According to Messari's Q1 2024 report, Solana's DeFi trading volume continues to grow, with the average daily spot DEX trading volume increasing by 319% to $1.5 billion. The trading of meme coins, especially SLERF and BOME, has been driving this growth. Solana has become a gathering place for retail traders and meme coin traders, as its extremely low transaction fees and fast finality confirmation enable DeFi protocols to provide users with a smooth user experience that other blockchain networks cannot support. Against the backdrop of SOL's steady price growth, Solana's total value locked (TVL) has also increased to $43.11 billion. Like other public chains, Solana's TVL is mainly contributed by DEX, LST, lending platforms, and Perps.

Decentralized Exchanges (DEX)

Decentralized exchanges are generally single-chain and revolve around a specific ecosystem, especially for non-EVM Layer1 chains like Solana.

Project

TVL (USD Billion)

Market Cap (USD Billion)

FDV (USD Billion)

24h Trading Volume (USD Billion)

Raydium

9.65

4.58

9.65

6.50

Jupiter

5.96

11.72

86.82

8.18

Orca

2.36

1.07

2.68

5.96

Raydium

Raydium allows anyone to create a pool and bootstrap token liquidity. This feature has led to a large number of meme coins being launched on Solana, making Raydium the preferred DEX for meme coin issuance. Raydium's TVL ranks first in the Solana ecosystem, with a TVL of approximately $9.65 billion and a 24-hour trading volume of approximately $11.62 billion.

However, with the rise of meme platforms represented by Pump.fun (Blinks/Moonshot), gradually replacing Raydium's project launch scene, more memes are launched through platforms other than Raydium, diminishing Raydium's influence. If meme platforms build their own DEX, this will have an even greater impact on Raydium.

Jupiter

Jupiter, as a liquidity aggregator, finds the most favorable price routes across all major DEX and AMM on Solana, minimizing slippage and transaction fees, making the trading process more efficient and user-friendly.

Jupiter is not only a leading DEX platform in the Solana ecosystem but also has a decentralized perpetual contract trading platform, where users can take long or short positions with leverage of up to 100x. Users can participate as traders or liquidity providers. When traders seek to open leveraged positions, they borrow tokens from the pool. In return, liquidity providers earn fees from these leveraged trading activities, as well as borrowing fees and swap income. As a JLP holder, you will receive 75% of the fees generated by the perpetual trading exchange, which are reinvested directly into the JLP, increasing its price and promoting continuous compounding of returns and earnings.

In simple terms, buying JLP performs better than stablecoins in the slow bull market, with an APR of 31%, and JLP does not require active "staking" of tokens or "harvesting" of returns. This is directly reflected in the token price, which has increased from 1.5U in December 23 to 3.1U now.

Boosted by Solana's meme popularity, on July 4th, Jupiter announced the launch of a MEME market discovery tool called APE. The platform's core functions include discovering the latest token listings, with APE constantly refreshing the 100 latest tokens on Orca, Raydium, and Meteora. Clicking on specific tokens provides detailed token inspection results, especially regarding RUG risk screening.

The trading volume of Perp DEX on Solana is mainly driven by various active point programs. The number of points can be said to be an important booster for user trading. Jupiter's point system, calculated at 0.8U, allows users to receive a minimum of 960U. During the TGE, all users who have used Jupiter were rewarded with 200 $JUP, even for a single swap, worth approximately 80U, which is a significant boost for attracting users in the future. The next closest is the upcoming second round of ASR staking voting rewards from September to November, and the next JUP airdrop will be in January-February next year.

Orca

With the slogan "DEX for people, not programs," Orca has long dominated the forefront of Solana DEX, featuring centralized liquidity active market-making - Whirlpools, similar to UniswapV3.

Under the new model, LPs can choose to concentrate liquidity within a certain price range, no longer uniformly distributed on a curve from 0 to positive infinity, but can concentrate liquidity to trade most frequently at the market price midpoint, significantly improving capital utilization efficiency and gaining more market-making profits.

ORCA is the top DEX in the Solana ecosystem, with an FDV of only $2.68 billion, which also reflects the bubble situation of other chains and DEX from Orca's FDV.

Liquidity Staking (LST)

The demand for liquidity staking on Solana is not strong, mainly because Solana does not have a minimum staking requirement, and the relatively low price of SOL greatly reduces the threshold for becoming a validator.

