Some trends are worth noting, such as the highly anticipated large-scale unlocks that may trigger unexpected market reactions.

Author: Stacy Muur

Translation: DeepTechFlow

A few weeks ago, Messari released their in-depth report "Don't Look Down: Navigating Markets Around Cliff Unlocks," which analyzed the impact of increased circulating supply on the market.

This article summarizes their main findings and provides background information and recommendations on tracking unlock events.

Messari's Report: Key Highlights

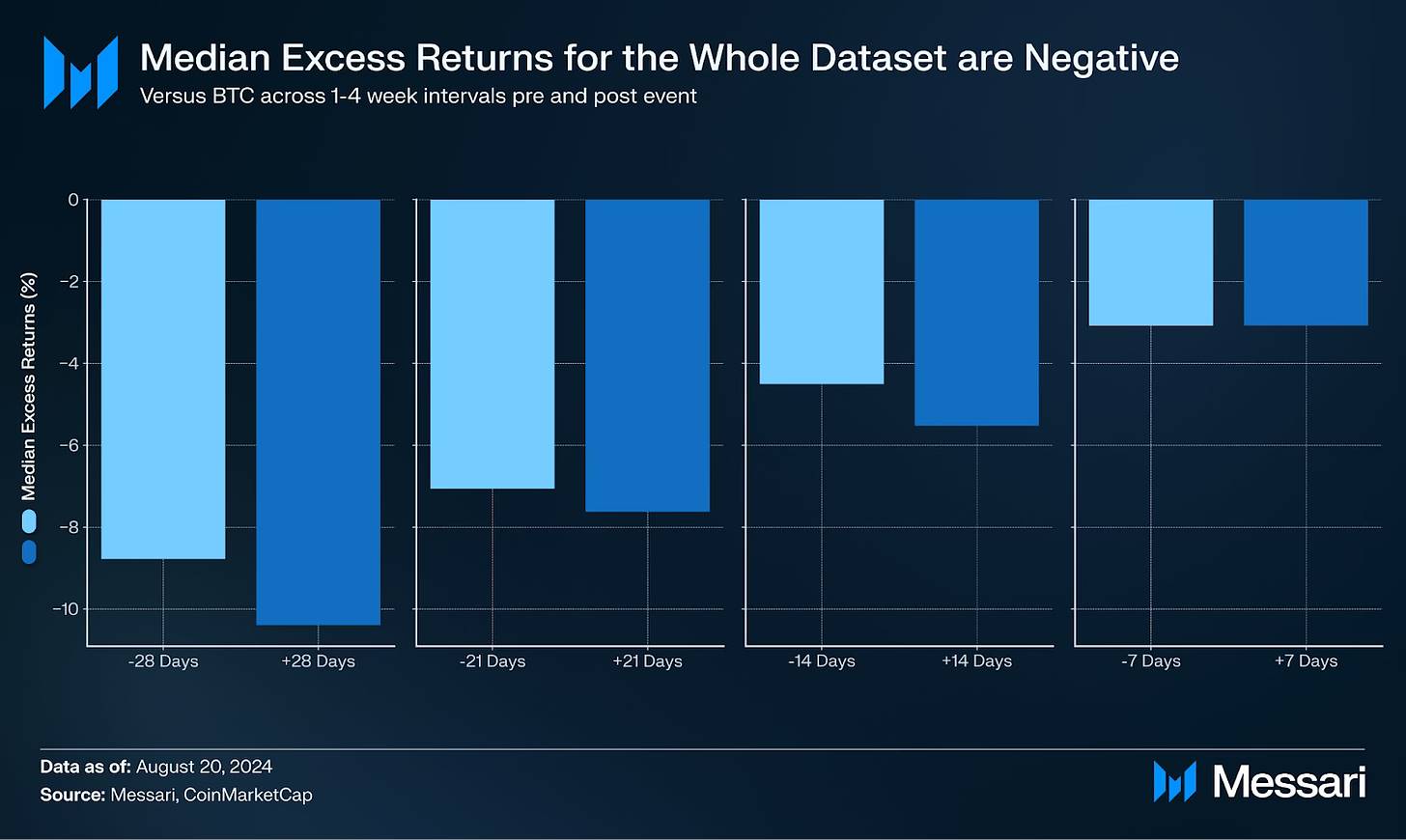

Messari analysts analyzed data from 619 unlock events of 41 assets to identify patterns of market reactions to increased circulating supply. Most events involved an increase in circulating supply of less than 2.5%, with over 5% unlock events accounting for less than half.

