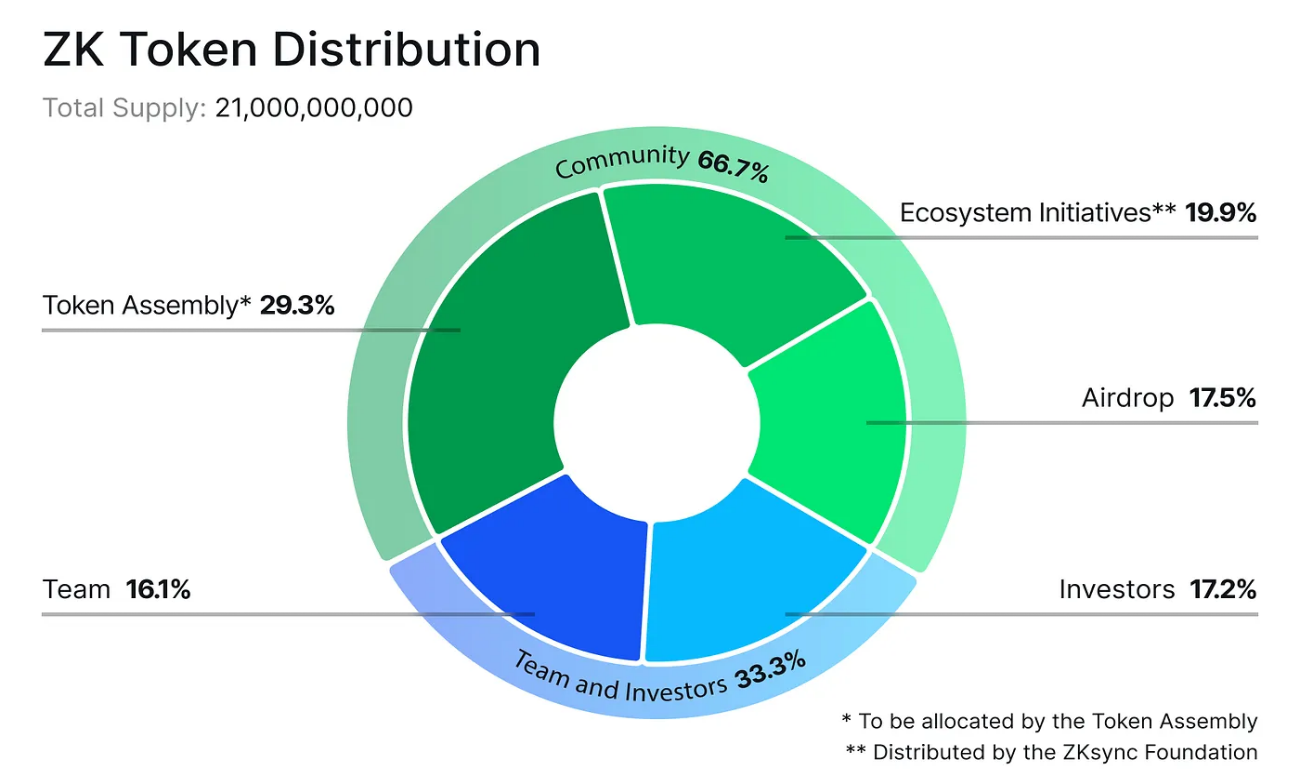

Here is an example of token distribution for Ethereum L2 zkSyncToken:

Source: ZK Nation

Tokens held by teams and investors almost always come with a lock-up period, especially in legitimate projects. In the case of zkSync, tokens held by the team and investors have a one-year lock-up period (during which they cannot be sold), followed by a three-year linear vesting period (unlocking 0.82% monthly). zkSync was founded in 2019, which means it takes up to 9 years for the tokens to be fully unlocked from the project's inception. In comparison, airdrop recipients can immediately receive their tokens, which is quite a generous airdrop in the case of zkSync, considering the scale of the project.

So, why is this information important? All investors of venture capital and team members who have put in significant effort for the company will eventually need to sell these tokens to realize the value of their equity. Understanding these "unlock schedules" and their impact on token prices is crucial for long-term trading.

Once tokens enter the public market from the private market, they become widely accessible to all types of investors and traders.

2) Dumpy’s Law

Without a strong narrative and crazy buyers on the other side, tokens often decline over the long term, as teams and private investors sell tokens, and demand from the public market also decreases. Even in the best case, the performance of altcoins often tends to be similar to mainstream coins, performing well in terms of the US dollar, but may not necessarily outperform Bitcoin over a span of several years. Therefore, entering the token market with the correct valuation and taking advantage during periods of outstanding performance (which can sometimes be extremely extreme) is crucial.

Teams typically sell equity in the secondary market before the token issuance, and may also sell locked tokens at a discounted price through "over-the-counter trading". This means that these team tokens may be sold to the market by non-team participants.

The most conservative approach is to follow what we call "Dumpy’s Law".