Project

LST

APY (Annual Percentage Yield) (usually includes MEV income sharing)

TVL (USD Billion)

Market Cap (USD Billion)

FDV (USD Billion)

Jito

JitoSOL

8.26%

17.05

2.95

23.74

Marinade

mSOL

7.44%

14.13

27.41

101

BlazeStake

bSOL

7.06%

2.75

Unlock amount unknown

6.83

Jito (JTO)

In September 2023, Jito launched an airdrop point program and quickly became the leading project in this track after Lido's exit from Solana. JTO has the highest TVL in the Solana ecosystem, at $17.05 billion. The staking APY for JitoSOL is currently 8.26%, which includes Solana staking yield and MEV income sharing.

The eligibility for airdrops for JitoSOL users is determined based on the ranking of the Jito point program. Only users with points equal to or exceeding 100 are eligible for the airdrop, and the final allocation standards are determined in ten levels.

From the chart, it can be seen that the lowest tier can receive 4941 Jito, calculated at a minimum of 10524U based on the first day's 2.13U.

By staking SOL to obtain JitoSOL, each JitoSOL accumulates 1 point daily. Engaging in lending earns 1.5 points per JitoSOL, providing liquidity in any JitoSOL/xSOL currency pair earns 1.5 points per JitoSOL, and providing liquidity for JitoSOL/SOL LP earns 2.5 points, while providing liquidity for JitoSOL/USDC (and other volatile currency pairs like JitoSOL/UXD and JitoSTOL/stETH) earns 3.5 points.

Marinade

Jito focuses on liquidity staking, while Marinade's native staking is more popular and offers a higher APY, making it a leading project in the ecosystem with a TVL of $14.13 billion. Despite having a TVL close to Jito, the market cap and FDV are several times lower, mainly due to Marinade's lower visibility compared to Jito, indicating that $MNDE has some potential.

BlazeStake

BlazeStake is the second-largest LST project in the Solana ecosystem, with a TVL of approximately $275 million. The estimated staking APY is currently 7.06%, slightly lower than Jito. The FDV is $6.83 million, compared to Jito's $2.374 billion. On one hand, there is room for growth, and on the other hand, the ecosystem is still mainly dominated by meme coin players, requiring high APY to compete with leading projects for users.

As the article does not contain investment advice or specific project recommendations, we will publish more research on Solana ecosystem liquidity staking projects on Twitter @MetaHub_ZH.

Lending

Save

Save (formerly known as Solend, as it later also supports SUI) is an algorithmic decentralized protocol for lending on Solana. Lending has proven to be crucial for the DeFi ecosystem. Current lending products are generally slow and expensive, but on Solana, Save can scale to be 100 times faster and 100 times cheaper.

In November 22, there was an oracle attack against the stablecoin USDH, affecting the isolated pools of The Stable, Coin98, and Kamino, resulting in bad debts of $1.26 million. Save provided full compensation for the event. This incident also highlights the importance of oracles for the DeFi ecosystem. Before the emergence of PYTH, the Solana ecosystem did indeed lack secure and fast oracle infrastructure.

Later, Save adopted the PYTH oracle, similar to the Solana version of Chainlink, providing price and market data for blockchain projects. It provides "mission-critical" price data in a secure and zero-latency manner for various asset categories (such as cryptocurrencies, forex, commodities, and stocks).

Currently, due to the low demand for lending in the Solana ecosystem and considering previous security issues, there are few lending products in the Solana ecosystem. The upcoming new lending protocol, Marginfi, is also worth looking forward to.

Derivatives

Derivatives are financial contracts that derive value from underlying assets, used for risk management and speculating on future market trends. In addition to Jupiter mentioned earlier, there are several other derivative protocols such as Drift, Flash Trade, and Zeta.

Before the FTX incident, Mongo had always been at the forefront. With the SEC's accusation of Avraham Eisenberg manipulating the MNGO token as a security for offering and selling on the crypto platform Mango Markets, Eisenberg was criminally charged and sent to prison, leading to the platform's TVL almost reaching zero. The current TVL of the platform is around $15 million, slightly lower than Flash Trade. Currently, Drift's TVL is around $3.8 billion, 25 times that of Mongo's TVL, surpassing Mongo's peak of $2 billion.

Project

TVL (USD Billion)

FDV (Fully Diluted Valuation) (USD Billion)

Drift

3.6

5.3

Flash Trade

14.69

5.5

Zeta Markets

9.7

Not yet issued

Drift

With a TVL of $3.6 billion, Drift offers an integrated DEX with pre-market trading, 20x leverage, collateralized lending, and more.

The project is backed by Multicoin Capital, a crypto-focused investment firm that led a $3.8 million seed funding round for the DEX in October 2021.

Drift is currently running its v2, a sequel to its v1, providing enhanced liquidity, market-making, and collateral to improve the trading experience.

The protocol mentioned upon the release of Drift v2 last year that Drift v1 attracted over 15,000 cumulative users and facilitated trading volume exceeding $100 billion, indicating Drift's popularity and fundraising capabilities.