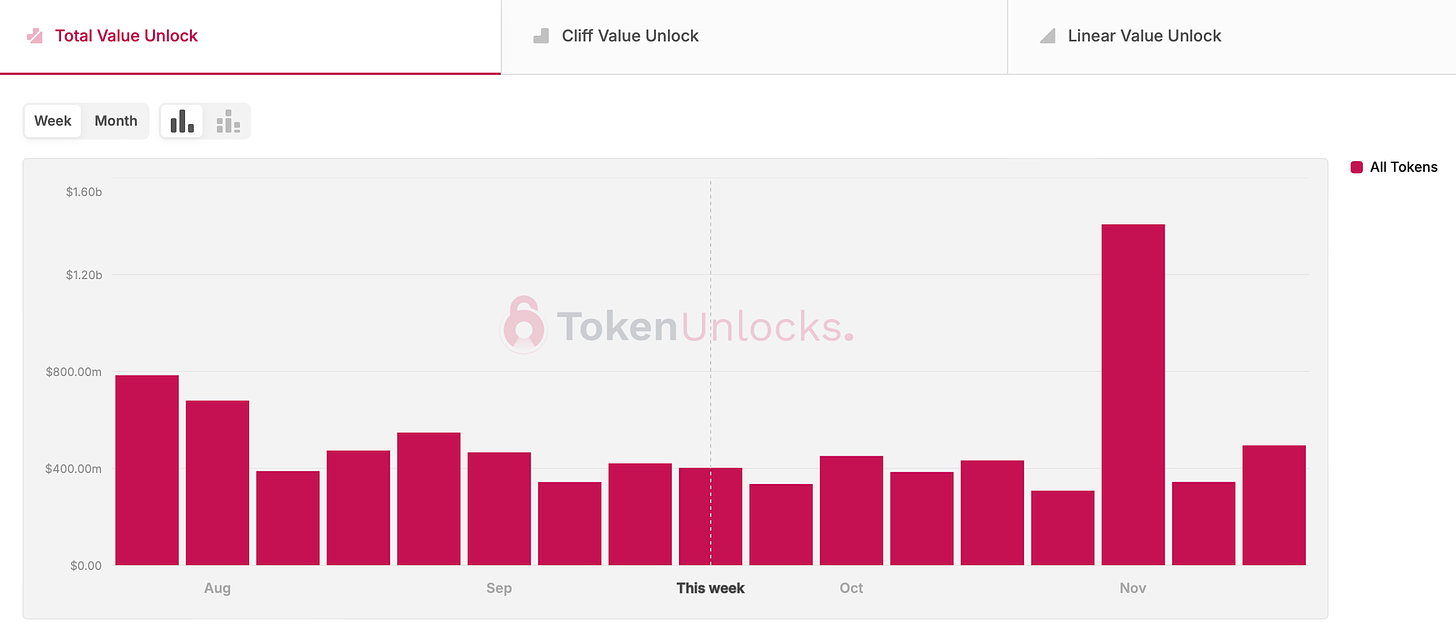

Data Source: Token Unlocks, as of September 16th

Cryptocurrencies rarely trade in isolation, and their prices are influenced by factors such as market sentiment, new product releases, and narrative changes. Although token unlocks typically have a negative impact on token prices relative to BTC, this is not always the case.

However, some trends are worth noting:

Unlocking at least 5% of circulating supply often significantly affects token performance;

Tokens typically underperform in the seven days before and after unlock events;

New product releases, strong industry performance, and other catalytic factors can influence typical behavior around unlock dates;

Highly anticipated large-scale unlocks may trigger unexpected market reactions;

Tokens with a large monthly unlock are difficult to outperform other altcoins in the long term;

Tracking Unlock Events

When tracking unlocks, I often use the Messari dashboard. However, other notable unlock tracking tools include Token Unlocks and DefiLlama.

