Will there be any future airdrops? What is the expected yield of the incentive plan?

Author: Azuma, Odaily Star Daily

In the past two days, EigenLayer, the pioneer of the restaking track, has successively announced two major actions regarding the EIGEN token.

- The first is that the second season (Season 2) airdrop is open for application, and the application window will continue until March 16, 2025.

- The second is the introduction of programmatic incentive measures (Programmatic Incentives V1), which will distribute EIGEN incentives to eligible stakers and operational nodes on a weekly basis starting from October (historical behavior traced back to August 15), with an estimated distribution of approximately 66.95 million EIGEN in the first year, equivalent to 4% of the initial supply of EIGEN.

For some users who are concerned about EigenLayer, the sudden acceleration of EigenLayer's pace is to preheat the upcoming "EIGEN unlocking" event, in order to gain more market attention and participation after EIGEN officially circulates.

On May 10th of this year, EigenLayer opened the application for the first season (Season 1) airdrop, but since the application, the EIGEN token has been in a non-transferable state. This somewhat "teasing" behavior has somewhat prevented EigenLayer from gaining the level of discussion in the secondary market that matches its status.

When will EIGEN be unlocked?

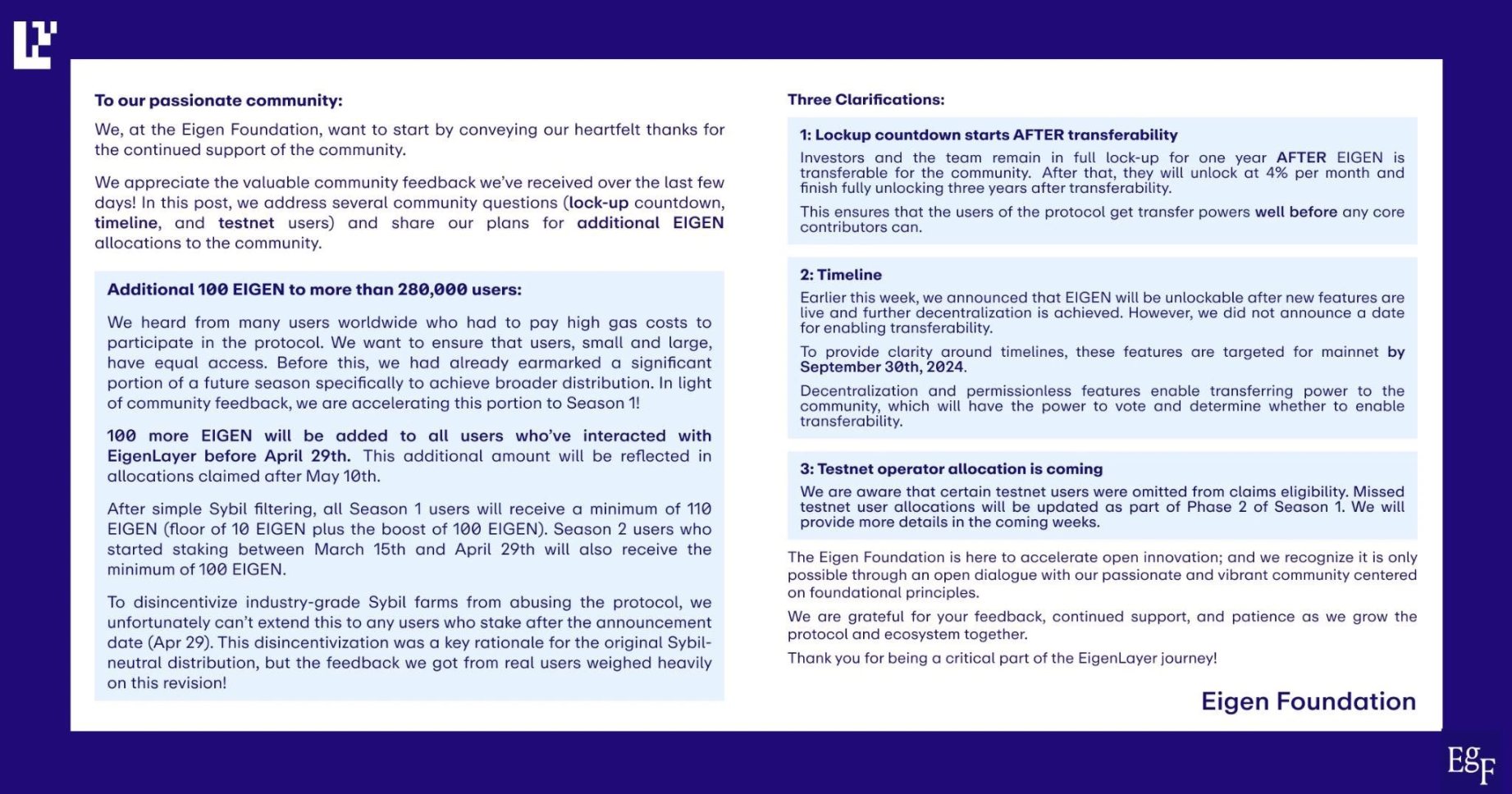

Regarding the unlocking time of EIGEN, it is first necessary to dispel a long-standing misunderstanding in the market — the circulating unlocking time is September 30.

