Analysts at Bernstein pointed out that with the expectation of a rate cut by the Federal Reserve and the recovery of the cryptocurrency market, DeFi yields may rebound, with projects like Aave performing well. The resurgence of the DeFi lending market may attract more investors back to the Ethereum and crypto credit markets.

Author: James Hunt

Translation: Plain Blockchain

According to analysts at research and brokerage firm Bernstein, with the expectation of a rate cut by the Federal Reserve approaching, a 25 or 50 basis point cut on Wednesday, the yields of decentralized finance (DeFi) are expected to rise.

"As the rate cut approaches, DeFi yields once again appear attractive. This could serve as a catalyst to reignite interest in DeFi and Ethereum, and reboot the crypto credit market," wrote Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia in a client report on Monday.

DeFi enables global participants to earn yields on stablecoins (such as USDC and USDT) by providing liquidity to decentralized lending markets.

While the DeFi summer frenzy of 2020 is now a distant memory, the high yields generated through incentive tokens have long disappeared. However, Aave, the largest lending market on Ethereum, still offers stablecoin lending yields of 3.7% to 3.9%.

1. DeFi Resurgence

Analysts pointed out that with the shift in the interest rate cycle towards easing, a new crypto cycle is building up, and the crypto lending market is experiencing a resurgence.

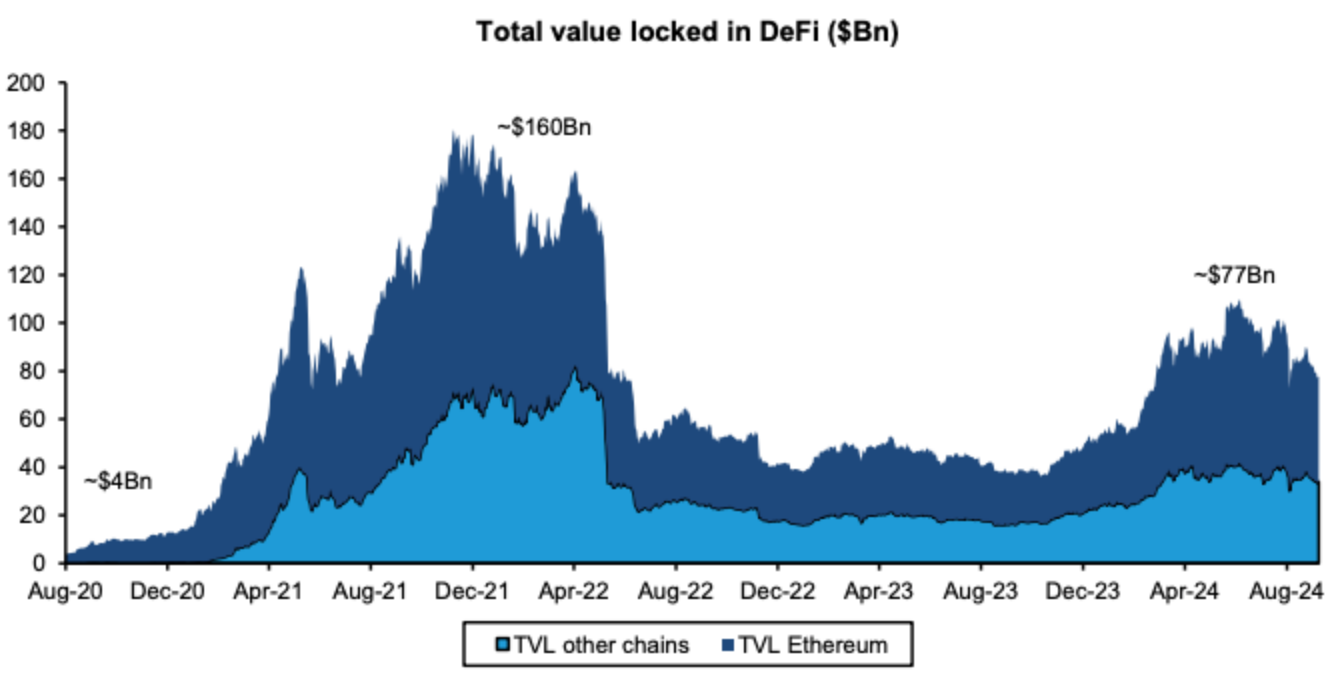

Although the total locked value in DeFi is still only half of the peak in 2021, it has doubled from the 2022 low to $77 billion, and the monthly number of DeFi users has grown three to four times since the low point.

Total locked value in DeFi. Image source: Bernstein.