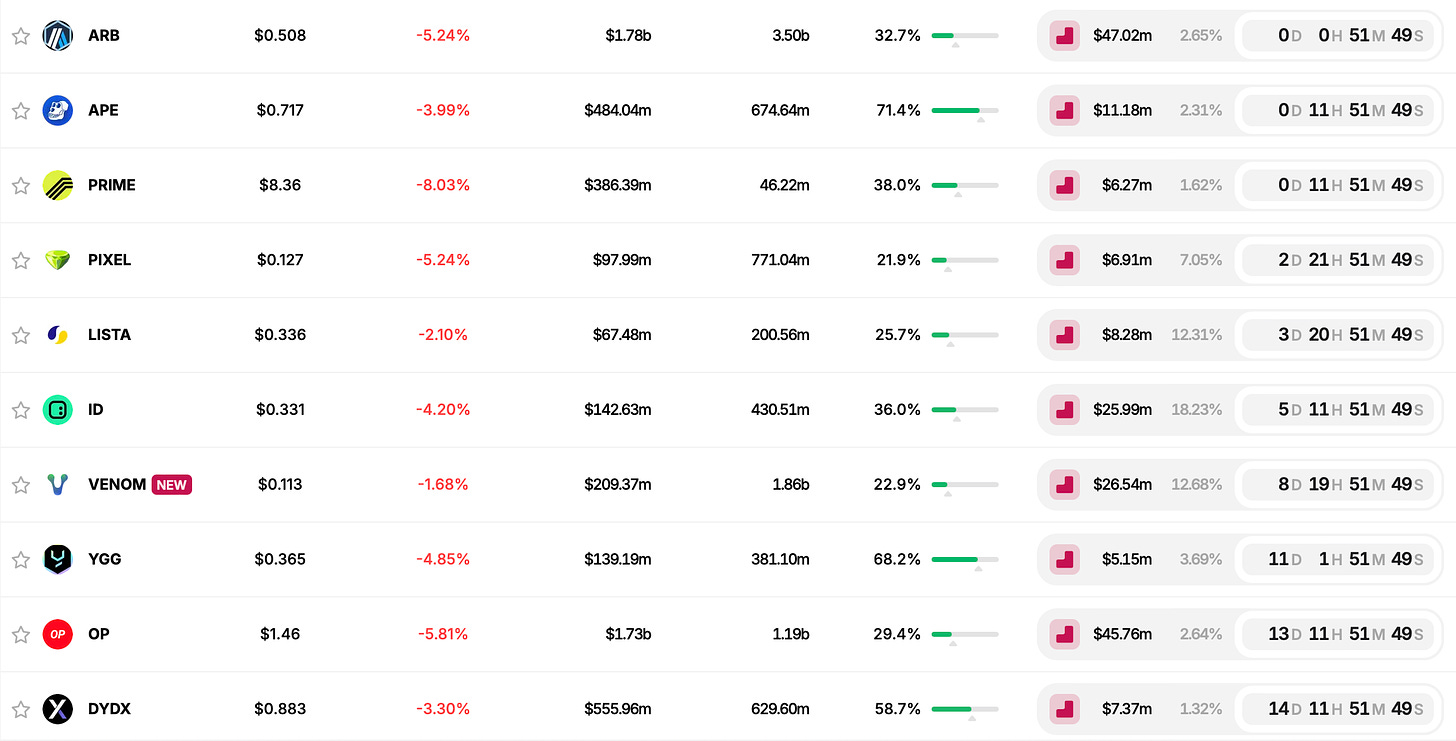

On Messari, the most important upcoming unlock events include:

$ONDO: 268% increase in supply within 3 months;

$OMNI: 154% increase in supply within 7 months;

$PRCL: 121% increase in supply within 7 months;

$JITO: 108% increase in supply within 2.5 months;

$TNSR: 96% increase in supply within 7 months;

$TIA: 83% increase in supply within 1.5 months;

$PYTH: 58% increase in supply within 8 months;

$PORTAL: 15.7% increase in supply within 2 weeks;

$MAV: 14.5% increase in supply within 3 weeks;

$ZETA: 11% increase in supply within 2 weeks;

DeFiLlama provides the following data:

$BIGTIME: 61% increase in supply within 3 weeks;

$CYBER: 69% increase in supply within 1 month;

$HOLD: 38% increase in supply within 2 months;

$LVL: 19% increase in supply within 3 months;

$BB: 100% increase in supply within 7 months;