The reason for this misunderstanding is that the Eigen Foundation mentioned the date of September 30 in its official document regarding the unlocking timeline in May. However, upon closer examination of the Eigen Foundation's description, it is revealed that the description actually states: "Earlier this week, we announced that ElGEN will be unlocked after new features are live and further decentralization is achieved, but we have not announced a specific date. To clarify the timeline, we plan to implement these features on the mainnet before September 30, 2024."

From the Eigen Foundation's statement, it can be seen that the transfer function of EIGEN should be unlocked "after new features are live and further decentralization" is achieved, and September 30 is the time expectation set by EigenLayer for "after new features are live and further decentralization."

As for the progress of "new features being live and further decentralization," "new features being live" is a relatively subjective concept. After May, EigenLayer has successively launched "AVS rewards" and "programmatic incentives," but it is difficult for external parties to judge EigenLayer's own assessment of the progress. As for the progress of "further decentralization," it is relatively measurable. The first season airdrop of EigenLayer has ended, with a final application rate of approximately 78.6%. The second season airdrop and subsequent incentive plans will further accelerate the distribution of EIGEN tokens.

In summary, EigenLayer's official statement does not mention the unlocking of EIGEN's transfer function on September 30, but combined with the progress of "further decentralization," it is personally predicted that the final unlocking time of EIGEN will not be delayed for too long after the opening of the second season airdrop and incentive plan.

Basic data and valuation expectations of EigenLayer

DeFillama data shows that EigenLayer's current total value locked (TVL) is currently reported at 10.79 billion US dollars, ranking third among all protocols in the ecosystem, second only to the liquidity staking giant Lido and the lending leader Aave.

EigenLayer's official data shows that the protocol currently supports 16 AVS (Active Verification Services), including EigenDA, covering various fields such as DA, oracles, privacy, DePin, gaming, ZK verification, and more. Although protocols such as Symbiotic, Karak, Solayer, and Jito from different ecosystems are aggressively entering the restaking track, EigenLayer still remains the protocol with the largest value scale, the fastest development progress, and the strongest network effect in the entire restaking track.

The emphasis on "network effect" is because, in addition to its strong fundamental performance, EigenLayer has almost single-handedly driven half of the innovation in the Ethereum ecosystem, surrounding different fields such as liquidity restaking and concrete AVS services. Many projects including ether.fi, Renzo, Puffer, Eigenpie, AltLayer, Omni, and eoracle have found their own protocol use cases, relying on the development of EigenLayer.

This is also why the community has jokingly referred to EigenLayer as the "guardian" of Ethereum, the "guardian" of the "son of heaven"…

In terms of valuation, although the transfer function of EIGEN has not been activated, some pre-market trading markets including Aevo have already started trading EIGEN contracts. As of the time of writing, EIGEN is currently reported at 2.95 US dollars on Aevo.

With a total supply of 1.67 billion EIGEN at its inception, the quoted price of 2.95 US dollars implies a corresponding fully diluted valuation (FDV) of approximately 49.265 billion US dollars for EigenLayer.

As for the initial circulating market value, EigenLayer has not yet disclosed the initial circulating structure of EIGEN. However, we can make a simple calculation of the user's holdings based on the data from the two airdrops (excluding the incentive plan, as the weekly distribution will start in October, and the initial circulation ratio is relatively low). In the end, approximately 87.89 million EIGEN were claimed in the first season airdrop (with an application rate of approximately 78.6%); the second season airdrop will distribute a total of 86 million EIGEN (60 million to stakers and operational nodes, 10 million to ecosystem partners, and 6 million to community contributors). If the application rate is the same as the first season, the final amount claimed is estimated to be 67.59 million EIGEN, and the combined total claimed from the two seasons will be 155 million EIGEN.

This means that the total value of EIGEN obtained by all users through the two seasons of airdrops is approximately 457 million US dollars — this is also the confirmed amount of fully circulating EIGEN shares.

Will there be future airdrops?

When announcing the first season airdrop earlier this year, EigenLayer mentioned that 15% of the EIGEN tokens would be distributed in the form of airdrops, and the planned distribution for the first and second season airdrops that have been announced is approximately 113 million and 86 million EIGEN, totaling about 200 million EIGEN, accounting for approximately 11.9% of the total supply of 1.67 billion EIGEN.

This means that according to EigenLayer's plan, approximately 3.1% of the EIGEN tokens will still be used for future airdrop rounds.

From a personal participation perspective, considering that the second round of airdrops did not adopt the "everyone gets a share" plan with a minimum of 100 tokens like the first round of airdrops, small staking users may have relatively fewer airdrop shares (after all, the base is too large), and the larger airdrop shares have basically been allocated to whale users, operational nodes, and community contributors — especially KOLs who have created high-quality content related to EigenLayer on social media, generally receiving thousands or even tens of thousands of EIGEN tokens in airdrops.