Dumpy’s Law states that any token that can be sold will eventually be sold. By following Dumpy’s Law, you can understand the amount of supply the market needs to absorb. The price (or expected price) of the token and the supply unlocking schedule will tell you how many new tokens may be sold and over what time period. The overall market environment (i.e., upward and downward trends, trading volume, narrative sentiment, etc.) can help you assess whether the market is ready to absorb this supply.

2. Public Market (i.e., "Liquid Tokens")

This is the area of the cryptocurrency market where retail participants have the greatest access. It is also where all other participants look for "liquidity exits," making it an extremely competitive market with huge profit and loss potential.

Liquid tradable tokens can be traded on decentralized exchanges (DEX) by anyone. The trading of altcoins is based on a combination of narratives, fundamental catalysts, and technical/market-driven factors.

1) Narratives

Narratives develop from the bullish price trends of specific tokens. For example, over the past approximately 6 months, meme coins have outperformed all other categories. Tokens like PEPE and WIF, which started with small market caps, have grown to several billion dollars, along with the success of giant tokens like DOGE and SHIB, consolidating the narrative of meme coins.

During this period, DeFi, infrastructure, and other technical categories of tokens have performed poorly (we believe these tokens have now bottomed out). With technology tokens like Aave and Sui performing well in the past month or so, traders' dominant narratives and focus have shifted. Whether this performance is organic or not is not important. What we know is that market participants tend to focus on tokens with rising liquidity and trading volume. The price performance of a token not only strongly affects its own demand, but also affects the demand for tokens in its category and adjacent categories.

In other words, AAVE's performance surpasses that of UNI, CRV, and other DeFi tokens, and vice versa. If SUI's performance surpasses (if sustained) that of other alt-L1 tokens and tokens in the SUI ecosystem, it will be beneficial. The performance of PEPE and WIF will be beneficial for meme coins. This trend prompts venture capital firms, liquidity funds, market makers, and other well-funded market participants to be willing to invest heavily in a particular category of tokens and profit from it. Cryptocurrency venture capital firms cannot simply explain to investors that the future of cryptocurrency they are promoting is meme coins. This is one of the fundamental reasons why altcoins may once again perform outstandingly. Otherwise, this will deal a serious blow to the cryptocurrency investment management business!

2) Management of Asymmetric Information

In the cryptocurrency market, attention and information flow drive decision-making, and sometimes a single tweet is enough to change the perception of a token/narrative. New investors may be confused by unexpected reactions to certain tokens (for example, announcing bullish news after several days of continuous token price increase, only to see it being sold off). Managing and leveraging asymmetric information in altcoins is a risk, but also an opportunity that can be turned into an advantage.