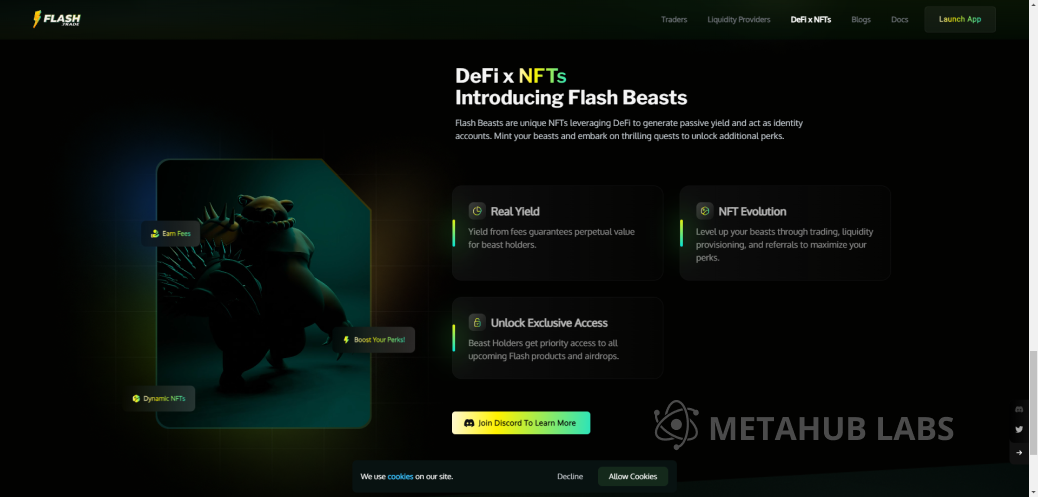

Flash Trade

Focused on decentralized spot and contract trading on the Solana network, Flash Trade stands out for its low trading fees and minimal price impact.

Flash Trade has a unique multi-asset pool system, the first of its kind on Solana, and uses innovative NFT structures to increase user engagement and account functionality.

The uniqueness of Flash Trade lies in its pool-to-point trading model, ensuring zero price impact and optimal trading conditions. Liquidity providers earn returns by collecting trading fees.

Additionally, dynamic pricing is achieved using the Pyth oracle and backup oracle system to ensure high uptime of the system. By incorporating NFTs, the platform further gamifies the trading process, incentivizing more user participation.

With a TVL of $17 million, the platform has achieved considerable success.

Zeta Markets

Zeta Markets is a DeFi derivatives platform aimed at democratizing derivative trading by providing liquidity and under-collateralized derivative options and futures trading to individuals and institutions. The platform offers two core products: DEX (decentralized derivatives exchange) and FLEX (option minting and auctioning layer, enabling any protocol to utilize options). Their mission is to simplify the derivative trading experience, allowing anyone to hedge, speculate, and express opinions on market trends.

The user interface looks clean and smooth, with candlestick charts integrated from Tradingview, and there are expectations for token airdrops, which explains the TVL reaching tens of millions.

PYTH

Blockchain oracles act as a bridge between the blockchain and the real world. The blockchain itself is closed and deterministic, only able to process and store transactions and events that occur within it. However, the execution of many smart contracts relies on data and events outside the blockchain, such as stock prices, weather conditions, sports match results, etc. Oracles obtain this external data and securely transmit it to the blockchain, enabling smart contracts to make conditional judgments and execute operations based on this data. Oracles can be applied to products such as financial derivative trading, risk management, insurance claims, and supply chain management, enhancing the value of blockchain technology and promoting its widespread application across various industries.

As a leading oracle on the Solana blockchain, PYTH has many innovations compared to the established Chainlink. PYTH updates data faster and more stably, and it can now be applied not only to the Solana chain but also to other blockchains. Its future and development potential are enormous.

Conclusion

As the Solana ecosystem continues to grow, more and more DeFi products are emerging on its platform, such as the recent launch of the prediction market B.E.T. These DeFi projects not only enrich the Solana ecosystem but also provide users with more financial tools and choices. Many promising DeFi products have recently been launched, and in terms of the current DeFi product ecosystem on Solana, there is indeed a large market. Established products have advantages, having built a strong user base and market trust, but emerging products have invested heavily in user interface design, user education, and community building, reducing the barriers to user adoption. Through carefully planned brand building and marketing activities, they can quickly attract a large number of users and gain a share of the market. In the future, with the emergence of more innovative products, the DeFi ecosystem on Solana will become more prosperous and diverse.

In the next issue, we can analyze projects that have not yet issued tokens. If you would like to see a detailed analysis and market movements of a specific product, feel free to leave a message on Twitter @Metahub_zh.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。