Therefore, in potential future airdrop rounds, small staking users who continue to stake on EigenLayer for the purpose of airdrops may no longer have ideal profit expectations, unless they take a different approach, such as participating in high-threshold activities like original content creation.

How about the expected returns from the incentive plan?

In addition to airdrops, another direct way to earn EIGEN is through the incentive plan that is set to launch in October. This plan aims to distribute EIGEN incentives to eligible stakers and operational nodes on a weekly basis.

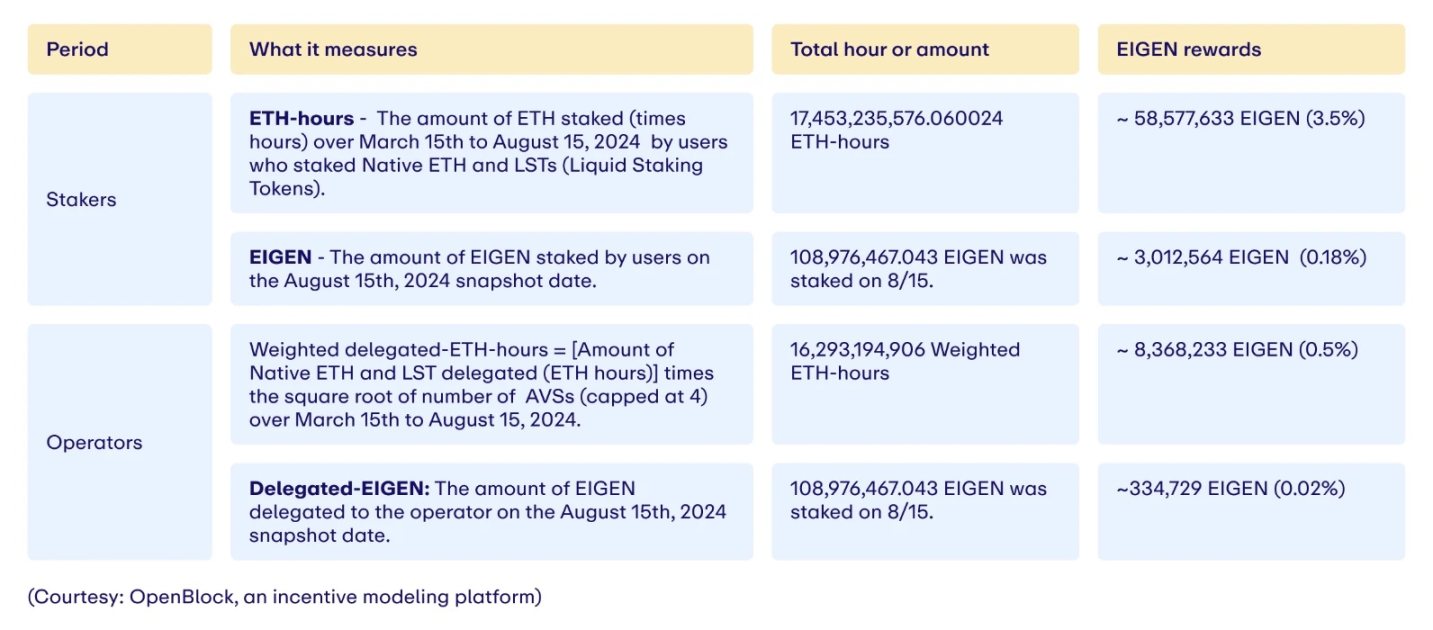

According to EigenLayer, the incentive measures will implement retrospective rewards based on staking activities since August 15, 2024, with the first rewards set to be available for claiming weekly starting in October. In the first year of the plan, it is expected to distribute approximately 66.95 million EIGEN, equivalent to 4% of the initial supply of EIGEN.

Combining the above data, we can calculate the potential return rate for stakers under this incentive plan.

First, the distribution targets of the incentive plan are stakers and operational nodes, but EigenLayer has not clearly allocated the proportion to these two groups. Therefore, we chose to refer to EigenLayer's distribution ratio for stakers and operational nodes when designing the second season airdrop. As shown in the figure below, EigenLayer allocated 3.68% of EIGEN to stakers and 0.52% to operational nodes in the second season airdrop, with a rough distribution ratio of 88:12.

Based on this ratio, it is estimated that out of the total incentive of 66.95 million EIGEN in the first year, approximately 58.91 million EIGEN will be distributed to stakers, which, at a price of 2.95 US dollars, is approximately 174 million US dollars. As mentioned earlier, EigenLayer's current TVL is reported at 10.79 billion US dollars, which means that the potential return for stakers under this incentive plan is estimated to be 1.6%.

It is important to emphasize that the above calculation is based on subjective distribution predictions and rough calculations based on static token prices, and the actual return rate will still depend on EigenLayer's actual progress. Although a 1.6% return rate may not seem significant, stakers on EigenLayer are mainly large capital users with a preference for "security/profitability," and they will pay more attention to the protocol's security level and liquidity conditions. Considering this, along with EigenLayer's ability to provide around 3% in native staking rewards and the expectation of EIGEN appreciation, staking on EigenLayer still has a certain appeal for capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。