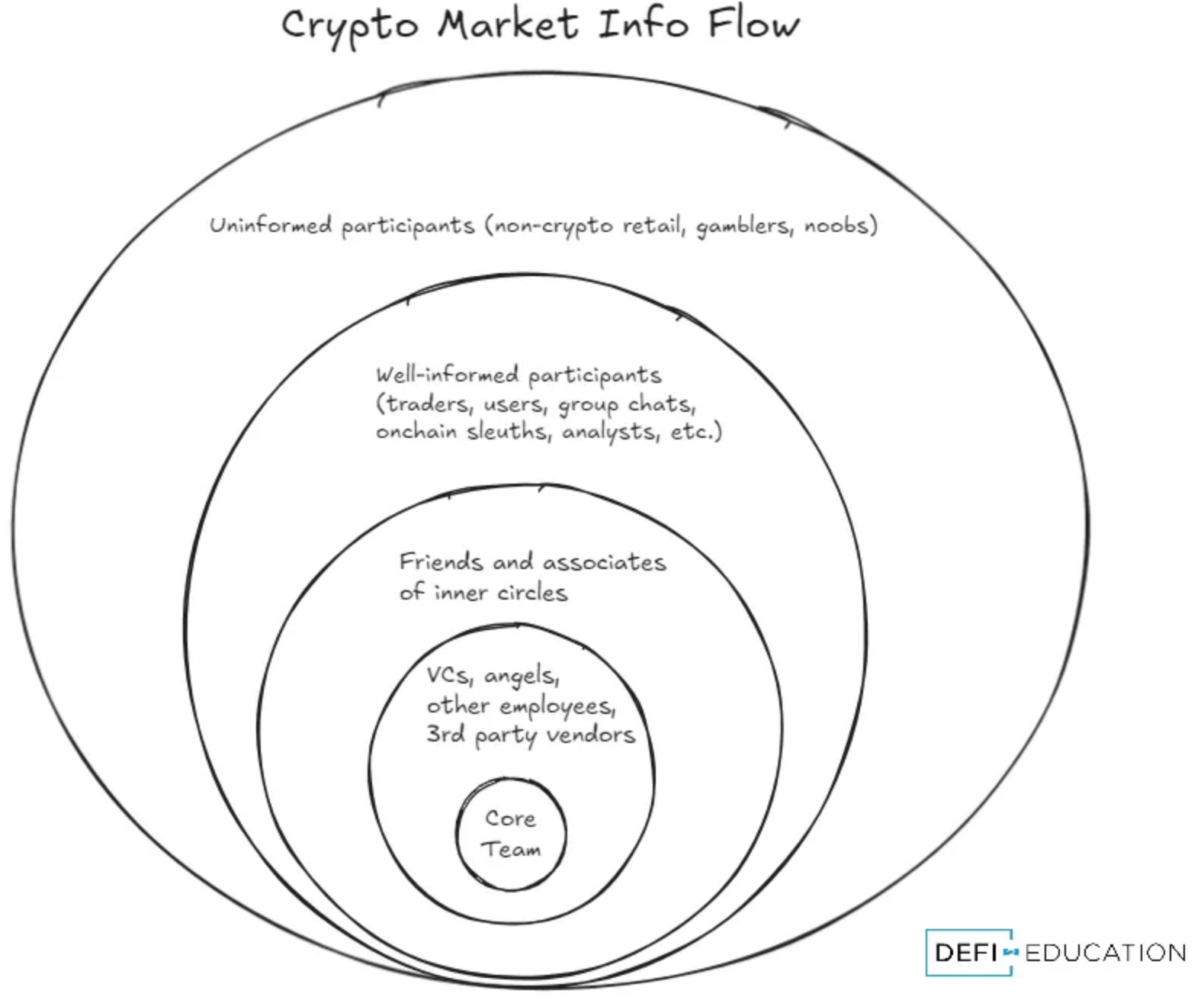

Here is a visualization we created to help you understand the challenges you face. This is part of our framework for altcoins, which should be helpful for your strategy, whether it's trading, investing, narratives and catalysts, etc.

Visualization Explanation:

Imagine a developing piece of information, such as a project's partnerships or a new product launch. This information flows from the inner circle to the outer circle.

Core Team: These are the individuals responsible for building the project. Undoubtedly, the core team of a project is usually the source of news and data, as they are the "root cause" of change. You are unlikely to know the market better than the core team, but understanding their incentives and track record is helpful.

Venture capitalists, angel investors, other employees, and third-party suppliers: This information is passed on to private investors and others working with the core team, such as marketers and opinion leaders. During the business process, the core team typically shares important product updates and events with this group. "Dumpy’s Law" usually applies here.

Friends and acquaintances of the core circle: Once information reaches this level, it may attract market attention. Participants outside the inner circle are less likely to have free tokens to sell and are more likely to position themselves around positive news. Market activity at this level can provide useful information, although it is not always easy to discern. Even in competitive market conditions, the market reaction at this level may be weak, becoming an exit liquidity.

Informed participants: This is the level where information is translated into large-scale buying and selling. Informed participants look for arbitrage opportunities, bid for tokens, shape market narratives, and profit in the process. They have enough understanding of the inner workings of the cryptocurrency industry, and even if they are not the first to know something, they can gain an advantage.

Uninformed participants: This is where everyone starts, but (hopefully) not where they stay for too long. If you are new to cryptocurrency, you are also in this group, even if you don't think you are. These individuals wait for "Twitter opinion leaders" to tell them when to buy and sell, while lacking independent critical thinking.

Note that this flowchart is dynamic—you may flow between different levels depending on the specific situation. This is why we recommend that newcomers focus on a specific area of the cryptocurrency field (e.g., DeFi) and then gradually expand. It is almost always best to refrain from investing or trading while you are still in the uninformed participant stage, reducing your active risk and striving to become an informed participant.

If you understand where you are in the information flow spectrum, you will have a clearer understanding of the risks you are willing to take. Hard information that can drive the market often leaves you with very little time, so if you are close enough to this information, you can profit more. For example, the announcement of the ETH ETF is a good example, with ETH surging nearly 20% within a few minutes. Even after such a significant announcement, you only have about 5 minutes to position yourself! Although this time is short, it is still much slower than traditional financial markets.

You can also analyze goals (buy/sell/hold) and time frames around each level, and use this information to guide your decisions.

3. Do Not Fight Bitcoin

The cryptocurrency equivalent of "Don't fight the Fed" is "Don't fight Bitcoin." Although altcoins can selectively perform well in difficult market conditions, as market participants gradually reduce risk or lose capital, the performance of altcoins will eventually be exhausted. Despite the maturity of the cryptocurrency market, the altcoin market is still highly correlated with Bitcoin. In fact, in the current market environment, you may be able to achieve the returns of altcoins by trading Bitcoin with 2-3 times leverage (we do not recommend leveraged trading—this is for reference only).

However, in 2024, there are multiple instances that show huge excess returns can be achieved by buying on-chain coins (mainly memecoins). This is why it is still important to pay attention to altcoins. When altcoins rise, they can bring returns of over 100% in a short period of time.

Scalability Considerations

For larger investors (such as our paid subscribers), scalability is a key consideration. It is very difficult to enter and exit funds of $50,000 or more in small or medium-sized memecoins, mainly due to slippage and the impact on holder sentiment. If you are operating with a larger amount of capital, you will want to focus on coins with liquidity far above the average level. This is also one of the reasons why we believe the altcoin market will continue to thrive—large funds and funds also need a place to operate.

Original article link: Understanding the Altcoin Market

Source: DeFi Education

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。