Monitoring Inflation

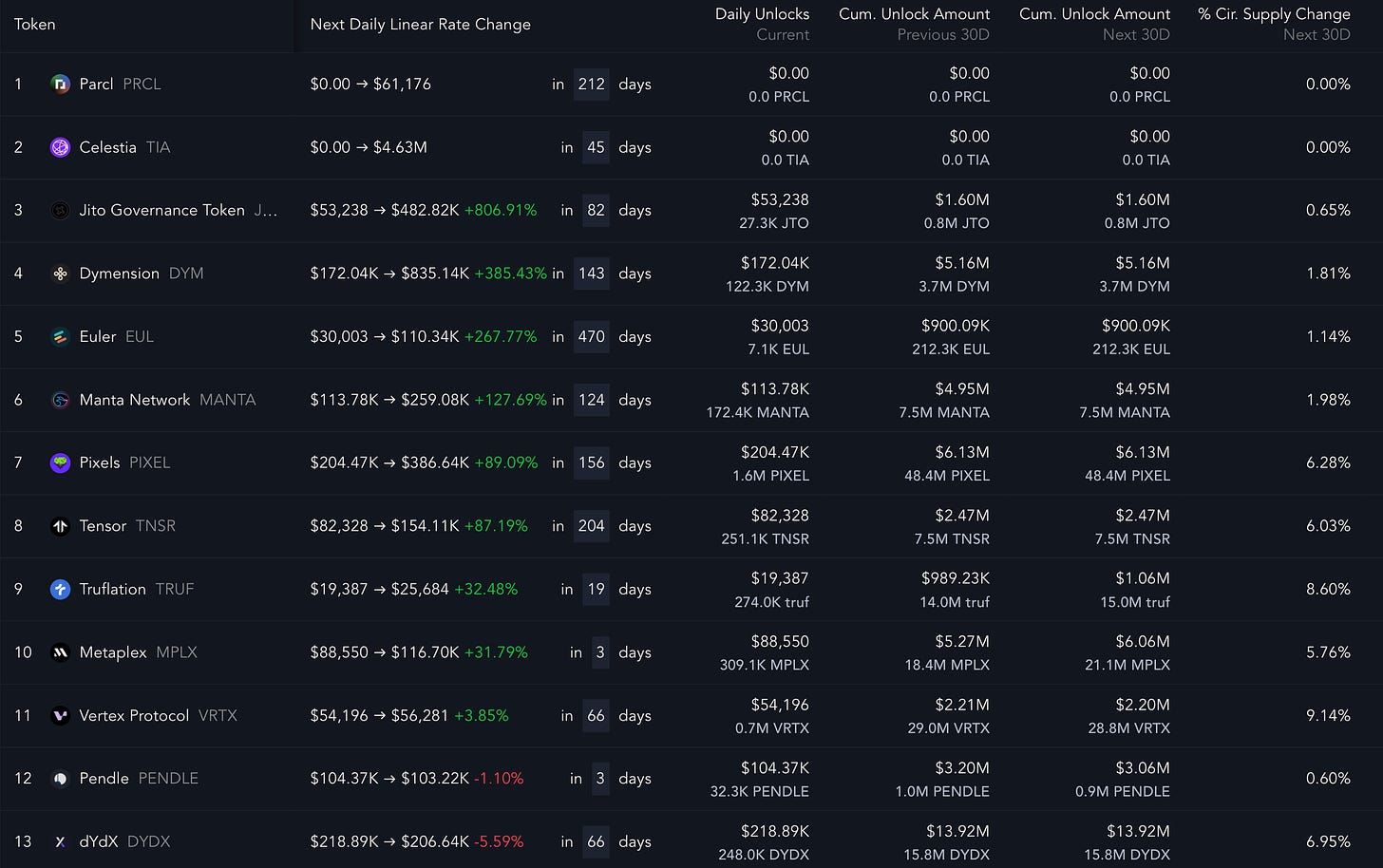

Another important metric is the daily token issuance and changes in issuance rate. In this regard, Messari once again provides great help with their daily maximum linear issuance rate changes dashboard.

Important events will lead to increased inflation:

$TIA will begin issuance within 1.5 months;

$JITO will increase daily issuance by 8 times within 3 months;

$DYM will increase daily issuance by 3.8 times within 4.5 months;

Important events will lead to decreased inflation:

UNI will stop new issuance this week, similar to RON and $XVS (stopping new issuance next week);

$WOO will reduce issuance by 75% within 1.5 months;

$NEAR will reduce issuance by 38% within 1 month;

According to Token Unlocks, the first week of November will see the highest new issuance, with an expected influx of $1.4 billion into the market.

Conclusion

Token unlocks are one of the many factors to consider when making investment or trading decisions. Other important factors include new product releases, overall market sentiment, and liquidity. Typically, when unlock events occur, their impact is already reflected in market prices, so shorting tokens on unlock dates is not a reliable strategy.

The most significant impact occurs when unlocks exceed 5% to 10% of circulating supply and there are no upcoming catalysts or high attention to the token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。