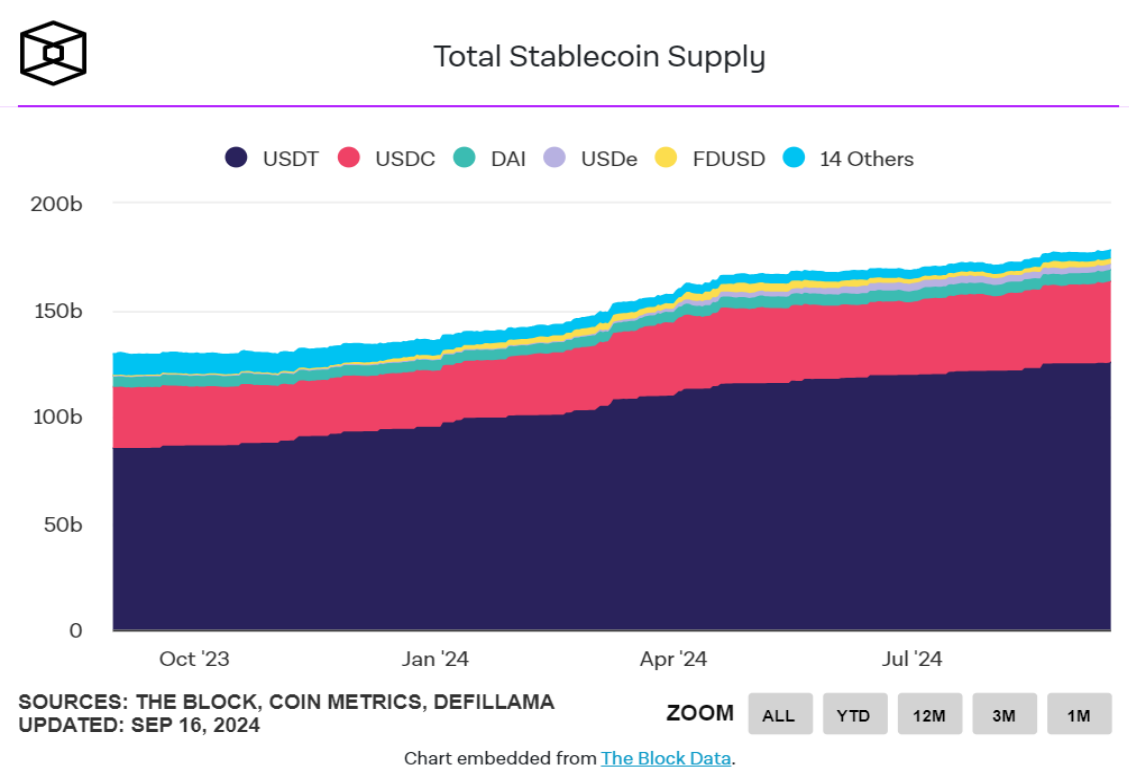

Chhugani, Sapra, and Chindalia stated that, according to The Block's data dashboard, the stablecoin market cap has also risen to around $178 billion, with the monthly active wallet count stabilizing at around 30 million. They added that these are "all signs of the crypto DeFi market's resurgence, with the potential for further acceleration as interest rates decline."

If the credit demand from crypto traders increases, stablecoin DeFi yields could exceed 5%, surpassing the yields of money market funds. This will further revitalize the crypto credit market and drive up digital asset prices, they said.

2. Betting on Aave and Returning to Ethereum

To reflect this trend, Bernstein has added AaveToken to its digital asset portfolio, replacing derivative protocols GMX and Synthetix. Analysts noted that Aave's total outstanding debt has tripled from its low point in January 2023, and despite little fluctuation in Bitcoin prices and even a slight decline, AaveToken has risen by 23% in the past 30 days. The portfolio also includes BTC, ETH, OP, ARB, POL, LDO, SOL, UNI, LINK, and RON.

According to TradingView data, due to poor performance in spot ETF inflows and Ethereum's relative weakness compared to Bitcoin, the ratio over the past 12 months has dropped by 36% and fell below the 0.04 level for the first time since April 2021 over the weekend.

However, analysts stated that the resurgence of the DeFi lending market on Ethereum may attract large whales and institutional investors back to the crypto credit market, providing a turning point for Ethereum's underperformance relative to Bitcoin. "We believe it may be time to refocus on DeFi and Ethereum," they added.

Gautam Chhugani holds long positions in multiple cryptocurrencies, meaning he is bullish on the future performance of these cryptocurrencies and has invested in them, hoping for future price increases.

Original article link: https://www.hellobtc.com/kp/du/09/5417.html

Source: https://www.theblock.co/post/316552/defi-yields-us-rate-cuts-bernstein?utm_source=twitter&utm_medium=social

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。